The right side of your brain just won’t quit! You’ve done your calculations. You’ve poured over projections. You’ve mastered your Excel spreadsheets with the magical stealth of Gandalf the Grey, but you’re still not absolutely sure you’ve done the math right.

How do you know the numbers add up for early retirement?

Helpful Early Retirement Calculators

Fortunately, if your spreadsheet is leaving you a bit nervous, there are plenty of “retire early calculators” out there to help you be sure you’re ready for what’s next. Here’s just a sampling of the retire early calculators we’ve found online from fellow FIRE bloggers and financial institutions to help you crunch the numbers. Enjoy!

Mustachecalc.com

Mustachecalc.com is a little gem of a website created by a fan of Mr. Money Mustache. On this page, you can find a variety of early retirement calculator tools along with other easy methods to see the fruits of your frugal labor.

You can easily pop in your numbers to the retire early calculator on the site via the “Time To Financial Independence” Calculator.

Yearly expenditures

If you aren’t sure, figure out what you need to live on per month. Take a look at your current credit card or checking account statement to get a true idea of what you are spending. Don’t forget expenses that don’t come monthly, such as vacations or holidays. Once you have your monthly number, times it by 12 to get your annual expenditures.

Withdrawal rate

The rule of thumb is a 4% withdrawal rate. Use this if you are unsure. If you already know you don’t feel comfortable with 4% you can change it to what you are expecting to use.

Current net worth

You can use your true net worth here, but I recommend only using your liquid assets that you actually expect to live on during retirement. For example, don’t use the equity in your home if you aren’t planning on selling it in retirement.

Yearly savings

How much are you saving per month? Multiply that by 12 for your annual amount. Put in what you are actually saving, not what you hope to save. But also play around with this number to see how saving different amounts will impact your “time to FI”.

Interest

How much do you expect your savings to earn annually between now and when you reach FI? On average, the stock market earns over 11% per year. But you may be invested more conservatively or are less optimistic.

Inflation

Prices rise over time. How much do you think inflation will eat into your savings, or increase your costs of living? 3% is a standard amount that is often used in these calculations but you can change it if you don’t feel that’s appropriate.

All these numbers together will tell you how much longer until you reach FI. It’s fun to fiddle with them and see how changes impact your journey.

You can also get quick stats with other helpful tools including the Compound Interest Calculator to figure out how much that loan really costs you.

Perhaps the most interesting tool on the site is the Savings From Not Spending Calculator. Dubbed the “Latte Factor” by other personal finance bloggers, this tool helps you calculate the true cost of what something–like a latte, or a monthly subscription you aren’t using can cost in the long run.

Resource: The Beginner’s Guide To Financial Independence

The FI Laboratory

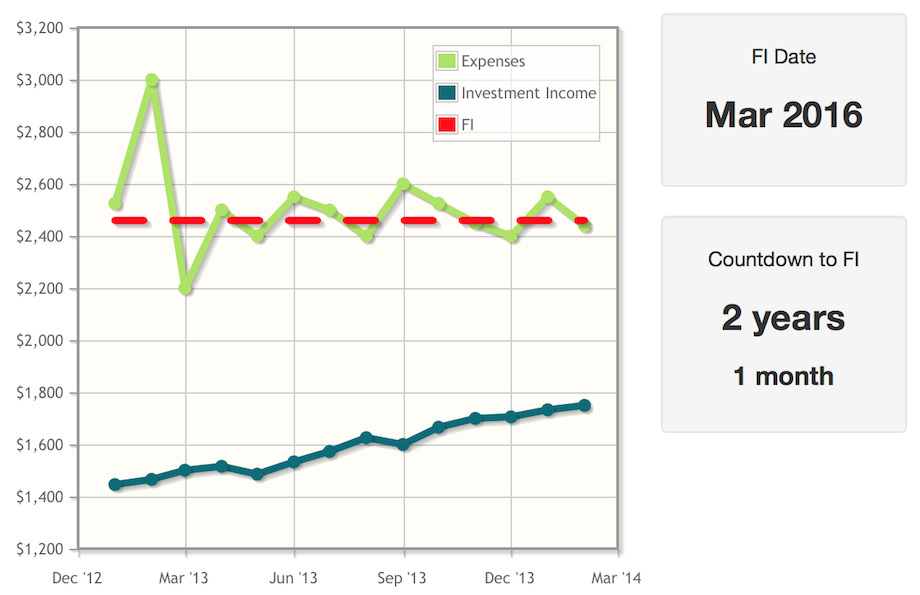

Curated and created by FIRE famous blogger, the Mad FIentist, this site is probably one of the best resources for aspiring FIRE walkers. For those of us who prefer visualizations over columns in spreadsheets, the FI Tracker in Brandon’s FI Laboratory is exceptionally helpful.

Once you sign up, you can plot out your monthly expenses and see how much income your assets produce. Then, you can plug in your estimated withdrawal rate. And Wham! You’ll be shown your data in a colorful line graph, moving horizontally toward your financial independence date.

Other tools include the Time To FI calculator and the Savings Rate estimator. You can see at a glance where you’re at and where you can make some basic tweaks to calculate along.

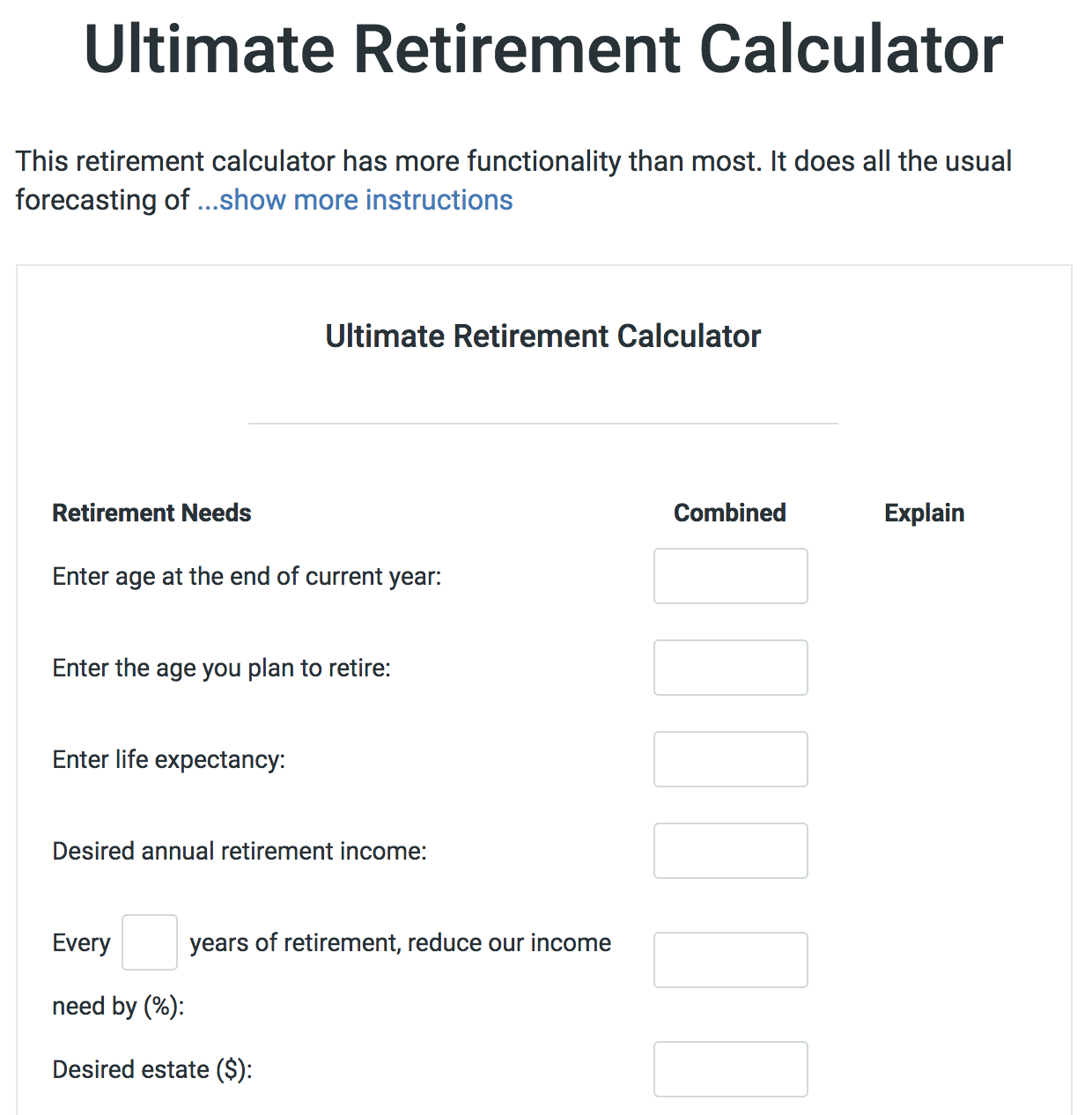

The Financial Mentor

Out of all of the retire early calculators, the one provided by the Financial Mentor is the most robust. While you can still plug in your expenses, withdrawal rates, and all that–this calculator also allows you to account for tax events and cost of living changes as well.

So, if you know you’re going to be relocating after retirement and your housing will go down, or if you’re hoping to have your mortgage paid off ahead of schedule–these extra little line items help you plan.

Additionally, it allows you to calculate the impact of any assets you’re planning on selling off. The Financial Mentor’s retirement calculator allows you to see what the sale of a boat, cabin, or car could look like in the future.

It also lets you account for any income you will have in retirement including how long you expect to have that income for. For example, let’s say you plan to earn $1,000 a month from a side hustle but only plan to do that until a certain age. This calculator will allow you to enter that information.

The level of tinkering you can do with these projections is pretty exciting!

Millennial Money Early Retirement Calculator

In looking for free online retire early calculators, Millennial Money provides a good middle ground calculator for anyone who feels overwhelmed or has a much longer retirement horizon with many unknowns.

For some young guns with a lot of variables before retirement, it can be impossible to guess what the future holds. For those who are single, unsure about kids, what income will look like, and other factors can make it hard to forecast. The Retirement Freedom Calculator is flexible and fun to play with.

I would recommend this retire early calculator for beginners since it’s a “just enough to be dangerous” type of tool. If you don’t understand some of the terms, each term is explained. If you’re new to thinking about things like inflation rates and your tax rate, this simple formula breaks it down.

This is a great tool if you or someone you know needs a “nuts and bolts” retire early calculator. It educates and explains terms in common sense language geared for a FI lifestyle newbie. If it sounds like a fit, check out Millennial Money’s early retirement calculator.

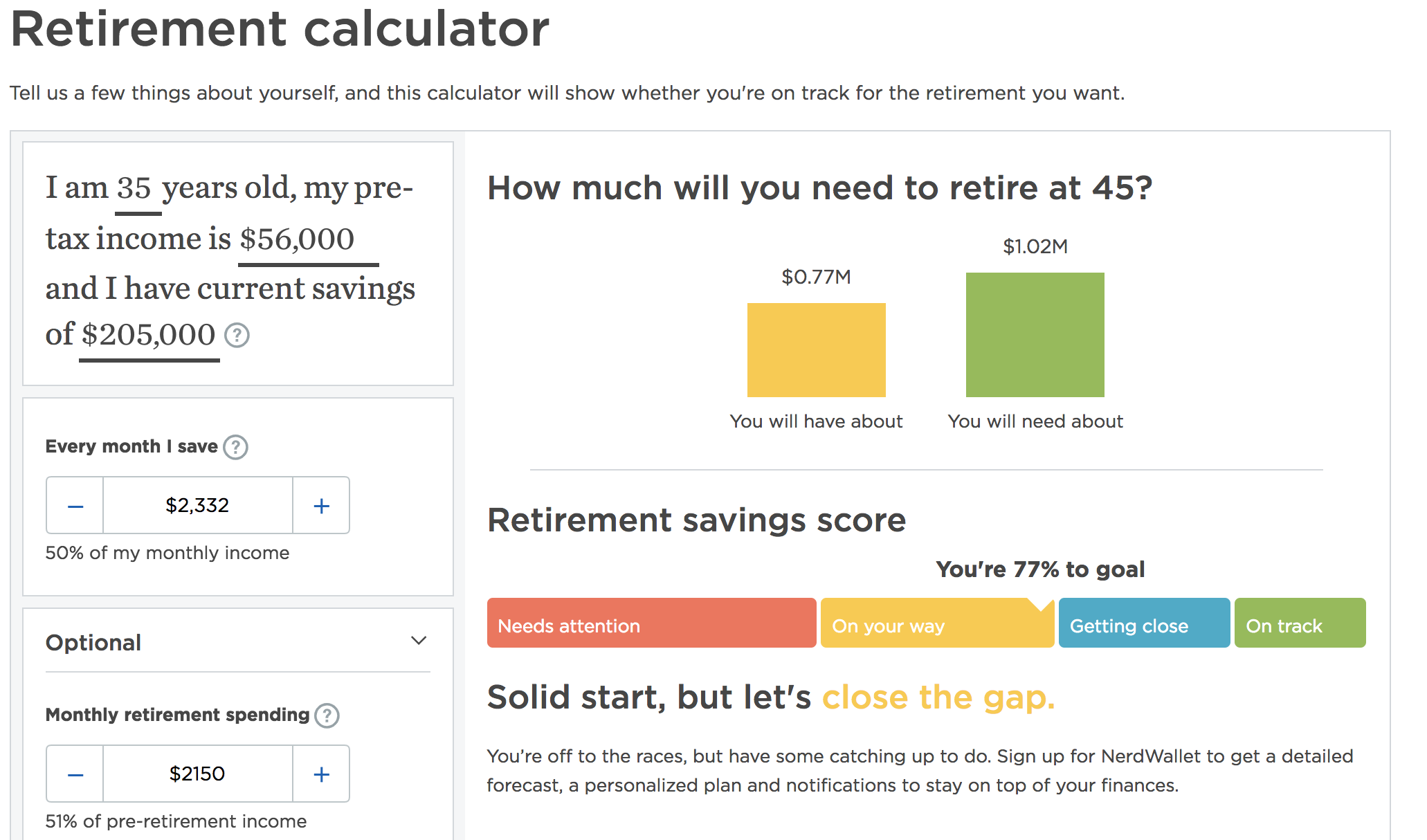

NerdWallet

Who doesn’t love colorful bar graphs? Out of all the retire early calculators, the NerdWallet Retirement Calculator seems to be the most well designed for the visually inclined. You’ll find a slick interface and easy to interpret data tables. If you hate looking at Excel spreadsheets and complicated bar charts, this might be the estimator tool for you.

This calculator is more of a traditional retirement calculator but it can be tweaked to offer some FI calculations.

It starts by asking about your income, which is more “traditional” than “FI”. But it does allow you to choose your income needs in dollar amounts so it still works for FI.

You can fiddle with different savings amounts and retirement ages to create a plan that works for you.

The tool is fun to click through, and the user interface is super easy and even fun to play with. The default retirement age is 67 so be sure to make your adjustments accordingly. After that, you’ll be provided with a handy color-coded range to see if you’re on track or not. You’ll also see how you can make adjustments along the way.

While there are plenty of retire early calculators out there, there is no better tool than the one you enjoy using regularly! So, no matter how you crunch your numbers–there are options for you beyond your basic spreadsheet. Just make sure to take a peek regularly to recalculate along the way (every 1-3 years is fine) and make regular adjustments.

Happy calculating!

Related: