Note: For a list of episodes of the ChooseFI Podcast discussing tips and tactics to optimize college costs, click here.

Here at Choose FI, we’ve always hated student loans. Not the college education you receive, but the idea that you have to borrow so much money to get the degree.

Many college students rack up tens of thousands of dollars in debt in order to complete their education. Then it takes them a decade or more of working in order to completely pay off those loans. At that point, they’re back to broke – the same place they were financially when they started college.

The pandemic we’re living through only adds more questions to the debate. High unemployment rates and shrunken savings are causing both parents and students to examine the four-year college with a new level of skepticism.

Here is the ultimate question: Is the ROI of a college degree worth the rising costs? We believe the answer, except when a student is pursuing a career in a few select vocations, is no.

However, just because we believe a college education may not be worth the cost, it doesn’t mean you should stop learning when you get your high school diploma. Instead, we at Choose FI believe the future of post-high school education lies in micro-certifications and building your talent stack.

Read on to find out why our mindset on getting a college education has changed, what you can do to help yourself financially if you need a degree for your career field, and just what a micro-certification is.

- Do You Have To Go To College To Be Successful?

- How Do You Decide If You Should Go To College Or Get A Job?

- Is College Worth It Or Is A Degree A Waste Of Money?

- What Role Does The Coronavirus Play In That Decision?

- If You Decide That College Is Worth The Investment, Can You Do It Without Student Loans?

- What If You Already Have Student Loans?

- Can You Make A Good Income Without A College Degree?

- What Are Micro-Certifications And How Can They Replace A College Degree?

- What Is The Salesforce Certified Administrator Certification?

- What Is A Google Career Certificate?

- What Is A Stackable Credential?

- Helpful Resources

- Bottom Line

Do You Have To Go To College To Be Successful?

The answer to that question lies in how you define success.

To be successful in general terms, including in a wide variety of careers, the answer is no. You do not need a college degree to be successful.

However, in certain specific fields, you may need a college degree to be eligible for the job you want. Some of these include medicine, law, accountancy, some kinds of engineering, and scientific research.

For the vast majority of professions, however, a degree is not needed. Instead, what people who hire in other professions are looking for is candidates who are good communicators and are capable of building the skills needed to perform the job for which the employer is hiring.

In the latter half of the 20th century, a college degree was viewed as a necessity to getting a job. Employers were looking for job candidates who had completed college. They were looking for people whose higher education had given them the knowledge and experience to do a job well.

Now it’s almost been reduced to a box that employers just check off as part of the hiring process. Whether or not you went to college is still a question they may ask, but it doesn’t mean anywhere near as much as it once did.

A college degree used to open doors for employment; a virtual guarantee of a job with a good salary as soon as you graduated. Now landing that job is much more about who you know and what skills you have acquired. It’s also how well you interview.

How Do You Decide If You Should Go To College Or Get A Job?

We’ll answer that question with a question: What type of work do you ultimately want to do?

As we mentioned above, there are definitely careers for which you must have a college degree. If you are strongly considering one of those professions, college is a necessity for you.

However, if you’re not in one of those specific fields, you should give serious consideration to getting a job instead of going to college. You’ll likely need additional education for a future job, but that education can come in different forms other than a four-year college. Earning micro-credentials instead of a degree is a faster and less expensive way to get the knowledge you need on particular subjects.

“[Whether or not you need a college degree for a particular job] all depends on the real requirements of the job… Certainly professional positions such as a CPA are going to require a related degree. But there are other positions where someone’s hands-on experience can be just as good. It all depends.”

from “should it matter if a candidate doesn’t have a college degree” on ziprecruiter.com

So in order to choose between going to college or getting a job, you need to know what you want your career to be. If it’s a vocation that requires higher education, then absolutely pursue that degree. And if you don’t know what you want to do or you can secure the job you want without going to college, that makes the decision easy. Don’t go right out of high school and you may not need to go at all.

Is College Worth It Or Is A Degree A Waste Of Money?

This is perhaps the most important question to ask yourself when you’re considering whether or not college is the right choice for you. Let’s break down things you need to consider when deciding on your answer.

Cost

It’s hard to determine whether something is a waste of money if you don’t know how much money it costs. So let’s start with understanding the price tag of a college tuition in 2023.

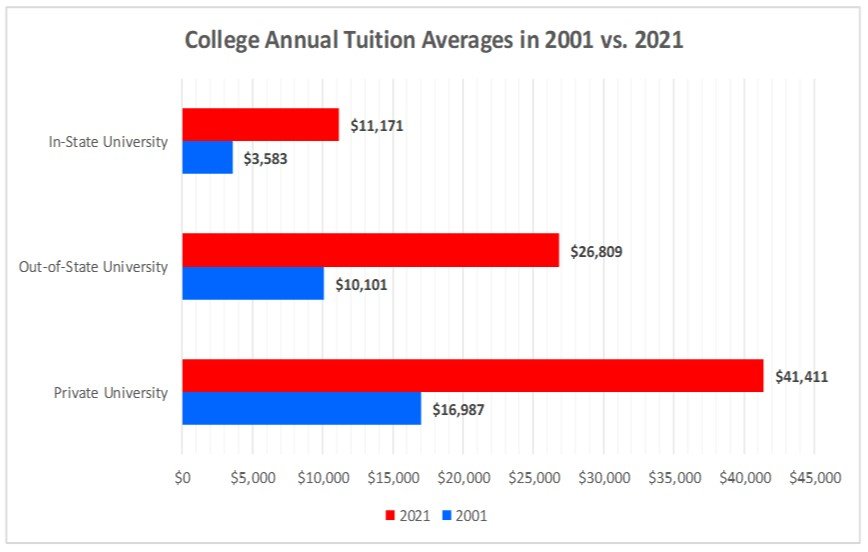

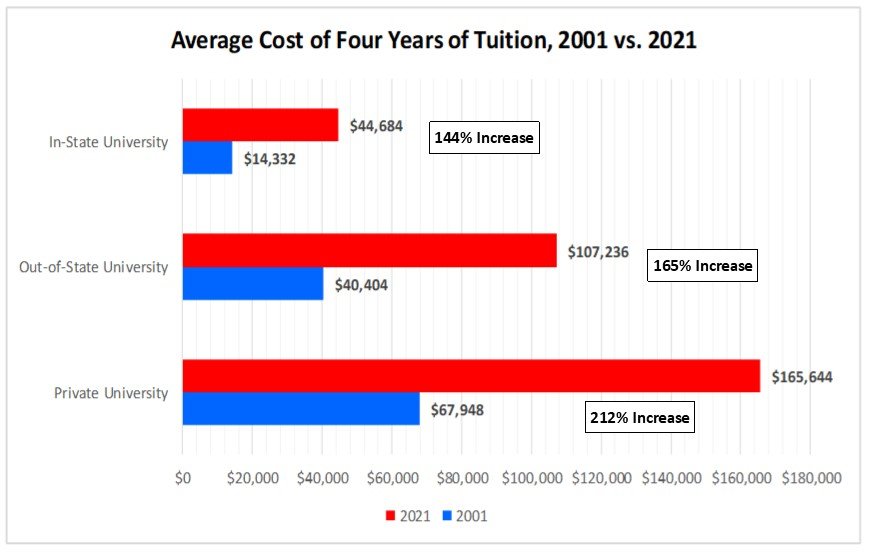

U.S. News and World Report published an article on average college tuition growth since 2001. In the last 20+ years, the cost of college has increased astronomically. While the numbers below don’t count for inflation, the article notes that the cost of college has significantly outpaced inflation rates.

Here’s what college costs 20 years ago vs. now.

It’s important to note that these figures are for tuition only. This does not cover the cost of room, board, books, supplies, or anything a student needs to live at a university. So the true cost of college is actually higher than what’s reflected above.

Up until about 20 years ago, it was also possible to get a part-time job and cash-flow your way through college, working to pay for the degree you were earning. That’s no longer a reality. So anyone paying the tuition needs to have it saved prior to starting school, win scholarships, or expect to incur a huge amount of debt in student loans.

Type of Institution

Something else to consider is that a degree from a “big name” school like Harvard, Yale, Princeton, Standard, etc., still holds its value. In other words, graduating from one of those universities is still prestigious and may open doors all on its own.

The schools that we’re talking about are smaller tier II or tier III schools. These are the ones that don’t have the powerful name or huge endowments to fall back on. They’re still charging high tuition rates for a degree from a school that your potential employers may very well never have heard of, and therefore it carries much less weight.

Why Are You Going To School?

The answer to this may seem obvious: You’re going to college to get an education. You’re going to get a degree so you’re prepared for the specific field you’ve chosen to study and eventually find a job in. And for a lot of students, that’s true.

However, for a significant portion of eighteen-year-old young adults, getting the education is only part of the goal. A larger one is having the “college experience.” That involves living away from home for the first time, experiencing independence, and learning how to live without constant parental supervision.

The students in it for the college experience have been told that getting an education is important and they believe it. But many of them enter college uncertain about what they want to study and what career they want to pursue. There are two financial dangers in sending these young adults to school with very little idea about what they want to do.

- They will likely flounder for the first couple of years, and that floundering comes at a really high price. A lot of college students head to school still unsure of their future career goals. During the first year or two while they’re there trying to decide what to do with their lives, they amass huge debt taking general education credits. While those credits will ultimately go toward a degree, there are other ways to get them without paying top price for them.

- They may graduate and still not have any idea what career they want. It’s not rare for a student to go through all four years of college and never figure out what they want to do. Students in that predicament often end up with a generalized degree, something like liberal arts or humanities. Hear us when we say this: There is nothing wrong with a degree in liberal arts or humanities. However, neither prepares you for a specific job, which should be the ultimate goal of college. It’s not like a mechanical engineering degree that prepares you to be a mechanical engineer, or a biology or chemistry degree that prepares you for medical school. So these students will spend many years and many, many thousands of dollars getting a degree that doesn’t help them find a paying job.

So knowing all of the above information, the question you have to ask yourself is this: Do I really need a college degree to accomplish what I want to do? Or is there another way, like micro-certifications, to get a post-high school education that specifically prepares you for your desired field once you know what that is?

6 months to $60k/year. Lots of upside. Take the first step for free.

Take the Salesforce 5-Day Challenge for FREE and jumpstart your Salesforce career. No technical or CRM background needed to get started. This free primer was designed for the motivated person exploring high-paying job prospects with no risk.

What Role Does The Coronavirus Play In That Decision?

There is no denying that the coronavirus has changed the landscape of higher education, possibly permanently.

How Schools Are Faring

In the spring of 2020, COVID-19 forced more than 1,100 colleges and universities across the United States to close their physical doors. Most initiated full courses of online learning. Months later, however, the future of a lot of these schools is in jeopardy.

In a recent article for The College Post on the survival of colleges, NYU Professor Scott Galloway, who also hosts the popular Prof G podcast, estimates that 10-20% of colleges could close within a year. Dwindling revenue from students who can no longer afford the steep price of school combined with shrinking endowments and high operating costs have placed these institutions on the endangered list.

As a prospective student, it’s hard not to be concerned that your school might be on the chopping block. Do you want to spend your hard-earned money at a school that may close down before you finish your degree?

Some institutions with big brand names, the Ivy League label, or huge endowments may weather the COVID storm and survive. But will students come back? And if they do, will the new normal at schools be worth the high price tag of admission?

How Students Are Faring

There are two parts to the answer of how students are faring. The first is financial and whether or not they can afford to attend school anymore. The second question is how students are handling the frustration of the unknown, including whether classes will be in-person or online, what’s happening with tuition, and even whether or not their chosen college can withstand this current financial crisis.

Frustrating Finances

Only a few months after the pandemic first hit, the effects on college students were already being demonstrably felt.

Those are huge numbers. Even 7%, which may sound small, is in actuality very big. In the fall of 2019, there were 19.9 million college students. By the end of the 2019-2020 school year, that 7% drop-out rate translates into 1,393,000 students having dropped out as a result of not being able to afford school due to the pandemic.

The question of students’ ability to afford an education had been slowly increasing in recent years. Now it has been thrust into the open as a real threat to the accessibility of college for current and future generations.

The New Unknowns

Many students are feeling frustrated at the closure of in-person classes and their schools’ responses to COVID, and many are feeling cheated out of the college experience.

According to Newsweek, students at more than 60 schools across the country had filed lawsuits, some class-action status, against their colleges or universities as of June 2020. They feel that because they were not allowed to be in classes in person, they are entitled to a partial refund of their tuition payments.

Students who filed the lawsuits feel that part of what they were paying for in their college tuition price tag was hands-on learning and building relationships that will last a lifetime in terms of both professional and personal networks. They allege those things can’t happen in the online environment that so many schools have been forced to use.

In effect, Zoom does not equal room when it comes to the cost of college classes and the public’s willingness to pay for them.

Some colleges have offered tuition discounts of anywhere from 10%-25%. Others have frozen tuition for the current 2022-2023 academic year. However, many schools have not altered tuition costs. Some schools have apologetically kept rates the same. Here is a statement from a nursing program at Penn State regarding the prospect of tuition reimbursement:

We understand the concern over tuition and the financial strain that this pandemic is putting on so many. Even during this unprecedented national and global challenge, our outstanding faculty are meeting the course and program learning objectives for our students by continuing to deliver a world-class Penn State education. University staff and educators are working around the clock. The full effort of the University is focused on getting all students into the remote environment to preserve their credits and enable them to finish the semester, and to graduate on time, which is important financially to students and families. Unfortunately, we believe the cost of fulfilling our educational commitment in a remote setting is likely higher, and there are no plans to issue tuition refunds.

Penn State Nursing Dept Q&A

Even if you’re fortunate enough to be going to a school that has offered some financial breaks in light of COVID, those are not promised to be permanent. Frozen tuition rates and discounted tuition are short-term solutions to a problem that has been building for decades and was forced into the spotlight by the coronavirus: The cost of college has made pursuing a degree both impractical and out of reach for many students.

Frozen tuition rates and discounted tuition are short-term solutions to a problem that has been building for decades and was forced into the spotlight by the coronavirus: The cost of college has made pursuing a degree both impractical and out of reach for many students.

This shift in these unprecedented times has led many students to reconsider their future. Should they continue paying for online classes that don’t give them the whole college experience? Or should they reconsider whether the cost outweighs the benefits of higher education?

Is The Coronavirus Impact On Colleges Permanent?

No one can answer that with 100% accuracy. Only time will tell if colleges can weather the storm. This will depend on how well they were prepared prior to the virus and how they’ve handled themselves, their students, and their finances after it hit.

What has been permanently exposed, however, are the cracks in the college system.

- The rising costs that have been going up for decades with no end in sight.

- The staggering amount of debt that many students are left with after they get their degree.

- The effect of high unemployment rates on a student’s choice to attend school because of both their parents’ inability to pay the bill and the student’s lack of a guaranteed job after graduation.

- Whether or not online classes can truly replace in-person classes and the college experience as a whole.

Employers now face the decision of trying to determine whether or not to continue to give the same amount of weight to a college education that they have in the past, knowing that so many students can’t afford it. Will they place more priority on other things like life experience, hands-on training, and good communication skills instead? That’s where we believe the job market is trending.

If You Decide That College Is Worth The Investment, Can You Do It Without Student Loans?

Yes, you can. It is possible to graduate from college without student loans.

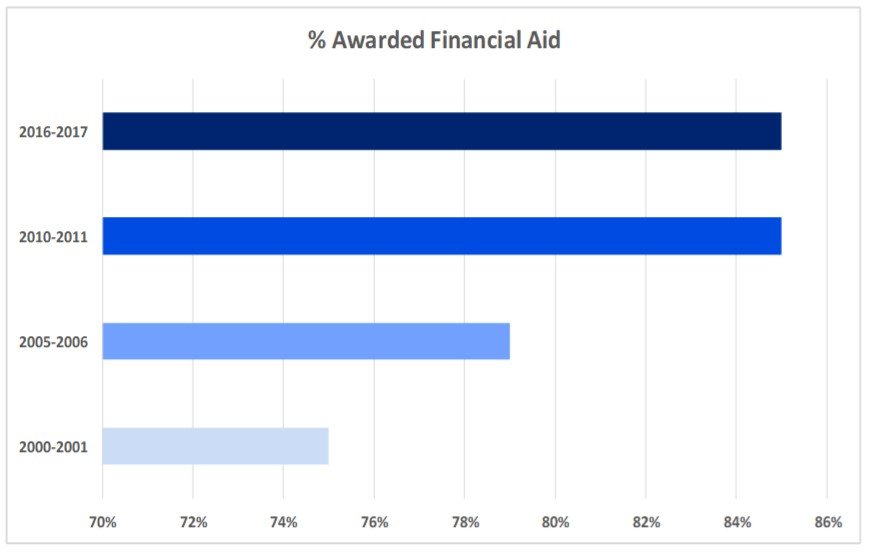

However, it’s worth noting before we continue that that is not the norm in the United States. A report published by the National Center of Education Statistics in 2017 showed the staggering number of students since the start of this century who received some form of financial aid in order to go to college.

If your desired field requires a degree and assuming that your parents or guardians have not financed your entire education, here are several ways to beat that statistic and be one of the 15% who graduates without debt.

- Take college classes while you’re still a high school student. Learn more about dual or concurrent enrollment and its benefits from the National Alliance of Concurrent Enrollment Partnerships.l

- Join the military. They have several options for making college affordable, including ones that won’t leave you with debt.

- Get a job with a company that offers tuition payment or reimbursement programs. Here’s a list of ten companies that help with college costs.

- Apply for scholarships. There are so many available, and some students have paid for their entire education through scholarships alone. Make sure you’re applying for standard scholarships as well as some lesser-known scholarships. They may not pay as much, but every little bit helps when the cost of college is so high.

- Negotiate the cost of your tuition and the amount of your aid package. Yes, you read that right. To some extent, the cost of college is negotiable. Here are tips on how to negotiate your college costs.

- Listen to this podcast on college hacking. They mention some of the tips we’ve listed here and many more on how to get through college without incurring debt.

What If You Already Have Student Loans?

Student loan debt can be daunting and seem like an impossible thing to overcome. If you have them, you’re not alone.

Those are daunting statistics. Especially how much more the student loan debt is than the credit card debt in this country. We hear a lot about how high credit card debt is, but student loan debt amounts to a whole lot more.

However, just because it’s daunting doesn’t mean that you shouldn’t start to pay them off – and the sooner the better. The interest that accrues on these loans can be just as bad if not worse than the loan itself. There are ways to pay off your student loan debt so that it’s not hanging over your head for years or even decades. Here are a few.

- Refinance your student loans for a lower interest rate. Credible is a solid refinancing company that can help you secure a good rate.

- Minimize your other expenses so that you have more money to put towards your student loans. Start with expenses like groceries (here’s a good how-to on that) and your cell phone (Mint and Republic Wireless have good, low-cost plans).

- Pick up a side hustle to bring in extra money that you can in turn put towards your student loan payments.

- Check out this guide to making more money and see if there are other things that you can do to bring in more income.

Can You Make A Good Income Without A College Degree?

We touched on the question of success at the beginning of this article, stating that depending on how you define the word, it is entirely possible to live a very successful life without a college degree.

But now let’s take that one big step further and ask another question that’s more to the point: Can you make a good income without having a college degree?

The answer is a resounding yes. Yes, yes, yes. Start your search for that job by learning the things you should do to get the job and things to do that won’t help you at all. Let’s start with the latter.

What Not To Do When Trying To Get A High-Paying Job Right Out Of High School

There are two things you should not do before we get to the things you can do to secure a great income sans degree.

Settle

The impetus when you’re looking for a job, especially in a bad economy, is to take the first job that’s offered to you. When you need money, take the sure thing, right? Maybe not.

I (Kelly) once applied for an internship in my desired career field during a summer break. Before I had heard whether or not I got it, I decided to take a minimum wage job in the food court at the local mall. Lo and behold, I got the internship. It not only paid more than minimum wage, but also gave me an “in” to the career I wanted to pursue. It made for a difficult conversation with the food court employers. They were upset they had wasted time in the hiring process of someone who would leave before she even started.

If you can subsist on your savings or gifts from your high school graduation for a few months, do that. If you take a job (likely a minimum wage job) right away, you may not have the time to search for anything else.

Waste Your Time

Use those few months to your advantage. Now is not the time to “reward” yourself for all of your hard work in high school by lounging around.

Instead, use this time to search for jobs that fit your skill set and make a good, liveable wage and have room for advancement. Apply for as many as you can and take every interview you’re offered. Even if you decide you don’t want the job, it will be good practice.

What You Should Do To Secure A High-Paying Job Right Out Of High School

Now you know what not to do if you want a good job right out of high school. Here are some things you should do to land that high-paying job without a college degree.

Research High-Paying Jobs That Don’t Require A Degree

If you don’t know what these jobs are, it’s impossible to take any next steps in getting one of them. You can start with this article on seven careers with six-figure earning potential or this one with 20 high-paying careers, although they may not top six figures.

Once you’ve read through these lists, decide if any of those careers feel like a good fit. If not, keep looking. But if one does, it’s time to get to work getting that job.

6 months to $60k/year. Lots of upside. Take the first step for free.

Take the Salesforce 5-Day Challenge for FREE and jumpstart your Salesforce career. No technical or CRM background needed to get started. This free primer was designed for the motivated person exploring high-paying job prospects with no risk.

Use Your Contacts To Make Inroads And Get Ahead

Do you know anyone in your chosen field? Reach out to them. Ask them questions about their career. See if you can come in and shadow them to learn more about what they do. Find out if there are special skills you need to be able to do that job.

Then show that you’re dedicated and paying attention to their suggestions by beefing up your skill set and coming to spend a day with them. Dress right for the job and show up on time. This may not be an interview, but you are still making a first impression and you never know where that might take you.

Build Your Talent Stack

We already mentioned building up your talent stack, but how do you do that? One of the best ways that you can do it is through micro-credentials. We’ll expand on them in the next section, but they’re basically small certifications in different career fields.

From a general perspective, you can also take communication or business classes at a local community college or learn basic budgeting from an account or by doing research online.

Perfect Your Resume

Since you’re just out of high school, you probably barely have enough information to fill half of a page. Or do you?

Don’t forget about the experiences that you’ve had. Have you traveled abroad? If so, maybe you learned something as part of that trip that applies to your ability to do a job. Have you cared for younger siblings? If so, that demonstrates responsibility.

It might be a good idea to have a professional resume writer look at your resume to help you craft it. When you have a less traditional resume that focuses more on experience than education, it’s good to have a professional help with how to present it.

Try a service like ResumeGenius. The site helps you build your resume. Then it gives you the option of having it professionally reviewed by someone on their team.

Learn Good Communication Skills

According to an Indeed.com article on the top skills that employers look for in job candidates, communication skills tops the list.

Most high schools don’t teach them, but you can learn them before you apply for jobs. Research how to write a professional email, how to talk to co-workers. You can even how to write a thank you letter to send to potential employers after your interview.

Practice Interviewing

If you do everything on this list and then blow the interview, it will all be wasted time. Practice interviewing. Ask for help from your high school guidance counselor, your parents, other bosses you’ve had in the past. Do a mock interview with anyone who will sit with you.

Take their tips, work on your interview style and answers, and set yourself up for success. A really good interview can go a long way to make up for the experience you may not have.

What Are Micro-Certifications And How Can They Replace A College Degree?

College degrees have been the gold standard of post-high school education for decades. Enter a micro-certification, a nanodegree with the power to make a big difference.

What Is A Micro-Certification?

Micro-certifications or micro-credentials are “mini-qualifications that demonstrate skills, knowledge, and/or experience in a given subject area or capability. Also known as nanodegrees, micro-credentials tend to be narrower in range than traditional qualifications like diplomas or degrees.”

Micro-certifications or micro-credentials are “mini-qualifications that demonstrate skills, knowledge, and/or experience in a given subject area or capability.

Also known as nanodegrees, micro-credentials tend to be narrower in range than traditional qualifications

like diplomas or degrees.”source: deakinco.com

The certification that you receive when you complete a micro-credential course demonstrates that you are specialized in a certain area of study. It’s valuable to employers because, much like a degree, it shows that you have specific skills relative to areas in which they are hiring.

How Can Micro-Certifications Replace A College Degree?

A lot of employers, especially those in the technology sector, are looking for candidates who have a specific skill or specialization in one area. It might be a computer language, it might be web design, it might customer relationship management (CRM) software certification, etc.

Micro-credentials certify you as having expertise in a certain area of your choice. These certifications take only a few months to earn and are generally less expensive than college credits. (Per this study by Student Loan Hero, the average college credit costs $594.) It’s also worth noting that a college class is often two or three credits.

By contrast, a college degree usually takes about four years to complete, and we’ve already shown you how expensive it is. When you go to college, you’re required to take a lot of general education requirements. These are often in subject areas that have nothing to do with your actual major. That’s a lot of money going towards classes that often have no impact on your ability to get a job.

If you have the certification that proves you are a specialist in one area, employers are likely to take a chance on you. They know that you have proven that you have mastered an important skill that they are looking for. If you can pair that with a great interview and other relevant experience, it may just take the place of a college degree.

What Is The Salesforce Certified Administrator Certification?

One example of a micro-certification is the Salesforce Certified Administrator certification issued by Salesforce – the CRM juggernaut that has been voted the #1 provider in the world for the past seven years in a row.

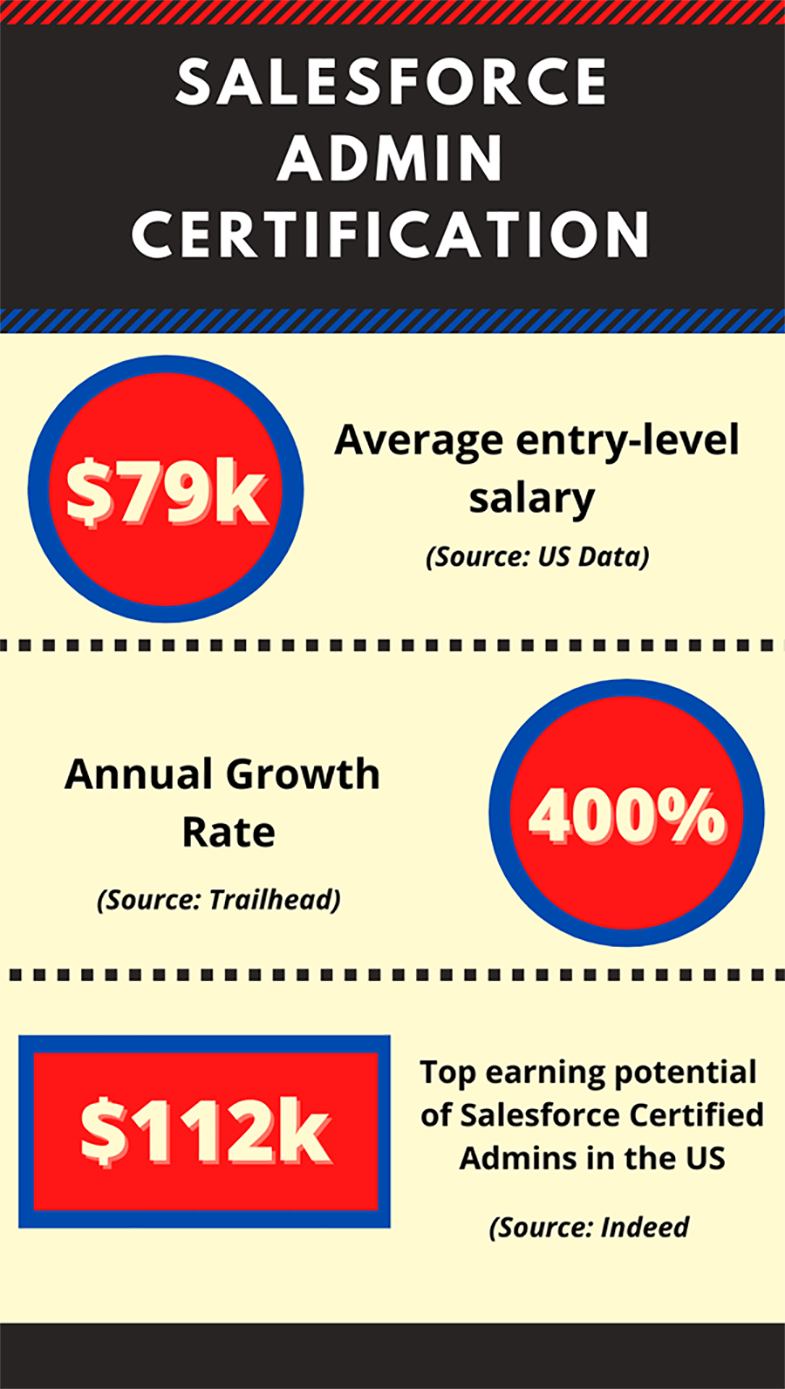

Salesforce Certified Administrators are in very high demand worldwide. In the US and Canada, many earn at least $60,000 within six months of acquiring this micro-certification, going on to reach a six-figure salary within a few short years.

A career in the CRM field is ideal for people that are strong communicators, organized, process-oriented thinkers, and who are interested in and comfortable with technology – but don’t have a desire to learn how to code.

A Salesforce Certified Administrator helps users develop reports, reset passwords, maintain data quality, run backups, add fields, and many other tasks that ensure the software’s seamless performance.

How Do You Get The Salesforce Certified Administrator Certification?

6 months to $60k/year. Lots of upside. Take the first step for free.

Take the Salesforce 5-Day Challenge for FREE and jumpstart your Salesforce career. No technical or CRM background needed to get started. This free primer was designed for the motivated person exploring high-paying job prospects with no risk.

In short, you study and prepare for some time (preparation time will vary based on experience), and then schedule and take the exam. You will have the option of either taking an onsite or online proctored exam through the Salesforce partner, Kryterion. The current exam consists of 60 scored questions, 5 non-scored questions, must be completed in 105 minutes, and has a minimum passing score of 65% and above.

How Long Does The Salesforce Certified Administrator Certification Take To Complete?

Those starting with no knowledge or experience typically need to dedicate at least 10 hours of study a week for approximately six months. Guided professional training and preparation is the best way to guarantee a successful exam result.

Joining a Salesforce-based peer community online, like the Facebook group Salesforce for Everyone, is another way to get support from individuals in all stages of the Salesforce certification process.

Bradley Rice, one of the highest-paid Salesforce Professionals in the world, offers an excellent, free email course called the Talent Stacker Salesforce 5-Day Challenge. Along with actionable tips, tools, and advice, he shares his expert knowledge and experience to help you jump-start the journey to a lucrative Salesforce career.

Step by step, Bradley helps you attain key milestones and understand how to learn Salesforce most successfully. Going above and beyond other experts, Bradley teaches how to showcase yourself to potential employers and shares the quickest path to gain the real-world experience needed to land your first job.

How Much Does A Salesforce Certified Administrator Certification Cost?

Registration for a Salesforce Administrator Certification exam costs $200. If you are unsuccessful the first time, you can retake the exam for a reduced cost of $100.

What Do You Study To Prepare For The Salesforce Certified Administrator Certification?

- User setup

- Organization setup

- Security and access

- AppExchange

- Sales and marketing applications

- Activity management and collaboration

- Desktop and mobile administration

- Standard and custom objects

- Service and support applications

- Data management

- Analytics

- Workflow and process automation

Proof In Numbers

Salesforce is the most widely used CRM software globally. Accessible through the cloud platform, it is available on nearly any device. The high demand for Salesforce Certified Administrators continues to grow year after year because of its extensive capabilities throughout the sales, marketing, and customer relationship cycle. What a Salesforce Certification gives you is not only an incredible income and career but also job stability and career longevity.

If you still need more information to be convinced that Salesforce Certification is an incredible career path to consider, check out Bradley Rice’s article, Top 7 Reasons to Salesforce.

6 months to $60k/year. Lots of upside. Take the first step for free.

Take the Salesforce 5-Day Challenge for FREE and jumpstart your Salesforce career. No technical or CRM background needed to get started. This free primer was designed for the motivated person exploring high-paying job prospects with no risk.

What Is A Google Career Certificate?

Google Career Certificates are Google’s answer to micro-credentials. It’s their own certification program that allows you to earn micro-credentials from their own Google employees.

What Areas Of Study Can You Get A Google Career Certificate In?

Google launched the Google Career Certificate program in 2018 with one program of study: IT Support Professional. They have three new programs coming soon: Data Analytics, Project Management, and UX (User Experience) Designer.

What Do You Study In The IT Support Professional Career Certificate Program?

The Google Career Certificates are taken through Coursera, an online course provider. There are five different courses that are part of the Google IT Support Professional Career Certificate.

- Technical Support Fundamentals

- The Bits and Bytes of Computer Networking

- Operating Systems and You: Becoming a Power User

- Security Administration and IT Infrastructure Services

- IT Security: Defense Against the Digital Dark Arts

Per their description of the program, you’ll also learn valuable other skills. They include customer service, network protocols, troubleshooting, systems administration, and encryption techniques.

When you graduate after completing all five of these courses, you’ll be prepared for an entry-level role in IT support.

Is It All Just Video Lectures?

While there are video lectures, that is not all there is. This certificate program is a comprehensive course of study. It involves participation in hands-on projects, labs, quizzes, and widgets that all complement the video lectures. All lectures are done by video so you can learn at your own pace on your own schedule.

How Long Does It Take To Complete?

Google reports that if you spend about five hours a week working your way through the certification, it will take you just under six months to complete the Google Career Certificate.

How Much Does A Google Career Certificate Cost?

To some extent, this is dependent on you.

As we mentioned, you’ll get the Google Career Certificate through the online course program Coursera. When you sign up for Coursera, you get a seven-day free trial period. Once that’s over, Coursera is a $49/month subscription.

The longer it takes you to complete the course, the more expensive it is. If you take the amount of time that Google estimates, it will cost you $294 for this certification. That means the cost of a Google Career Certificate would be exactly $300 less than the cost of one college credit, as we noted above.

Even if you take twice as long as Google says is average, you’re still only paying $588. That’s $6 less than one college credit.

What Do You Receive When You Complete The Google Career Certificate Program?

Once you complete your Google Career Certificate Program, you’ll receive the following.

- A shareable certificate of completion. You can use it to apply for every job you want. It can attach electronically to a resume or you can print it out and attach it to a paper copy.

- Career resources. This includes access to resume assistance, mock interviews, and an IT-specific job platform.

- “A pathway to jobs.” That’s Google-speak for connection to a large number of major companies who are considering for candidates with Google Career Certificates. Those companies include Walmart, Hulu, Best Buy, Google (of course), Bank of America, Sprint, and Intel, to name a few.

- College credit. Per the FAQ on their Google Career Certificates website, “The Google IT Support Professional Certificate program recently secured a credit recommendation from the American Council on Education (ACE) ACE CREDIT®, which is the industry standard for translating workplace learning to college credit. Learners can earn a recommendation of 12 college credits for completing the program–the equivalent of four college courses at the associate degree-level. This aims to help open up additional pathways to learners who are interested in higher education, and prepare them for entry-level jobs.”

What Is A Stackable Credential?

A stackable credential is a smaller certificate related to your profession. You earn it with the purpose of advancing in your career. The idea is that each one you earn builds on the one before it. Put together, they lead to bigger and better job opportunities. There are two main kinds of stackable credentials.

Traditional Stackable

A traditional stackable occurs when you gradually accrue credentials and certificates as part of a following a clear, linear path. An example of this is someone who earns a certificate in a chosen field. They could then apply that to an associate’s degree, then to a college degree.

Supplemental Stackable

Supplemental stackable credits are what you seek when you already have some credentials, course credits, or experience, but it’s not enough. You need additional knowledge or skills to get ahead in your job. So you earn more credentials that supplement the ones you already have.

Both of these stackable credentials are meant to allow you to either not go to college or leave school in order to work. These credentials help you continue to get an education while you’re on the job, making an income to support yourself or your family.

Helpful Resources

College-Related Episodes

- Optimizing the Scholarship Application Process: 083 | A Second Generation FI Case Study | Cody Berman FlytoFI (Start at 15:00)

- College Benefits for the Military: 095 | A Military Path To FI | Military Dollar (Start at 40:00)

- Preparing for the SAT: 114 | Demystify College Scholarships | Brian Eufinger | Edison Prep (Start at 4:00)

- PSAT and Merit Scholarships: 114R | Fine Tuning the College Equation | PSAT and National Merit Scholarship (Start at 35:30)

- College Employment as a College Hack: 138 | How To Get Paid To Go To College With Anthony Gary (Start at 12:50)

- The Scholarship For Service: 139 | Reaching FI With Real Estate With Sunny Burns (Start at 5:35)

- Optimizing the FAFSA: 154 | Hacking The FAFSA | Brian Eufinger And Seonwoo Lee (Start at 4:05)

- Community Tips & Ideas to Hack College: 230 | College Hacks from the ChooseFI Community (Start at 3:05)

- CLEP Testing: 238 | How To Test Out of College While You’re Still In High School | Millionaire Educator (Start at 2:35)

Other Useful Links

- Salesforce: A Lucrative Career and No Degree or Tech Background Needed

- Dual Enrollment: The Pros And Cons You Need To Know

- From Pandemic Layoff to $100k+ | A Salesforce Success Story |EP 297

Bottom Line

We strongly believe that the future of post-high school education is micro-credentials.

For several reasons including a savings of cost and of time, it makes more sense for people pursuing certain degrees to give serious consideration to foregoing a traditional college degree in favor of smaller credentials. These will give people the specific knowledge they need to secure a good-paying job in their field without incurring the debt that comes with a college degree.

Google may be the first to offer a comprehensive program of certificates, but they’re not the only ones.

Professor Scott Galloway, whom we mentioned earlier, recently discussed the idea of micro-credentials. He felt that Google’s Career Certificate program had given corporate America the excuse it needs to break away from the marketing machine that is college.

That’s a powerful statement from someone who teaches at a college. The future of education may not be in a big school, but rather in a small credential. And those micro-credentials will open doors and get you started on the path to the career of your dreams faster – and cheaper – than you ever thought possible.

The Simple Startup: A Beginners Guide to Starting a Business

This is a guidebook for teachers, parents, and students interested in starting student businesses - but aren't sure where to start or how to move forward. You'll learn everything you need to know to help students take their ideas and turn them into profitable businesses.