Do you know what your car is actually costing you each year? What about over an investing lifetime? In this episode of the ChooseFI Podcast we cover the True Cost of Car Ownership and you’ll be absolutely amazed at the numbers.

Podcast Episode Summary

- ChooseFI: The Ultimate Guide to the True Cost of Car Ownership

- Your car payment is a terrible way to spend your hard earned money

- We’ll present two different perspectives: Brad will show the long-term compounded cost of buying/leasing new cars continually versus holding a car for 15 years while Jonathan is going to present the yearly cost of your car

- Brad wanted to see what it was costing someone to constantly “manage their car payments” at a set number forever by buying/leasing new cars

- This example is too conservative so a FI person would actually save even more money!

- In Brad’s example the FI person is buying a new car every 15 years. They have payments for the first 5 years and $0 car payments the final 10 years. Person B is constantly paying $300 per month. This is a 45 year study, so Person A bought 3 new cars in the 45 year period

- At the end of the 45 year period, Person A’s savings compounded to be worth $742,000 versus Person B who was constantly paying $300 per month.

- Takeaways: Don’t buy new cars and continue to drive your car as long as possible with no car payment!

- Most people can’t truly afford an expensive car and house even on a large salary. This is a true key to FI

- Astounding that $300 per month for 30 out of 45 years are ending up with $742,000 while most people don’t have anywhere near that much money after a lifetime of working and “saving.” That also shows how little money most people are saving

- Jonathan’s bad track record with buying cars in his life

The True Cost of Car Ownership Calculator

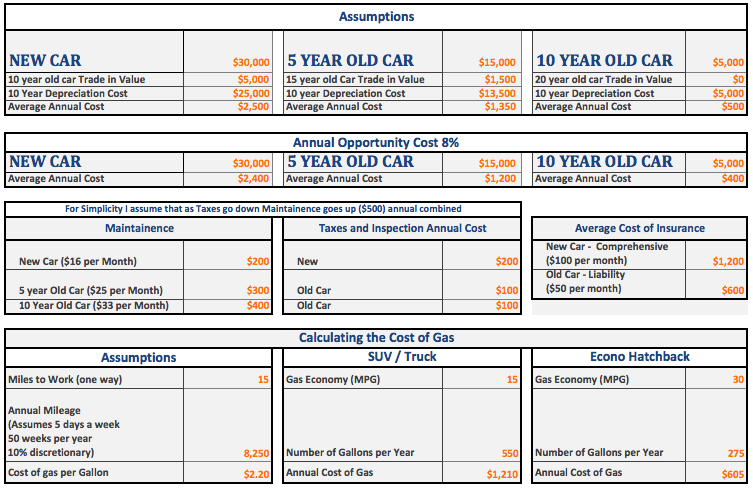

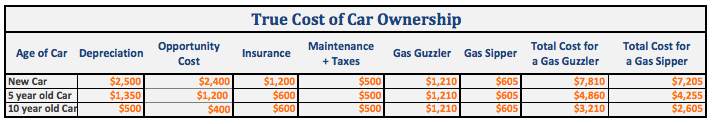

- Jonathan’s example for yearly car cost compared a new car for $30,000, a 5 year old car for $15,000, and a 10 year old car for $5,000

- Went through yearly depreciation calculation for Jonathan’s three examples

- Went through a calculation of annual opportunity cost of the year-by-year amount lost at 8% annual return if you would have invested based on these 3 examples

- Calculation of maintenance, insurance, taxes, inspections, etc.

- Also calculate the cost of gas each year depending on the type of car

- The 20 year difference from having a used car versus a new car is almost $250,000

- Jonathan’s determination is you should buy a ‘gas sipper’ that’s at least 5 or 10 years old

Listen to Brad and Jonathan’s thoughts about this episode here.

Discover the framework for success from dozens of people who have found their own path to financial independence. Learn how to spend less, earn more, and live a fulfilling life of abundance. Download your free sample chapter today!

Choose FI: Your Blueprint to Financial Independence

Links from the show:

How Much Does Your Car Payment Really Cost You at Richmond Savers