As we’ve always said, Financial Independence is for everyone. However, geoarbitrage is a powerful FI tool. The vast costs of living, price inequality, asymmetrical taxes, and the ilk; where you live makes a significant difference on your journey to FI. So, just like we did last year – we put together a Top 10 Best Cities for Financial Independence list, updated with some new parameters and changes in the national financial landscape (notably the COVID-19 pandemic):

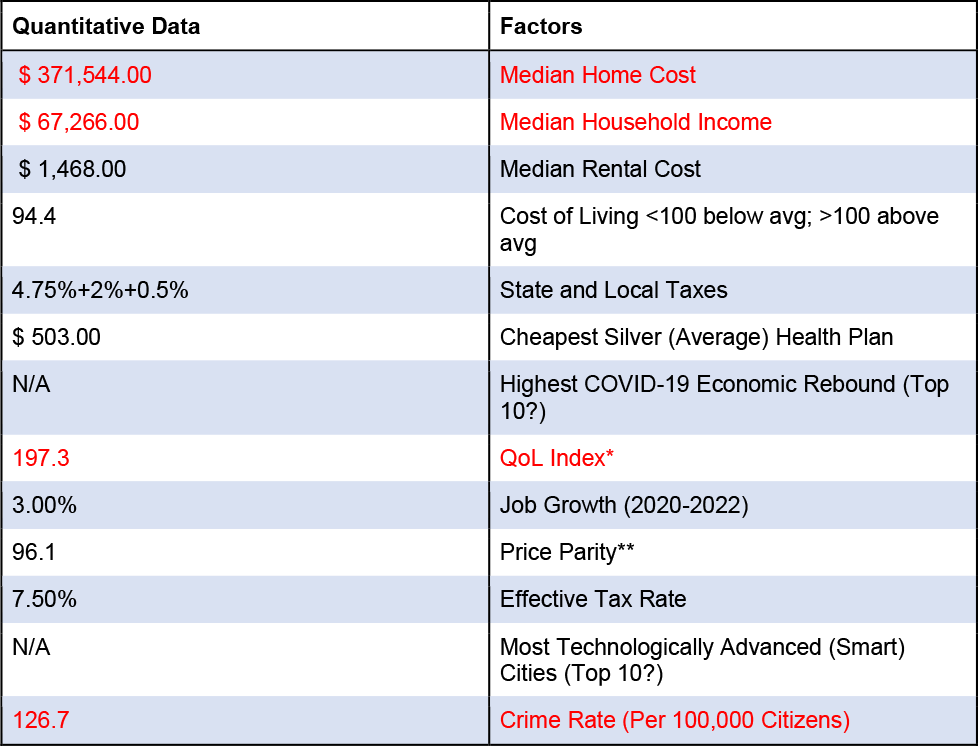

- Cost of Living

- State and Local Taxes

- Cheapest Silver (Average) Health Plan

- Highest COVID-19 Economic Rebound (if they ranked in the Top 10)

- QoL Index*

- Job Growth (2020-2022)

- Price Parity**

- Effective Tax Rate

- Most Technologically Advanced (Smart) Cities (if they ranked in the Top 10)

- Crime Rate (Per 100,000 Citizens)

*QoL (Quality of Living) Index is a mathematical result consisting of a formula of the following variables: Purchasing Power, Rent, House to Price Income Ratio, Cost of Living, Safety, Traffic Time, Pollution, Climate

**Price Parity is the actual dollars spent that could buy $100 worth of goods (on average) nationwide (i.e., a city with a Price Parity of 85 could pay $85.00 – in that area – and receive $100 average worth of a nationwide basket of goods).

There are qualitative and intangible attributes to cities that we considered when creating this list. But, we did lean heavier on the mathematics than the “feel” as we made the last list. But, we included the cool stuff to do too when not planning for your financial future.

Drum-roll, please!!!

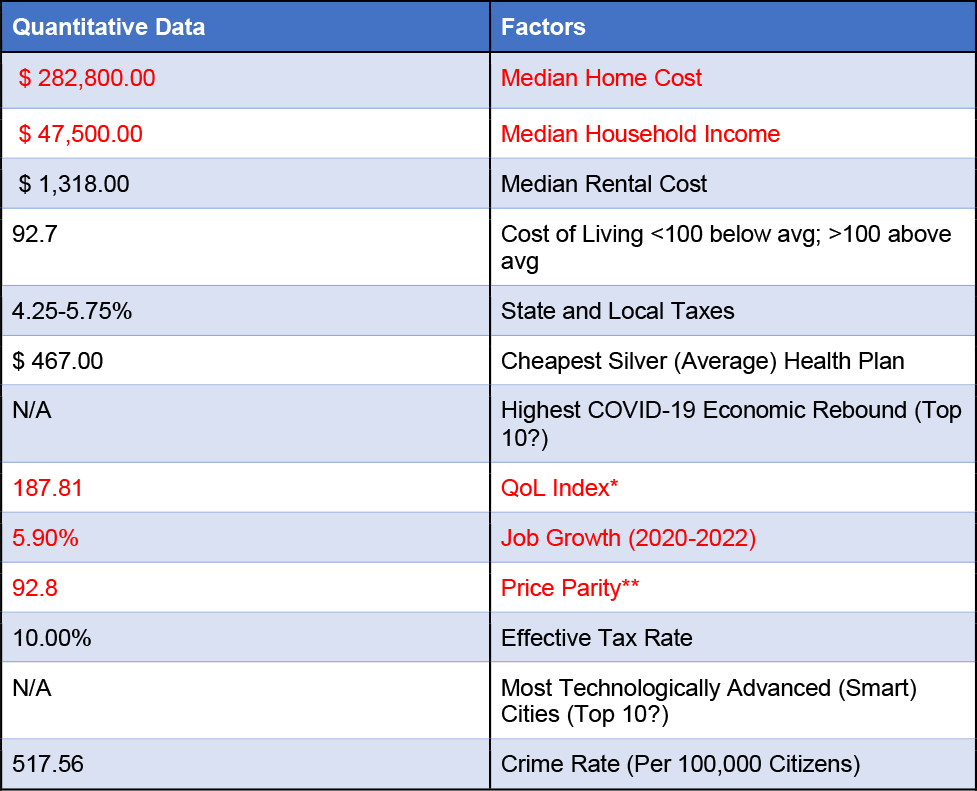

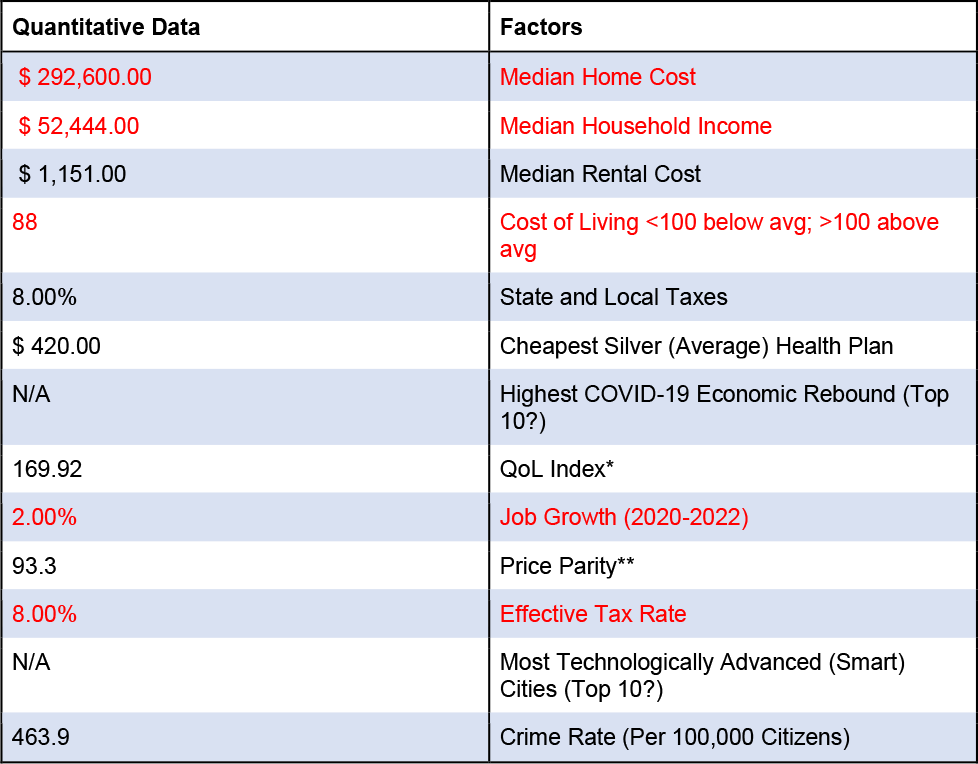

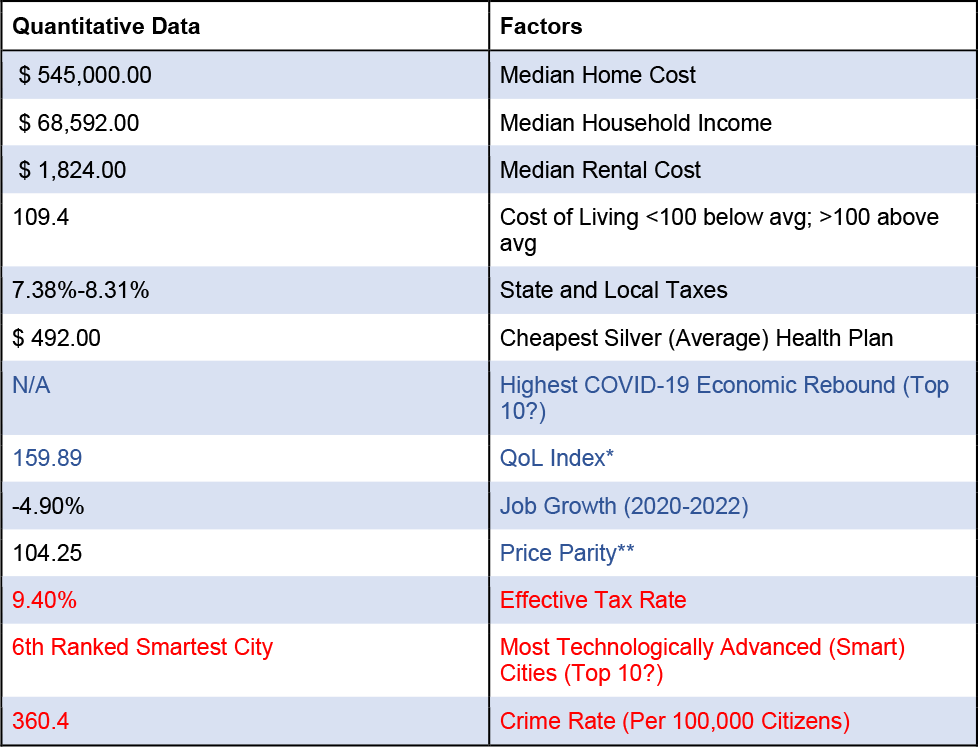

1. Richmond, VA

Why Richmond Rocks

●The “unofficial” headquarters of ChooseFI – the founders (Brad Barrett and Jonathan Mendonsa) live in and record the ChooseFI Podcast from the River City.

●An incredibly high QoL Index.

●Very low tax rate.

●Flexibility in living situation choices: Richmond has a healthy surplus of both housing and rental assets.

●A rich, full historical city mixed with modern-day coolness and hangouts.

●Proximity to “big town” action, such as Virginia Beach and even Washington, D.C.

●Fun fact! Rat basketball was created at the Science Museum of Virginia in Richmond!

Taking In The Atmosphere

Richmond is well known for its rich history and the new sights and eateries around town.

So, if you’re a history buff, there is the famous Jefferson Hotel to take in a bit of the old sights and new food. Monument Avenue is a nice stop if you are a Civil War enthusiast, and the Virginia Museum of Fine Arts is one of the best museum stops on the East Coast. Another must-go-to is the Virginia Capital Building – one of the nation’s most impressive and longest-standing capital buildings.

Lemaire Restaurant (featured in the Jefferson Hotel), Comfort, Dixie Donuts, and the South of the James Saturday Farmer’s Market are well-known Southern famous hotspots to grab a great bite.

For the whole experience of history and dining, the “Real Richmond Tour” does not disappoint. Stretching out 1.5 miles, the tour visits the oldest neighborhoods in the city – delivering on some of the finest historical and architectural richness of the town. All while noshing on some of the best local cuisines.

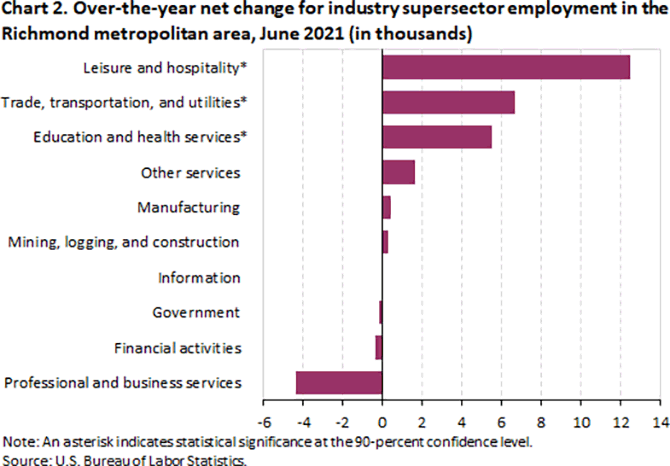

Job Market Growth And Potential

Outside of the parameters of this article, we looked at the BLS (Bureau of Labor Statistics) to see the health of the Richmond job market since COVID.

Although there has been a drop in professional and business services, an unfortunate byproduct of the pandemic, Richmond has seen a healthy job market growth.

Leisure and Hospitality have enjoyed a 27.8% increase, about 8% more than the national average. Trade/Transportation and Education/Health services enjoy a 2% marginal growth over Richmond’s national counterparts.

Richmond’s job market future looks bright. There is plenty of growth ahead with the robust changes to the current infrastructure combined with the rebounding financial and professional districts.

The Bottom Line

Richmond has led the Top 10 Cities for Financial Independence for two straight years mainly due to its housing, salary, and job market resilience – especially in the face of the COVID pandemic. In addition, it has a sizeable local FI group that is very active in the community. If you’re looking for the capital of FI, Richmond is your destination.

Dive Deeper: Things to Do in Richmond, VA

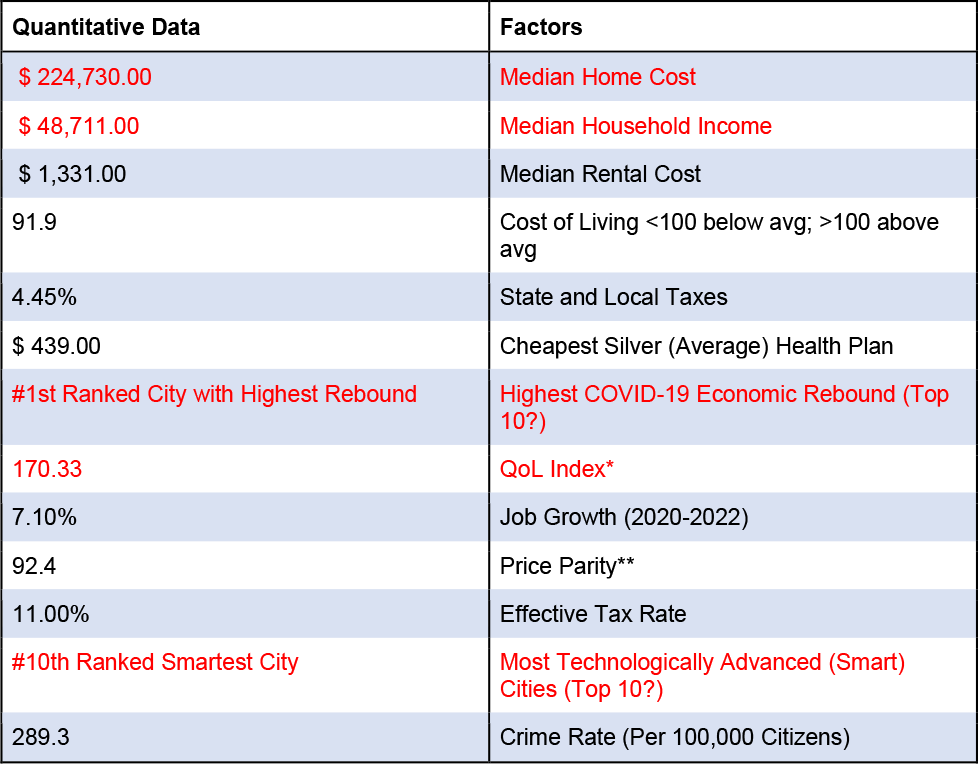

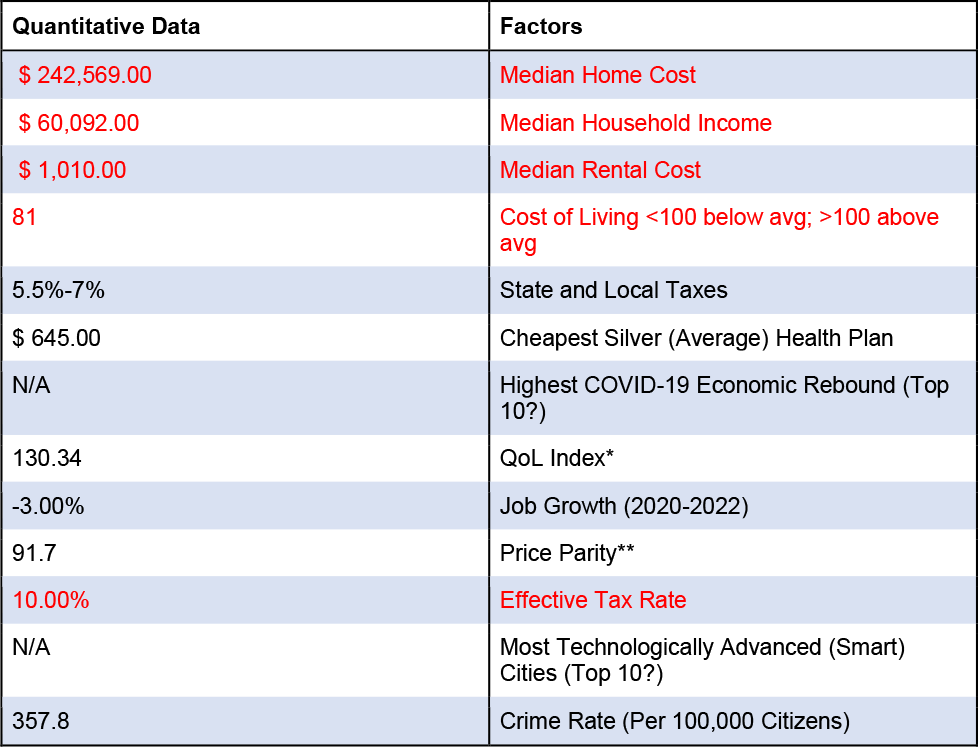

2. Pittsburgh, PA

Why Pittsburgh Pops

●It has enjoyed the highest economic rebound (vs. any city nationwide) since the COVID pandemic began.

●Metro 21: Smart Cities Institute at Carnegie Mellon creates technological revolutions as we look towards 2050. Due to the anticipated population growth, the Institute is working towards solutions to possible food shortages to climate change. This makes Pittsburgh the 10th “Smartest” City in the nation.

●Pittsburgh is a “small, large city” with 90 neighborhoods within the city limits. Many ‘Burgh citizens say the diversity and the friendliness of their neighbors draw them closest to the city.

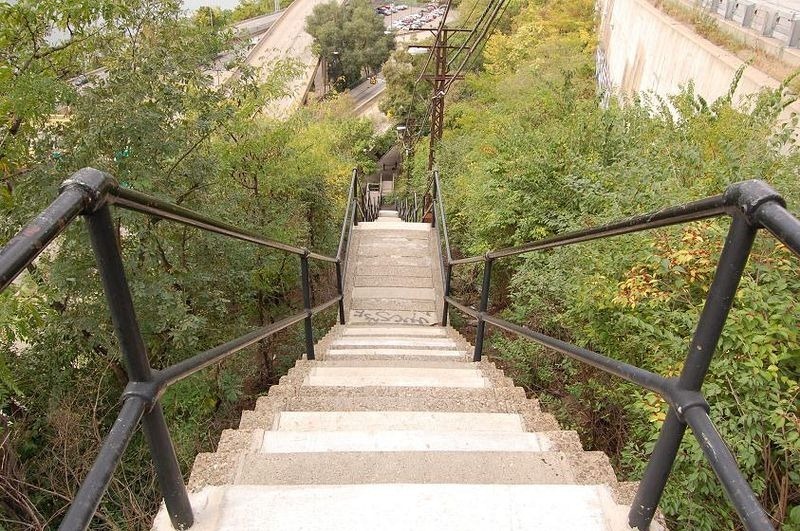

●Fun fact! There are more than 700 sets of public stairs within the city limits of Pittsburgh, which is more than any other city in the world. They are maintained by the “Inspector of Steps”. He wasn’t available for comment.

The “Comeback City”

Pittsburgh was pulling itself out of the steel crash of the 1980s until about a decade ago. With most of their manufacturing jobs going to other countries, the city had to evolve with the times. Enter in the technological revolution started by the local universities. By pouring resources into the tech fields, Pittsburgh accomplished two significant feats: be minimally affected by the Housing Crash of 2008 and evolve into a tech marvel in the Rust Belt. This attracted many suitors for the newly born tech cradle, including Google, which opened a satellite headquarters there in 2011.

Phipps Conservatory

The Phipps Conservatory, located in downtown Pittsburgh, is the “world’s largest green building.” It is a part-research and education center, museum, and part-visitor center. It’s also one of the world’s largest zero-energy buildings, which means that it generates its own self-sustaining energy—another feather in the “Comeback City’s” cap.

Millennials Love It

Millennials are wild about Pittsburgh for several reasons. The growing job market in tech fields, availability of affordable housing – in both modern and historic districts, the abundance of public transportation, and the diversified demographics. Pittsburgh has quickly become a Millennial magnet for starting a new life or career.

The Bottom Line

Pittsburgh is one of the Rust Belt’s biggest success stories and a great city for Financial Independence. Evolving from the Industrial Revolution as a steel powerhouse to a 21st Century technology leader, it proves to be a diverse, fertile ground for FI. Opportunities abound in both housing affordability and job market growth. With low taxes and cost-of-living, you can’t go wrong with the ‘Burgh.

Dive Deeper: Things to Do in Pittsburgh, PA

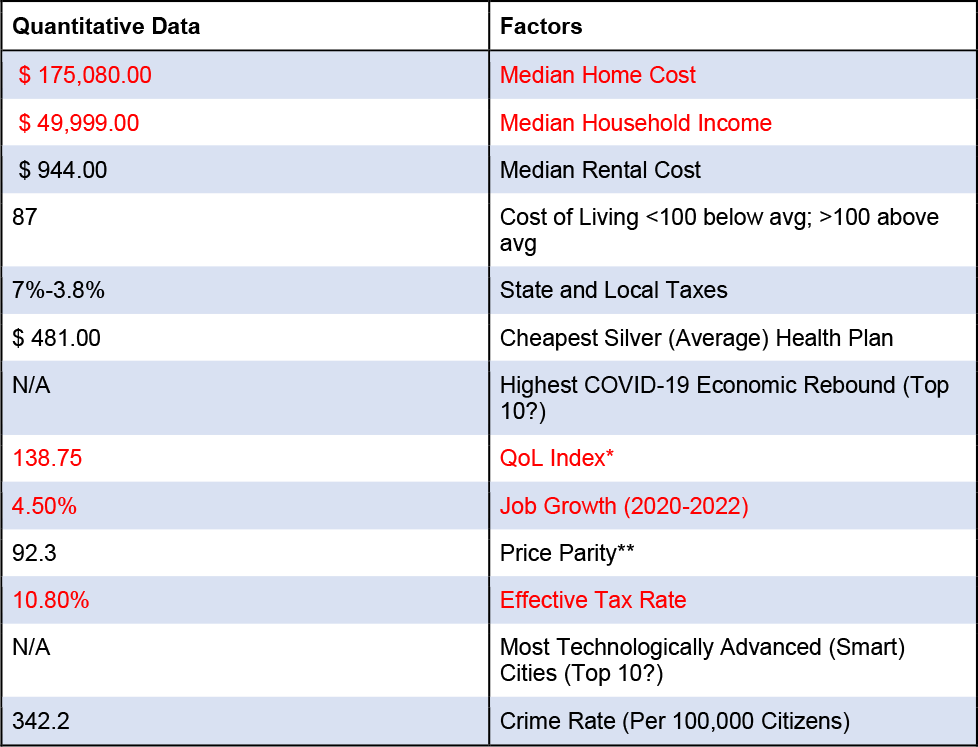

3. San Antonio, TX

Why San Antonio Shines

●An incredibly low cost of living for the nation’s 7th largest city.

●Solid job growth since the pandemic started.

●With 20 million tourists per year, San Antonio enjoys an economic impact of $13.6 billion a year.

●No state income tax and an effective tax rate of 8%.

●Out of the 35 largest cities in the United States, San Antonio ranks 7th in safety (463.9 crimes per 100,000 citizens).

●Fun fact! Amazon named San Antonio the “Most Romantic City” in the United States, which they attribute based on the number of purchases of romance books and movies.

Alamo City

With similarities to Pittsburgh, San Antonio is known for evolving with the times. Again, another Industrial Revolution marvel (mostly in transportation and military growth), Alamo City had to reinvent itself about 20 years ago. Turning now-defunct military airfields and ports into privatized organizations, the city began to see economies of scale branch out from these newly established supply chains.

Toyota opened an assembly plant in 2003, followed by Valero Energy’s new corporate headquarters in 2004. The world’s first all-digital library, BibloTech, is located in the tech sector. By the mid-2000s, 41,000 businesses called San Antonio home. Most of these organizations are telecommunications, technology, energy, and corporate home offices.

Tourism

Another similarity San Antonio shares with Pittsburgh is its tourism. Military museums, massive shopping malls, art, and history displays, and plenty of other cool stuff to do are located within city limits. Some noteworthy mentions are the San Antonio Botanical Gardens, the Tobin Center for the Performing Arts, the San Antonio Missions National Historical Park (where the Alamo calls home), and Morgan’s Wonderland – the first theme park for special needs individuals.

Family-Friendly Metropolitan Living

It may sound a bit oxymoronic, but San Antonio truly is considered a family-friendly metropolis. First of all, because of the housing market, which is incredibly affordable for larger homes. In some areas of the city, a lovely house in a good neighborhood can run less than $200,000. Considering that your purchasing power in San Antonio is strong (with a Price Parity of 93.3), families seeking FI can make an intelligent choice buying here. Especially with such a low tax rate.

Family-Friendly Fun

For family fun, there is a ton of stuff to do. The San Antonio Zoo (where we can nearly guarantee it’s the only place in Texas to see a polar bear) is open year-round. LEGOLAND Discovery Center San Antonio is a fantastic place to take the kids for a day. And if you get tired of that, Sea World and Six Flags Fiesta Texas aren’t too far away.

Are you looking for a more well-rounded family adventure? The Texas Folklife Festival is a great place to start. This yearly, three-day event introduces its visitors to 40 different heritage groups and honors Texas heritage. Diwali, the Hindu festival of lights, is a San Antonio favorite. The abandoned Discovery Village Mining Company is a must-visit. It contains one of the most famous cave tours in the world, along with many outdoor mazes to get lost in.

The Bottom Line

A solid FI choice for families, San Antonio, has tons to offer – from the deep heritage to high-tech professional jobs. Although some may be looking for a larger “big” city, San Antonio’s charm is the small town in a big city. You get a lot of bang for your buck in a great town with plenty to keep you busy – both professionally and personally. A great city for Financial Independence.

Dive Deeper: Things to Do in San Antonio, TX

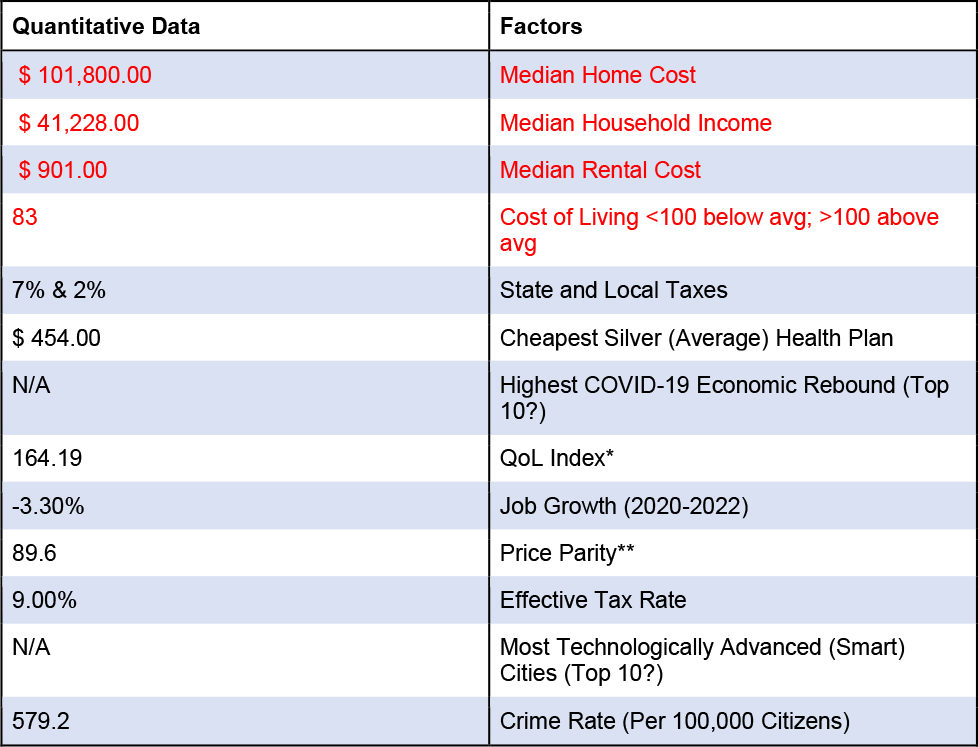

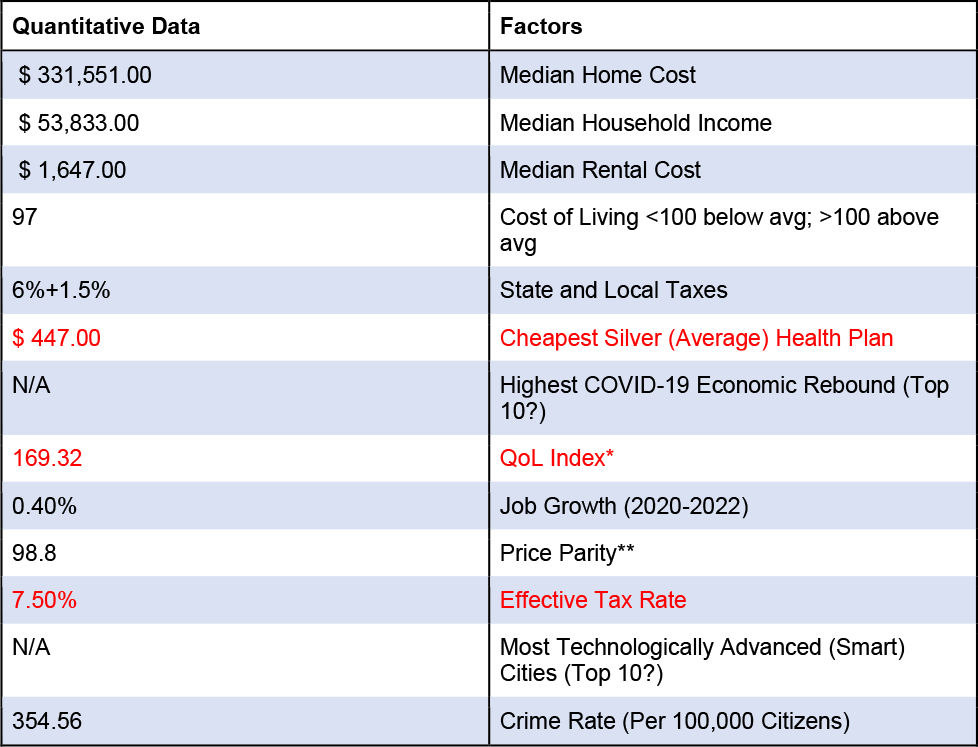

4. Memphis, TN

Why Memphis Marvels

●Chattanooga made the list last year; therefore, Memphis was a sleeper-hit for all of us.

●Its nationally atypical housing market downturn coupled with a significant salary upturn is a game-changer.

●Incredibly low taxes. It had a strange last year where it charged a 1% tax on all income. That law has since been repealed, so there is no income tax in Memphis.

●Along with a buyer’s home market, rental properties are dropping; thus giving anyone moving there flexibility in where they can live.

●One professional sports team: Memphis Grizzlies (basketball)

●Memphis is the only known city to have a “Financial Independence Day,” which is July 4th. The project is to help everyone achieve financial independence.

●Fun fact! The Piggly Wiggly, a grocery chain that started in the early 1900s, was the first store that allowed shoppers to shop for themselves (1916). Before then, you had to give a grocery list to an employee to shop for you.

A Leader In Industry and Transportation

Memphis is unique on this “cities of financial independence list” because they still rely upon the manufacturing industry for much of its economic output. Since WWII, Memphis has created electrical goods, chemicals, and wood-based items. It is also home to the largest meatpacking plant in the South. Memphis still has its industry roots firmly planted, and they are still one of the best providers in the nation.

Also, due to its location on the East Coast, it’s a natural transportation hub. It is nearly in the middle of the country, so reaching either side of the coast or Mideast or Midwest quickly is the most significant selling point. Memphis also has the largest transportation hub in the East, making it the busiest inland port – moving about 15 million tons of goods per year. FedEx, one of the most extensive transportation and logistics companies in the world, calls Memphis home.

This provides a solid job market for those looking to work in these “rarer” industries all in one city. And even though the job market has been a bit soft since the pandemic started, it promises to rebound soon. The unemployment gap has been closing steadily over the last year.

Musical Monarchy and the King’s Home

Memphis is incredibly well known for being the birthplace of Rock N’ Roll music. Elvis Presley, the King of Rock N’ Roll, was born there, and his legacy, Graceland, remains an incredible tourist attraction. But that’s not the only kind of music Memphis is known for anymore. Downtown Memphis is legendary for new country, bluegrass, and rock bands vying to get discovered by performing along Beale Streets iconic restaurants, clubs, and venues.

Vinyl

The birth of the vinyl record also calls Memphis home, for the most part, with two of the earliest heavy hitters in the industry; Sun Records and Stax Records were both started in Memphis. Arguably, between Memphis and Detroit, MI – most vinyl was created for decades in these two legendary music cities. The energy of those days gone by can be felt when walking the streets under the glow of those neon lights.

The Bottom Line

Memphis’s rich musical history, married with the industries that have kept the city thriving for almost 70 years, makes Memphis a suitable locale for older members of the FI community that may want to revisit the tiny time capsules. But, rest assured, between the transportation and manufacturing one-two punch, jobs are relatively easy to find, and so is an excellent place to live.

Dive Deeper: Things to Do in Memphis, TN

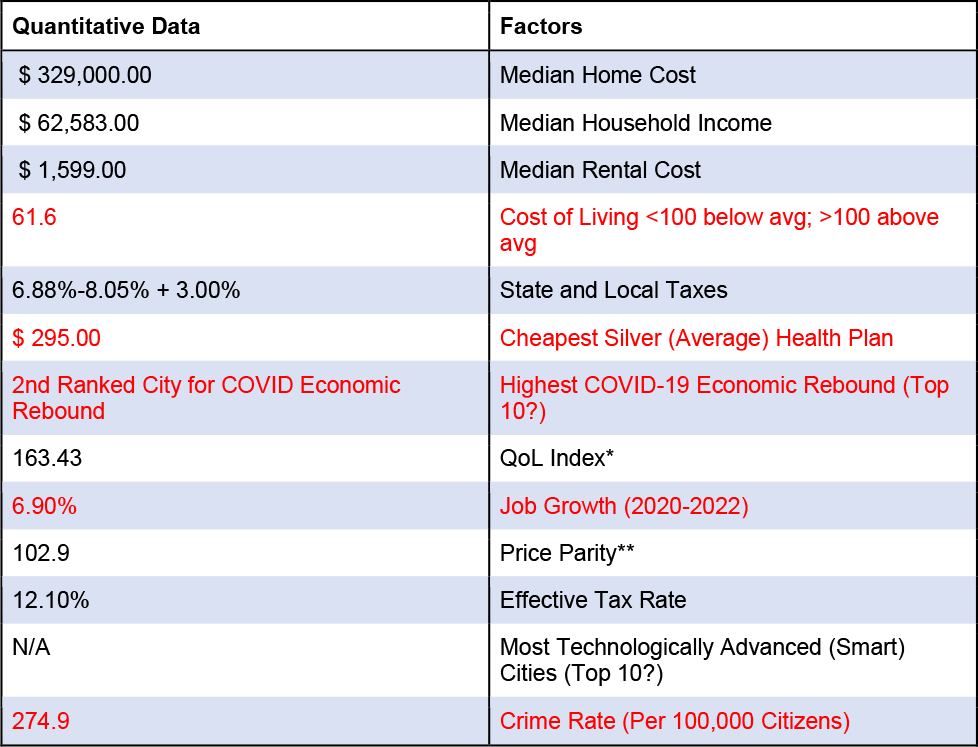

5. Minneapolis, MN

Why Minneapolis Is Meteoric

●Has the lowest cost of living on our cities for financial independence list.

●Private healthcare is incredibly financially accessible and overall healthcare costs are relatively low.

●Has a high household income, but we would have liked to see lower housing and rental prices.

●A relatively even price parity.

●Its location makes it a love/hate place to live. It’s #1 for cold amongst the nation’s largest urban areas.

●Has enjoyed the #2 highest economic rebound (behind Pittsburgh) since the pandemic.

●One of the safest places to live on this list as well, with 274.9 crimes per 100,000 citizens.

●Fun fact! The Minneapolis Skyway is the largest of its kind in the world. Spanning nearly 80 city blocks, it was built to keep out of the cold. Seriously.

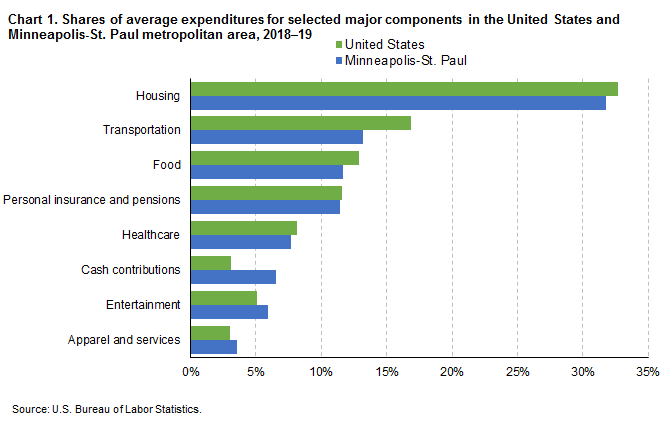

The Key Percentage Is 21%

Minneapolitans (yes, we looked it up) spend just 21% of their household income on living expenses. This is incredibly low for any city, much less for a metro area. This gives a massive advantage to those living a Financial Independence lifestyle. With 79% of household income available to invest, this fact alone makes Minneapolis a phenomenal FI city.

One of the great things Minneapolis spends this money on is reinvesting in itself. Of these the most notable is in public transport. There is a considerable effort, by both businesses (contributing money) and citizens (using the service and spending money) to ensure the health of the bustling public transport system. This means it’s very easy to catch a bus or light rail to get where you are going. State transport makes up $2.7B a year (this obviously includes cities other than Minneapolis and other funding, but impressive for a state frozen in ice).

Most Affordable Cost-of-Living of the Top 22 Metro Areas

The Bureau of Labor Statistics discovered that out of New York, San Francisco, Houston, Boston, et al. that Minneapolitans spend the least on housing, transportation, and food combined. Further, they ranked 2nd to last on how much they spent on transportation, probably because they have kept their current transportation program and have continually improved it – instead of destroying it and starting all over again. This helps place it on our cities for financial independence list.

Other vital notable facts found from this BLS study (note these are pre-pandemic numbers):

Diverse Job Market

One of the reasons why Minneapolis has rebounded so well since the pandemic is because of its diverse job market. It still relies on manufacturing and agriculture as staples to their economy, but have added on to include a wide variety of technology stables.

Target is the largest employer in downtown Minneapolis. Headquartered in Minneapolis, thousands of jobs are filled by the retail giant. Likewise, many other Fortune 500 companies have a presence in the city. United Healthcare has a headquarters in suburban Minneapolis. 3M, Best Buy, Wells Fargo, US Bank, and Hennepin Healthcare (the city’s second-largest employer) round out the stacked deck.

Also important enough to mention is the international airport (MSP) downtown, which brings in millions to the state in tourist and conference revenue (Minneapolis is a hot spot for conferences). Healthcare is also a big hitter for the city, as the Mayo Clinic is only an hour away. Further, state-of-the-art hospitals are easily accessible to any resident, mostly due to the healthcare infrastructure investments of United Healthcare and Hennepin Healthcare.

The Bottom Line

Like heavy winter coats? Get used to them – Minneapolis is freezing cold. That’s about all the negatives we could bring to the table in regards to the livability of the city. It has a robust economy, a solid economic job market, plenty of really interesting sights and sounds to take in, great food, and affordable housing. So, if you are on your path to FI or already are FI and want to preserve your investments, Minneapolis should be on your contender’s list.

Dive Deeper: Things to Do in Minneapolis, MN

6. Denver, CO

Why Everyone is Down With Denver

●Stunning views and a moderate climate, no matter what people may say.

●A flat income tax (4.63%). Most citizens top out at 11% paid in taxes.

●A relatively low cost of living for such an area; however, the housing market is incredibly expensive and tight.

●Citizens enjoy the best public schools in the nation.

●Budget surpluses mean more public goods and services to enjoy while taxes stay low.

●Fun fact! Denver Union Station banned kissing on rail platforms in 1902 as it slowed down the trains.

The Odd Man Out

It may seem a bit antithetical to put Denver on this “cities for financial independence list”, especially since the housing market is so high and it’s expensive to live there. The numbers on paper definitely make Denver the “Odd Man Out” on this list. However, we are looking towards the future and what promises to be around the corner.

Although the unemployment rate in Denver is at 3%, it has four major industry players that will turn it around post-pandemic: aerospace, telecommunications, energy, and technology. As it stands now, the GMP (Gross Metro Product) of the city sits at $209B per year. These are pandemic numbers.

Job Market Explosion

Denver is poised to have a job market explosion of 45% over the next 10 years. There are many factors that play into this figure, but it truly comes down to the potential expansion of the high-tech sector jobs and the housing market coming back to equilibrium. We are in a strange transition phase in the world. We aren’t out of the woods yet with the pandemic, yet we can see where jobs have been lost and need to be filled. Furthermore, knowing the expected needs of cities gives us this high percentage.

Denver hits all the hot spots. Along with the aforementioned “big four” tech industries, Denver also has a robust hotel and hospitality industry, which will certainly be back up and booming by the time people are traveling en masse again. This will bring another $400M back to the state.

Education and Low Taxes

Ever since Colorado legalized recreational marijuana 9 years ago, it has contributed $2B to its public school systems. This has led to Colorado, notably Denver, having the best public education program in the nation. It has also taken the burden off the taxpayers of the state to pay for its educational systems.

Speaking of taxpayers, Denver pays an effective tax of 10-11% when you consider income and sales tax. This is incredibly low, especially for a city that offers as much as Denver does. This comes from smart investments by its government officials (from the city to the state level) and ensuring the best for Denver’s population.

The Bottom Line

Denver may seem like an odd choice for a list of FI-friendly cities to live in. But, we took a look at all tenets of FI and the potential growth of wealth. Although Denver does have a large budget, a small (and expensive housing market), and an unemployment rate – we see the potential in where Denver will be in 10 years. With the infrastructure in place for high-paying tech jobs and the housing market on its way to getting back to equilibrium, Denver is a sleeper-hit and should stay on your radar.

Dive Deeper: Things to Do in Denver, CO

7. Omaha, NE

Why Omaha is On-The-Ball

●Incredibly low home prices compared to average household income.

●One of the lowest costs of living on this list.

●Has a small, progressive income tax – putting most households at a 10% effective tax rate.

●A great price parity.

●The home of the great billionaire Warren Buffett.

●Fun fact! Omaha’s Henry Doorly Zoo and Aquarium, an 84,000 square foot facility, is the largest indoor rain forest and desert in America.

“Silicon Prairie” Member

Omaha is becoming one of the fastest-growing tech hubs in the US. We guess it doesn’t hurt that Warren Buffett is bankrolling a lot of these start-ups, but we digress. Berkshire Hathaway is located here and is Buffett’s brainchild. Conagra Foods, a food processing company with a focus on genetic engineering, serves a great swath of grocery stores and restaurants around the nation. SkyVu, a game developer, and BuyNow, a mobile startup, have just joined the ranks. As you can see, there is a ton of potential.

On top of the tech corridor, there is plenty of “old world” industry left in Omaha. Union Pacific Railroad, one of the oldest railroads in the country, still serves 23 states in the Western US. Mutual of Omaha, one of the oldest insurance companies in the country, has nearly $44B under management. And Kiewit Corporation, a mining, construction, and engineering company is one of the largest privately-held organizations in the country.

Cost-Of-Living Plus Location Equals Profit

Omaha is roughly 10% less expensive to live in than the median US average. For a city with the kind of industry it has, that’s an impressive feat. Its location on the Missouri River gives Omaha a great leg-up against other industrial cities. Shipping lanes, hydroelectric power, clean drinking water, and other obvious choices show why this one-two punch of Omaha can be a great choice for FI seekers.

The Bottom Line

The most resilient on our cities for financial independence list has varied industries and Omaha is no different. From the new tech corridor that has introduced revolutionary products to companies that are over 150 years old, Omaha has established itself as one of the big rebounders of the COVID pandemic.

Dive Deeper: Things to Do in Omaha, NE

8. Des Moines, IA

Why Des Moines Doesn’t Disappoint

●Job growth even in the face of the pandemic.

●High QoL Index compared to median household income.

●Affordable housing market with a healthy supply.

●The median home price is about 50% below the national median.

●Cost-of-living is about 20% below the national average.

●Finance and Insurance is the largest industry in Des Moines, followed by Entertainment, Restaurants, and Bars.

●Take a look at an interactive map of the expected employment growth in Des Moines between 2010-2050.

●Fun fact! From 1942 up until 2009, it was illegal to dance between the hours of 2 a.m. and 6 a.m in Des Moines. Living in their own Flashdance movie.

Facebook and Microsoft

Yes, we are all fans of both Facebook and Microsoft. But, did you know that Facebook opened its headquarters in Altoona (a suburb of Des Moines)? It’s a $300M, 500,000 square-foot building that contains both server farms and corporate offices. So, a tremendous amount of jobs are filled by Des Moines residents.

Microsoft has yet to invest in Des Moines; however, they have promised data centers that will cost just north of $2B in West Des Moines. Once this happens, an estimated 10,000 high-paying tech sector jobs will come to the area.

Farmers and Agriculture Industry

Des Moines, as with the rest of Iowa, is known for its farming and agriculture. However, Des Moines is notable because it constantly reaches the Top 10 Farmers’ Markets by several different sources. Further, agriculture, especially corn – is a staple of Des Moines’ economy.

Want more? The Iowa State Fair, an 11-day celebration in the heart of Des Moines every year, features a 600lbs butter cow. If that’s not enough to pique your interest, there is a recreation of The Last Supper completely in butter – and yes, there is butter on the table.

The Bottom Line

Des Moines is yet another diverse industry market with both the new tech sector jobs covered (with the two heaviest hitters in the industry) along with quaint farming and agriculture twists. With its low cost of living and proximity to a solid job market, it should be on your list of cities for financial independence.

Dive Deeper: Things to Do in Des Moines, IA

9. Tampa, FL

Why Tampa Tempts

●An incredibly beautiful climate most months out of the year.

●Low healthcare premiums and moderate healthcare costs.

●A high QoL Index.

●Low taxes considering the location.

●Fun fact! Even though it’s located in Florida, the temperature has never risen about 100 degrees!

The Economic Hub of Western Florida

Tampa has a ton going for it when it comes to industry. Tourism obviously scores high because of its location. Gambling is also part of its economy, albeit a small one – you can bet on horses and play low-limit poker.

Due to its aging population, healthcare and insurance are the heaviest hitters. Finance, technology, and construction round out the rest.

A Great Place to Retire and Preserve Your Financial Independence

Tampa is unique on our list of cities for financial independence as it is primarily listed as a retirement spot for us FI-ers out there. The cost-of-living is a bit on the higher side and housing is relatively expensive; however, we always look at the long run. Taxes are very low for the region. Healthcare costs, especially insurance premiums, are lower than the national median, so that’s good news for a retirement state. And you absolutely cannot beat the weather.

The Bottom Line

Tampa is a great city with lots to offer retirees. Yes, younger FI-ers too, but mostly geared towards the needs of the “near retirement” age FI-er. Stay warm, keep healthy, and preserve your wealth if you decide to make Tampa home.

Dive Deeper: Things to Do in Tampa, FL

10. Raleigh-Durham, NC

Why Raleigh-Durham Rarely Disappoints

●The highest QoL Index on our cities for financial independence list.

●The lowest crime rate on the list.

●A solid median household income compared to median house prices.

●Home of the fabled rivalry of UNC vs. Duke basketball.

●Research Triangle Park (RTP) which is located between Raleigh and Durham has been a hotbed for tech and bio revolutions for 20 years.

●Fun fact! Raleigh Beer Garden has 350+ beers on tap, making the Guinness Book of World Records for the largest beer selection.

Three Heavy Hitters on the Horizon

Granted, Raleigh-Durham already has a lot going for it – especially with RTP. However, three massive companies have committed to contributing significant infrastructure (which obviously brings jobs) to the area.

- Google has announced that it will be bringing 1,000 cloud engineering jobs to the area, making it the second largest Google has under its umbrella.

- Apple has made plans to invest $1B in RTP to create a campus on-site. The 10 year plan will bring 3,000 jobs to the area.

- Amazon has promised a 620,000 square-foot distribution center right outside of Raleigh city limits in 2023. Satellite stations will then be on the drawing board once logistics has been worked through.

Job Growth is Expected To Increase 50% by 2031

Although many cities will enjoy a bump in employment after the pandemic ends, Raleigh-Durham is poised to take the #1 spot. Due to its existing infrastructure and the enormous organizations that are headed their way, many economists think that the metro will enjoy a 50% increase in jobs by 2031. This is unprecedented and obviously could be incorrect, but the numbers are trending in that direction.

The Bottom Line

Raleigh-Durham is our wild card on our list of cities for financial independence. So, it has the potential to be something truly amazing, or it could be status quo. So much depends on the moves of Google, Apple, and Amazon. Therefore, with the proper development of the infrastructure RTP already has and enough real estate to absorb the giants in, this could be a massive boon for the Triangle.

Dive Deeper: Things to do in Raleigh-Durham

The Bottom Line of All the Above Bottom Lines

As you can see, just with last year’s cities for financial independence list, there are pros and cons to each city we’ve listed. It’s up to us to provide you with the most accurate, clear data for you to make the decision if you want to make the move from where you are to a “FI city near you.” And obviously, we couldn’t hit upon each pro and con for each city, but we hit the sweet spots for you.