Want to learn how to negotiate like a pro?

Negotiation can be a scary word for a lot of people. It often evokes a feeling of challenge or even going to war with another person or persons. In reality, negotiations are crucial communication tactics that are necessary on almost every level of human existence. From personal relationships to high-powered brokered business deals, negotiation plays a role. This guide will teach you how to negotiate anything.

We want to help give you a step up on how to improve your negotiation skills, not just for your Financial Independence but also for life’s negotiations in general, and how you can be a better communicator, listener, and deal maker. But further, how to gear up for a negotiation to be better prepared than “the other guy.”

- Negotiation is the Art of Discussion, Not the Art of War

- Basic Concepts of How to Negotiate

- The 4 Principles of Negotiation

- 8 Crucial Things to Understand Before You Start Negotiating

- How To Negotiate Salary

- How To Negotiate Car Price

- How To Negotiate Buying a House

- The Takeaway

- How To Negotiate Medical Bills

- How to Negotiate: The Bottom Line

Negotiation is the Art of Discussion, Not the Art of War

Negotiation is NEVER a war. If you go into a negotiation with a “kill all” mentality, it just won’t work out. But it isn’t a seduction either. You research what you want and have evidence to support it.

“You need to learn to negotiate on your own behalf, without ego or the fear of loss. That’s a challenging thing to put into perspective and practice. You have to know what you want, you have to be able to communicate it, and you have to be able to say ‘no’ and mean it.

Because in order to say no you have to be built on a solid foundation and you must have options. If you aren’t willing to use options against someone in a negotiation, they win: period. For instance, asking for a raise from your boss. You must have a proper negotiating position in place in order to ask for said raise and consequences to not receiving the raise – you don’t need to do this rudely – you just state the facts. But be willing to walk away”.

Jordan Peterson

The Basic Psychology Behind How to Negotiate

We’ll let you in on a well-known secret: almost every negotiation contains anger – whether it be on your own side or your opposition. Diffusing that anger is the key to winning. Why? Because we are emotional beings.

We are creatures of habit. There is always a subconscious process when you get ready for a meeting, drive home for the day, take a shower, or get ready for bed. The same holds true with a negotiation. Most people get ready for an argument, not a discussion. This breeds anger, which feeds into fear, then anxiety, then hostility: rinse and repeat.

"Bringing anger to a negotiation is like throwing a bomb into the process".

- Alison Wood BrooksWe go into how to diffuse issues below, but the way you carry yourself in the negotiation will be critical to success. Don’t look too good or come off as too wise. Have professional confidence in your appearance. Above all, be respectful and courteous. Manners go a very long way in negotiations.

Take the time to endear yourself to your opposition. You don’t have to be golfing buddies; talk to them about their interests. It doesn’t take long, and it shows you are interested in their interests, which is a major psychological plus.

If they are upset, let them punch themselves out. We already have our plan. Our plan is for them to agree to it. If they don’t, we walk away. It truly is that simple.

Negotiation Is a Balance

Negotiation is a business transaction. You can’t be too agreeable (conflict avoidant), nor can you be too aggressive (conflict seeking). Those who can use psychology to their advantage and not emotion will have a massive leg up at the negotiation table. And always have second, third, or even fourth options.

Along those same lines, know what the other party desires with relatively high confidence before you come to the negotiation table. Thinking several moves ahead is critical in negotiation, but it starts with what the other party desires. If you’re after a salary increase, are you aware of your current finances and the value you bring to your company? Are you well-liked and well-coveted? You can use these concepts to your advantage.

Art Married With Science

Negotiation is part art and part science. Art in that it requires improvisation and thinking on your feet to be adept. Science because it applies behavioral psychology to the negotiation’s meta (or the overall picture). This is illustrated initially through the way negotiation is taught in the classroom. There are “principles” (organic) to negotiation, not “rules” (linear). Therefore, there must be flexibility.

Basic Concepts of How to Negotiate

To mix art and science, you must have the fundamentals of negotiation under your belt. The following concepts will be an excellent reference for you.

BATNA: What It Is and How To Use It

BATNA is the “Best Alternative To a Negotiated Agreement.” This may sound not very easy, but let’s break it down. Your BATNA is whatever the result of a failed negotiation is.

Say you want to purchase a car. You know that you are willing to buy that vehicle for no more than “X.” As you’ll see, preparation, homework, price history, and the like will empower you to make the correct decision on making your purchase. All of these concepts considered have already created your BATNA; we just put a name to it.

So, you are at the negotiation table, and you’ve determined to show your BATNA, your “drop-dead” price for the vehicle that is on the table. The seller declines. What’s the cost of that failed negotiation? Well, you’ll have to take the time to go to another dealership and might need to do more homework; however, your preparation in creating your BATNA has probably saved you thousands of real dollars because most negotiators don’t invest the time and effort. Yes, it is more of a headache and does cost your time. But, you’ll be a better negotiator for it.

ZOPA: The Solution

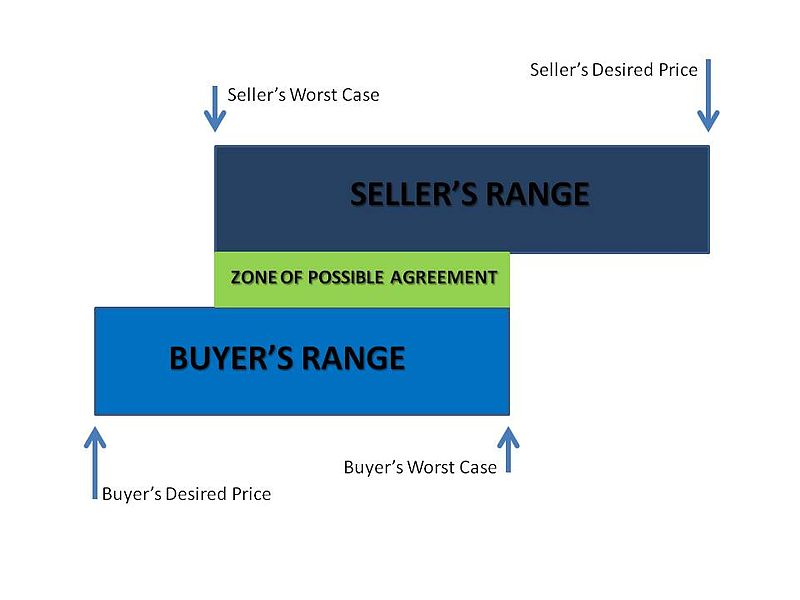

ZOPA is the “Zone of Possible Agreement.” This is the common ground between the negotiators, determined by the desired buying/selling price range and the buyer’s/seller’s worst-case negotiation scenario. It’s important to note that there must be an overlap between the seller’s selling price – worst case and the buyer’s buying price – worst case. Here’s an illustration:

As you can see, we’ve married the BATNA for both parties to attempt to find the ZOPA. Anything outside the ZOPA falls in either the Seller’s or the Buyer’s BATNA (outside the “worst-case” on either side), kills the deal.

SWOT Analysis: During the Negotiation Process

SWOT stands for:

-

- Strengths – of the negotiation outcome on your behalf and have a positive expected value

-

- Weaknesses – of the negotiation outcome on your behalf and have a negative expected value

-

- Opportunities – of the negotiation outcome on your behalf and have a positive expected value

-

- Threats – of the negotiation outcome on your behalf and have a negative expected value

The following is an example of a SWOT table. You will use this during a negotiation process to weigh positive values against negative values. We’ve added a possible outcome for each quadrant.

| S (Strengths) 1) This company could bring a lot of value to our struggling demographic |

W (Weaknesses) 1) Their inventory tracking could be a real issue for our purchasing department |

| O (Opportunities) 1) Their patented designs will boost our brand by at least 30% |

T (Threats) 1) We are importing 80% of their product. We need to get a better idea of VAT/import taxes |

Understanding SWOT analysis is important to quickly assess each positive and negative outcome and see where the balance lies. You may want to move toward the closing negotiation phase if it lies heavily in your favor. If you are unsure or believe there isn’t enough utility (or upticks) in your favor, you may want to negotiate a better deal.

BAFO: Never Close A Negotiation Without This

BAFO, or “Best And Final Offer,” is the official close to any negotiation. It lays out all terms and conditions that you have agreed upon during the negotiation and “crosses the ‘t’s” and “dots the ‘i’s” to ensure all is wrapped up correctly. Note: That it may not always be referred to as “BAFO,” but ensure you get everything you’ve agreed upon in writing before leaving the table.

The 4 Principles of Negotiation

In general, there are four main principles to negotiation tactics.

-

- Negotiation is a partnership, not an adversarial relationship. Separate the person from the issue. Set aside personal feelings (positive, negative, neutral) and attempt to achieve a goal together.

-

- Negotiate not as “position-focused” but as “interest-oriented.”

-

- Position-focused means taking a position in an argument and digging your heels in. “Customer vs. seller” is a classic example: You want to buy/sell an item to the point where you begin taking the negotiation personally. Once this happens, the negotiation falls apart.

-

- Interest-oriented underlines the value and incentives of making the deal. Take the “customer vs. seller” example again, yet let’s have both interest-oriented (instead of positional). The customer wants to buy, and the seller wants to sell. However, the mindset is entirely different. If neither can come to an agreement, shake hands and walk away.

-

- Negotiate not as “position-focused” but as “interest-oriented.”

How to Negotiate Win-Win Situations

-

- Develop endgame criteria so that a solution creates a “win-win.” In other words, make an agreement before the negotiation so that both parties will walk away happy. Happy is obviously a relative term, but setting this goal from the outset will allow a more open and accessible discussion of terms and conditions. Most negotiators will say that problems and solutions are fired so quickly on both sides of the table (to solve all issues quickly and at the lowest cost to each party) that they rarely reach a satisfactory agreement. Creating endgame criteria will alleviate this issue.

-

- Develop different options for both parties to choose from. This loops back to number 3. Creating a “win-win” situation is incredibly difficult with just one option on the table. Creating multiple solutions to the negotiation gives both sides a more significant statistical advantage in selecting an option that best fits their needs.

8 Crucial Things to Understand Before You Start Negotiating

-

- Planning is your best friend.

-

- What the other party wants.

-

- Discovering your opposition’s stance can be a difference-maker.

-

- Balance is critical when you’re pushing edges. Don’t push too soft or hard.

-

- Listening skills will serve you exponentially better than speaking.

-

- You should always think outside the box – don’t become fixed in a binary situation (they win, you lose, and vice versa).

-

- Not paying attention to your opposition will destroy the negotiation, no matter how much ground you’ve gained or how far along you are in agreement.

-

- Stay in control of the negotiation. This only comes from planning ahead.

How To Negotiate Salary

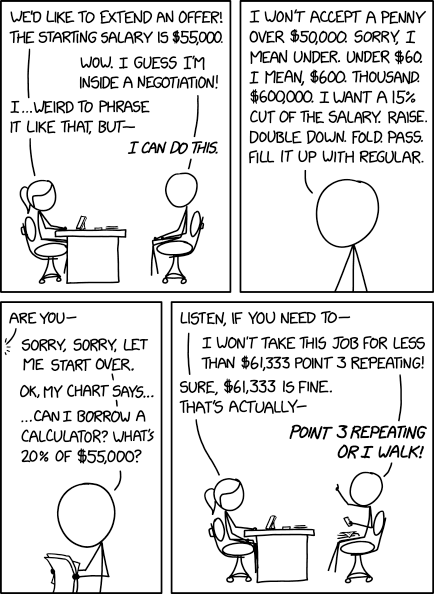

Want to make more money? Of course you do. First off, come to the negotiation table prepared with what you are willing to accept as your potential or current employer will give you the lowest possible salary. This is especially important when you are a new hire, and your potential employer tells you, “Sorry, this salary is not negotiable.” Everything is negotiable. So negotiate even when you are stymied.

This is where the first step comes into play, where we said, ” Be prepared with what you are willing to accept. ” This is a critical step. Do your homework. Know what comparable careers offer in terms of salary and other compensation. Don’t fire into the dark. Be more prepared than anyone else at the table.

Imposter Syndrome and Better “Tabled” Offers

Along those lines, don’t fall into the psychological trap of “imposter syndrome” or the feeling that your skillset and education aren’t enough when you have researched and proven that you do have the skills and the abilities a company wants. Further, apply for several jobs while seeking an offer from your potential or current employer.

This goal is two-fold: you get negotiation practice by speaking with several firms and can hone your negotiation skills for your dream job. And you will probably have more than one offer on the table. Going to a potential employer, especially a current employer with a higher offer, is incredible leverage. It shows you are in demand and that you are willing to walk away. That employer will need to top that offer, or they risk letting you go.

Do not bluff another offer to your employer. If you get caught, it will end poorly in your favor. Your ROI (return on investment) isn’t there. And it’s unethical.

Listen More Than You Speak

It sounds counterintuitive. And it’s not to say to stay silent throughout – on the contrary. However, listening gives you a psychological advantage in a negotiation. You allow the other party to voice their opinion and take the time to listen to what they have to say. This is a rarity in everyday conversation and won’t go unnoticed.

You have the upper hand if someone believes you are paying attention to what they’re telling you. Because you are controlling the tempo of the conversation, psychologically, they’ll feel obligated to give you the floor and more room to “maneuver” because you are being so fair to them. This is the persuasive power of allowing someone else to be heard over your own voice. And that’s the goal of negotiation: persuading the other side to come over to yours.

Understanding “Anchoring” and Your Opposition

Negotiation Anchoring is a behavioral economics term defined by a data set with only one data point. Companies often use this as a leveraging tool to make you take the salary (the anchor) because there is no other offer on the table. It’s like how a used car salesman runs through an offer with you and briefly mentions the price before entering the car’s cool engine and color. Understand your worth and pull out the anchor.

If they aren’t willing to move off the anchored salary and you know you are worth more, walk away. It’s one of the tenants of negotiation we’ve talked about. You need to be fearless and walk away from a negotiation table that isn’t in your favor. You know your worth, so get your worth!

Salary Negotiation and the Path to FI

We’ve all heard the saying that “nothing is a given in life; if you want something, you need to go and get it.” This is the mantra you should have when it comes to negotiation. Think about yearly salary bumps. Do you believe your employer will go out of their way to give you a massive salary raise when they don’t have to? No. They will give you the bare minimum they have to in order to keep you around.

You need to speak up. Don’t be afraid of what they’ll think of you or how they’ll react. You aren’t volunteering for your career. You work to put food on the table. Your employer uses your skills and talent to gain wealth for themselves. But, they are in the position of giving you effectively the least amount they can. Speak up and negotiate.

Negotiation Does Not Equal Conflict

So many people shy away from negotiation because they “don’t want to be a bother” or they “think they’ll piss someone off.” No. Again, you are advocating for yourself if your employer or potential employer acts like you are upsetting them, tough.

You aren’t starting a fight. You are simply attempting to get the fair compensation that you genuinely believe you deserve by being an employee in the position you are or will be in. Don’t be afraid to speak up for yourself. Both parties should be satisfied by the end of the negotiation.

In Game Theory, this result is called the Nash Equilibrium. In layman’s terms, it’s the ultimate win-win situation. And yes, you can have a win-win situation in a negotiation. Both parties need to listen and be fair. If it starts to unravel into a conflict or fight, walk away from the negotiation table. That is not worth your time; you don’t want to work with individuals like that.

Make the Potential Employer Show Their Hand First

How to negotiate a job offer. If you are asked during an interview, don’t answer the question, “What sort of compensation range were you expecting from this position”? Don’t be rude and ignore the question. Turn the question back to the opposition. Make them show you their hand first. Because when they tell you their “anchored” salary, there is almost always room to move upward. In some fields, salaries vary widely depending on skill set and position.

For instance, say you were expecting $60,000 from a company, and they asked you what you were hoping for. If you say $60,000, you’re locked into that salary. They aren’t going to offer you more than $60,000. You’ve shown your hand, and they have all the information.

So, let’s turn the tables. Say you are expecting the same amount for the same job offer; however, they say they’ll offer you $80,000. Not only are you receiving $20,000 more in expected value, but you also have room to negotiate a higher salary than $80,000. Because, nearly always, a company is coming out with their bottom (their “anchored”) salary offer.

You have room to offer $90,000 and perhaps settle on $85,000. Hopefully, you can see the value of timing and asking the right questions in a negotiation and how it can pay dividends by just planning and learning negotiation tactics.

Dive Deeper: Negotiating Your Salary Without Burning Bridges

Salary Negotiation Tips: Negotiating Your Salary With Tori Dunlap

How To Negotiate Car Price

Negotiating the price of a new or used vehicle is incredibly similar, so we will not differentiate for purposes of this negotiation guide. Obviously, buying either condition has pros and cons, so use your discretion. We’ll look at the most important steps to touch on to get the maximum discount possible.

Do Your Homework

New or used, doing your homework on the purchase of a car is critical to success. Not only the price of the car, but the safety ratings, how reliable the car is, and pricing trends over time. The automobile market is fickle, with some out-of-date autos retaining their value incredibly well while others fall into the tank after a couple of years.

The most important decision you must make is not to get married to a particular make and model. Keep your options open. The more options you have, the more flexibility you have in purchasing. Again, this comes down to negotiating and the seller smelling blood in the water. If they know you are attached to a specific make/model, they’ll be like a bulldog – relentless until you give in. Having a favorite is fine, but work on your poker face and retain your excitement.

Be Patient

Negotiating a car is exciting, but don’t get caught up in the “romance. ” A common sales technique involves getting you into a test drive, and then the salesperson treats the situation like it’s a done deal. Don’t fall for this tactic. Always be in control of the tempo. If a salesperson is rushing you, slow them down. If they are outright rushing you into decisions, walk away. You need to establish that you are buying on your time, not on anyone else’s.

Further, keep in mind that you have many, many different dealerships to buy from. So, as we always say, be willing to go somewhere else. The trickiest part for most buyers is walking away from a “nice” salesperson who treats you like you are their buddy. You are not their buddy, and they don’t care about you. Don’t like the initial deal and/or hate their trade-in offer? Go to the next of the 23 dealerships on your list before you get in deeper.

Get Multiple Offers/Quotes

Nearly every car dealership has an “internet” department that specializes in quoting prices for nearly every make and model that they carry. You could also do this the old-fashioned way: go to each dealership and get a written quote. Either way, you are accomplishing the same goal. With documented price quotes, you have hard evidence (not just your word) that someone has offered a price to you.

Never Show Your Hand

The same concept as in salary negotiation. Do not give off any information about how much you like the car, how much you are willing to pay, what your price range is, or when you are thinking about buying. This information does not help you in any way but only helps the salesperson. Gather as much information as you can. If asked a question, respond with a question that helps you.

Consider this when you finally get to the negotiation table. You have all the information, and your opposition has none. This is power. And obviously, never throw out the first offer. Let the salesperson do all the work for you. If the first offer is too high, tell them so. But don’t tell them “how” high.

Simply let the salesperson make the next offer. This is called “silent negotiating”. You truly don’t have to say a word. The salesperson may say something like, “You’re giving me nothing here, c’mon”! or “I gotta know a ballpark”. No, they don’t. Again, walk away if they don’t meet you in the ZOPA.

Get Pre-Approved Financing

Although you may not need it (as some dealerships may offer a promotional rate), get financing before going to the dealership. This is especially true if you belong to a credit union, as they will typically offer a lower APR. Not only will this give you peace of mind heading into the potential purchase, but it will also give you leverage against the dealership. Having the financing secured before walking through the door will take pressure off needing to secure it after purchase, potentially with poorer terms through the dealership.

Your Trade-In

Most buyers make the mistake of bringing up their trade-in before closing. Do not make this mistake. Bringing up your trade-in before closing on the purchase gives the salesperson a leg-up in the negotiation, allowing them to factor in the price they are willing to pay for your trade-in before even getting to the table. So, during the shopping phase, do not mention a trade-in. Once you start the negotiation process, then bring in your trade-in. That way, you’ll get the maximum value.

The Negotiation Table

There are specific pitfalls to avoid at the dealership negotiation table.

-

- Add-ons, such as mudflaps and tinting, are typically offered quickly at closing to boost profits. Say no to all of these unless you just really want them.

-

- Decline the extended warranty.

-

- Only accept the dealership financing if the terms are better than your already approved financing. Be sure to read all the fine print to ensure that you aren’t hit with early pay-off costs or a massive penalty if you are a day late with a payment.

Now that you are aware of the standard “tricks,” you are ready to negotiate. You have already done your homework, know the price you are willing to pay, and are willing to walk away. You couldn’t be more prepared to get the best price on your terms.

Dive deeper: Credit 101: The Ultimate Guide to Credit

How To Negotiate Buying a House

Buying a home is almost often the largest single purchase of your life. So, learning how to negotiate the best price is an invaluable skill. It is a skill learned through taking the proper steps of preparation and understanding within yourself that you cannot be emotionally connected to the process. This means that buying your dream home is inherently emotional; however, even a relatively unseasoned real estate agent selling the home can pick up on these emotional cues.

So, it’s important to come to the absolute realization that your first pick may fall through. You’ve lost the negotiation if the seller knows you’ll effectively pay tens of thousands above the asking price. The willingness to walk away from the negotiation table is an incredibly powerful tool to wield. Use it.

Preemptive Positioning Through Soft Bargaining

So we’ve covered the top two steps to getting the best price for your home: divorce yourself emotionally from the buying process and be willing to walk away from the negotiation table. It should be noted that you shouldn’t storm away from the table if things aren’t falling your way. But the willingness to walk away should be conveyed through action or words if the deal appears to be heading south.

The most effective way to do this is called “soft bargaining.” Soft bargaining focuses more on the humanistic skills of negotiation (e.g., endearing yourself to your opposition, being non-confrontational, and using listening as a power tool instead of speaking). This approach is psychologically disarming, as most “wheelers and dealers” expect you to drive a hard bargain.

Use Cognitive Dissonance

One of the best ways to create a soft bargaining psychological advantage is to ask a small favor of the opposing side before you begin negotiations. This can be as simple as “Oh, I forgot a pen; would you mind if I borrowed one of yours? Thank you so much”. This psychological “ploy” is referred to as cognitive dissonance theory. In layman’s terms, cognitive dissonance theory suggests that asking a favor of someone who inherently believes they are your enemy and takes an aggressive stance against you will soften.

It’s the brain’s way of dealing with the conflicting ideas of “the buyer is the enemy” and the contrary, “the buyer nicely asked me for a favor; what a nice person.” The brain deals with it by changing preconceived notions about you and eliminating you as a threat. Does this sound complicated and far-fetched? It’s a common tenet in social psychology.

Negotiation Strategies

Now that we’ve established some background, let’s examine the steps to negotiating the purchase of a home.

Before the Offer

-

- Remove emotion from the buying process.

-

- Be willing to walk away from the negotiating table.

-

- Do your research. This includes researching the home (completing an inspection), the comparative comps, the house’s selling history, the realtor or realtor company that is selling the home, and nearly everything else you can think of.

-

- This research will yield information on the home’s market history, including the number of times it has changed hands and its price history. All of this information is tremendously helpful at the negotiation table.

-

- Do your research. This includes researching the home (completing an inspection), the comparative comps, the house’s selling history, the realtor or realtor company that is selling the home, and nearly everything else you can think of.

-

- Create a data-driven decision regarding an offer that is devoid of emotion. Again, use the information from Step 3 to determine the proper parameters for a data-driven decision. Not only will this mathematically give you an edge, but it will also give you comfort in knowing you are making a well-educated and informed decision, not one that is driven by desire.

-

- It is also best practice to create an MAO (Maximum Allowable Offer) during this step. In economics, this is referred to as the “choke price.” Whatever you choose to call it, it is the absolute highest offer you’ll make in negotiation. Having this already planned ahead of time will give you a sense of completeness in your approach to negotiation. And you hold to your MAO always.

-

- Create a data-driven decision regarding an offer that is devoid of emotion. Again, use the information from Step 3 to determine the proper parameters for a data-driven decision. Not only will this mathematically give you an edge, but it will also give you comfort in knowing you are making a well-educated and informed decision, not one that is driven by desire.

The Offer

-

- Keep in mind that timing is crucial. So, getting your offer in promptly and ahead of other offers will give you an advantage. This is not to say try to beat everyone to the punch as you’ll seem too eager, and that’s blood in the water. However, a well-timed, fair, negotiated price can be the difference between you purchasing the house and someone else purchasing the house for the same price.

-

- The listing agent may try to puff up an implied value of the home. “Once in a lifetime deal”! “We’ve got several, much higher bids on the table”! Do not fall for these flimsy psychological mind games. If they have other offers on the table and are outside your comfort zone, we’ve already established you are ready to move on. If they don’t, this will backfire.

-

- Keep in mind that timing is crucial. So, getting your offer in promptly and ahead of other offers will give you an advantage. This is not to say try to beat everyone to the punch as you’ll seem too eager, and that’s blood in the water. However, a well-timed, fair, negotiated price can be the difference between you purchasing the house and someone else purchasing the house for the same price.

-

- “Hard bargaining”. This can be anywhere from the actual price of the home to attempting to pass off expenditures (e.g., repairs, closing costs) your way. Sellers often try to tack these on during the close of the deal because they feel that you probably have had enough negotiation for one day and can easily take advantage of user fatigue. Do not accept this unless it falls far beneath your MAO.

The Close

-

- Your offer is accepted once you’ve made it through the minefield of bargaining. Congratulations! Your journey is not over yet, though. Hopefully, you’ve already gone through the steps of getting pre-approved for a mortgage, but if not, that’s absolutely your first venture. Secure financing for the home.

-

- Be sure to read over your closing documents thoroughly and carefully.

-

- Included in your closing documents is your closing disclosure. This details the loan term, loan amount, closing date, closing costs, etc.

-

- Be sure to read over your closing documents thoroughly and carefully.

-

- A title company will perform a title search to ensure the estate owes no outstanding debts.

-

- You’ll need to get homeowner’s insurance. Shop around for the best rates and coverage for what you want to protect and the related deductible.

The Takeaway

Always be prepared for all negotiations, including meetings prior to the actual negotiation. Be on time. Act professionally at all times; this is a business transaction, and both parties are expected to behave like pros. Remember the tips we’ve given you and the proper steps you need to take to best prepare to negotiate the purchase of a home. If in doubt, over-prepare and over-deliver your best interests. You aren’t here to make friends (nor enemies). You are here for your self-interest alone.

Game Theory (Backwards Induction) applies mathematical and psychological tools to achieve the best outcome for those highly mathematically inclined.

Check out this downloadable PDF from MIT regarding Backwards Induction.

How To Negotiate Medical Bills

So, you feel pretty confident in your negotiation skills now. You’ve learned how to negotiate a higher salary and buy a house. So, let’s dive into an area a lot of our readers ask about how to lower my medical bills. Medical bills are tricky because they are complicated (for a reason), and they can be crippling to your credit. So, let’s take this step-by-step.

First, negotiating medical debt is very different from buying a product. A service has already been rendered. Health care is very expensive (especially without health insurance), but it is necessary if you are hospitalized and have a procedure done (which is the case for most of our readers looking to lower their medical bills). When you start the negotiation process, you must remember these two things:

-

- The person you are speaking with is a human, too. Treat them as such and with respect.

-

- Keep very detailed records of who you speak with, their extensions, and any information that you can. This is incredibly important because you’ll more than likely speak to many different representatives, and getting back to one that knows your case will help tremendously.

Being Polite, Empathetic, and Sympathetic Will Get You Further

Have you ever worked in a service job? If you have, you understand that dealing with angry personalities over the phone is difficult. Be different. When you call, be genuine. Ask them how their day is going and how the weather is. Small talk, yes, but it goes a long way. Then, politely tell them your issue. They may not be able to assist you with lowering your bill, but they’ll be much more inclined to help you get to the right place to do so.

If you are angry or indifferent when you call, they’ll want you off the phone as soon as possible. And they’ll do so. I know it’s difficult to remain calm in a situation where you feel like your financial world is crumbling around you, but know that this is the best way to get what you need.

Ask For an Itemized List of Services and Equipment Used

We can assure you that this will take a few phone calls, as the financial department doesn’t want to reveal this information. Plus, it takes a lot of work to itemize a bill. Getting an itemized bill is crucial because it shows exactly how much you were charged.

According to a study by Beckler Hospital Review, more than 80% of hospital bills contain some errors. So carefully review your itemized bill to ensure you were charged for what you received.

Organization, Organization, Organization

As we stated in number 2 in the intro, organize, record, detail every conversation, and keep everything together. Don’t use Post-it notes and scrap paper to write information down. Keep a notebook that has every bit of information you can put down. People you talk to, people you should talk to, what those people say, and times when to call back.

Set alarms on your phone to ensure that you make callbacks on time. If you are sent information via email, print it out and save it in a folder. You’ll probably need to keep multiple folders to ensure you keep everything tidy and accessible. This is especially important after you get your itemized bill.

You may need to break your folders down into categories like “major disputes,” which are clear errors on the hospital’s part. Especially look for duplicate charges and phantom charges (charges for services that were not rendered). “Possible disputes” are outrageous hospital charges (e.g., $5.00 for a q-tip). And then “general disputes” where you will try to work with someone to get the overall total of your medical debt down to a manageable amount.

Arm yourself with the Healthcare Cost and Utilization Project and the Healthcare Bluebook. These two resources give you a fair price for healthcare services throughout the country.

See if Financial Aid is Available Through the Billing Department

It may seem surprising, but the federal government does offer grants and other money to hospitals for those who have a difficult time with debt relief. This isn’t necessarily tied to your income. Sometimes, it’s the massive cost of the procedure. And this assistance isn’t through an insurance company. You just need to ask while you are trying to reduce your bill. Occasionally, they’ll offer it, but speak up and be heard.

And don’t use your credit card for any agreed payment. You don’t want the hospital to have your card on file. They may charge you more than you agreed upon.

Time to Negotiate

“The billing people have gotten so used to negotiating that they expect it”.

- Carolyn McClanahanSo, we’ve done all the background, planning, and research we need. We have an itemized bill that we have already corrected and probably saved some money. Now, we need to settle our debt. This process will probably take several phone calls and playing phone tag with supervisors. Be determined and stay focused.

During a negotiation of this nature, they often offer you a ridiculously low “discount” and an installment plan. This is similar to the “anchor” theory used earlier in the vehicle negotiation. Think of this as their starting offer. They’ll say that “we can’t go lower.” However, we know that everything is negotiable.

Change Up Your Mindset

Take this mindset. If you do not pay this bill, the hospital will sell it to a collection agency for pennies on the dollar. Now, we don’t want that hit on our credit, nor do we want to have a collections mark to credit bureaus or a debt settlement company. But we do have leverage. Leverage to settle the bill before that whole process.

They want a good deal, more money than pennies on the dollar. Don’t say, “You’ll sell this for pennies on the dollar,” but be aware that will be their last resort. So, when they give you that offer that “they can’t go lower,” counter with a much lower amount. Now, you’ve set what you are willing to pay. Obviously, it will be lower than they want, but it will give them an idea of what you feel you can afford.

This may feel awkward at first. You are doing the best you can to lower your bill to make it affordable. So, be relatively aggressive, not in your tone, but in the offers you make and consider.

Keep in mind that the hospital wants to settle with you, not with an outside agency. This will yield the best results for you. Stand up for yourself, and don’t take anything that you can’t afford. If it comes down to a payment plan, so be it. But ensure you’ve done everything possible to get the lowest bill.

Important Resources

There is free to low-cost medical care in some states through Charity Care. Check to see if you qualify.

Also, listen to An Inside Look At Debt Collection And Forgiveness

Another great resource: Practical Tips for Negotiating Medical Bills

How to Negotiate: The Bottom Line

Probably the best takeaway from this guide is that now you aren’t so intimidated by negotiations. Although not entirely straightforward, two sides try to convince the other to see a situation their way. And that’s life too, you know? In conversations, we are always trying to win the other person over with our opinion and vice versa. We may not realize it, but that’s precisely what conversation is all about. Negotiation is an extension of conversation. Higher stakes and more complex ideas, but an extension nonetheless.

Also, please take this away: don’t be afraid, ever, to stand up for yourself. Especially if you feel that you are being treated unfairly or wrongly. This goes a bit beyond negotiation, but using negotiation tactics, as we’ve discussed, will help you with your communication skills as well as your self-confidence.

Finally, use these negotiation principles and tactics wisely. Practicing and honing your skills will take time, but they’ll come. So, if you don’t get the results you want, try again! That’s the beauty of negotiation. There is always someone else out there who can offer you the services or the products you want.

So if the first 9 decline, the 10th may be the winner. The same holds true when negotiating down your medical debt. All it takes is one person, one voice to advocate for you to get what you want. Be persistent, be polite, and be professional!

Related Resources:

SWOT Analysis for Financial Independence | EP 359

From Vision Board to Action: A FI Success Story | Rakesh | Ep 436

Practical Tips for Negotiating Medical Bills

Everything Is Negotiable | Ep 119