Emergency funds aren’t a new concept to having a healthy financial life. Part of being responsible with your money is keeping a certain amount in an easily accessible place in case of an emergency.

You should have at least six months of income tucked away in your emergency fund. The general recommendation is to keep those funds in either a checking or high-yield savings account.

Why? Having that money close at hand means you can afford to cover any crisis that comes your way. That could be losing a job, covering a medical emergency, handling a home or car repair, or anything else that happens.

We’ll cover the foundations of how to create an emergency fund, when you should spend it, and advanced emergency fund concepts once you become comfortable with the fundamentals.

- What Is an Emergency Fund

- Why You Need an Emergency Fund

- Do NOT Use These Methods to Pay for Emergencies

- How Much Money Should Be In Your Emergency Fund

- How to Start Building Your Emergency Fund

- How to Make Your Emergency Fund Part of Your Budget

- Our $1,000 Emergency Fund Challenge

- Ways To Save $1,000 This Month

- Ways To Earn $1,000 This Month

- How to Rebuild Your Emergency Fund

- Where Should You Keep Your Emergency Fund

- When and Why Should You Withdraw From Your Emergency Fund

- Advanced Emergency Fund Strategies

- Bottom Line

What Is an Emergency Fund

An emergency fund is an amount of money you have saved and set aside to pay for any emergency that may occur (e.g., unexpected expenses). It is the proverbial financial safety net. How you define an emergency is really up to you, but there is an essential financial rule of thumb. That rule is this: do not spend your emergency fund on anything that doesn’t fall under the actual emergency category. It isn’t a windfall account. It is to be used ONLY for unplanned significant events in your life that, when they occur, could put your financial health in serious jeopardy.

Why You Need an Emergency Fund

Financial planners always consider their monetary future, whether it is keeping on top of their credit score or how much money they need to retire. For some, the idea of building an emergency fund that you may or may not need might be frustrating. Why not use that money to help you in your current situation instead?

Top 3 Reasons Why You Need an Emergency Fund

- Crisis

- A crisis can include unexpected bills, unforeseen car or home repairs, or a medical emergency. No matter what form it takes, a crisis will happen to you at some point. It will also require a lot of money from you when it happens. A crisis doesn’t care whether you have the funds to pay for it or not.

- If you’re like most American families, you’re already living paycheck to paycheck. A crisis might push you over the cliff into financial ruin.

- Job Loss

- You’ll need an emergency fund if you are fired or laid off. You’ll need to go into debt or sell off assets if you don’t.

- An emergency fund can help you manage your finances from when you lose your job to when you find another one.

- Having three to six months of emergency income will psychologically help you when you get hit with a pink slip.

- To Prevent Derailed Financial Stability

- Regaining control of your finances can be challenging

- bit of financial stability you now have.

- An emergency can wreck your financial stability and set you back months or years. It also may discourage you to the point where you’re permanently derailed from your financial freedom goal.

Do NOT Use These Methods to Pay for Emergencies

Part of Financial Independence is planning; having an emergency fund is solid financial planning. Not having an emergency fund could result in relying on one (or more) of these financial tools. You’ll see this will cost you money and time: two concepts that are counterintuitive to our FI goals.

- Tapping your 401k or IRA retirement accounts: Retirement planning is a cornerstone of financial health. So, if you are younger than age 59 1/2, there are severe penalties for taking from these accounts early. For example, touching even a fully vested 401k before retirement hits you with a 10% penalty plus income tax. This would register at least a 32% (probably higher) loss to whatever you withdraw. This is an irresponsible financial move.

- Selling assets: Emergencies call for immediate funds. Trying to sell off even unwanted assets will cause you to lose value. If you had to sell a second car for the money you need within a week, you’ll almost always be facing a loss – if you consider that the rush to sell will cause you to ask considerably lower than the vehicle’s value. Again, you lose significant financial value.

These Methods Are Even Worse

- Liquidating part or all of your portfolio: Again, the timing issue equals loss of value. If you need immediate funds, you’ll need to offer your securities at a lower market price to obtain the funds within a tight time frame.

- Credit cards: Using your credit cards for responsible financial spending is critical to financial discipline. Spending them on emergencies is irresponsible. If you can’t pay the entire balance off during the grace period, you’ll see an average of 16.99% APR. Further, a credit bureau will look at your credit card balances and adjust your credit score range accordingly if you keep a high balance and pay the minimum.

- Asking friends or family: It’s true that there likely won’t be interest if you borrow money this way. However, you could be putting a relationship at risk if you can’t pay the money back in a time acceptable to the person who lent it.

How Much Money Should Be In Your Emergency Fund

Your emergency fund amount goal depends on how much your monthly expenses are. A good rule of thumb (according to almost everyone in the personal finance world) is to have six months’ worth of income saved. If that sounds like a daunting task to some of you, consider saving six months’ worth of your basic living expenses as a starting goal.

To calculate that goal, make a list of all your critical expenses. It should look something like this:

- Housing

- Groceries

- Utilities

- Transportation

- Insurance Premiums

- Loans and Other Debt Payments

- Personal Care Expenses

Once you’ve compiled your list, estimated your monthly spending for each line item, and added it all up, you’ll have an accurate emergency fund savings goal to work towards.

Having an emergency fund with at least six months of income will cushion nearly any blow to your finances- from a job loss to a car accident. Check out Ally’s emergency fund calculator to determine how much you can save each month.

How to Start Building Your Emergency Fund

There are two basic approaches to starting an emergency fund, depending on whether you’ve started one or are starting from scratch. Either way, we strongly suggest implementing your emergency savings into your budget, which we’ll introduce in the following section.

If You’re Starting From Zero

Learning how to plan for your emergency fund is the most critical step. Start by closely examining your spending and what can be cut to start your emergency fund. Then, set that money aside and slowly start adding monthly contributions.

If You Already Have an Emergency Fund

If you have simply contributed ” X ” of your income to your fund, begin setting monetary goals. Reconsider your budget once you’ve hit them. For example, if you have six months’ worth of income in your emergency fund, lower your contribution. However, set a goal for 7 months. Lower your contributions and put the residual funds into a higher-yield security (e.g., low-cost index funds). You can never have enough in your emergency fund. Nor should you stop looking for opportunities to invest.

How to Make Your Emergency Fund Part of Your Budget

The easiest way to keep track of how much you’re saving is to include it in your budget. Just like you may save for other goals, set aside a good portion of cash to fund your account, so create a savings account through your bank. This can easily be set up through the online banking portal that you use for your checking account. Then, deposit your emergency fund monthly goal into your savings to keep it separate from your checking.

For example, say you need $3,000 monthly to pay for rent, utilities, food, and other debt obligations. If you want to start on the small end of the emergency fund, you’ll need $9,000 for three months of expenses.

That’s quite a bit of money. So, start putting a few hundred dollars a month in your emergency fund. Don’t use these funds for anything except for emergencies. No dipping in to buy that new 4K TV you’ve had your eye on. Be disciplined and stash.

Our $1,000 Emergency Fund Challenge

We’ve stated that keeping an emergency fund that will cover at least six months’ worth of expenses is the best practice. However, this can be daunting, especially if you’ve never learned to save.

We recommend an initial goal of $1,000 in your emergency fund.

First of all, that’s an achievable amount. It’s not so overwhelming that it seems impossible to reach.

Secondly, $1,000 is often enough to cover more minor emergencies. Even if it’s not, it’s usually enough to mitigate the damage to your financial situation. In other words, you’ll only have to charge or borrow a small portion rather than the whole amount.

Finally, if your goal is to build an emergency fund of $1,000 in one month, that’s a small enough amount that it’s possible that it could be hiding right in your budget. With some minor changes to your budget and some intentional efforts, you could find yourself with an extra $1,000 in the bank before the next 30 days are up.

Ways To Save $1,000 This Month

Before you look to earn extra money, check your spending habits to see how much money you can save.

Go through your budget and identify non-essential spending. Then, challenge yourself to eliminate it.

Here are seven quick and easy swaps that can dramatically increase your monthly savings.

Eliminate Paid Streaming Services – Use Your Local Library Instead

Many streaming services like Hulu allow you to put your subscriptions on hold. This prevents you from having to pay but won’t delete your preferences and streaming history.

While that’s on hold, check your local library for entertainment. Getting a library card, which allows you to check out resources, is free and usually requires a valid driver’s license.

If you haven’t been in a while, you might be surprised at what you find there. Books are still available, and you can check them out in digital or hard copy. Movies and music are also available. Many offer classes or lectures on popular and informative topics.

Eliminate Eating Out – Cook For Yourself Instead

Eating out is an expense that can add up quickly. Take the temptation away by preparing ahead.

If you usually go out for lunch, pack one the night before instead. Then, you can’t use the excuse that you were running late and didn’t have time to pack your lunch.

If you go out for dinner, meal plan for the week ahead, and grocery shop so you know you have all your supplies. You can even prepare meals on the weekends, so they’re super easy to pop in the oven after a long day of work.

Check out our collection of delicious $2 meal recipes here!

Eliminate Cable – Try Free Streaming Options Instead

We know–we just told you to put your streaming services on hold in favor of the library. However, if the choice is between cable and streaming, the latter is often your cheaper choice.

YouTubeTV, for example, offers many of the same channels as cable and costs $72.99/month. By contrast, the average cable bill is now $217.42/month.

Granted, the internet is a part of that cable cost, but you can get the internet in your home for an average of $50/month. Following our math, that’s $122.99 with YouTubeTV and internet vs. $217.42 for cable. That’s a huge savings of $94.43/month.

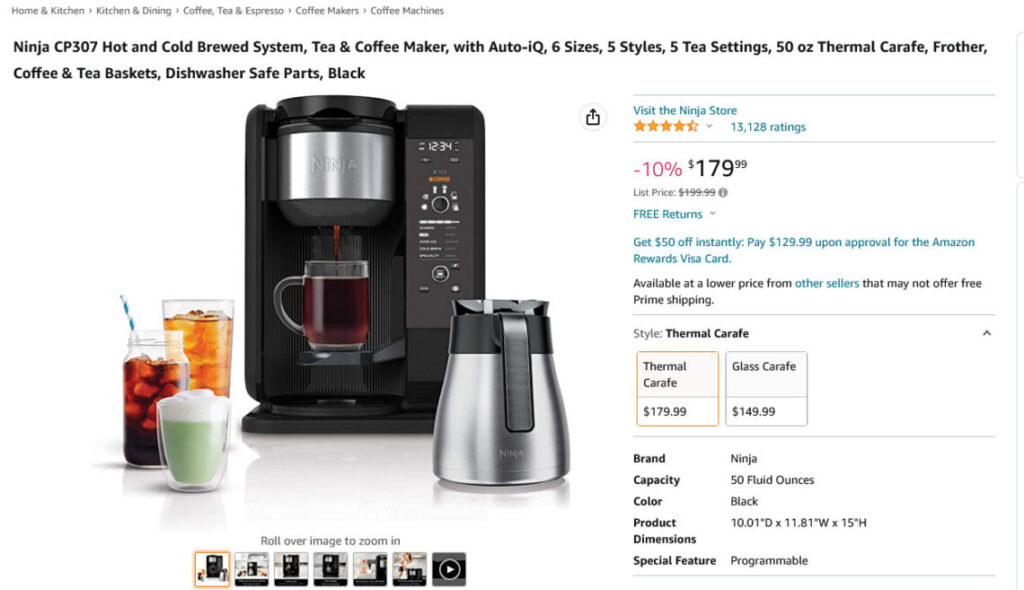

Eliminate The Coffee Shop Trips – “Treat ‘Yo Self” At Home Instead

Amerisleep recently polled just over 1,000 coffee drinkers about their java habits. People aged 25-34 spend an average of $2,008 per year just on coffee. That’s about $167/month.

Dust off your Mr. Coffee and buy some grounds at your local store, and you’ll watch your savings rack up. Or, if you’re a little more passionate about your morning brew, consider conjuring your inner barista and investing in one of the many affordable coffee brew stations. You can dupe your favorite Starbucks drink at home for a fraction of the cost.

Reduce Your Work Commute Costs – Explore Other Methods Instead

Transportation can be costly. One of the easiest ways to save money on it is to give your car a break and find alternate ways of getting where you need to go.

First, ask your boss if you can try working from home. Post-pandemic attitudes have changed the game regarding working-from-home options. Besides, there is no shorter or cheaper commute than the one from your bed to your home office.

If your boss wants you in the office and your commute to work isn’t very far, consider riding a bike to work when the weather permits. Bikes are free to ride and park and also typically less expensive to maintain than a vehicle.

If your commute is too long to bike, consider public transportation. Many local bus systems offer discounts to riders who buy multi-fare bus passes upfront or those who qualify for typical discounts, like those awarded to veterans.

Maybe you live somewhere with limited or no public transportation. Ask your co-workers to start a carpool. They’re a great way to save money and possibly make some new friends.

Eliminate Excess Energy Spending–Revise Your Habits Instead

The key here is evaluating your patterns and seeing where you can make adjustments.

Electricity

Your electricity bill is one of the most manageable bills to lower because it is very dependent on how you use it.

Some appliances, like your refrigerator, will need to draw electricity consistently. Other appliances do not need to be plugged in when not in use. Even when your appliances are turned off, they are likely still drawing power. Keep your electronic devices on a power strip to unplug several unused ones at once effortlessly. Excess electricity drawn from your appliances makes up an average of 20% of all residential electricity use.

Related: How To Lower Your Electric Bill

Heating

Use a programmable thermostat for easy savings. These thermostats allow you to align your home’s heating schedule with how you live. A programmable thermostat will automatically turn down the heat when you leave for work and turn it up before you come home.

If you’re leaving your heat at the same temperature all day, you might be surprised at the savings you incur with this simple switch.

Water

Depending on where you live, water can quietly eat into your budget. From Oregon to New Jersey, and recently, monthly water prices hover near $100 even in states like West Virginia. During these uncertain economic times, utility costs like these can quietly eat away at your budget.

Taking shorter showers, ensuring you turn off the taps, and other hacks can create noticeable savings each month. Check out some of our favorite water bill-hacking tips here.

Eliminate Your Bad Habits–Live Cleaner Instead

We all have a bad habit we’d like to kick, like smoking, over-snacking, or drinking.

Bad habits are not just bad for your health but can also be bad for your savings. Staying in and working out (saving on fitness centers), eating cleaner with home-cooked meals, and keeping an overall healthy mental attitude can help you become a better you and a more financially stable household.

Also, check out our dynamite article written by Mr. 3000 about saving $500,000 over a lifetime when you cut out drinking.

Ways To Earn $1,000 This Month

If changes to your non-essential spending don’t allow you to build an emergency fund of $1,000 in 30 days, you might be able to make up the difference by earning some money.

Sell Your Stuff

If you haven’t used a selling app before, check out our guide to the best-selling apps for getting rid of your stuff. These apps, which include Facebook Marketplace and Craigslist, can connect you with people in your neighborhood or even across the country.

Some apps will even buy your things directly from you. This means meeting up in parking lots or at your home could be a thing of the past.

Decluttr is one of those apps. It’s a great way to sell your used electronics. You can use their app to look up your items for an instant price. If you agree to sell your items for that price, you can mail your tech to them for free with their provided shipping labels. They will pay you the day after the items are received.

Check out Decluttr’s FAQs to see how it works.

Cashback Apps

Cashback apps make it easy to receive cashback on purchases that you plan to make anyway. Apps like Rakuten, formerly Ebates, can offer up to 40% cashback at over 3,500 different stores.

Rakuten is a shopping portal that directs you to some of your favorite stores and then collects the cashback for you. They then pay you quarterly with a check in the mail or a deposit into your PayPal account.

Get started earning cashback on your online shopping with Rakuten here.

Short-Term Side Hustles

Side hustles are an excellent way to make some extra cash. They don’t have to be long-term. Short-term side hustles can make it possible for you to earn an additional couple hundred dollars towards your goal of $1,000. Make sure you pay taxes on earned income if you fall within that category.

Manual Labor In Your Community

Ask your neighbors if they need help keeping up their lawns or shoveling snow in the winter. Working those jobs could earn you some decent money. Do a good job; the word-of-mouth reviews might earn you a lot of clients.

Virtual Assistant

If manual labor doesn’t sound like your sort of hustle, maybe try becoming a virtual assistant. If someone you know can’t seem to get ahead, offer your services and help them organize their life online. You might yourself have a whole new career!

Grocery Shopper

Stores need additional shoppers to fulfill online orders. Since you can often set your own hours, it’s easy to pick this up as a second job.

If one of these three doesn’t fit your skills, check out our full article on short-term side hustles.

How to Rebuild Your Emergency Fund

Many of us have had to dip into our emergency funds due to the COVID-19 pandemic. So if you fall into this category, rebuilding your emergency fund is critical. The best approach is to rethink your budgeting strategy. Buckling down on unnecessary expenses will help you incrementally add back to your losses.

Where Should You Keep Your Emergency Fund

You can keep your emergency fund in several places, but accessibility is crucial. Keep that in mind when planning your emergency fund budget.

Traditional Savings Accounts

Traditional savings accounts are the simplest and easiest way to keep track of and fund your emergency savings fund. They are easy to contribute to and open. Also, they rarely have requirements attached (such as high-yield savings accounts), so they are incredibly accessible. The downside is the return. The average savings rate is 0.10%. There are just too many other options now that will allow your money to make money for you.

High Yield Savings Accounts

A high-yield savings account has an advantage over its traditional counterpart with a much higher average APY. However, you should keep in mind that “high yield” in today’s market sometimes carries significant requirements: a high minimum balance (to avoid a monthly maintenance fee), access limitations, substantial overdraft fees, and varying compounding methods (monthly, quarterly, annually). Make sure to do your homework and read the fine print before opening.

Dive Deeper: CIT Bank Review: High Interest Rate Options

M1 Finance

M1 Finance is one of ChooseFI’s favorite robo-investors that offers many different types of options to invest your emergency fund at a high return. And you don’t have to be a financial guru to invest in securities such as ETFs and stocks, which offer a much higher return than savings accounts. Finally, there are zero fees to invest or withdraw funds.

M1 Finance offers high flexibility and returns at no cost, so we highly suggest using it to contribute to your emergency fund.

Dive Deeper: M1 Finance Review or open an account now here.

Roth IRA

Using your Roth IRA as an emergency fund has its advantages and disadvantages. Contributions to a Roth are made with post-tax dollars. So, you are allowed to withdraw funds from your Roth tax-free and without penalty, even if you haven’t reached the age threshold (so long as you do not withdraw gains). Further, gains from keeping your money in a Roth are significantly higher than even a high-yield savings account. The downside is that when you withdraw principal from your Roth, you reduce the long-run potential for exponential growth on that money. Since social security cannot provide a comfortable living for you in retirement, this can be a significant setback.

Dive Deeper: Should You Store Your Emergency Funds in the Total Bond Market?

Further reading: Investing 101 | The Ultimate Guide To Investing

When and Why Should You Withdraw From Your Emergency Fund

Withdrawing your contributions should only be triggered by an actual emergency.

- Job loss. This is the most crucial reason you should have at least six months’ worth of income saved. If you were to lose your job, you’d need money for expenses until you can find a new one.

- Health expenses. No one plans to get sick or have a car accident.

- Major car repairs. A new alternator or a water pump replacement can save you hundreds of dollars.

- Home repairs. If you have storm or flood damage without home insurance, these can be costly.

- A higher-than-expected tax bill. This is especially true for those without tax withholdings through their employer.

Advanced Emergency Fund Strategies

What if a different way to approach your emergency fund in FI would still let you keep cash on hand for emergencies but would also allow you to make more money?

For years, financial experts have told us that we should have money stashed away to deal with emergencies. That hasn’t changed.

What has started to change, especially for people pursuing Financial Independence, is where we keep that money. Typically, you would keep cash in a bank or a money market account where it earns very little interest but is easily accessible in the event of an emergency.

Changing where you keep that money is the new way of thinking about emergency funds in FI. You should put it somewhere less accessible so that it earns more while you are waiting to potentially use it. This keeps your money working for you.

This advanced section will closely examine this non-traditional approach to emergency funds in FI. The success of this idea depends on what a true emergency is, and we’ll define one. We’ll also discuss HELOCs and credit card floating, two new crisis management strategies. And finally, how to tell if the non-traditional emergency fund is right for you and the action steps to take.

Non-Traditional Recommendations to Fund an Emergency Fund

Let’s make one thing crystal clear. Rethinking your emergency fund in FI doesn’t mean you lose earmarked cash for an emergency. It’s about how that money can be accessed.

In podcast episode 66, Jonathan and Brad interviewed Big ERN (Early Retirement Now). He then did two things that rocked Brad and Jonathan’s world.

Big ERN first discussed his life story and how he was poised to give notice of his impending departure from his job so he could retire early.

Secondly, he offered a new way of thinking about emergency funds. The question that prompted his new path is this: What emergency would require you to have your emergency fund immediately accessible?

The answer is not many. You could be storing your emergency fund in something that gives you a better interest rate for a higher return because it’s not money that you have to access at a moment’s notice.

When an emergency occurs, you can use your credit card to float the money until you receive the funds stored in a growth account. Anything that might cost more than that can be paid for later after you have received your funds.

What Do True Emergencies Actually Cost Upfront

The success of this plan rests on what emergencies cost. When Big ERN asked what emergencies would require a large sum of money available immediately, it proved to be a difficult question to answer.

Try as they might, Brad and Jonathan couldn’t come up with something that costs more than $1,000, which most of those on the path to Financial Independence have in their bank account. Emergencies related to your health, home repair, car repair, your pet, losing your job – none of them amounted to much more than $1,000 upfront.

Many items on that list likely cost more than $1,000 in total. But the entire bill is never due immediately. There are always at least a few weeks between the emergency and the total bill.

Even the most pressing emergency, like losing your job, shouldn’t cost more than what you have in the bank. And by the time you’ll need to use money from your emergency fund, it will have been transferred to your account.

So, if you don’t need a lot of money upfront, why are you keeping it in a bank or money market account where the interest rate is incredibly low? You could keep that money in a number of other places – equities, index funds, stocks – that will help your money grow. This is where you can get creative with your emergency funds.

What Is Opportunity Cost and Why Does It Matter

The economic concept of opportunity cost started this whole change of thought regarding emergency funds in FI.

Opportunity cost is the process of asking yourself what you’re giving up to keep something else the way it is. In this case, what are you sacrificing to keep your traditional emergency fund?

The answer could be a substantial amount of wealth. On his blog, Big ERN cites a whitepaper on Empower’s website that succinctly explains the math behind this opportunity cost. In summary, it states that you’re losing about a third of your retirement spending by leaving all your emergency cash in the bank.

Big ERN’s Example

Big ERN cites the fact that if you had invested $1 in a 70% stock/30% bond portfolio in 1983 by 2013, that $1 would have been worth $18.36. On the contrary, putting $1 in a 60% stock/20% bond/20% cash portfolio simultaneously would have been worth only $14.11 in the same period.

With a different outlook on emergency funds, you could have made a 33% return on your money in that same time period. Over the course of your lifetime, you can see how that would add up tremendously.

So, the opportunity of keeping cash on hand costs you when it comes to your retirement savings is significant. At best, it means a large cut in your retirement spending. At worst, it means it takes you more years to retire with the money you need.

Non-Traditional Ways To Fund An Emergency Fund

In the same podcast where he introduced the idea of a non-traditional emergency fund to Brad and Jonathan, Big ERN discussed other places to find money to help you pay for emergencies.

There are two primary sources of extra funds: HELOCs and credit cards. It’s possible one of these could be your emergency fund in FI. Let’s look at both.

HELOC

A HELOC is a Home Equity Line Of Credit. Before qualifying for one, you typically need at least 20% equity in your home. The bank sets your HELOC credit limit based on the amount of equity that you have.

How Does a HELOC Work?

Once your HELOC is open, you have a draw period where you can remove funds from the line of credit. The draw period usually lasts five to ten years. What you borrow, plus interest, defines your payback period. You cannot take any more money out now; only pay it back. This period usually lasts from ten to twenty years.

What makes a HELOC attractive is that the interest rates are usually much lower than that of your average credit card. Based on the borrower, the average HELOC rate ranges from 2.99% to 21%. Banks examine your debt-to-income ratio, the amount of equity you have in your home, current interest rates, and your credit score to determine your rate.

Things to Consider

There are two things to consider when applying for a HELOC.

- Your home is collateral. You risk foreclosure if you don’t repay the HELOC within the defined time frame.

- The variable interest rates of a HELOC could come back to bite you. While they’re primarily based on you and your financial situation, they also depend on national interest rates. If those go up, you could end up paying more to repay the money from the HELOC.

Knowing all of this, if you have a HELOC at the time of your emergency (or you’ve done your homework to know where to get one), you’ll have extra funds close at hand whenever you need them.

Credit Cards

If you’ve been around FI for any length of time, you know how to use credit cards wisely. You don’t want to carry any debt with them, but you do want to use them for your purchases so that you can earn points and rewards with them. The goal is to pay off the entire card then immediately.

Credit cards can work to help you float money during an emergency while you work to transfer funds to your bank account.

Things to Consider

You need to consider a couple of things before making this choice.

- Credit card interest rates can be incredibly high. The average APR is 14.58%/month for existing customers and 17.98%/month for new customers. That’s a lot of extra money to pay back if you can’t pay off the whole balance on the first bill.

- You need to know your credit limits. Obviously, different cards have different rates and different credit limits.

Dive Deeper: Credit 101 | The Ultimate Guide To Credit

How To Tell If This Method Is Right For You

We’ll tell you now that this strategy might not be right for everyone. To determine whether it’s right for you, see if you can answer “true” to the following statements.

You Have a Very Solid Financial Foundation

Big ERN, Jonathan, and Brad are educated risk-takers with significant wealth. They don’t just jump into the latest financial fads and wouldn’t recommend that you do that, either.

The key to the success of this non-traditional plan for emergency funds in FI is the financial foundation that you have in place. Big ERN lists some hallmarks of an excellent financial foundation in his blog post about emergency funds.

- No consumer debt

- A significant net worth

- Structured monthly expenses

- Knowledge of the financial tools available if you need them

- A plan for what to do should a crisis hit

If you are still struggling to pay off debt and haven’t started saving much, this is not right for you where you are right now. This step is for those in the FI community who have advanced in approaching their finances.

You Have Done Your Research

As mentioned above, two of the most popular places to access more significant amounts of cash than you might have on hand are through a HELOC and using your credit cards.

However, the time to start researching a HELOC is not when you’re in the middle of a crisis. You should have that plan in place before the crisis hits. In other words, know who has the best rate on a HELOC, so you know where you’re going to get one if you need it and don’t already have it.

Which credit card will you use to float the money until you can transfer the funds to pay for the emergency? Which card offers the most points or rewards? What are the limits on each card you have? When catastrophe hits, you likely won’t have the time or energy to research this.

You Are Comfortable Choosing Flexibility Over Fear

In Podcast Episode 66R, Brad openly admits that he has a large amount of money in his bank account. He states that he feels comfortable with the idea that he has money that’s accessible should he need it.

By choosing the non-traditional emergency fund on the route to Financial Independence, you’re opening your mind to other possibilities. How much more money could you be making? Could you retire even earlier if you didn’t have this cash drag on your portfolio?

The bottom line is that people who follow Big ERN’s advice are ready to let go of their fear of not having money. They’re ready to be flexible enough to envision their money in a different way.

Action Steps To Move Your Money To A Non-Traditional Emergency Fund

Moving your money from your bank account or money market to an investment with a higher return may not be challenging, but it still requires some planning. Start by asking yourself these three questions.

Where Are You Going to Put the Money?

You must be careful where you put your cash as you still need access to it without penalties. Putting money in your 401(K) or a certificate of deposit (CD ladder) and then having to withdraw it may cost you a significant penalty. Look for options that have low-to-no penalties for withdrawing your money. Keep an eye on maturity dates when using a certificate of deposit account.

How Will You Diversify?

Part of moving your money should include an examination of your current investments. What do you have that’s working? Do you want to contribute more to that or branch out into other areas?

In a follow-up podcast to Big ERN’s new theory on emergency funds, Brad discussed the idea of putting his emergency fund cash into a Vanguard taxable account with automatic investments. If he does that, he doesn’t have to think about making decisions. Vanguard will do it for him.

Are There Other Ways to Use That Cash Accumulation That Make More Sense?

Brad also mentioned that since he already has significant funds in other places that are easily accessible, he might want to think outside the box.

He could use the money to pay down his mortgage or as a down payment on a rental property investment.

The point is that there isn’t one right way to use the money. You need to closely examine what you have and your goals to make the decision that makes the most sense for you.

Bottom Line

While these approaches aren’t for people just starting to understand their path to Financial Independence, examining your emergency fund is incredibly important for everyone. Anyone pursuing Financial Independence should keep these emergency fund concepts in the back of their mind. Your financial well-being becomes more secure through years of saving and investing, so you’ll have more room to be creative with emergency fund investing.

The bottom line is that you need to know your finances and your goals. When you do, the decision about what to do with your emergency fund in FI will become clear.

Related: Billions Of Dollars Go Unclaimed Each Year – Claim Yours!