For most of us, our home will be one of the biggest purchases we make in our lifetime. And your home will often account for a significant percentage of your overall net worth. That’s why finding the best homeowners insurance policy is so critical.

No one wants to think that we’ll be the unfortunate person whose home burns down or withstands massive flooding damage. But the truth is that none of us are immune to catastrophes. That’s why you need to own the best homeowners insurance policy today so that you’re fully protected if a pipe were to burst or a tree was to fall through your roof tomorrow.

In this guide, we’ll help you find the best homeowners insurance policy by following several steps. First, we’ll define the key elements of a homeowners insurance policy. Then we’ll take a look at how to choose the right coverage type and the amount for your home. Finally, we’ll explore how to shop for the best homeowners insurance policy in 2020.

Table of Contents

- Elements Of The Homeowners Insurance Policy

- Choosing The Right Type Of Coverage

- Homeowners Insurance Add-Ons To Consider

- Ways To Reduce Your Homeowners Insurance Cost

- How to Buy Homeowners Insurance

- How to Shop for Homeowners Insurance With Policygenius

- The Bottom Line

Elements Of The Homeowners Insurance Policy

Before we can begin to look at how to compare homeowners insurance policies, we first need to define a few key terms. Below, we look at the most common elements of a homeowners insurance policies and what they mean.

Dwelling (Coverage A)

Coverage for the physical structure of your home will be the first section of your homeowners insurance policy. Dwelling coverage is often referred to as Coverage A.

Like the other elements of the home insurance policy, your dwelling coverage will have a deductible and a coverage limit. Your coverage limit is the most money that your insurer will pay per claim. Your deductible is how much money you’ll need to pay per claim before your insurance kicks in.

Typically, dwelling coverage covers the structure that you live in as well as any attached structures. So, for example, your garage will often be covered by the dwelling coverage section of your policy.

Other Structures (Coverage B)

The second section of the homeowners insurance policy that you’ll need to look over is Coverage B–Other Structures. This is the section of your policy that would cover unattached structures on your property.

For example, if you have a shed in your backyard, it would be included in “Other Structures.” Detached garages, barns, workshops, or in-law suites would also be included in this section.

Coverage limits for “Other Structures” are often set as a percentage of your dwelling coverage limits. That percentage is typically 10% according to an Insurance Information Institute report on homeowners insurance coverage. So, for example, if you have $400,000 of dwelling coverage, you’d usually have a maximum of $40,000 in coverage for “Other Structures.”

Personal Property (Coverage C)

While dwelling coverage protects the actual structure of your home, personal property coverage protects what’s inside your home. From electronics to furniture to jewelry, the items sitting inside your home can represent a lot of money. And for most of us, it would be difficult to replace them all at one time with our own funds.

Thankfully, the contents of your home are covered by Coverage C on your homeowners insurance policy.

The Insurance Information Institute says that Personal Property coverage is typically limited to 50% to 70% of your dwelling coverage. For many homeowners, this will be enough coverage. However, if you own very expensive jewelry or other items, you may need to add a rider or buy a separate policy to make sure they’re fully covered.

Additional Expenses/Loss of Use (Coverage D)

This portion of the policy covers expenses you may incur while being displaced from your home.

For example, if your home is unlivable for three months and you’re forced to stay in a hotel while the repairs are made, your hotel bills may be reimbursed by Coverage D. And Additional Expenses/Loss of Use can pay for your restaurant expenses while you’re away from home too.

Do you rent out your home? If so, Coverage D could cover rent payments that you lose out on if your tenant is forced to leave your home while repairs are made.

However, Additional Expenses/Loss of Use coverage are typically limited to a certain period of time. Check with your insurance company to see how long your policy will pay for Coverage D expenses.

Personal Liability (Coverage E)

Personal liability coverage will pay for the damage that you (or your pet!) cause to another person or their property. What’s really interesting about this coverage is that it doesn’t matter if the damage took place in your home or someone else’s.

For example, if your son accidentally throws a baseball through your neighbor’s window, you could file a claim on your home insurance to pay for the repair. Or if your cat ruins your friend’s couch, your personal liability coverage could pay for her to buy a new one.

Personal liability coverage can also pay for medical expenses if someone else slips and breaks their arm while visiting your home or is bit by your dog. It’s important to point out, however, that personal liability coverage will not pay for your own medical expenses. So if you visit the emergency room after slipping in your own home, you can’t make a homeowners insurance claim to pay for the medical bills.

Medical Payments (Coverage F)

Coverage F is similar to the Personal Liability coverage described above. But there are two main differences. First, Coverage F will pay for someone else’s medical expenses regardless of who is at fault. But with Coverage E, you must be proven to be at-fault in order for your insurance to cover your friend or neighbor’s medical bills.

Second, Medical Payments coverage is for very small dollar amounts (typically $1,000 to $5,000), while Personal Liability coverage can pay for up to $500,000 or more of covered expenses. The idea behind Coverage F is that it can quickly pay for small injuries that occur at your home, regardless of who is at fault, helping you avoid costly lawsuits.

Not all policies automatically include Coverage F. So if it’s something that you know you’d like to have, be sure to ask about it during the shopping process.

Choosing The Right Type Of Coverage

As you’re shopping for home insurance, you’ll find that there are three main levels of coverage: cash value, replacement cost, and extended or guaranteed replacement cost. Let’s take a look at what you get with each level of coverage to help you pick the best homeowners insurance for your situation.

Cash Value

This is the most basic level of home insurance coverage. With a cash value policy, your insurance company takes the initial value of your property and belongings and then reduces your payout based on depreciation.

Depreciation is unlikely to significantly reduce the value of the physical structure of your home. But it can definitely put a big dent in the payout for your personal belongings. For example, while your mattress may have initially cost you $1,000, it may be worth less than $50 today. With a cash value policy, that $50 would be the most money you could receive for the mattress.

Actual cash value policies will typically have the most inexpensive premiums. But when you add up all the items in your home that depreciate (electronics, clothing, and furniture, etc.), it’s easy to see how you could be left with a serious funding shortage after a disaster.

Replacement Cost

With replacement cost coverage, your insurer will pay what it actually costs to replace your home and belongings in today’s dollars. This is a much safer level of coverage. Here’s how it works.

Let’s say that you paid $100,000 for your home, but it’s worth $200,000 today. If you have replacement cost coverage, your insurer will pay the full $200,000 to repair your home (or build you a new one) up to your policy limits. And the replacement cost limits on these types of policies typically increase 2% to 5% per year to keep up with inflation.

Extended Or Guaranteed Replacement Cost

While replacement cost coverage offers better protection than a cash value policy, there can still be coverage gaps.

For instance, let’s say that your insurer estimates that it would cost $250,000 to replace your home in today’s dollars. What happens if your insurer underestimated and your home builder says it will actually take $300,000 to rebuild your home?

With a replacement cost policy, you’d need to come up with that extra $50,000 on your own. However, with an Extended Replacement Cost Policy, your insurer will cover replacement costs up to 25% above your limit. And with a Guaranteed Replacement Policy, your insurer promises to cover the full cost of replacement under all circumstances.

Related: Entry Level Middle Class Lifestyle | Intro To Insurance

Homeowners Insurance Add-Ons To Consider

All of the coverage limits and types discussed above only apply to “covered events.” Covered events include fire, theft, burst pipes, and many other events that could damage your home. However, certain “acts of God” are typically left uncovered on standard policies. That’s why you might want to consider paying for the following homeowners insurance add-ons.

Flood Insurance

Home insurance will not typically cover flood damage, no matter the reason for the flooding. That’s why your mortgage lender may require you to buy a separate flood insurance policy if you live in a flood zone. But even if you own your home free and clear and don’t live in a flood zone, purchasing flood insurance could be a smart move.

Earthquake, Hail, And Windstorm

If your home were to be damaged due to a natural disaster like an earthquake or hurricane, most homeowners insurance policies won’t cover the damages. But, thankfully, many insurers will allow you to add coverage for these types of events.

Keep in mind that these add-ons may come with special deductibles that are set as a percentage of your home’s value. For example, if your home is worth $250,000 and your hurricane deductible is 2%, you’d need to pay $5,000 before your hurricane coverage kicks in (even if your standard deductible is set at a lower amount like $500 or $1,000).

Sewer Backup

There are few events more dreadful to a homeowner than finding that their sewer has backed up and caused water damage. But, to make matters even worse, most home insurance policies won’t cover these damages. However, your insurer may offer a separate sewer backup/water backup endorsement.

Additional Valuables

Most insurance policies put a dollar limit on claims for certain valuables. For instance, many insurers set a $1,500 limit on electronics and $2,500 on jewelry. But you can typically add coverage for expensive items without having a major effect on your annual premium. For example, Consumer Reports’ guide on purchasing homeowners insurance says that most homeowners can increase their per-item jewelry coverage from $2,500 to $5,000 with State Farm for about $17 per year.

Ways To Reduce Your Homeowners Insurance Cost

After reading the sections above, you may have discovered a lot of coverage gaps in your own home insurance policy. And once those gaps have been filled, you may find that your annual premiums are much higher than before. But there are ways to save on homeowners insurance. Here are a few ideas.

Raise Your Deductible

With all other factors being equal, annual premiums generally go down when deductibles go up. So raising your deductible from $500 to $1,000, $2,000, or $5,000 could save you a lot of money each year in premiums.

However, you should never set your deductible so high that you couldn’t pay it without causing undue financial hardship or having to take out a loan. Also, if you have a mortgage, your lender may set a limit on your maximum deductible

Increase Your Home Security

Improving your home’s security features provides better protection for you and your family. But did you know that it can also save you money on your home insurance?

According to a report by the Insurance Information Institute on ways to lower your homeowners insurance costs, homeowners can usually save at least 5% on their premiums by simply adding smoke detectors inside their home. Adding other protections like indoor sprinkler systems and fire and burglar alarms could save you even more–up to 20% in some cases.

Related: DIY Home Security For The Frugal Homeowner

Bundle Home and Auto

Having one insurance company handle multiple types of insurance for you can save you time and hassle. And, thankfully, it could also save you money. According to an article Policygenius about on bundling home and auto insurance, you could save up to 15% to 20% per year in premiums.

But be sure to compare insurers that offer bundled policies with those who don’t. In some cases, keeping separate policies for your car and home insurance could still be your most affordable option.

Update Your Home to Increase Disaster Protection

There are many ways to better protect your home against major natural disasters like hurricanes. For example, adding wind-resistant windows, replacing your roof, or buying hurricane shutters are all smart improvements. Whenever you make these types of updates, be sure to notify your insurer to see if you qualify for a premium discount.

Avoid Claims for Low-Dollar Repairs

Let’s say you have a $500 deductible on your homeowners insurance policy. Your child breaks one of your windows and the cost to install the new window is $800. In this case, it would probably best to just pay for the repair out of pocket. Your insurance would only cover $300 after your deductible anyway. Plus, they may raise your deductible after you’ve made the claim.

There’s a long-running joke that when it comes to home insurance “if you use it, you lose it.” While that’s not necessarily always the case, Rutgers Law School published findings about how insurance companies can decide to “non-renew” you if you’ve made too many claims. And being dropped by one insurer can make it harder to get accepted with other companies at an affordable price.

For all these reasons, it’s best to avoid home insurance claims for small expenses. This will keep your deductible low while keeping you protected against truly catastrophic events.

Dig even deeper: 8 Ways to Save Money on Homeowners Insurance by our friends at Money Crashers.

How To Buy Homeowners Insurance

Now that you know what you’re looking for, it’s time to start comparing home insurers. Here are a few tips that can help you find the best homeowners insurance policy for the most affordable price.

Get Multiple Quotes

Don’t just call one or two insurers. Get quotes from at least three different insurers and preferably even more. Ask for the first company to email you a PDF of their estimate with the details of the coverage and limits.

Then email that quote to the other insurance companies that you contact. Tell them that you’d like their quotes to match the terms and coverage limits of the first company. That way you can make sure that you’re comparing apples to apples with each company’s quote.

Check Each Insurer’s Financial Rating

Good coverage and low prices are a great start when comparing insurance companies. But a homeowners insurance policy is only as good as the company that’s backing it. If one of the insurance companies that you’re considering is dealing with financial problems, they may not be able to pay for your claim a few years from now.

That’s why it’s important to check the A.M. Best rating of each company that you’re considering. The best homeowners insurance companies have an A.M. Best rating of A++. But any company with a rating of “A-” or above is considered “Excellent.” Other popular insurer financial strength ratings systems include Fitch, Kroll Bond Rating Agency (KBRA), Moody’s and Standard & Poor’s.

Look At Customer Satisfaction Ratings And Reviews

Many customers get excited when they’re quoted an unusually low rate with a home insurer. But the excitement can quickly turn to dread when they actually try to make a claim. That’s why one of the best things that you can do during the shopping process is to check to see what others are saying about the claims process.

One resource that can help you identify the best homeowners insurance companies is J.D. Power’s Annual Property Claims Satisfaction Survey. It can also be a good idea to read customer reviews on sites like Trustpilot or editorial reviews from sites like Policygenius.

Use A Broker Or Online Comparison Tool

Calling three insurance companies to get quotes may be doable. But trying to call five, ten, or even more companies may simply take too much of your time. That’s where a broker or an online comparison tool can help.

If you’d like to choose a local broker, ask your friends and family if there’s anyone they recommend or read local broker reviews on sites like Google or Yelp.

If you’d prefer to do all your shopping online, you can use a tool like Policygenius. They can instantly shop your policy with their 25+ insurance partners. They’ll even take care of the paperwork to make switching insurers simple and seamless.

How to Shop for Homeowners Insurance With Policygenius

Recently, Ed from the ChooseFI team used Policygenius to shop for home insurance. In June 2019, he was informed by his homeowners insurance company that it was exiting the home insurance business and that he would have to find another carrier.

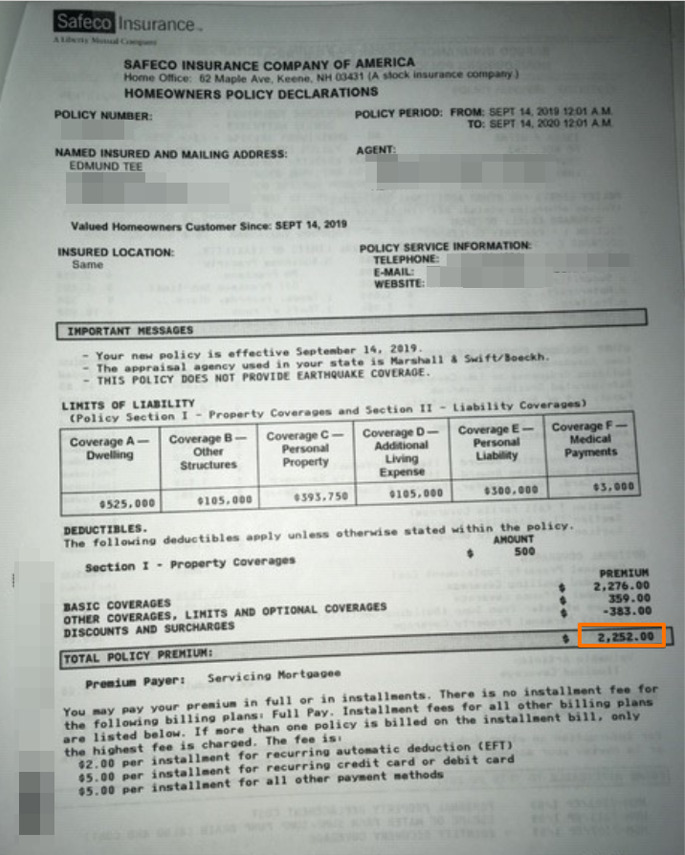

Ed’s agent recommended a comparable policy with Safeco for a similar premium of $2,252 per year.

He thought that seemed a little high. So he demurred and decided to shop around for the best homeowners insurance policy he could find.

During that time, ChooseFI had just published an episode with Jennifer Fitzgerald, the CEO of Policygenius, where she explained how insurance needs can change as we journey through life, from health insurance to umbrella insurance to disability insurance.

Listen to the episode with Jennifer Fitzgerald here.

She also touched on homeowners insurance, which prompted Ed to get off the couch and start shopping. He went to the Policygenius site, selected the homeowners’ insurance path, and plugged in his details and desired coverage requirements. Then Policygenius automatically went to work, shopping around for a policy that met his needs for less money.

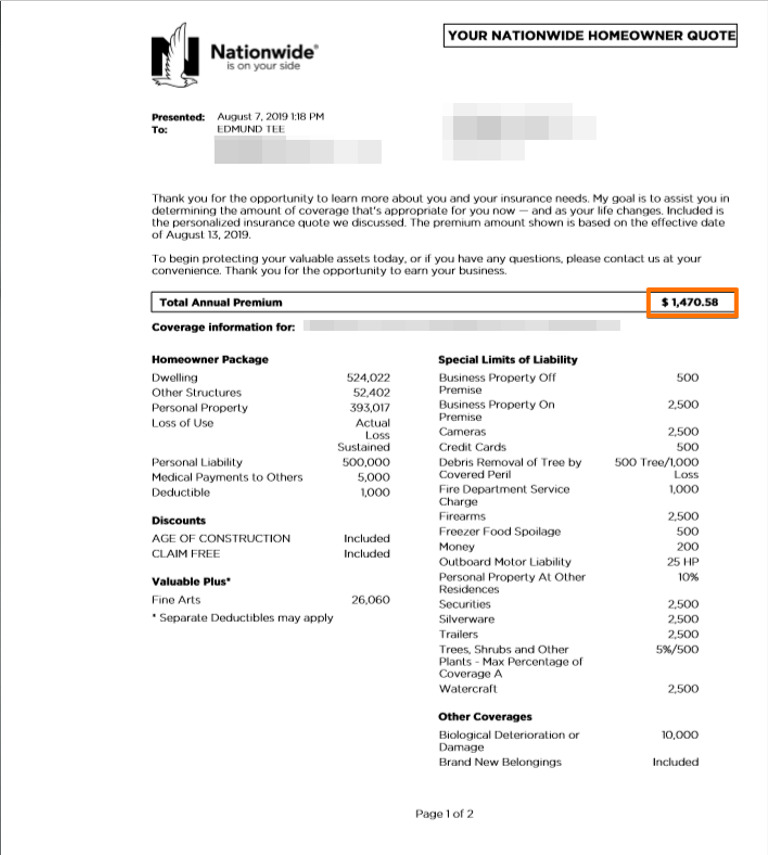

Within 48 hours, Ed said that he was presented with a comparable policy from Nationwide that was only $1,470.58. That was a savings of over $781.42 of the $2,252 from Safeco, or a 34.7% discount!

In addition to taking care of all the paperwork, Policygenius also promised to automatically shop rates again before his one-year anniversary date. Ed said, “I was sold.” He went with the Nationwide deal and was able to save a ton of money without lifting a finger.

Get your customized homeowner’s insurance quote from Policygenius here.

The Bottom Line

Your homeowners insurance is too important of an expense to go with a second-rate insurance company or to settle for coverage options that don’t fully meet your needs. But, on the other hand, your home insurance is too large of an expense for you to pay more than you should.

That’s why shopping around for the best homeowners insurance policy is so important. And, thankfully, with the advent of online comparison tools like Policygenius, its never been easier. With just a few clicks, you can be on your way to finding insurance companies that offer great coverage at affordable prices.

Related Articles