Most everyone has heard of Vanguard, Fidelity, and Charles Schwab. After all, they are the three top investment management firms in the U.S.

Since they are three of the best in their field, it may be hard to decide which will work best for you.

Well today, I’ll talk about the differences between the three and show you step-by-step how to sign-up for an account with each.

That should help you decide which company is right for you!

Vanguard

Types of investment accounts

- Brokerage Accounts

- Roth IRA

- Traditional IRA

- Simple IRA

- Rollover IRA

- SEPs

- Individual 401(k)

- 529 College Savings

- Annuities

Potential investments

- Mutual Funds

- ETFs

- Stocks

- Secondary Market CDs

- Bonds

- Option Contracts

Fees

With Vanguard, you’ll only pay an expense ratio with mutual funds and ETFs. According to Vanguard, their expense ratio is 82% less than the industry average. Notably, you can buy and sell nearly every non-leveraged ETF commission-free on the Vanguard platform.

At the time of writing, Vanguard’s average expense ratio is 0.11%, while the industry average expense ratio is 0.62%.

Vanguard also has a few more fees, including:

- $20 annual fee that applies to each of your brokerage and mutual-fund-only accounts, if you have less than $10,000 invested and want paper statements.

- Vanguard’s Personal Advisor Services fee is an optional advisor service and charges 0.30% of assets under management.

- If you are purchasing individual stocks, the commissions are $7 per trade. If you have over $500,000 invested the price drops to $2 per trade.

Convenience

Open accounts for a low minimum

You can open a Vanguard Target Retirement Funds and Vanguard STAR® Fund for $1,000, most other mutual funds require a $3,000 minimum. You can check out their minimums for mutual funds here.

If $3,000 is more than you have right now to get started, you can invest in an ETF for the price of one share of the ETF. According to their website, this generally ranges from $50 to a few hundred.

It takes just a few steps to open an account

As you’ll see below, opening an account with Vanguard is simple.

Throughout the application process, Vanguard tells you what to expect on the next step. Plus, the application only takes about 5-10 minutes to finish.

Other features

Customer service

Like any good company, Vanguard has a customer service line that you can call Monday through Friday.

Overall, I’ve found that getting in contact with a real person isn’t at all difficult with Vanguard.

The company is owned by the shareholders

Vanguard is owned by the Vanguard funds, which in turn means it’s owned by the folks who have investments with them. There are no outside owners, meaning there is no incentive for the company to charge unnecessary fees. Any extra profits would simply be returned to the company owners, who are effectively the customers.

Vanguard’s interests are completely aligned with their clients because the clients are the owners.

Step-by-step with screenshots of how to open and set up an account

Vanguard’s application process is incredibly easy. It’s a few steps, and they even tell you exactly what you’re going to be doing (see below).

Since I don’t intend to open an account with Vanguard, I’ll give you the first few steps so you can decide for yourself if Vanguard seems right for you.

Step 1: Opening an account

Your first step is to choose if you’re a new investor or if you want to move an account over to Vanguard.

For the purposes of this example, I clicked “open a new account”.

Step 2: Register

If you’re new to Vanguard, you’ll need to register for an account. Again, for this guide, I said I was new and needed to register.

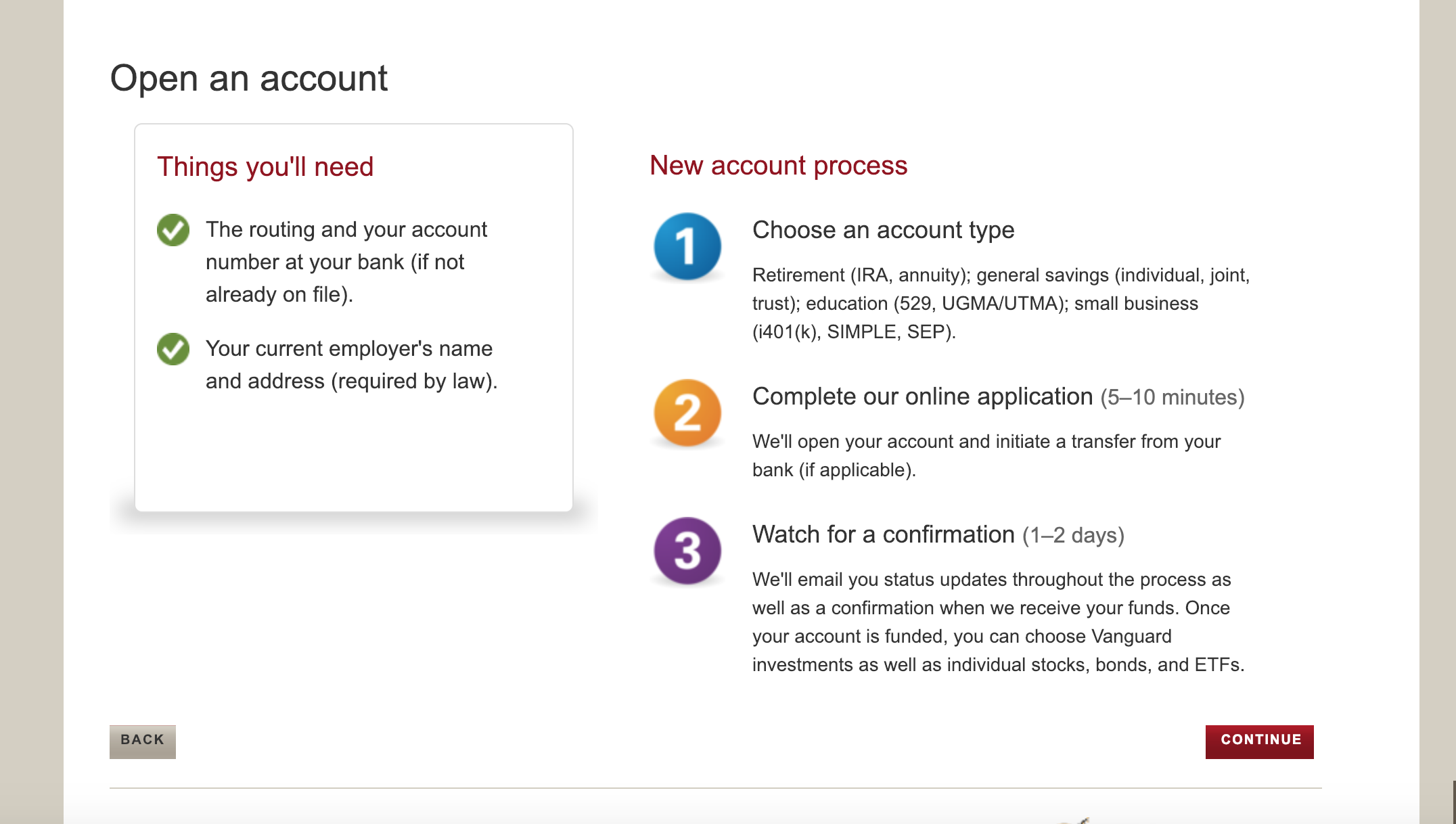

Step 3: Open an account

Vanguard is super helpful and shows exactly what will be on their application process. According to Vanguard, their whole application process takes just 5-10 minutes.

You’ll have to start by picking an account type, so make sure you know what you’re looking for.

After you choose what kind of account you want to open, you’ll need to fund the account (obviously). After that, you finish the 5-10 minute application and you’re on your way to being a Vanguard investor!

Fidelity

Types of investment accounts

- Brokerage Accounts

- Rollover IRA

- Traditional IRA

- Roth IRA

- SEP IRAs

- SIMPLE IRAs

- Self-employed 401(k) + other 401(k)s

Potential investments

- Stocks

- ETFs

- Mutual Funds

- Bons

- Secondary Market CDs

- Option Contracts

Fees

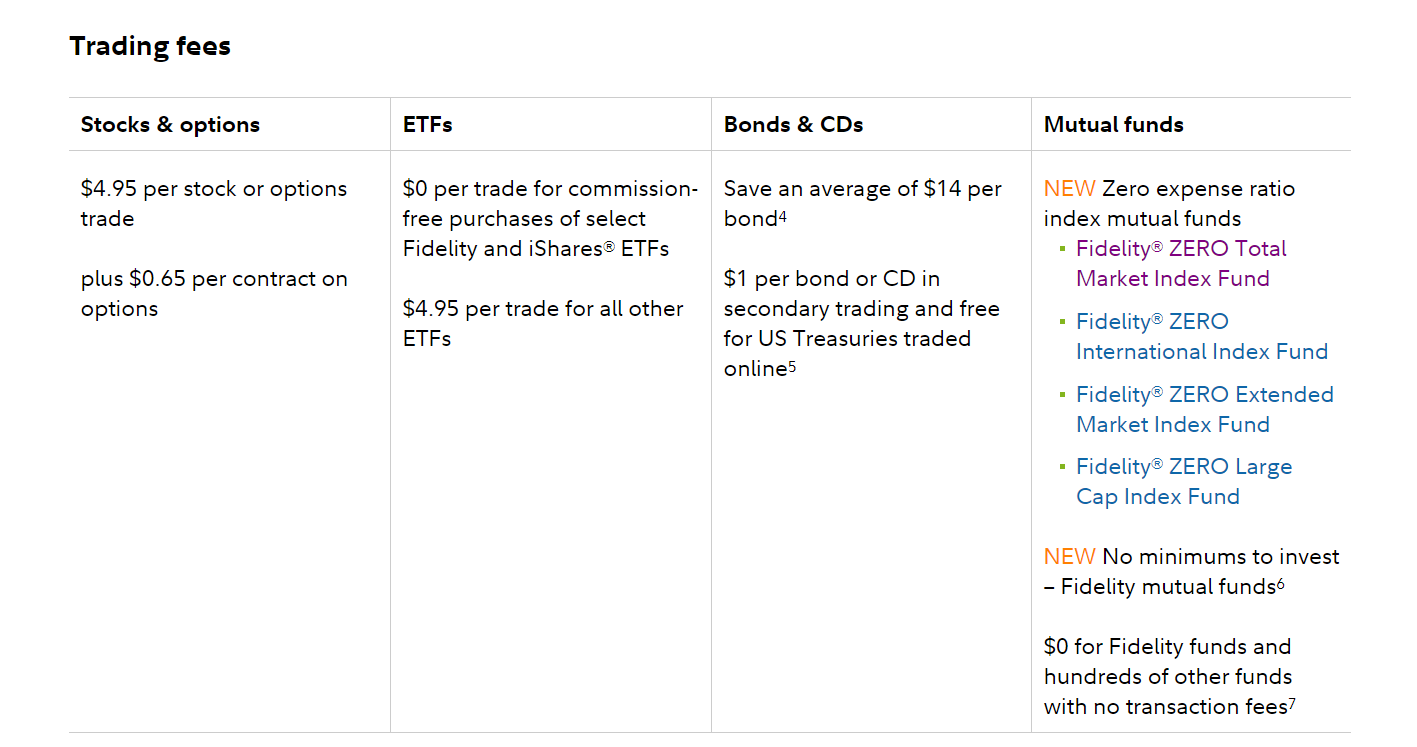

Fidelity’s fees depend on your choice of investment:

- Stocks: $4.95 per stock or options trade

- ETFs: $0 per trade for commission-free purchases of select Fidelity and iShares® ETFs; $4.95 per trade for all other ETFs

- Bonds & CDs: $1 per bond for secondary bond trading and free for US Treasuries traded online

- Mutual funds: Many of Fidelity’s mutual fund have no commissions or transaction fees. In fact, a few mutual funds don’t even have expense ratios, meaning it’s absolutely free to invest in these funds.

Convenience

No account minimums

Most Fidelity mutual funds have no account minimums to start investing.

That’s why, for newer investors, Fidelity is a great option. Plus, they offer a great robo-advisor (more on that in a minute).

No account fees

Unlike the other two options on our list, Fidelity has options that are truly free.

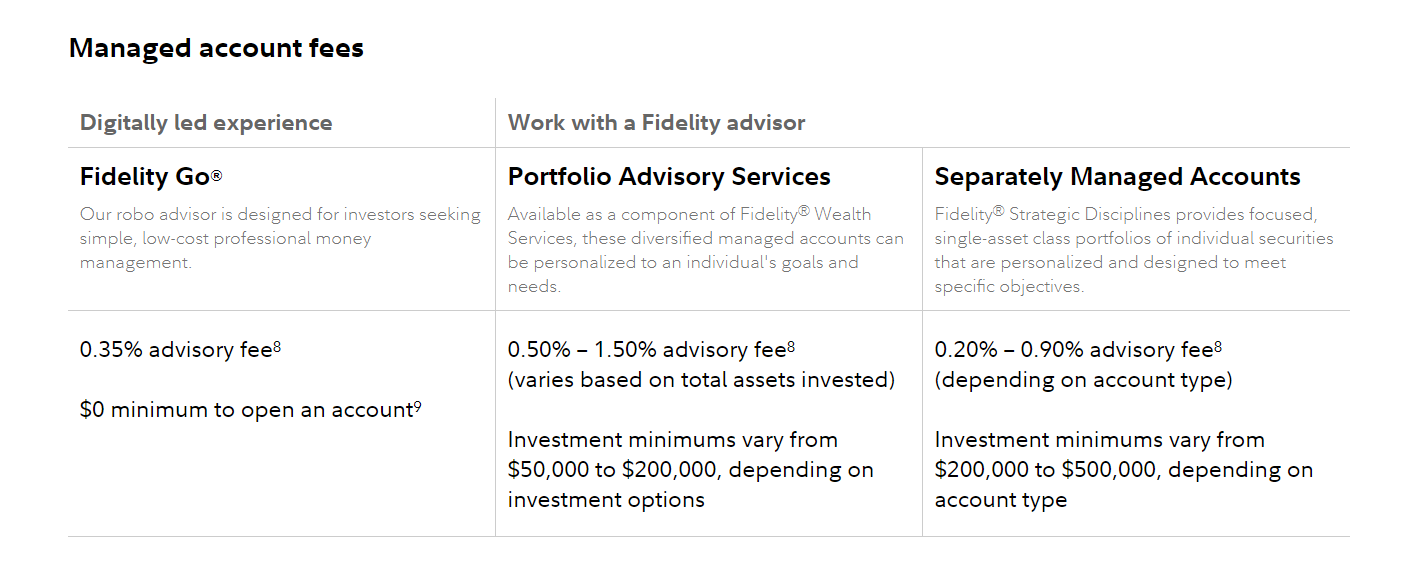

Fidelity GO–Fidelity’s Robo-advisor–does have a fee of 0.35% since it is a managed account. But it’s worth it since Fidelity doesn’t have a minimum to open an account, so anyone can start investing.

Other features

Customer service

Fidelity has fully embraced the virtual assistance model. You can access Fidelity’s Virtual Assistant, which should be able to answer most of your questions.

Fidelity’s site is also very easy to use, so finding your answers shouldn’t be too much of an issue.

Finally, if you want to go the old fashion route, Fidelity has a number you can call anytime.

Fidelity GO

As I mentioned above, Fidelity offers a robo-advisor called Fidelity GO. When you invest with Fidelity GO, all you have to do is answer a few questions and the robo-advisor will give you a suggested investment strategy.

Then they’ll compile a mix of investments based on your goals. You can just sit back and know your money is being taken care of.

Step-by-step with screenshots of how to open and set up an account

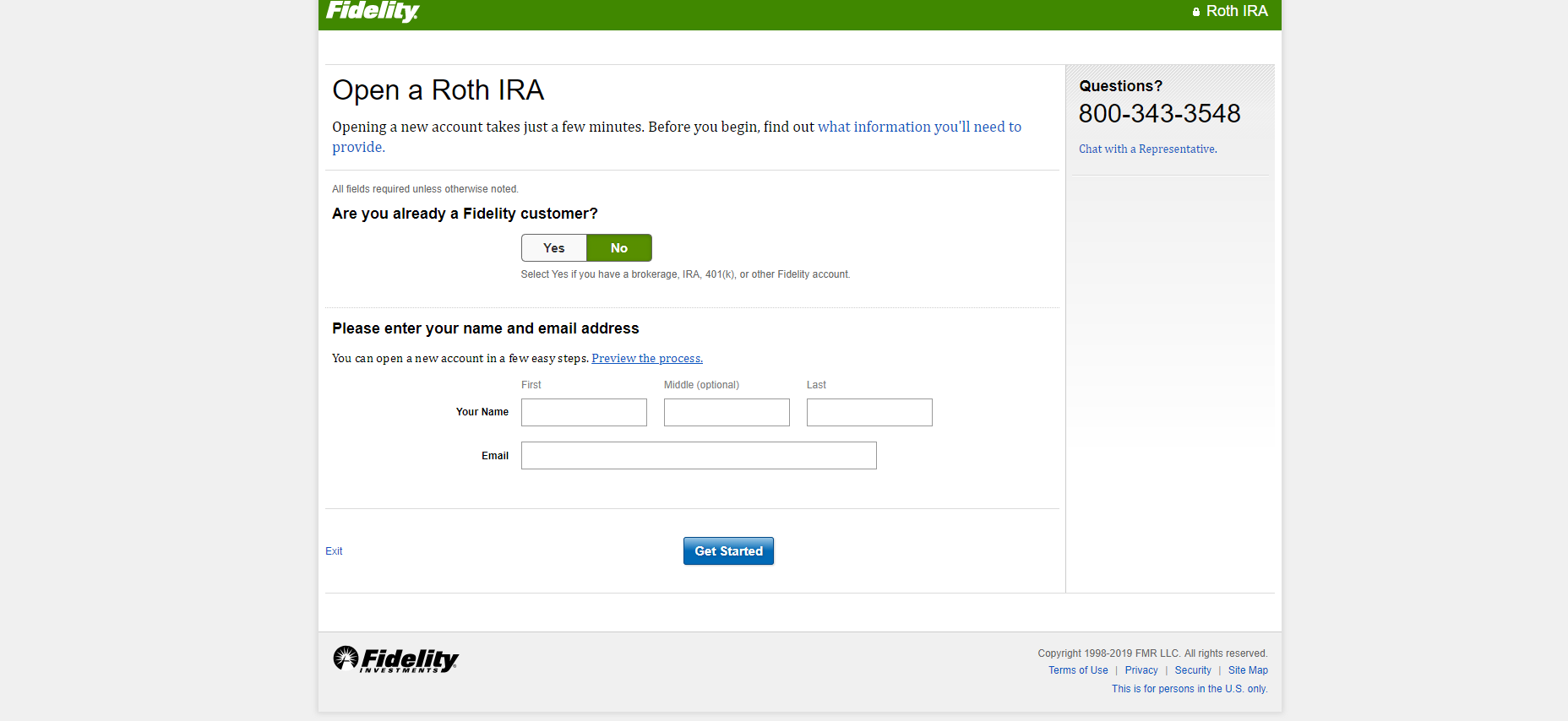

Step 1: Choose your account

Once you go to the Fidelity homepage, you can create an account. You’ll be asked what kind of account you want (for this example I chose a Roth IRA).

You enter your basic information like your name and email.

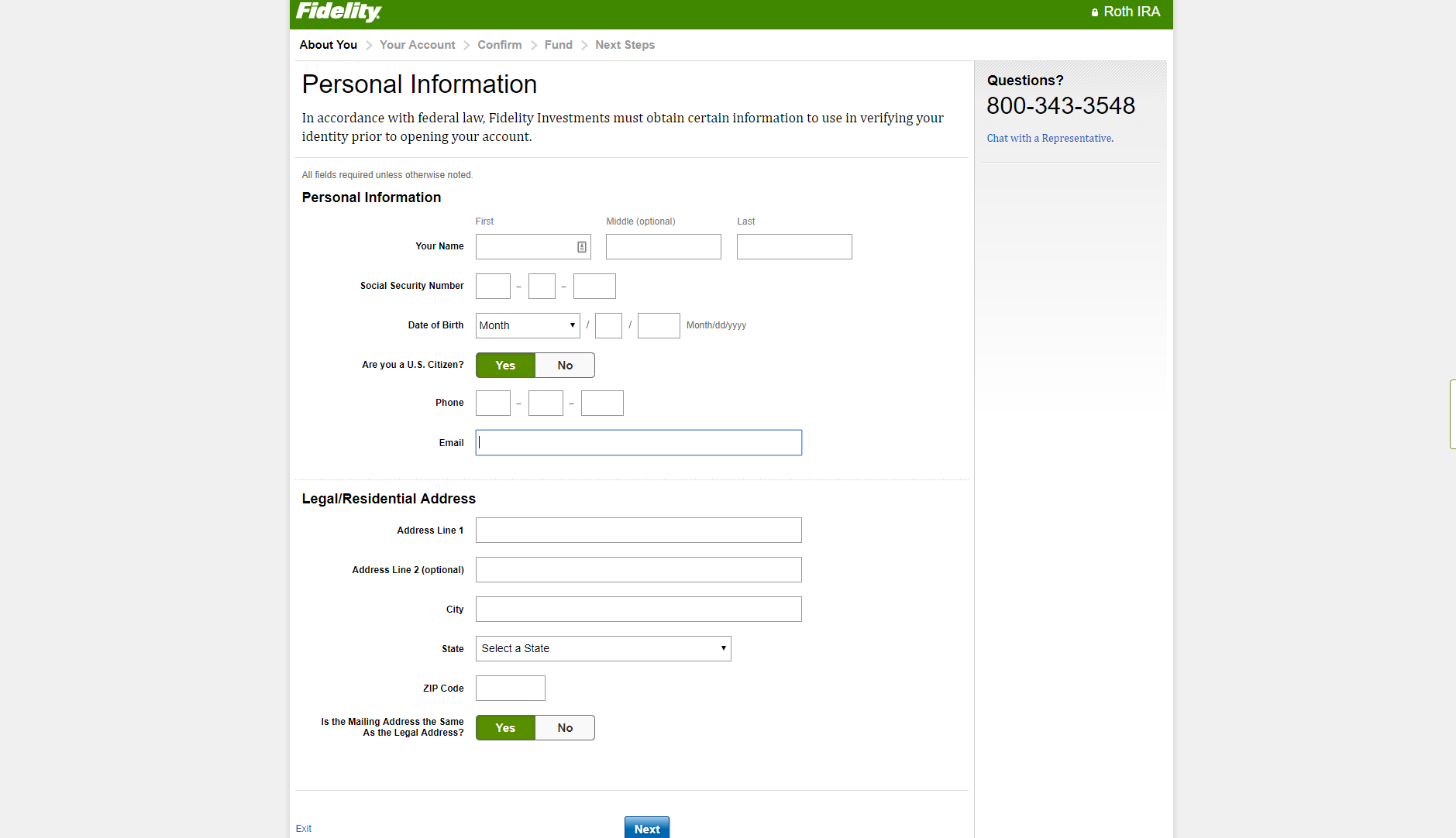

Step 2: More personal information

Next, you’ll have to get into the nitty-gritty of your personal life. You’ll need to enter everything from your social security number to your address.

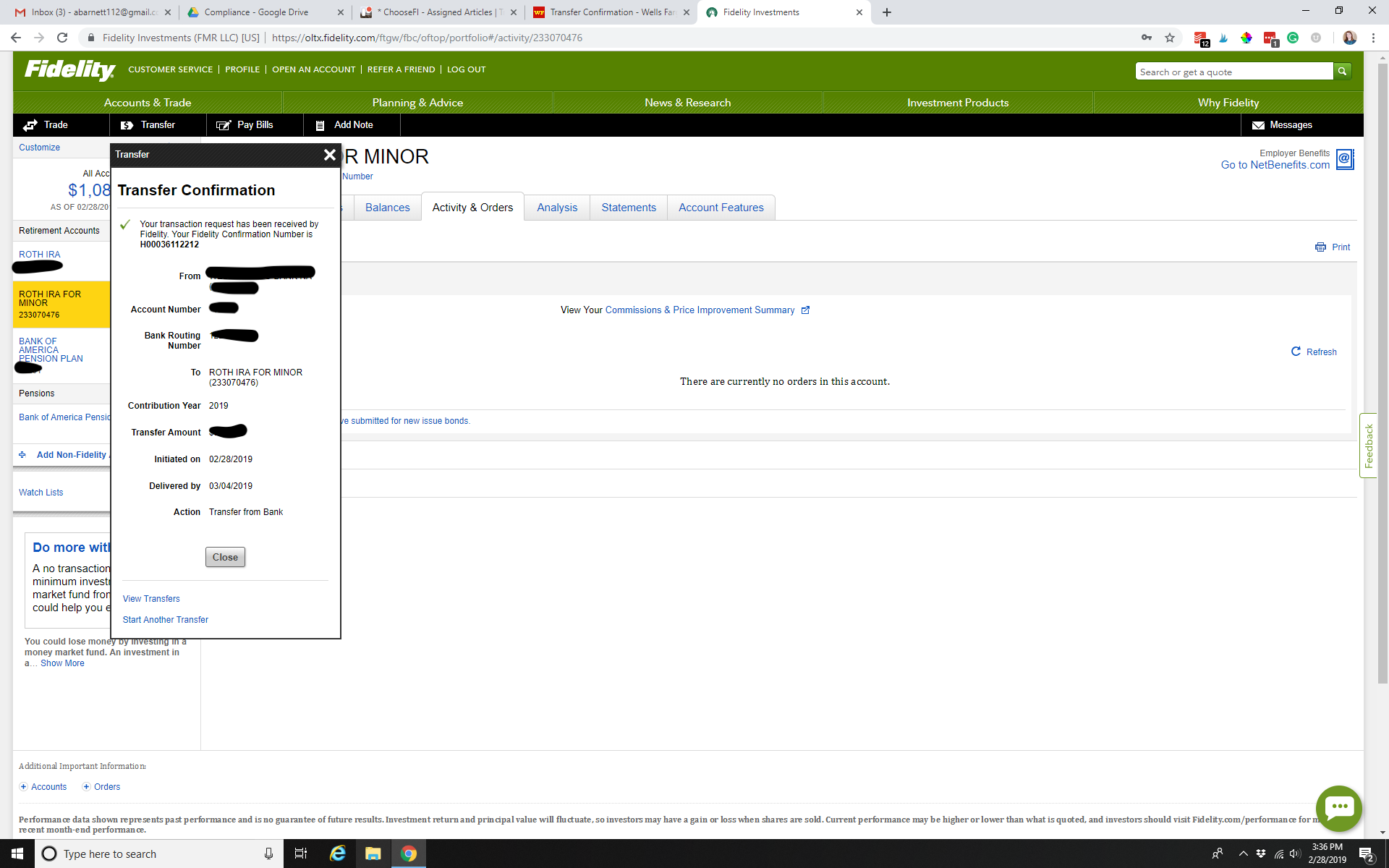

Step 3: Fund the account

Fidelity’s sign-up process is very similar to Vanguard. Now all you do is fund your account–you’ll need to enter your bank info.

Start investing with Fidelity today!

Schwab

Types of investment accounts

- Brokerage Account

- Traditional IRA

- Roth IRA

- Rollover IRA

- Estate and charitable planning

- Schwab Intelligent Portfolios

- Checking account

Potential investments

- Mutual funds

- ETFs

- Money Market Funds

- Stocks (including international stocks)

- Bonds

- Options

- Futures

- Annuities

Fees

With Schwab, the fee you pay also depends on your investment choice:

- Stocks: $4.95 per trade

- Mutual funds: $0 online for Schwab Funds and any fund participating in Schwab’s Mutual Fund OneSource service; up to $49.95 for all other funds

- ETFs: $0 online for Schwab ETFs and any ETF participating in the Schwab ETF OneSource™ platform; $4.95 for all other ETFs

- Bonds: $1 per-bond transaction fee

Annual portfolio management fees depend on the type of portfolio you have with Charles Schwab:

- Schwab Intelligent Portfolios: No fee

- Schwab Intelligent Advisory: 0.28% of your assets

- Schwab Private Client: Starts at 0.80%

Convenience

Schwab is very hands-on

If you’re looking to get great one-on-one help from a financial professional, Charles Schwab is perfect for you.

You’ll have access to a Financial Consultant at no cost to you. All you need to do is pay for the products and services you choose (and have $250,000+ in assets).

Since the investment minimum is so high, this option may not be best for beginning investors, But Schwab does offer a robo-advisor option that has an annual fee of just 0.28% (see below).

They also have an individual investor option

If you prefer to handle your investments yourself, you can do so through Schwab.

Again, you simply pay for the price of the trade and any fund fee. You get to use all of Schwab’s educational resources and tools for free!

Other features

Customer service

Schwab offers plenty of ways to contact them if you run into any issues. You can call their customer service line, chat with someone (available 24/7), or visit a branch near you (there are 345 in the US).

You can also find many of your answers by browsing through the Charles Schwab website–but their site is a little clunkier than Vanguards or Fidelitys. (And that’s saying something because none of these websites would be called “user-friendly.”)

Robo-advisor

Most investment firms offer robo-advisors, and Schwab is no different.

Their robo-advisor builds a portfolio of ETFs, which are monitored daily and rebalanced if needed.

Plus, Charles Schwab offers a premium service that allows you to talk one-on-one with a Certified Financial Planner. That’s a nice option to have if you’re looking to become a little more involved with your investments.

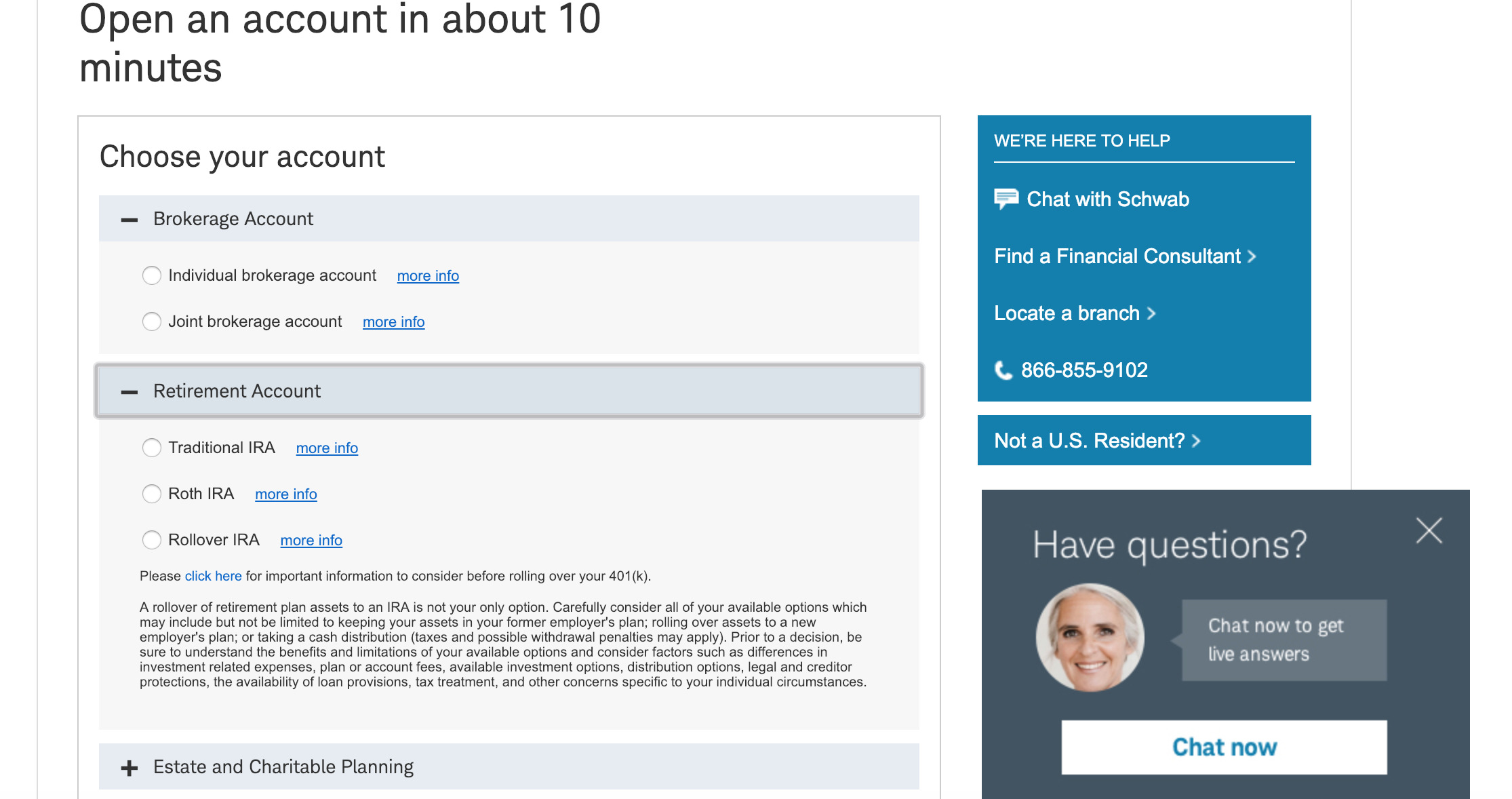

Step-by-step with screenshots of how to open and set up an account

Step 1: Choose your account

After clicking “Open An Account” on Schwab’s homepage, you’ll be lead to this screen. You can choose a brokerage account, retirement account, estate, Schwab Intelligent Portfolio®, or a Schwab Bank Checking Account.

I decided to go with a Roth IRA, but if you can’t decide you can click the plus sign next to each option and a dropdown menu will appear, explaining what each option is.

Step 2: A sales pitch

Next, Schwab will give you the option to enroll in their Schwab Trading Services–their personalized trading support.

They also let you know what to expect when opening an account. You’ll need to give all your personal info, including your social security number, your employer’s name, and any beneficiary.

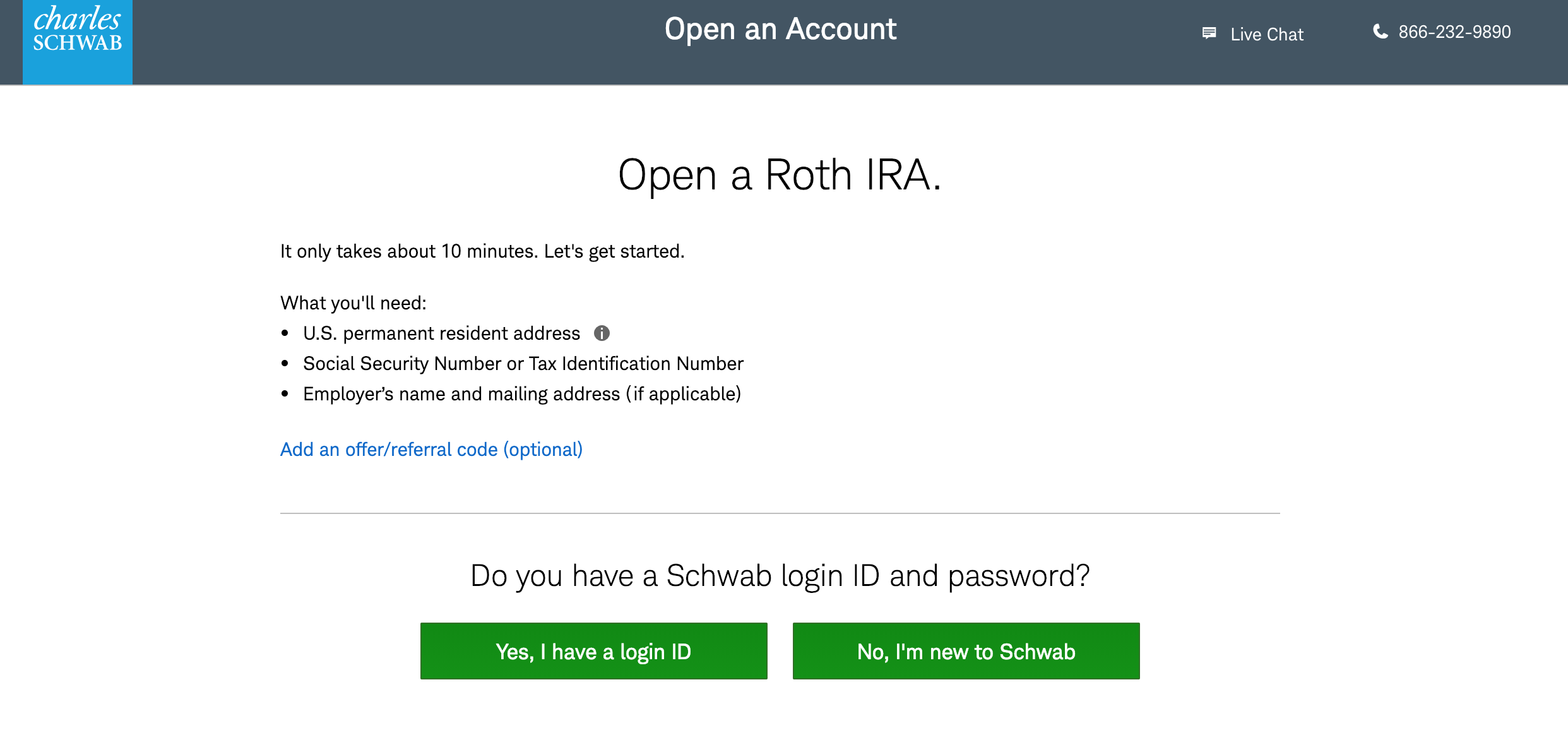

Step 3: Login or create a new account

If you have an account with Schwab already, you’ll be asked to login. If not, you’ll need to create an account, which will take about 10 minutes.

Since I don’t have a Schwab account, I clicked “No, I’m new to Schwab”.

Step 4: Personal information

As promised, you’ll have to enter all your personal information during this step. What’s helpful here, is Schwab shows you, again, what you’ll be filling out.

As the process continues, you’ll need to make some decisions about the account you want.

You’ll then have to agree to some Terms and Conditions, and finally, you’ll decide how you want to fund your account.

Get started investing with Charles Schwab today!

An alternative To consider

Vanguard, Fidelity, and Charles Schwab are all great options when it comes to investing your money, but there’s another option that may be right.

M1 Finance is a robo-advisor brokerage that lets investors manage their money through automated investing.

What makes M1 different than every other robo-advisor service out there? It’s free! Yup, totally free. There are no maintenance fees associated with your account, so all your money is fully invested.

You can invest in ETFs and individual stocks with M1 Finance. Retirement accounts have a minimum balance of $500 and taxable brokerage accounts require a $100 minimum balance.

But overall, M1 is a great alternative to bigger investment companies.

No matter which company you ultimately choose, the important part is to start saving. The hardest part is setting everything up! Once you have it going the maintenance is easy.

Related Articles

- M1 Finance Review: Completely Free Automated Investing

- Podcast Episode: Index Investing–How To Buy VTSAX

- What To Do When You Get Laid Off