This six-part ‘ultimate guide’ to maximizing both earning and redeeming credit card rewards points is intended for you if: you’re new to travel rewards, you want to learn the simplest ways to efficiently earn and redeem your miles & points and, most importantly, you want to take 1-2 (nearly) free vacations each year.

- What Are Travel Rewards?

- Best Practices for Earning Travel Rewards

- What Type of Travel Are You Looking For?

- Four Questions to Ask Before You Start Planning

- Case Study | Travel to Hawaii from the West Coast

- Case Study | Fly to Australia and Japan

- How to Find Your Credit Score

- What Determines Your Credit Score?

- Tips for Building Credit

What Are Travel Rewards?

Here’s what we’re after with this strategy: Let’s take your smart credit card habits (paying them off on time and in full every month) and turn that into 1-2 nearly free vacations every year.

Many of us use our credit cards for all our life purchases and then pay them off in full every month. We’re used to getting only 1%-2% cash back and that feels like a win.

What if instead of 1% you could earn 10% – 30% on all your spending just by following this guide and opening very targeted credit cards with massive signup bonuses?

Now that’s a true win.

With the right planning and flexibility, this should be very realistic for you.

The great thing is if you have any questions along the way, you can always get help from the ChooseFI Travel Facebook group. With over 7,000 members of the FI Community in the group all focusing on maximizing their travel rewards points & miles, you’re sure to get the assistance you need!

Best Practices for Earning Travel Rewards

Organization Is Key

This travel rewards strategy is not difficult at all, but it does require some simple level of organization. Someone who can be a little organized, especially using the right tracking tools (get a sample sheet here on Google Drive) has the best shot at succeeding with travel rewards.

It’s essential you track when a new credit card account was opened, and the date when the ‘minimum spend’ amount must be met. You don’t want to miss out on earning a bonus due to a simple lack of organization.

Minimum Spend Explained: A credit card might offer a bonus such as “Earn 50,000 miles when you spend $3,000 in the first 3 months.” This means you have 3 months from the date of account approval to spend a cumulative $3,000 using that card. You of course will pay the bill on time and in full every month along the way, but once you reach that cumulative $3,000 spending, you will receive that bonus at the end of that account statement cycle in most cases (some award the bonus points immediately upon hitting the spending requirement, but that’s fairly rare).

If you choose to use our sample sheet or any spreadsheet, be sure to password protect it because points and miles accounts are valuable, and should be treated with the same care as you would your bank account information.

It’s also important to know what your log-in details are for the various airline and hotel loyalty programs. You can use the second sheet in the sample tool, or, sign up for a service like Bitwarden or LastPass.

Pay Off Your Card In Full Each Month

We can’t say it often enough: paying off your credit card on time and in full every month is crucial.

Also, never spend more than you would have spent otherwise just because you’re using a credit card or because you have to hit a spending requirement.

The extra amounts you spent or any interest expense you pay (if you didn’t pay the card off in full) will outweigh any “free” travel you earn.

Make Travel Plans Early

Make some initial travel plans as far ahead as you can, preferably about 12 months ahead of time.

You want to have a lot of time to earn the necessary points & miles to pay for your trip, instead of scrambling at the last minute and hoping there are still award flights available.

“Blackout dates” are mostly a myth, but what actually occurs is pretty simple: There are limited award seats available on every flight and there are millions of people with airline miles and they get booked up.

So you always want to plan as early as is practical to get the “saver level” award seat availability.

Award seats usually open up between 300-355 days out (roughly 10-12 months prior to the flight), depending on the airline.

When that date comes around, and you have the necessary points, grab those flights! Then you can start figuring out all the other details later (hotel, rental car, etc.).

That all said, it isn’t a requirement to plan so far in advance, so if that scares you, definitely know you can still succeed with this strategy! You might just need to…

Be Flexible

Flexibility is the single most important factor in succeeding with travel rewards.

Be flexible with where you want to go.

Be as flexible as you can when you travel. If you can shift your travel days by even a few days, that could mean the difference between getting flights using mile and being shut out.

Be as flexible as possible with the airlines and airports you’re willing to fly into and out of.

If you are locked into a precise set of dates to a precise location on one particular airline, then you might be frustrated at the “blackouts” (again, someone else booked these seats…).

But if you say something like, “I’d like to take a 10-day vacation to Europe next summer” and you’re flexible with dates and destinations, it’s nearly a 100% likelihood you’ll successfully be able to pull that off.

Keep An Eye On Your Credit Score

Your credit score is an essential part of your travel rewards journey, so you want to pay attention to it and understand the different ways that the score can change.

A credit score that’s at least rated “good” (670-739) is going to be necessary to even think about getting started, but those whose scores are “very good” (740-799) and “exceptional” (800-850) are more likely to get approved for cards with the best bonuses.

Key Point

The actionable takeaway for this section is to download the sample organizational tool and get familiar with each sheet’s different columns. Don’t apply for any credit card or loyalty programs just yet, though.

A little flexibility and organization are key, so if you want to get the best rewards, make sure you do those two things.

What Type of Travel Are You Looking For?

Since earning ‘nearly free’ vacations can be an important part of your financial independence journey, let’s take a step back and figure out your ‘Why of Travel.’

Doing so will help you prioritize your strategy and help determine how best to get started.

Are you celebrating an anniversary? Flying to care for a loved one who is ill? Taking the family for a Disney vacation? Doing a little international geo-arbitrage? All are good reasons to travel and take advantage of rewards points and miles.

Here are a few quick examples of different traveler types, which will help inform their strategy to accumulate miles & points:

Traveling the US to Visit Family & Friends

If your plan is to fly around the US visiting family and friends, an excellent strategy is to build up Southwest Rapid Rewards® points. Sure, the other US carriers will get you where you want to go, but Southwest can’t be beaten for flexibility and availability when it comes to award flights.

Put simply, these are the easiest miles to redeem and there are no award seat limitations. If they have a flight available to pay for with cash, you can use your miles.

The first place to start with this, or really any, potential travel rewards strategy is to find the Wikipedia page for your local airport(s) by Googling “(city name) airport wiki” and then navigating down to the “Airlines and destinations” section.

This is the single easiest way to find out what airlines service any airport in the world and what direct flights are available to/from that airport.

In our case, you want to see if Southwest Airlines has any service to/from your local airport(s). If so, and especially if there are many destinations listen, then this Southwest strategy is going to be an amazing option for you.

You might even want to earn the lucrative Southwest Companion Pass, which lets a family or friend fly with you for free (just $5.60 each way domestically for the mandatory TSA security fee. So from here out, just remember that on round-trip flights in the US where you use miles, you’ll always have to pay $11.20 out of pocket).

We’ll get to the Companion Pass in a later section, but if you think you can maximize Southwest miles, then the credit cards you want right off the bat are:

- Any one of the Southwest Airlines personal cards

- Any one of the Southwest Airlines business cards

If you don’t care about the Companion Pass and just want to build a stash of Southwest Rapid Rewards® miles, then the ultra-valuable and transferable Chase Ultimate Rewards® (UR) points are going to be a big part of your strategy. These UR points can be transferred to Southwest’s loyalty program and become Southwest miles.

Think you don’t qualify for a business card? Think again! We explain later in this series why almost anyone with a side hustle may qualify for a business card, so leave all those travel rewards on the table for now.

Family Travel

So let’s say your plan is to take your family of five to Disney World or Hawaii. In the world of travel rewards, things get more difficult when the size of the traveling party grows. This again is because award seats are generally limited (except Southwest) and to find 5 award seats on the route you’re looking for can be more challenging than finding 1-2 award seats.

So you are going to need plenty of points and ideally you want to plan ahead as far as possible so you have these points accumulated when you want to book.

Travelers Without Much Flexibility

Let’s say you have school-aged children and you want to travel on spring break, or you’re a teacher or in a profession where you have very specific days off each year without much flexibility. We’ve mentioned that flexibility is key, but that doesn’t mean you’re shut out if you don’t have flexibility with your dates of travel.

Remember, there are always other ways to build in flexibility!

You can be flexible with your destinations or the airports you fly out of.

You can also be flexible with the types of points & miles you use or how you use them. For instance, Chase points can be used through Chase Travel℠ which is essentially a search engine for flights and hotels. You find something you like and you can book it partially or completely with UR points.

Or multiple instances of Capital One miles can be used to offset a travel expense on your credit card statement, so you just book your trip using your card and go back in after the fact and offset part or all of your travel expense.

Four Questions to Ask Before You Start Planning

As with any hobby, there are rules, and you need to learn them for optimal results. It’s why we put this guide together. Below are some factors you should take into consideration when determining how and when you’re going to travel:

Your Estimated Travel Date

Is your travel tied around specific dates? Or do you have some flexibility in picking when the travel actually happens? Generally, the more flexibility in the dates you have, the better your chance of booking almost-free travel.

Domestic VS. International Flights

Are you staying within the US, or will your travel take you further afield? The further you go, the further ahead you’ll need to plan your travel rewards strategy. International travel also means you should learn how to get the best deals on non-US airlines (stay tuned!).

Number Of People Traveling

How many people will you be traveling with? Is it solo travel, or with a significant other? Is it with family and friends?

The more people you have in your party, the harder it is to get almost free travel on the same flight. But there are workarounds, such as flying on different days, or on different airlines. Flexibility here definitely helps.

When You Travel

How soon do you wish to travel? The sooner your desired date of travel, the fewer options you may have. Don’t be discouraged, though, there are always ways to save on travel.

Now, onto two quick real-life case studies, where you’ll see examples of travel rewards in action:

Case Study | Travel to Hawaii from the West Coast

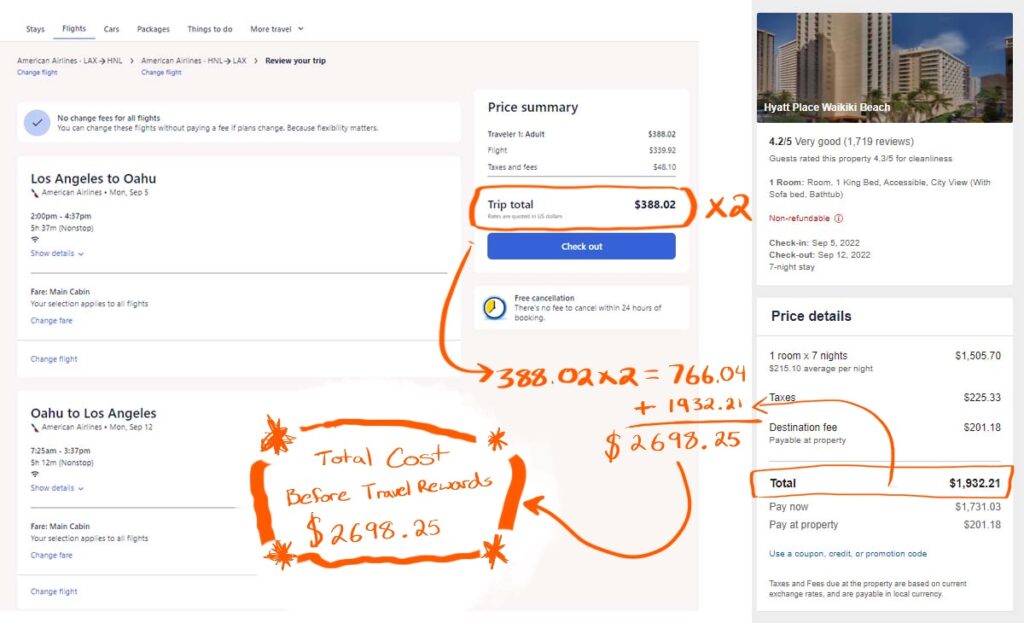

Flight for two in economy from Seattle to Honolulu plus a 7-night hotel stay, in September 2022.

Without travel rewards, you’d be paying over $3,000 for the plane tickets and hotel. Here are the calculations and screenshots to prove it. These prices were checked in November 2021, but note that prices fluctuate throughout the year.

Roundtrip, non-stop flights on American Airlines for two:

$388.02 x 2 = $766.04

Hyatt Place Waikiki Beach for 7 nights:

$1,932.21, including $426.51 in taxes and fees

Total cost if you paid in cash:

$2,698.25

Rather than paying $2,698.25 in cash, we can use travel rewards to get this same trip for only $22.40! To do this, we will be using Chase Ultimate Rewards® (UR) points.

The optimal way to use UR points is to transfer those points to one of their airline or hotel partners. Our favorite partners include: Southwest, United, Hyatt and British Airways (more on BA below).

You simply link up your rewards account at these airlines & hotels in your Chase online account and make the transfer. These UR points then become those miles/points and are no longer in or related to your Chase account.

Flights

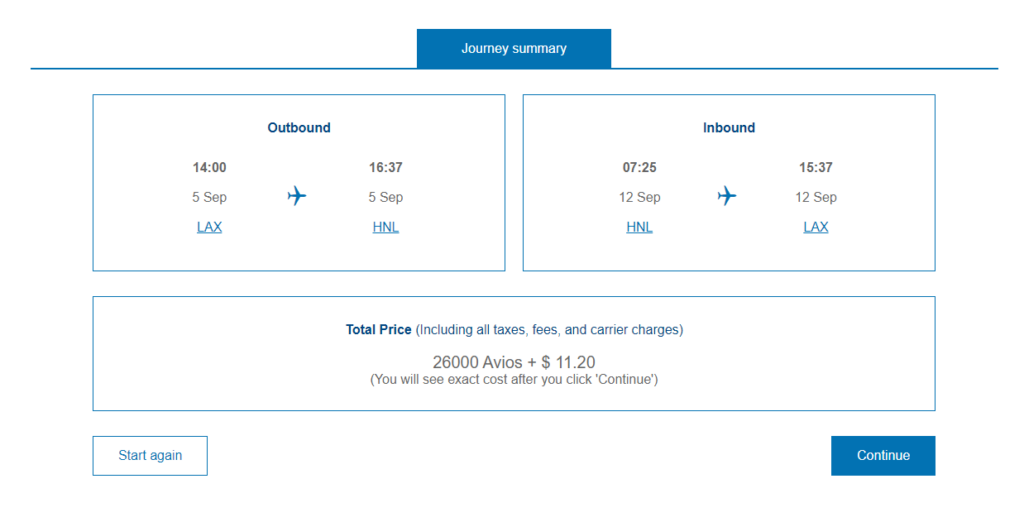

For the flight we can transfer 52,000 UR points to our British Airways account, to redeem the same two flights in economy on American Airlines to Honolulu.

2 x 26,000 = 52,000 UR Points + 4 x $5.60 TSA Fee = $22.40

British Airways you ask?

This is the beauty of two fun aspects of travel rewards:

- Airlines alliances

- ‘Sweet spot’ redemptions

Airline Alliances

When you have miles of one alliance partner, you can use those miles to book award flights on routes flown by other alliance partners.

So in this instance you’re using your British Airways miles on the British Airways site (you’re using their miles after all!) to book a flight flown by their OneWorld Alliance partner American Airlines.

This is the beauty of the alliance: BA doesn’t have a flight from LA to Oahu, but American does. So you can use your BA miles to book the flight if there is “saver level” availability on American for a particular flight. Note: Alliance partners only see the lowest level “saver” seats offered by their alliance partners. So you may see an instance where an award flight is available for more miles on AA’s site, but you can’t book that flight with BA miles.

The 3 major alliances and their main US airline:

- OneWorld: American Airlines

- Star Alliance: United

- Sky Team: Delta

‘Sweet Spot’ Redemptions

Sweet spot redemptions usually come about by taking advantage of the airline award chart (the chart that shows how many miles it costs to book certain routes. For instance, a standard one-way ‘saver level’ award seat from the US to Europe is 30,000 miles) to book flights on alliance partners for far fewer miles than you’d otherwise spend if you had miles in the partner you’re actually flying.

British Airways has many ‘sweet spots’ because their award chart is based on the actual distance of the flight.

In the case of LAX-HNL, the flights are 13,000 BA miles for a one-way flight on the American Airlines plane, but for those people with American miles, the cheapest award flight they could get on that same airplane would be 20,000 AA miles one-way.

That is a sweet spot.

Hotel

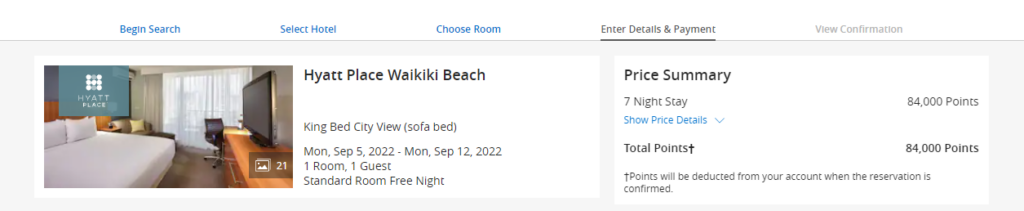

For the hotel we can transfer 84,000 URs points to Hyatt, to make the reservations at Hyatt Place Waikiki Beach.

Hotels are much easier to redeem points at than using airline miles, because as long as they have a “standard” hotel room available for booking with cash, you can use your points to book.

In the case of the Hyatt Place Waikiki Beach, this is a “Category 3” Hyatt hotel which only costs 12,000 points per night. So our 7-night stay will cost 84,000 UR points when transferred to our Hyatt account.

There are also $0 in taxes and fees added to most hotel points bookings!

84,000 URs points = $0

Total cost for this 7-night trip to Hawaii including airfare and hotel:

136,000 UR Points + $22.40

Total value of points redeemed:

$2,698.25 – $22.40 = $2,675.85. This is the amount that travel rewards saved us.

To figure out the value of each UR: $2,675.85/136,000 URs = ~2 cents per UR point. Compared to your option of redeeming UR for 1 cent per UR cashback, that’s pretty good value!

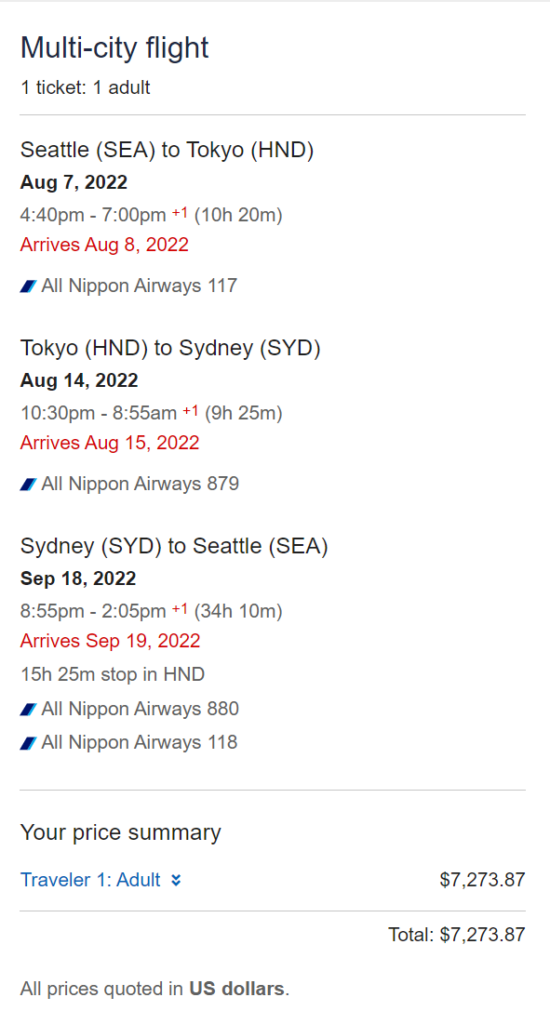

Case Study | Fly to Australia and Japan

Flight for one in business class from Seattle to Sydney, with a stopover in Tokyo.

Full Cash Price

If you paid cash, this trip would have cost $7,273.87. Ouch!

Business class award seats are a true luxury, especially on such long trips, so let’s just see what is possible using miles!

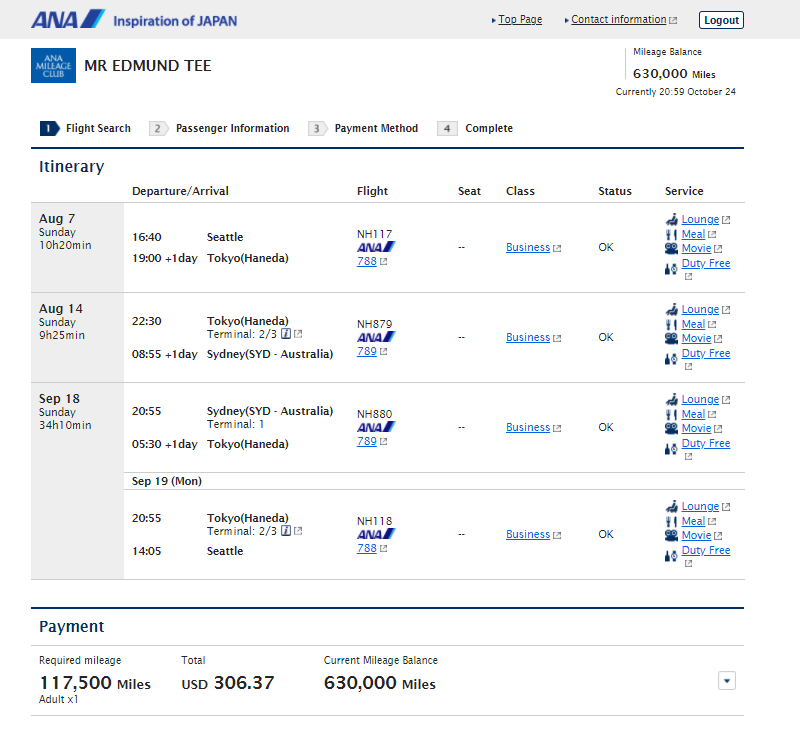

Here was what we found for a flight on All Nippon Airways (ANA) from August 2022 through September 2022.

If you use a travel rewards currency from American Express called Membership Rewards (MR) and transfer those points to ANA at a 1:1 ratio, you can book a business class flight to Sydney, with a stopover in Tokyo, for 117,500 MR. These MR become 117,500 ANA miles and you have to pay $306.37 in taxes & fees.

Note: While we only pay $5.60 one-way for US domestic flights, when you fly internationally using miles, there are often significant taxes & fees required by other countries. This is unavoidable if booking award flights with miles. However, if you book using something like the Chase Travel℠, these taxes & fees are already included in the ticket price, so it makes a redemption option like that much more plausible.

Total value of points redeemed:

$7,273.87 – $306.37 paid in fees = $6,967.50 saved

That works out to $6,967.50/117,500, or almost 5.9 cents per MR point, which is amazing for this kind of business-class luxury.

Who Should Not Use This Travel Rewards Strategy?

If you have ever cut up your credit card or stuck it in the freezer because you can’t control your spending, or if you are not able to pay off your credit card statements in full, on time, every time, this is not for you.

Using credit cards irresponsibly can set your financial freedom clock back by years. We’ll always be here to help you get started with travel rewards when you’re ready, so take your time to get your basic finances in shape first.

Crush high-interest debt. Build up your emergency fund. Nurture your credit score. Do all these things first, and you’ll find travel rewards a great tool to enjoy your FI journey while spending less.

Still with us? Great! Now let’s take a look at how all of this is possible.

How Are Travel Rewards Even Possible?

Credit card companies buy miles from airlines and points from hotels and then repackage them as ‘signup bonuses’ or “rewards” to entice people to use their travel rewards credit cards.

However, in the FI community, we optimize and approach everything with intentionality, so we’ll use credit cards if and when they serve us best.

The whole idea is to earn these sign-up bonuses by spending money you were already going to spend anyway and to be intentional about what method (in this case a targeted credit card) you use to pay for that expenditure.

Know that if you actually spent extra money just to earn a signup bonus, that kind of defeats the purpose. It isn’t “nearly free travel” if you’re increasing your monthly expenses to buy the stuff you don’t need, just to hit a spending requirement for a signup bonus.

Travel Rewards Points are Even More Valuable than You Think

When you normally pay for a trip that costs, let’s say $4,500, you’re actually using “after-tax” money to pay for that travel.

For instance, if your annual federal and state taxes are 25% (for easy math), and you spend $4,500 on your travels, that actually cost you $6,000 in pre-tax money ($6,000 x 25% = $1,500 in taxes you paid to have the remaining $4,500 you spent on your trip).

So, the value of your travel rewards is actually higher than the actual cash you would have paid!

How to Find Your Credit Score

Learning Your Credit Score Is Easy

Many banks give you your credit score for free directly from at least one of the three credit reporting agencies: TransUnion, Experian, and Equifax.

If your bank does not provide you with this information, you could get an approximation of your score with a free account at Credit Sesame or Credit Karma.

In general, you’ll need a score of at least 700 to get approved for the high-value travel rewards cards that we discuss in this course.

Checking Your Credit Report

It’s generally a good idea to check your actual credit report every few months to make sure there isn’t any unauthorized activity there.

If you enjoy free travel, it’s especially important to check your credit report so you know just how many cards you have open, and for how long they’ve been open.

This knowledge will empower you by helping you decide which credit cards to apply for, and when to apply for them so that you maximize the odds of approval.

Each of the credit reporting agencies has to give you a free copy of your credit report once a year. So if you space out your requests, you’ll get a free report every four months.

You can get your free annual reports here from the official site.

Protecting Your Credit

You can freeze your credit file with each of the three credit reporting agencies for free.

This makes it harder for someone to open a new account in your name because, during a freeze, businesses cannot request your credit file unless you unfreeze it using your security credentials.

You will have to contact each agency separately to request a freeze. Here are the links to each of the three agencies:

Once your credit is frozen, you will need to call the agencies to lift the freeze at least an hour before applying for a new credit card. When you are done, remember to call back to refreeze your credit.

Don’t confuse a freeze with a lock. They do the same thing, but a lock is a paid service, whereas a freeze is free, guaranteed by federal law.

Another important way to protect your credit file is with a year-long fraud alert. This instructs businesses that check your credit to verify with you before opening a new account.

Unlike a credit freeze, which requires you to contact each agency separately, when you request a fraud alert with one agency, that agency has to notify the other two.

What Determines Your Credit Score?

High Impact

Derogatory marks: One of the things that will sink your score is if you have missed a bill, defaulted on a loan, or declared bankruptcy. If you have been in any of these scenarios recently, this is likely not the time to pursue travel rewards credit cards

Credit card usage: When you have multiple accounts with a significant total credit limit, but only use a small percentage of them, you are exhibiting behavior that tells lenders you’re a responsible consumer.

This will actually give your credit score a nice bump. So the more cards you have, the more credit you will have. If you continue to limit credit usage despite having more cards and a larger line of credit, your new travel rewards credit cards will actually strengthen your score over time.

Medium Impact

Age of credit history. Each time you get approved for a new card, the average age of your credit history gets a little smaller. Since lenders prefer a long credit history, new cards will cause your credit score to dip. Thankfully, the longer your credit history, the smaller this impact will be. So keep your oldest accounts open!

Low Impact

Total accounts: The more accounts you have, the better it is since it suggests that lenders think you are creditworthy. So, your score goes up a little.

Credit inquiries: The more credit inquiries you have, the more your score will drop, whether or not your application was approved. The good news is that after a few months, each inquiry will have little to no impact.

Tips for Building Credit

Don’t Apply For Too Much Credit At Once

The most common concern we’ve heard from folks who are new to travel rewards is whether opening new credit cards every few months will affect their credit score.

In the short term, yes, it may cause the score to dip ever so slightly. So, if you are going to be applying for a major loan, like for a home or car, consider holding off on applying for new credit cards for at least 12-18 months prior.

But over time, your credit score may actually go up if you use your credit cards responsibly.

Actionable Takeaways For Your Credit Score

You have three actionable takeaways for this section:

- Check your credit score, either with your bank or with free services like Credit Sesame or Credit Karma.

- Freeze your credit file with all three credit reporting agencies.

- Request a fraud alert from at least one agency.

Now that you understand the basics of getting started in travel rewards–and how important your credit is–it’s time to learn how to put all this information to use.

Now that we’ve got you set up for success, in our next travel reward article, we’ll dive deeper into the world of travel rewards in part 2 of this series.