ChooseFI | The Financial Independence Community

Are you new to the Financial Independence community and wondering where to start? This guide lists some of our most popular episodes that will introduce you to our amazing ChooseFI community and answer some of the FAQs new listeners tend to have!

Recent Podcast Episodes

Our Favorite FI Resources

These are the companies, credit cards, accounts, and tools that we recommend over and over again because all of us here at ChooseFI use them nearly every day! Discover our favorite bank accounts, investing platforms, finance trackers, comparison tools, and more.

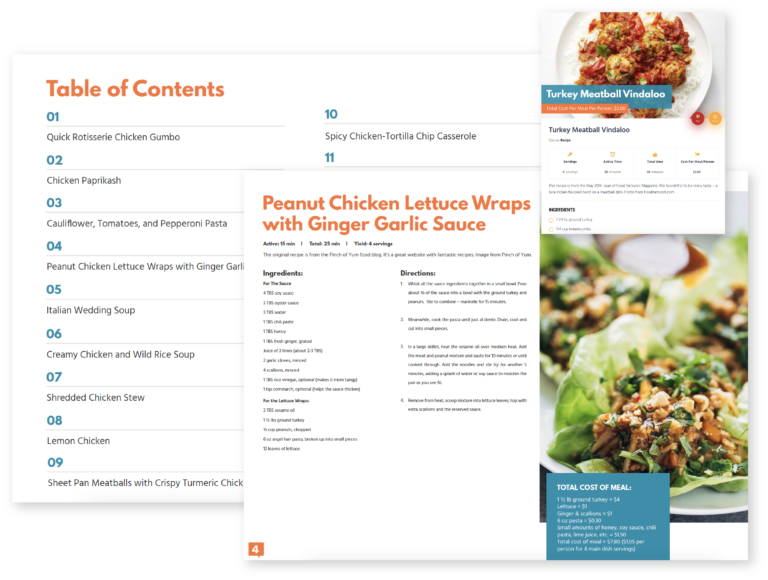

Save Money with Frugal Recipes

Cooking at home allows us to eat healthier, save money (how can you beat $2 per person per meal for dinner!), enjoy time together at home as a family, and on busy nights, pull leftovers out of the refrigerator when we are all going in different directions.

Crush Your Travel Costs

What if, by being intentional about which credit cards you use, you could take 1-2 nearly free vacations every year? Read our Ultimate Guide to Travel Rewards to get started!

Get Your weekly FI update from Brad

Encouragement, accountability, actionable advice, and inspirational community stories that are curated and written by Brad Barrett, host of the ChooseFI podcast, and delivered to your inbox once a week.