Once you start your FI journey, your first step is generally to establish an emergency fund. Finding a high-yield savings account is a great way to earn some interest on your savings and this is the first time in 20 years we’ve seen significant interest rates on savings accounts!

Savings accounts are even becoming a viable (and safe — all of these accounts are FDIC Insured!) option for putting a more significant percentage of your assets than just a few thousand dollars that might be lying around for an “emergency.”

One of our favorite banks (both Brad and Jonathan have their own accounts here) is CIT Bank. We’ll run you through their three main savings account options, of which we can definitely recommend either of the first two depending on your circumstances:

- Platinum Savings Account: 5.05% APY (with a balance of $5,000 or more)

- Savings Connect Account: 4.65% APY

- Savings Builder Account: 1.00% APY (Minimum balance of $25,000 or $100 monthly deposit. $100 minimum opening deposit.)

Three Options for CIT Savings Accounts

Platinum Savings Account

CIT’s Platinum Savings Account currently has an amazing 5.05% APY on balances of $5,000 or more. You need to open the account with a minimum of a $100 deposit.

If you have more than $5,000 to deposit the Platinum Savings Account is one of the best bank account options currently available on the market.

Some features and benefits:

- FDIC Insured

- Zero account opening or maintenance fees

- Daily compounding interest

- Remote deposit checks

- Make transfers via CIT’s mobile app

Learn more about the Platinum Savings Account and get started here.

Savings Connect

CIT’s Savings Connect Account has an APY currently of 4.65% and there’s no minimum balance requirement like the $5k the Platinum Savings Account has to get the top rate.

If you can’t maintain a $5,000 total balance, the Savings Connect Account is a great option for you!

Features and Benefits:

- FDIC insured

- Zero account opening or monthly maintenance fees

- Digital convenience with online banking and the mobile app

- Deposit checks remotely and make transfers easily with the CIT Bank mobile app

Learn more about the Savings Connect Account and open an account here.

Savings Builder

CIT’s Savings Builder Account earns up to a 1.00% APY. There is a $100 minimum to open an account. In order to earn the 1% APY you must maintain a minimum balance of $25,000 or you must make at least a $100 monthly deposit.

Features and Benefits:

- FDIC Insured

- No account opening or monthly service fees

- Daily compounding of interest

- Deposit checks remotely and make transfers with the CIT Bank mobile app

Learn more about the Savings Builder and open an account here.

How To Open An Account

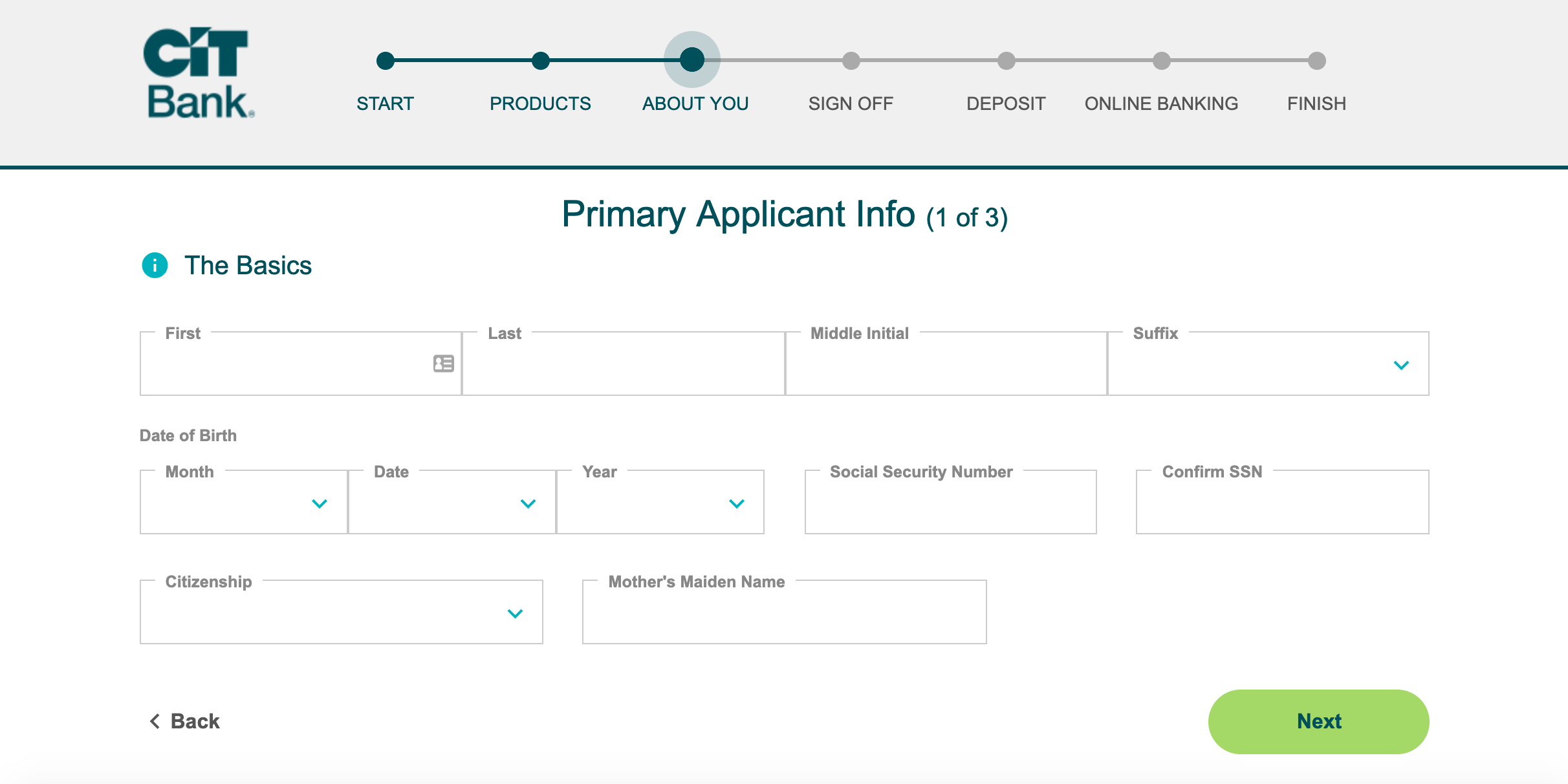

Now, let’s get into how to open a CIT bank account, step by step. We used an example of the CIT Savings Builder and we stopped when you need to input your social security number, but that’s one of the last steps.

First, go to the CIT Bank Website for the account you want to open:

- Platinum Savings Account: 5.05% APY (with a balance of $5,000 or more)

- Savings Connect Account: 4.65% APY

- Savings Builder Account: 1.00% APY (Minimum balance of $25,000 or $100 monthly deposit. $100 minimum opening deposit.)

Note: These interest rates were confirmed on 4/15/2024 with current interest rates

On the page you land on, click “Get Started” right in the middle of the page.

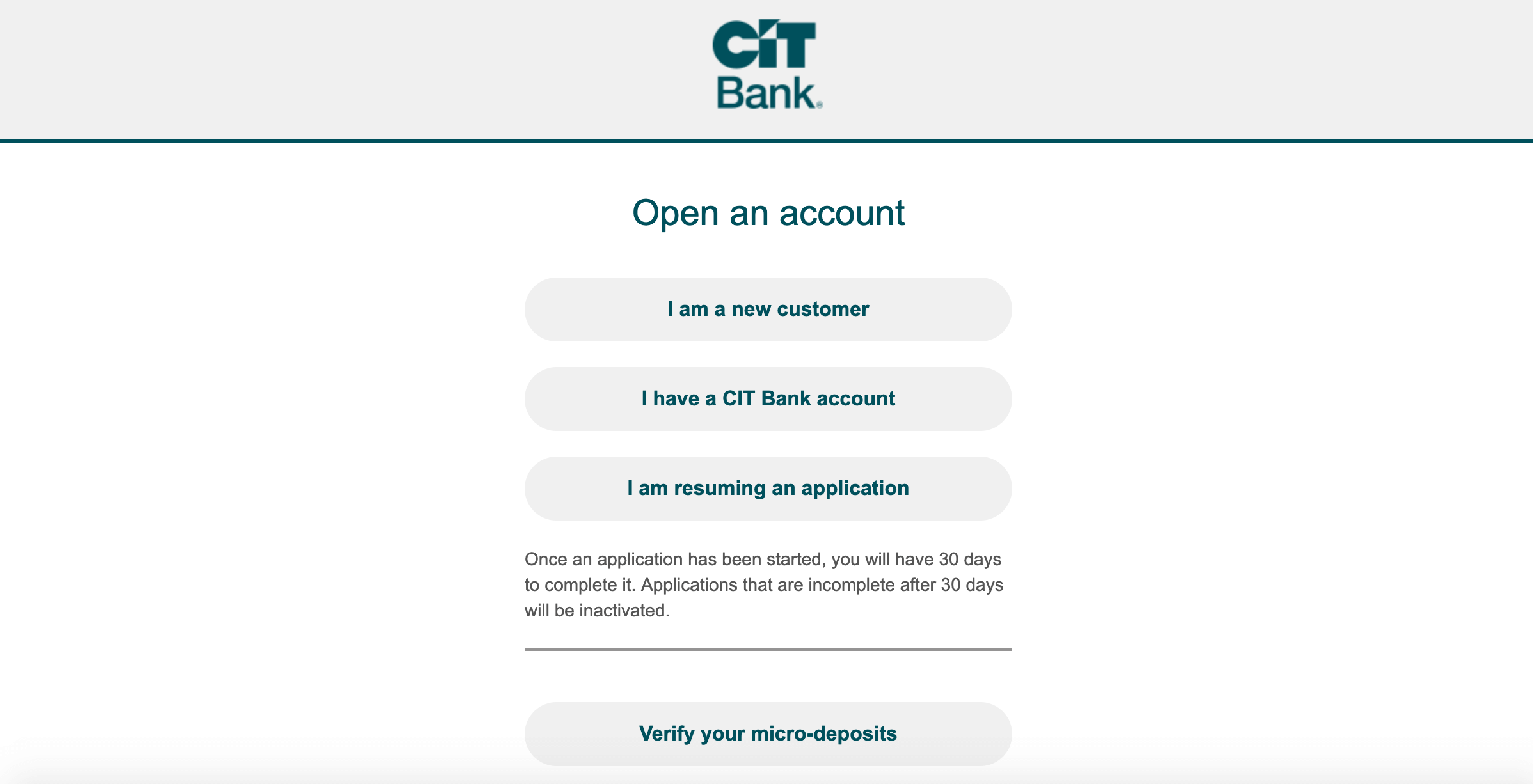

Next, select an option. For most people, you’ll click “I am a new customer.”

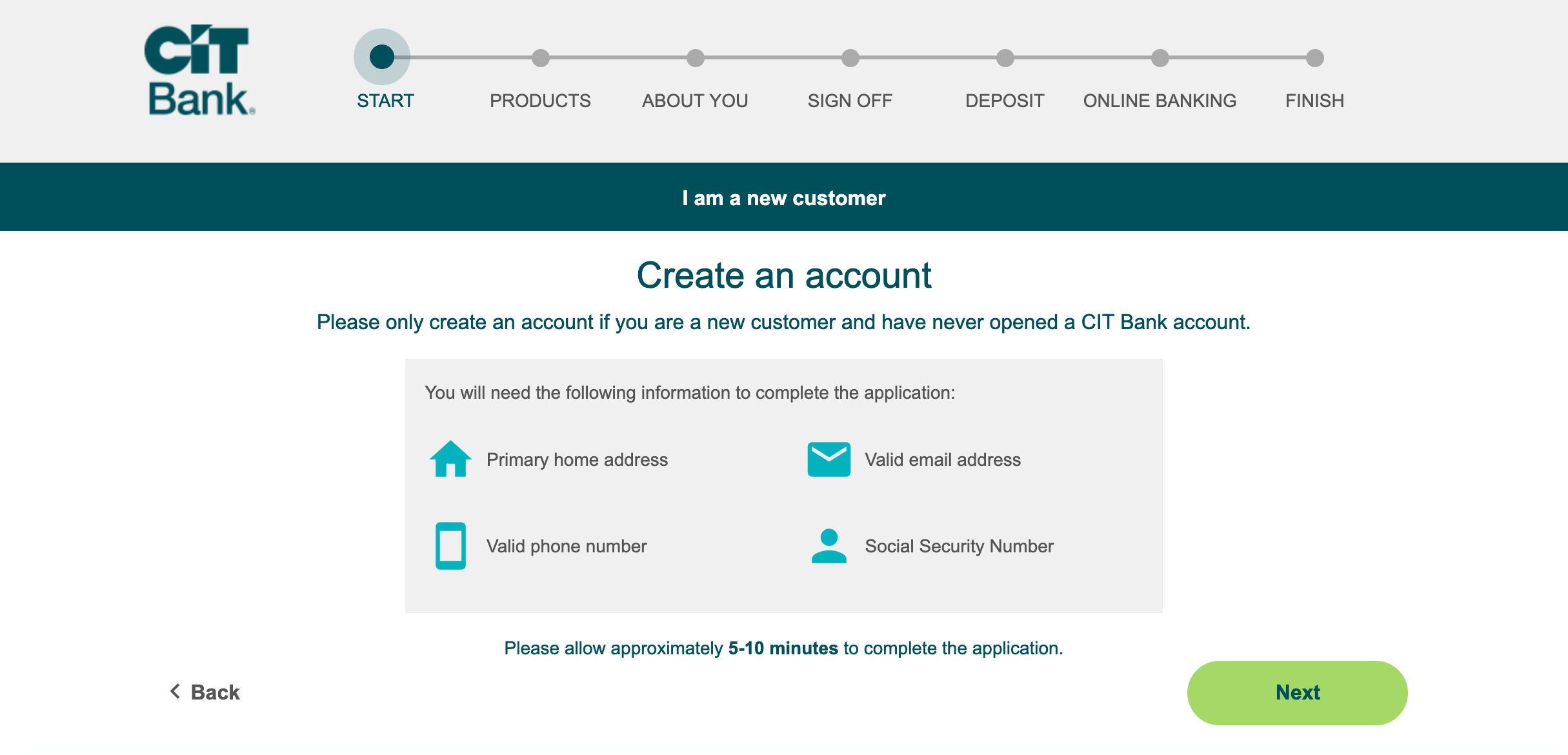

Next, CIT will let you know that opening an account will take about five to ten minutes. The first three steps took me about three minutes, so it’s definitely an easy application.

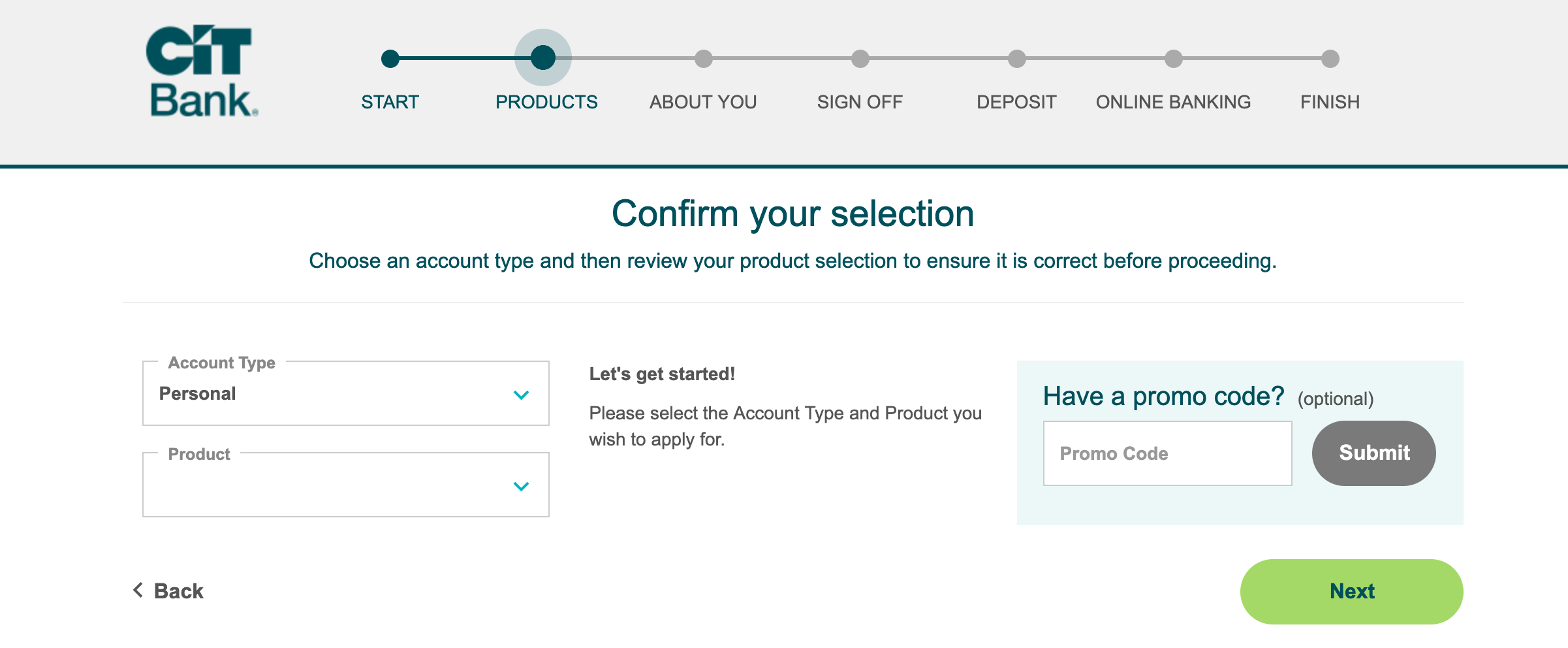

After that, you’ll choose an account. For this review, we chose the Savings Builder account.

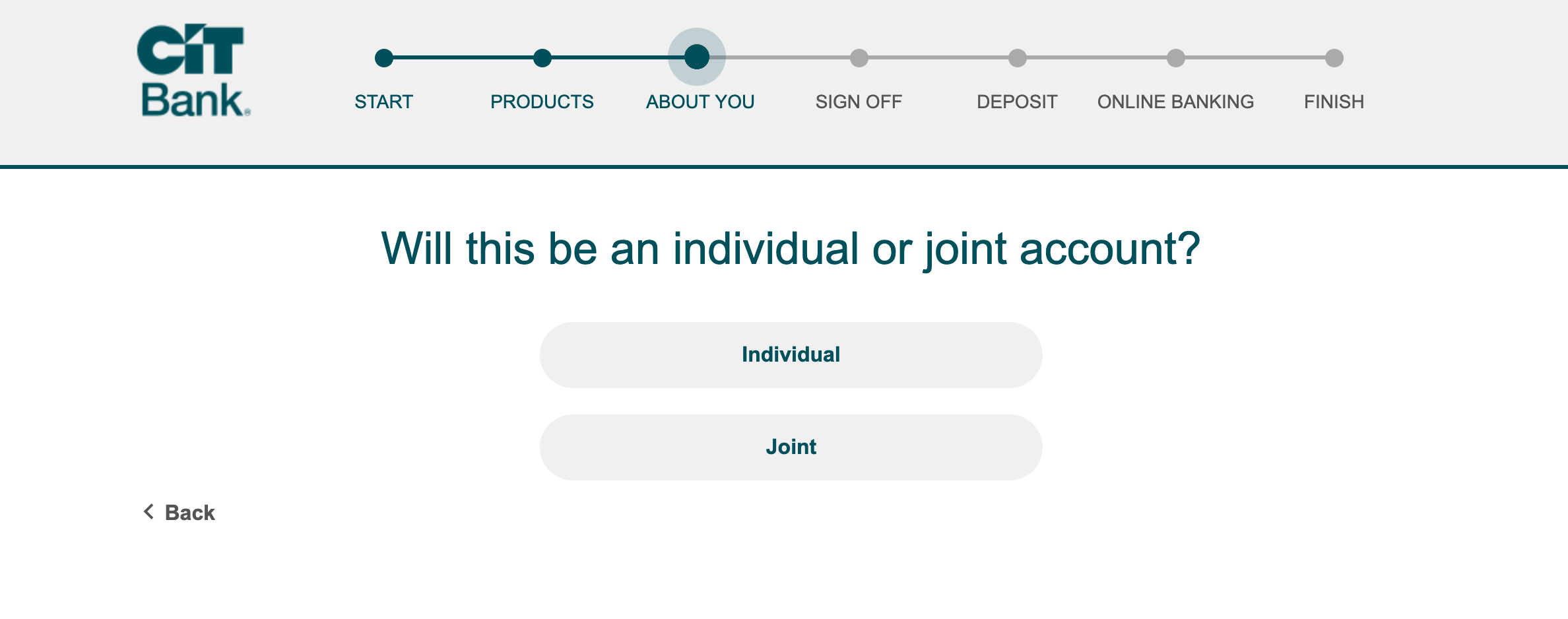

CIT offers both individual and joint accounts. For this review, we chose an individual account. We went back later and tried to open a joint account and found that it was an almost identical process.

Now, CIT gets into the details. They’ll ask for your name, your birthday, your citizenship, your social security number, and your mother’s maiden name (for security reasons). As you can see, this is a lot of personal information that we won’t share publicly, so we stopped there.

The rest of the application consists of reviewing your information and making your first deposit into your account, so it should only take a few more minutes.

About CIT Bank

There’s a lot about CIT that impresses us. First, they have a century of experience, so they know what they’re doing. Second, First Citizens Bank and CIT recently merged, which created a top 20 US financial institution with more than $100 billion in assets as of January 2022. making them one of the largest banks in the U.S.

CIT is also great for those who like to hold their money with a company that cares about their community. CIT has a number of community programs; for instance, their employees volunteer throughout the year, they invest in clean energy, and they focus on helping the underserved in their home community of Southern California.

We’ve been pleased with the ease of setting up an account and how quickly money transfers to and from your online account.