If you’ve been educating yourself about how to achieve financial independence (FI), you’ve probably learned a lot about investing on your journey to reach your FI number. You’ve probably also learned that fees can eat up a huge portion of your investment return over time, especially as the losses–due to fees, compound.

Let me give you an example of how fees will eat into your nest egg. In 2019, you can contribute $6,000 into a Roth IRA. Let’s say you’ve been doing this for a while and the balance in that account is $300,000. Great job! However, if your fees are 2% of your balance then the entire $6,000 you are contributing each year is being taken in fees. It’s as if you aren’t contributing to your Roth at all!

If you moved that $300,000 to a company like Vanguard, with a fee of .04%, your fee would only be $120 per year. Big difference.

But what about financial advice!? Good question.

There is a bit more responsibility on your shoulders when you are managing your own money. But that doesn’t mean you have to go it alone. There are tons of books about investing that will teach you everything you need to know. A highly recommended book on ChooseFI is The Simple Path To Wealth by JL Collins. This book will give you a lot of confidence when it comes to investing.

Also, managing your own money doesn’t mean you can’t get professional advice. There are fee-only financial planners who are happy to look over your investments and give you their opinions. They will charge you a flat one-time fee, which you don’t have to pay for your out of your retirement accounts. You can just write them a check. This moves the impact of their fees away from your nest egg. Visit The National Association Of Personal Financial Advisors for a fee-only financial planner near you.

You can hire this fee-only financial planner to help you decide your original set of investments, and then visit them for a checkup as needed. Perhaps annually or bi-annually. This won’t cost you anywhere near what you are likely paying in management fees at your typical financial advisor.

Ultimately, where you manage your investments is a personal decision that only you can make. However, if you want to move your money away from a financial advisor to a firm like Vanguard that offers relatively low fees to invest, here’s how to do it.

Related: Vanguard Vs Fidelity–Which Is The Right Company For You

The Process Will Vary Depending on Your Financial Advisor

First, the process to transfer your assets from your financial advisor to Vanguard will differ from advisor to advisor. You should read any paperwork you’ve signed when you started working with your financial advisor to see if they gave you any information about terminating your relationship with them. In particular, look to see if you have to give a particular type of notice or if there will be any fees that will be charged during the process.

Talking to Your Old Financial Advisor

Breaking up with a financial advisor is an awkward thing to do. Unfortunately, when it comes to your money, no one cares more than you do. Technically, you can inform your advisor you’re leaving by transferring your money out (as detailed below), but usually, it’s a nice courtesy to let them know you’re leaving. It’s just awkward.

Having the breakup conversation can help you, too. You can request your complete transaction history and any other information you think would be important before you sever ties with your soon-to-be former advisor.

Be prepared for your financial advisor to try to keep your business. After all, they make money managing your money. They may try to lower the fees they charge you or come up with other reasons why you shouldn’t leave. Before you give the bad news, make sure you know why you’re leaving. Be prepared to stand up for yourself and shoot down their sales tactics to keep you.

Of course, if there are any reasons that would make you willing to stay with your current financial advisor, that’s fine, too. Just know what they are before you have the conversation; that way you don’t make a decision due to high-pressure sales, or because you’re trying to get out of an awkward conversation.

The least confrontational way to leave your advisor, other than transferring assets without any notice, is by emailing them. An email removes the possibility of the advisor trying to immediately talk you out of your decision. However, it is still likely you’ll get a phone call as a follow-up. You could also leave a voicemail after hours, but again, you’ll eventually end up talking to your advisor when they call you in response.

Related: The Advantages Of The Individual Investor: Why You Can Beat Professional Money Managers

Moving Your Assets to Vanguard

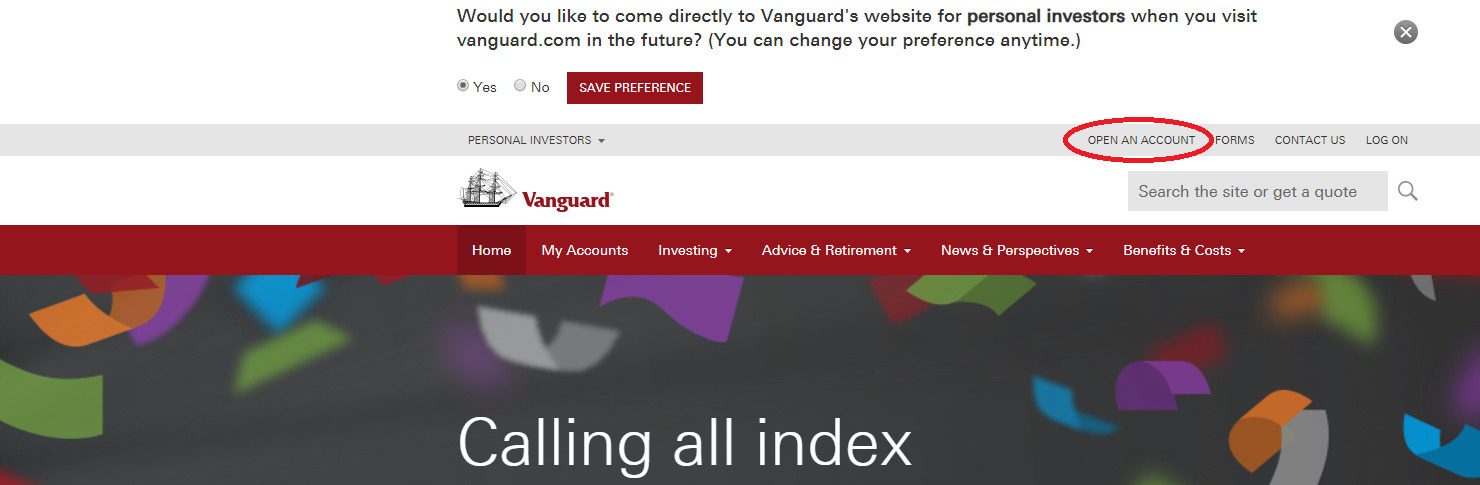

If you want to transfer your assets to Vanguard, here’s how to get started. First, head over to Vanguard.com and select the “Personal Investor” option on their homepage.

Next, click on “Open an Account” to get the whole process started.

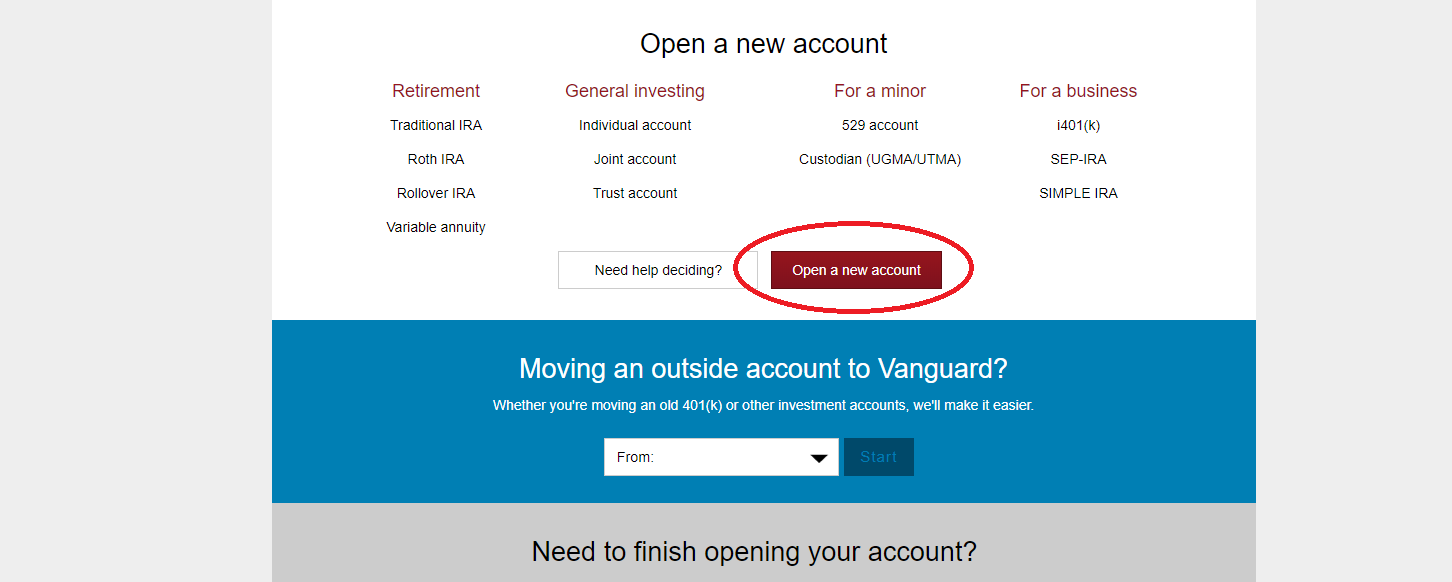

And again… Click open an account.

On the next page, you will tell them you are moving funds to Vanguard from another financial firm.

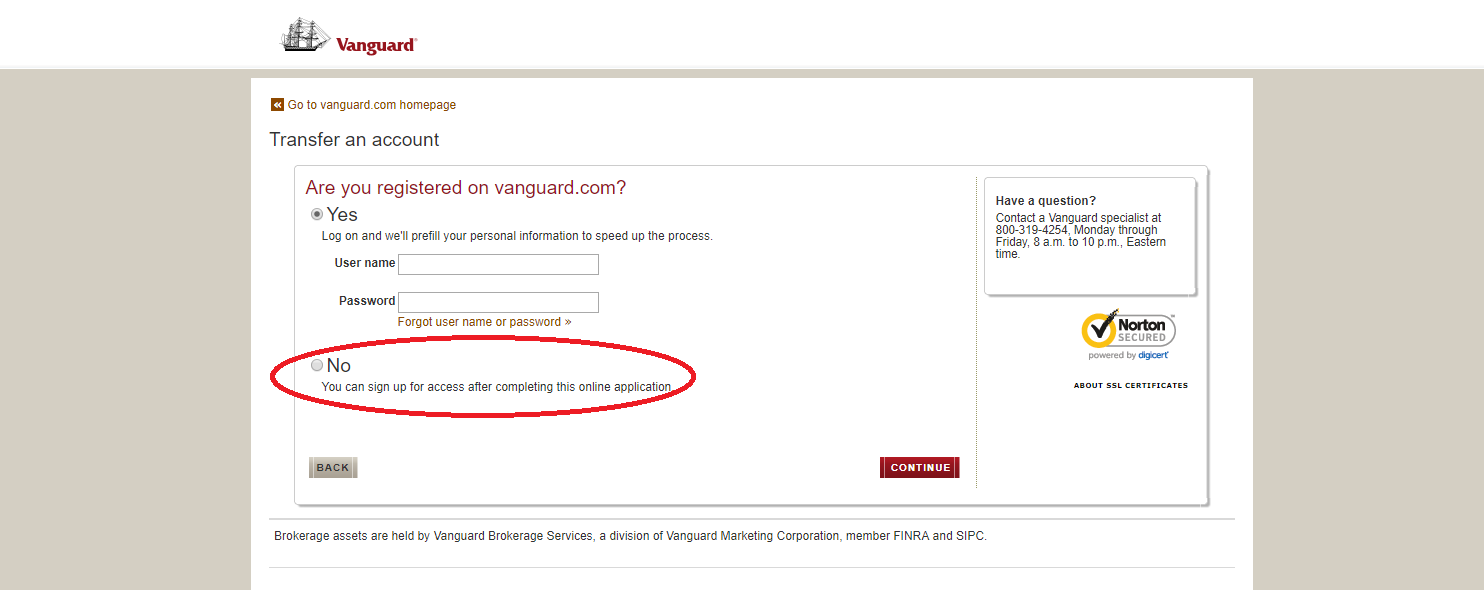

If you don’t already have a Vanguard account select “No” here. If you do have an account you can log in.

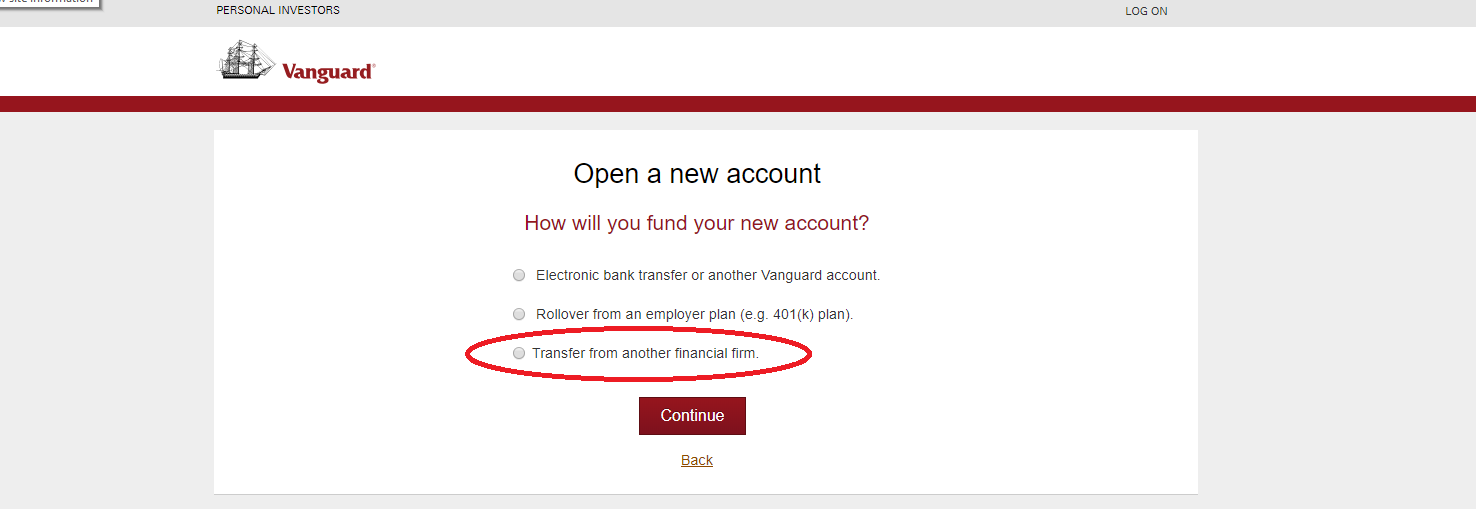

Then, select that you’re funding the account by transferring the money from another financial institution. Vanguard will then ask where the assets are that you’d like to transfer. You’ll select “With your brokerage firm or financial institution”.

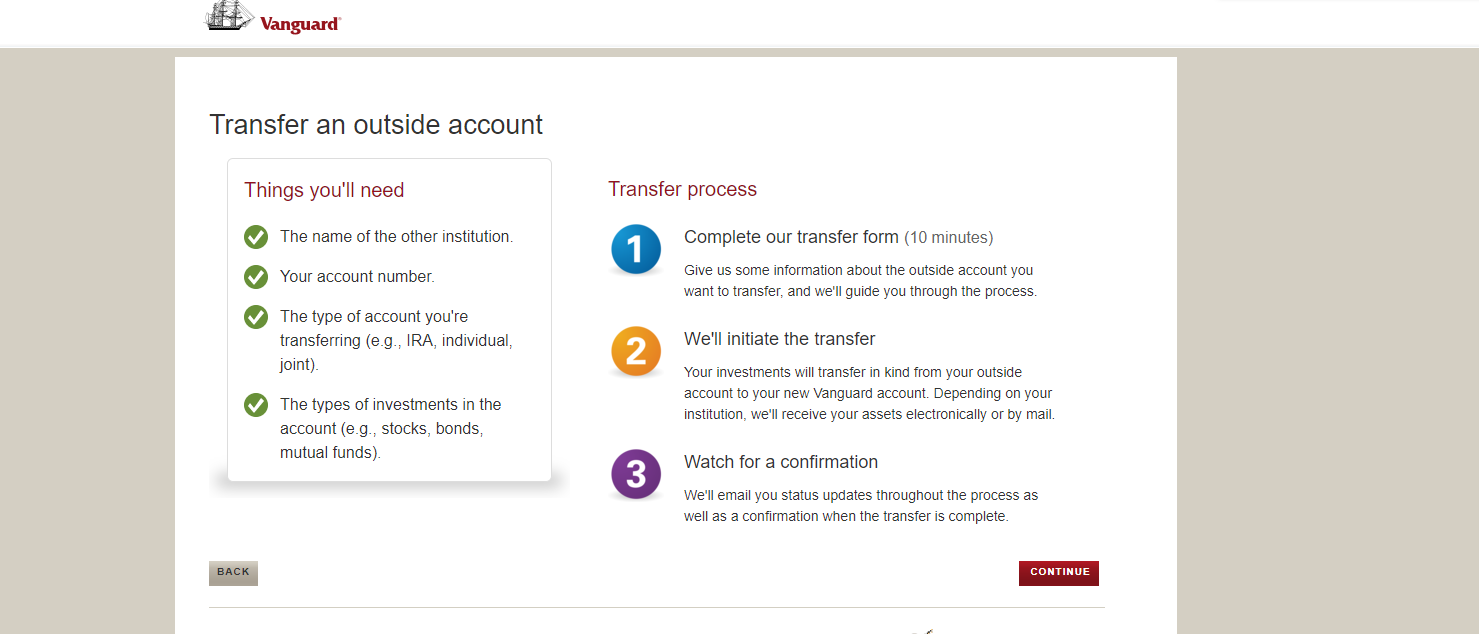

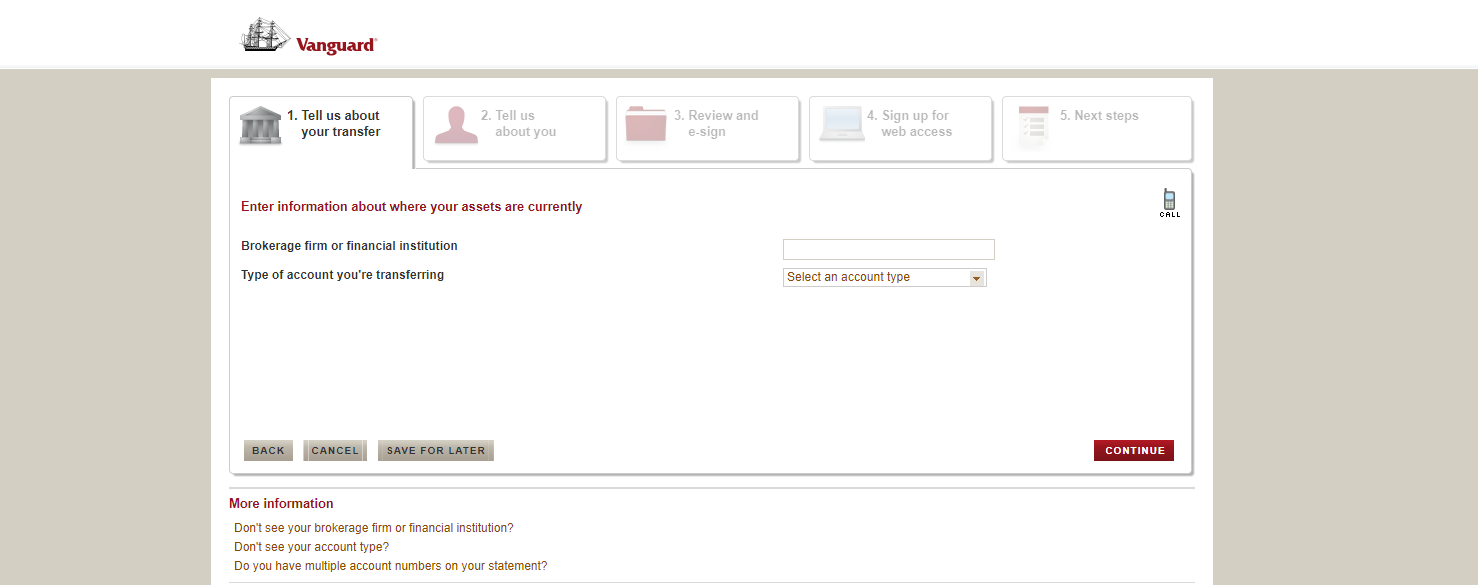

Vanguard will then tell you that you need to know the name of the other institution where your assets currently are, your account number, the type of account you’re transferring and the types of investments in the account (such as stock, bonds or mutual funds). All of this information can be found on your statement from your financial advisor. If you are having trouble finding it you can call your advisor and ask for it.

With this information, you’ll complete Vanguard’s transfer form which they estimate takes 10 minutes. Vanguard will then initiate the transfer and will transfer your assets in kind from your outside account to your new Vanguard account. This means they won’t sell your assets in the old account and repurchase them in the new account. Instead, they just take what is in your old account and move it to your new account.

This is an important point. They will not sell your current investments, just change the name of the company that holds it. If you want to change your investments during the transfer it may be easier to liquidate the investment while you still have it with your financial planner. That way Vanguard is moving cash, rather than investments. Check the fees that will be associated on both ends to determine the best move.

That’s as far as we can take you in the process with screenshots without actually opening an account. If you get stuck on any question you can call Vanguard for assistance. They will walk you through the process. Or maybe even do it for you.

Sometimes your old financial advisor will require additional information other than the transfer request from Vanguard to move your account. In this case, your old financial advisor may reject the transaction. If the transaction is rejected for whatever reason, Vanguard will call or email you to let you know why it was rejected.

Once Vanguard notifies you the transaction was rejected, you can work on whatever needs to be done to satisfy your financial advisor. After that is completed, let Vanguard know and they’ll continue with the process. Sometimes your advisor may require a notarized letter or Medallion signature guarantee to move forward with the process.

Breaking up with a financial advisor is never fun, but neither is losing out on money due to high fees. If you’ve decided it’s time to move on to a Vanguard account, you now know how to get the process started. Just remember, Vanguard isn’t your only option. You can switch to another financial advisor, a robo-advisor, or even a different brokerage firm. Make sure you research, in depth, where you want to take your money before you make the move.

Related Articles

- M1 Finance Review–Completely Free Automated Investing!

- Why Investing Conservatively Is Better

- F.I.R.E. Essentials: Low-cost Index Fund Investing