Vanguard and Fidelity are the two of the largest, and most well-known investment management companies around. Both offer the low-cost broad-based index funds we love here at ChooseFI. But why choose one over the other? That’s exactly what we’ll be talking about today.

If you’re looking for low-cost mutual funds and have over $1,000 to invest, you’ll probably want to pick Vanguard. But Fidelity is best for active stock traders and investors who are starting with an account value of less than $1,000.

What Is Vanguard?

Vanguard is an investment management company that offers low-cost mutual funds and ETFs. John Bogel–the founder of Vanguard and mutual funds themselves, wanted Vanguard to be a client-owned company (which it is) in order to eliminate outside owners seeking the company’s profits.

Vanguard is the leading authority in low-cost funds, making it great for investors who want to avoid hefty fees.

Vanguard Features

Let’s take a look at a closer look at Vanguard’s platform and all that they have to offer for investors.

Mutual Funds

Mutual funds are obviously the star of the show at Vanguard. Vanguard offers no-load mutual funds, meaning you don’t pay any sales fees when you buy fund shares or when you sell fund shares.·All you pay is one low expense ratio fee. How low? Well, Vanguard says that the average expense ratio across their index mutual funds and ETFs is 73% less than the industry average. And they say that they’ve saved their investors $715 million in just the past seven years alone.

That can make a huge difference in your portfolio’s overall return over time. And, if you’re concerned about managing your funds, don’t worry. Vanguard has experts who keep track of every security your mutual fund owns.

Vanguard Admiral Shares

Vanguard’s normal mutual fund ratios aren’t low enough for you? Believe it or not, you can cut costs even further by buying Admiral Shares of Vanguard funds. Vanguard says that their Admiral Shares expenses ratios are 35% lower than their standard Investor Share class

83% lower than the industry average!

Most of Vanguard’s funds have Admiral Shares options. But in order to qualify for the lower expense ratios, you’ll need to meet and maintain a minimum investment of:

- $3,000 for most index funds.

- $50,000 for most actively managed funds.

- $100,000 for some sector-specific index funds.

The $3,000 minimum for index fund Admiral Shares is actually quite reasonable. And even if you don’t meet the minimum account requirements now, don’t worry. Just start investing now with Investor Shares. And once you meet the account minimum, you can convert to Admiral Shares!

See which Vanguard mutual funds have Admiral Shares.

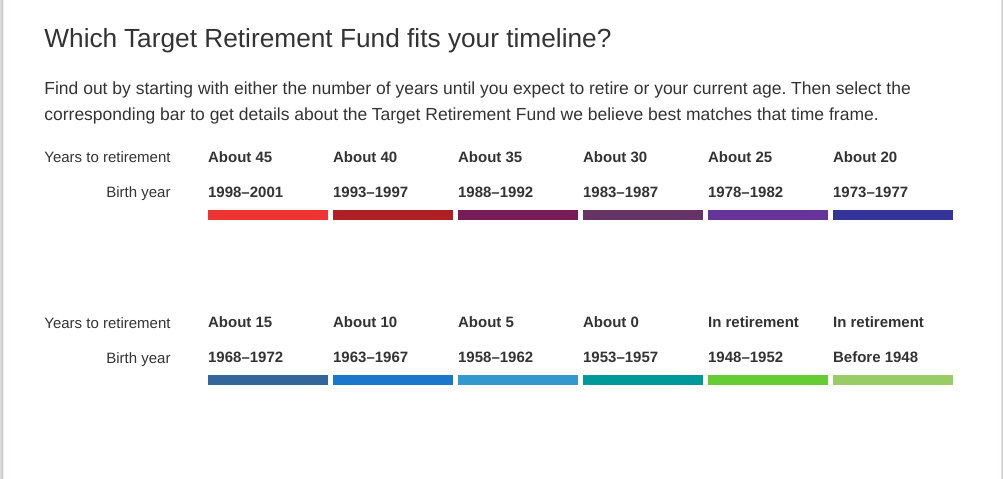

Vanguard Target Retirement Funds

Another one of Vanguard’s most popular mutual classes is their Target Retirement Funds. To begin, you tell Vanguard your current age or how many years from now you expect to retire. Then, Vanguard will add you to the Target Retirement Fund that matches that retirement date.

From that point forward, Vanguard actively manages the fund for you. Their goal is to maximize growth while minimizing risk, especially as you get closer to your retirement date. In other words, if you’re 30 years from retiring, the Target Retirement Fund will be more aggressive. But it will transition to a more conservative profile if you’re only five years from retirement.

Since Target Retirement Funds are actively managed, they’ll be more expensive than an index fund. But Vanguard says their Target Retirement Funds are 81% lower than the industry average for comparable funds.

Vanguard ESG Funds

Have you heard of socially responsible investing? The idea is that you only invest in companies that meet certain ethical, moral, or environmental guidelines. Socially responsible investing has taken the investing world by storm in the past few years. And if that’s something you’re looking for, Vanguard has options for you.

Vanguard calls their socially responsible funds ESG funds. By ESG, Vanguard means that the money from these funds will only go to support companies that meet Environmental, Social, and Governance standards. Currently, they have two ESG funds:

- Global ESG Select Stock Fund (VEIGX)

- Social Index Fund (VFTAX)

Learn more about Vanguard ESG funds and ETFs.

ETFs

Exchange Traded Funds, aka ETFs, are similar to conventional mutual funds in that they are composed of a collection of tradeable assets, such as stocks or bonds. In fact, all Vanguard ETFs have a mutual fund shareclass which is not only equivalent, but the mutual fund and the associated ETF are backed by the very same assets and the mutual fund shareclass can be converted into ETFs as a tax free transactions. Vanguard has a large list of low cost ETFs of their own that or you can choose to invest in other company’s ETFs using the Vanguard platform. On average, Vanguard’s ETF expense ratio is 74% less than the industry average.

Accounts Offered

When it comes to retirement accounts and savings vehicles, Vanguard has most options, including:

- Roth IRA

- Traditional IRA

- Simple IRA

- SEPs

- Individual 401(k)

- 529 College Savings

Minimum Investments

The minimum investment Vanguard requires differs depending on the investing vehicle. For example, mutual funds require a minimum investment of $3,000. But you can invest in any Vanguard Target Retirement Fund or in Vanguard STAR®Fund with as little as $1,000.

The minimum investment for ETFs is the cost of one share. And the same goes for stocks, CDs, and bonds.

Fees

There are few fees associated with Vanguard, but that doesn’t mean there aren’t any. As I said above, you only pay on expense ratio with mutual funds and ETFs. According to Vanguard’s site, their expense ratio is 82% less than the industry average.

At the time of writing, Vanguard’s average expense ratio is 0.11%, while the industry average expense ratio is 0.62%.

Vanguard also has a $20 annual fee that applies to each of your brokerage and mutual-fund-only accounts which are configured to receive paper statements, prospectuses, and privacy notices rather than electronic delivery. This fee is easily avoided by choosing electronic delivery.

Vanguard Personal Advisor Services

Vanguard offers Personal Advisor Services that can help you create a financial plan that works for your goals and risk assessment. What’s so nice about Vanguard Personal Advisor Services is that you get both a Robo-advisor and access to a human advisor. And all for only a 0.30% annual advisory fee.

That fee is nearly as low as many of the top Robo-advisors available today. But virtually no Robo-advisor allows you to contact a human CFP without paying a higher fee. With Vanguard Personal Advisor Services, you’ll have a one-time meeting with a CFP to create your plan.

And if you decide to continue with the service, you can connect to an advisor at any time via phone, email, or video chat. They offer a helpful video that explains Vanguard Personal Advisor Services in more detail.

The downside? Unfortunately, you’ll need a minimum of $50,000 to invest in order to qualify for Vanguard Personal Advisor Services. If you don’t have that much to invest, then Fidelity may be a better choice, as they have advisor options for all account sizes.

Mobile Apps

There truly is an app for everything, including managing your Vanguard account. With the Vanguard mobile app, you can:

- Check your balances, performance, prices, returns, transactions history, and cost basis

- Buy, sell, or exchange

- View your whole portfolio

- Use Touch ID or Face ID to log on a lot faster (if you have an iPhone)

Related: How To Open Accounts With Vanguard, Fidelity, and Schwab

Who Should Use Vanguard?

Best For:

- Investors looking to trade mutual funds and ETFs

- Low-cost investing

- Those with at least $50,000 invested and are looking for a good advisor service

Related:

- Vanguard Review 2022: Low-Cost Investing On The Path To FI

- How To Move Money From A Financial Advisor To Vanguard

- How To Open Accounts With Vanguard, Fidelity, And Schwab

What Is Fidelity?

Founded in 1946, Fidelity is another investment management company that offers many of the same features and accounts as Vanguard. Unlike Vanguard, Fidelity is privately owned. The current CEO and President of Fidelity is Abigail Johnson.

Fidelity Features

Here’s everything you need to know about Fidelity’s investment options, perks, and fees.

Accounts Offered

Fidelity offers many of the same accounts as Vanguard, including:

- Rollover IRA

- Traditional IRA

- Roth IRA

- SEP IRAs

- SIMPLE IRAs

- Self-employed 401(k) + other 401(k)s

Minimum Investments

This is an area where Fidelity really shines. Some of their funds do have $1,000 or $3,000 minimums like Vanguard, but they also have mutual funds with minimums as low as $1. Additionally, Fidelity allows you to buy fractional shares of ETFs and stocks across more than 7,000 stock and etf choices. So if you just starting investing and have less than $1,000 to invest, Fidelity is a good fit.

Stocks and Options

Fidelity is the clear winner if you want to actively trade stocks. Vanguard is primarily built for fund and ETF trading, not stock and options trading. The stock and fund research tools are far better at Fidelity than at Vanguard for anything other than Vanguard funds.

Fidelity’s Active Trader Pro platform is full-featured and is available to customers who trade at least 36 times in 12 months. Neither Fidelity or Vanguard charge commissions for stock purchases, but if you wish to dabble in options trading, Vanguard does not even off this option.

ETFs

Each of Fidelity’s ETFs are completely commission-free. You can search by themes to identify investments that interest you. And you customize your screens using over 100 different ETF criteria. Much like Vanguard, you are not limited to only investing in Fidelity ETFs. You have your choice among the nearly all widely traded ETFs—including Vanguard ETFs—commission free.

Mutual Funds

Even though Vanguard is the creator of mutual funds, Fidelity holds its own when it comes to offering some of the best low-fee mutual funds on the market. Let’s take a look at a few of Fidelity’s most popular mutual fund classes.

Fidelity Flex Funds

Fidelity sent mild shockwaves through the investment world when they announced that their Fidelity Flex funds would have 0% expense ratios. That’s right, no expense ratio whatsoever.

But before you get too excited, there is a major catch upcoming. You can only access them if you’re a Fidelity Go member. Fidelity Go is Fidelity’s entry-level Robo-advisor service which we’ll discuss later. But for now, all you need to know is that Fidelity Go charges a 0.35% annual advisor fee.

So in order to get “free” index funds, you have to pay a 0.35% annual fee. Now, if you happen to be a Fidelity Go member, I think Fidelity Flex funds are a great option. But I wouldn’t join the service just to access the “free” funds.

Fidelity Freedom Funds

Fidelity Freedom Funds are Fidelity’s version of Target Retirement Funds. Currently, Fidelity has 13 different choices. Once you’ve picked your fund, Fidelity takes things from there. You don’t need to worry about changing your asset allocation over time. And many of them have very affordable expense ratios, several as low as 0.08%.

Check out each of the Fidelity Freedom Fund choices.

Fidelity ESG Funds

Remember Vanguard’s socially responsible investing funds? Well, Fidelity has its own versions. Currently, Fidelity offers 5 ESG funds.

- FITLX–Fidelity® US Sustainability Index Fund

- FNIDX–Fidelity® International Sustainability Index Fund

- FSLEX–Fidelity® Select Environment & Alternative Energy Portfolio

- FNDSX–Fidelity® Sustainability Bond Index Fund

- FWOMX–The Fidelity® Women’s Leadership Fund

Interested in learning about the types of companies that each of the above funds invests in? Learn more on their ESG Funds page.

Mobile Apps

Fidelity has fully embraced app culture. Their app allows you to:

- View and monitor your portfolio

- Manage your workplace accounts

- Trade

- Pay bills

- Receive alerts

- Deposit checks

Fees

Fidelity’s fees depend on your choice of investment:

- Stocks: $0 per online stock trade. Options have a $0 commission but have a $0.65 per contract fee.

- ETFs: $0 per trade for online ETF trades

- Bonds & CDs: $1 per bond for secondary bond trading and free for US Treasuries traded online

- Mutual funds: Many of Fidelity’s mutual fund have no fees (see above)

Advice

Right now, Vanguard only offers one option if you’re looking for advice—Vanguard Personal Advisor Services—which offer Robo and human advice. And while the service is great and affordable, it’s only available to clients who have account values of at least $50,000.

However, Fidelity has a variety of Robo and human advisor services. No matter your account size, Fidelity should have a service that’s a perfect fit. Currently, they have four different options:

- Fidelity Go:

- Type of service: 100% Robo-Advisor

- Advisory fee: 0.35%

- Account Minimum: $0

- Fidelity® Personalized Planning & Advice

- Type of service: Robo-Advisor combined with coaching from advisors when you need it

- Advisory fee: 0.50% fee

- Account Minimum: $25,000

- Wealth Management:

- Type of service: You get a custom plan and dedicated advisor

- Advisory fee: 0.50% – 1.50%

- Account Minimum: $250,000

- Private Wealth Management:

- Type of service: You get your own wealth management team lead by your advisor

- Advisory fee: 0.50% – 1.05% fee

- Account Minimum: $2 million managed through Fidelity® Wealth Services and $10 million or more in total investable assets

The annual fee for Fidelity Go is about on par with other Robo-advisors. But keep in mind, Fidelity is a relative newcomer to the Robo-advise space.

You’ll want to compare their features and performance with other top Robo-advisors like M1 Finance, Betterment, and Wealthfront.

Who Should Use Fidelity?

Best For

- Anyone who wants an excellent Robo-advisor

- Stock and mutual fund trading

Final Thoughts

Fidelity is best for active stock traders or investors just getting started who don’t have a lot to invest yet. Vanguard, on the other hand, is best for fund and ETF investors or investors who have large enough account balances to qualify for their best funds.

But both brokers offer low fees and a great array of stocks, mutual funds, and ETFs. So there’s really no going wrong with either choice.

Related Articles