Want to get the best price on life insurance? Want to ensure your family is financially protected?

Understandably, the pandemic has made a lot of members of our community think more deeply about emergencies and how to protect our families. One of the biggest emergencies a family can face is the death of a loved one. A critical piece of planning, especially if you have people who depend on your income, is term life insurance. And if you are pursuing FI, you’ll want the best price on life insurance you can find.

You don’t need life insurance for your entire life, but you need it until you reach the point where your assets or the income from those assets are enough to support your family’s life without you in the picture. There are different terms for these policies, often in the 10-30 year range, and where you are on your FI journey will determine the term length that’s right for your family. Our general assumption is that someone just starting out on their FI journey would likely need a 20-year policy.

Get a Free Quote

How Much Term Life Insurance Do I Need?

Determining how much term life insurance you need isn’t as intimidating as it may sound. If your family’s living expenses are $40,000 a year, multiply that times 25 (the inverse of the 4% rule) and you would need one million dollars in investments to cover your expenses. The next step is to subtract your current net worth (your existing investments) from this calculated FI number and your life insurance will ideally replace all or most of this gap, allowing your loved ones to cover their living expenses without depending on your earned income. So if you have $400,000 of net worth and a FI number of $1,000,000, it would be reasonable to consider a policy in the $600,000 range. If most of your net worth is in accounts that are difficult to access (e.g. employer retirement plans like 401k or 403b) or if a major part of your net worth is home equity, you may want to add additional life coverage to avoid forcing decisions that your survivors might prefer to avoid. Additionally, if you have a stay-at-home spouse providing services such as childcare, do not neglect to cover that individual with a life insurance policy as well to account for the reality that if they were to pass away, it would likely impact the ability of the surviving parent to focus as fully on their career.

How To Get The Best Price on Life Insurance

There are variables you can’t control, but there are plenty you can.

Be Young And Healthy

Your age and health are major factors in the rates you will pay for life insurance. Obviously, there’s nothing you can do about your age, but the sooner you apply for life insurance the better. Your rates are only increasing over time. As they say, we aren’t getting any younger.

Your health however is something you can control–to a degree anyway. And illness can strike at any time so if you are healthy today then today is the best time to apply for life insurance. A short-term illness, such as the flu, will not affect your rates. But if you become ill and it permanently affects your health then your life insurance rates may be dramatically affected. Here are some things you can do to positively affect your health and lower your rates.

- Stop smoking

- Stop drinking

- Lose weight

- Exercise

- Lower your cholesterol

- Maintain a healthy blood pressure

- Take your medications

- Avoid dangerous activities

Shop Around For The Best Price

Getting multiple quotes is the best way to ensure you are getting the best price for life insurance. But who wants to deal with several life insurance salespeople at once?

Policygenius shops hundreds of term life insurance providers to get you the best deal. It also doesn’t have any restrictions on who can use it. Brad hadn’t checked his quotes in a while so we decided to run a horse race between Policygenius and this special vegan marathoner program we had heard about. Not only did Policygenius match this other company, but it actually ended up beating them. That’s when we knew this was the one. Brad ended up saving close to $700 in premiums and you could as well.

Policygenius Review

Policygenius gives you the perfect blend of flexibility and free-market competition. This ensures you get the lowest price for your family. You can pick your coverage rate and it’s very simple to come up with an estimate of how much you might need.

With that basic construct in mind, let’s take a look:

When you start on their homepage you’ll see a very simple intuitive interface where you’re prompted to select whatever dollar amount you decide for your coverage level and the term that you desire. You can see we chose a $500,000 policy with a 20-year term.

Then just press the orange “Get Quotes” button and they start finding carriers for you, finding the best price for life insurance.

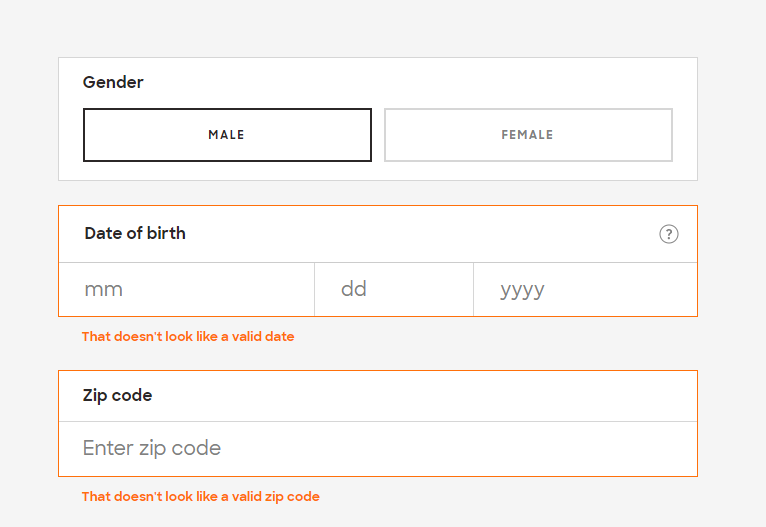

Specify your gender, put in your date of birth, and put in your zip code. Specify whether or not you are a U.S. citizen and then go to the next screen.

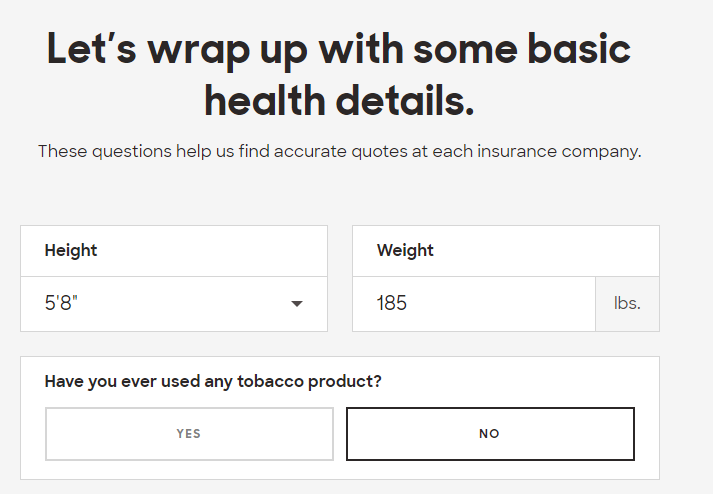

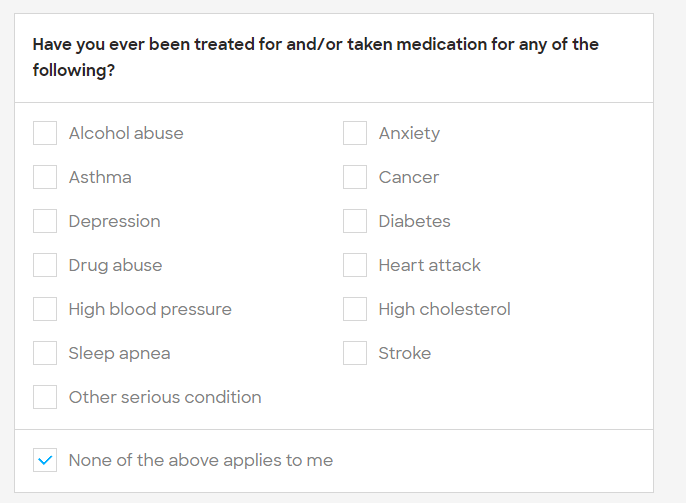

The next screen is going to ask you for just some basic health details. Questions like your height, weight, and tobacco use.

They will also ask you if you’re taking any medications. It’ll gather information about any chronic health conditions and your family health history.

Term Life Insurance

Term life insurance is basically a bet. The bet is whether or not you are likely to die over the period of your term. While that sounds kind of morbid, one of the reasons that term life insurance is so cheap is because it’s rather unlikely that you will ever need it and the policy ideally should expire without a payout. However, it’s such a low cost to you and not having coverage can be so financially damaging to your family if you are the income provider that it is absolutely worth a good policy.

The final question they ask is if you had your license suspended, revoked, or had more than one ticket or accident in the past five years. Obviously, if you’re a reckless driver that moves the needle a little bit on the life expectancy charts. Once you’ve submitted that little bit of information just click “Get My Quotes.”

Policygenius takes about 10-15 seconds to get you a full list of quotes. It’ll ask for your e-mail address to save the results.

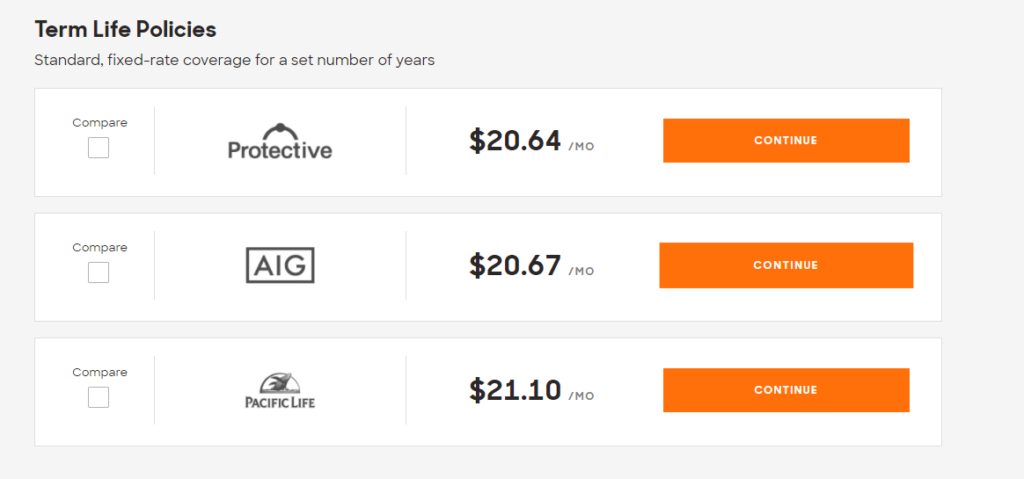

While you will get quotes from around 10-20 companies – they will separate out the top three most competitive quotes for your convenience.

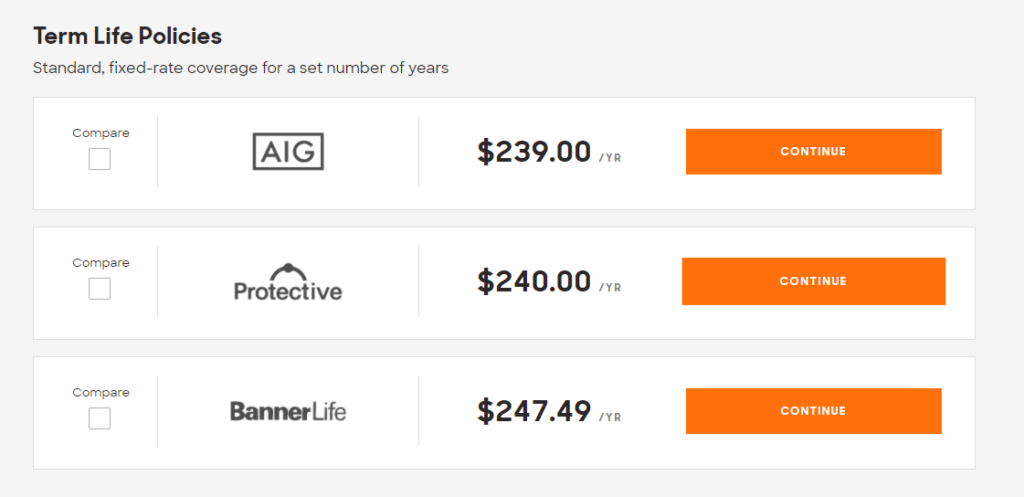

If you are willing to pay on an annual basis you can get an additional discount on your pricing. This may change the top three choices.

In this example, paying annually changed the numbers a little bit. AIG came in at two hundred thirty-nine dollars a year. Quick, simple math shows you get it for $19.91 a month. That’s amazing!

A Financial Necessity

Welcome to the future. This is the way to go about getting the best price on life insurance. We hope this helps save you some money and gives your family the financial security they need until you get closer to your FI number.

It’s a financial backstop for your family. This isn’t necessarily something you’re going to need for 20 years. They are committing to you that they’re not going to raise their price on you for this period of time.

They’re not allowed to change the policy as you get older or if your health changes. So if you reach FI in ten years or five years, or whatever it may be, you can always cancel the policy. You’re not locked in, but they are. And that is why we love this as just a backstop.

Crowd-Sourced Feedback

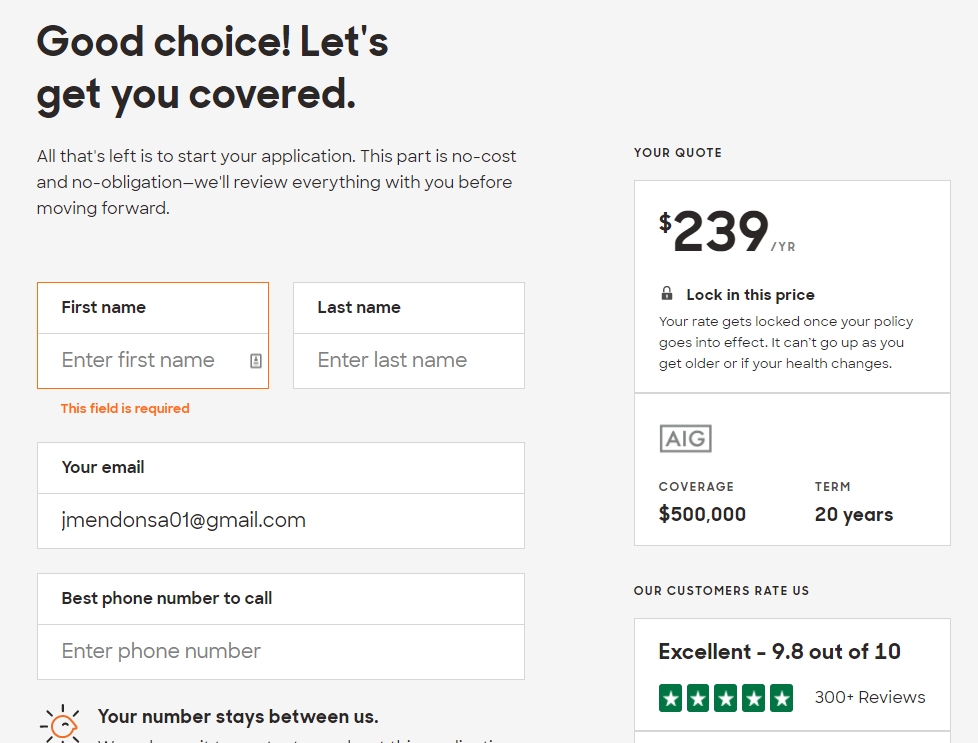

A nice feature we noted is that after you select the company you are interested in, they will share their aggregated user ratings for this company. This is crowd-sourced feedback. It’s nice to have those ratings right there on the dashboard before committing to an in-person call. Once you have made your decision based on your specific options, it’s going to ask you for your phone number so you can get on a call with a representative from the selected company. Then you can lock down the policy.

Enter your first name, last name, and best contact number, and talk with an agent. Take action. Life insurance prices only go up as you age. This is the cheapest you may ever receive it. And you don’t know what the future holds. If you discover you have a major health issue before you buy life insurance, that will significantly impact your rates or even your ability to receive coverage at all.

Ask yourself if I were to die tomorrow or next year it would ruin my family’s financial future? Would it be very difficult for them to thrive if I wasn’t around? That may not be the case in five or seven years, but term life insurance covers us for now. We can always reassess later.

What Our ChooseFI Community Says About Policygenius

“After hearing Poliygenius ads for years on various podcasts, I finally took the service for a spin, and saved $618 (25%) on my annual insurance premiums. I had to do zero work — they found the cheapest comparable packages, reviewed the options with me, signed me up, AND notified my previous insurer that they’re getting the heave-ho!”

Karen (ChooseFI Community Member)

“After contemplating for the last year, I finally made the plunge to evaluate both my home and auto insurance after hearing about Policygenius on your podcast. Honestly, one of the main reasons I had never evaluated it was because of how daunting the process sounded but Policygenius could not have made it any simpler for me, they literally did all the work from comparing plans to cancelling my existing policies. Overall, they helped me save (to invest) over $930 on my insurance premiums this year.”

Mark (ChooseFI Community Member)

Getting The Best Price On Life Insurance: Why Term?

We don’t like the idea of very complex insurance or bundling insurance with investments. We’re not a fan of whole life insurance, universal life insurance, or cash value insurance. The implied complexity is lining the agent’s pocket with marginal benefits for the end-user. But we think that a great low-cost term policy absolutely makes sense for the individual who is aggressively pursuing financial independence.

Dive deeper: