Every week we here at ChooseFI get hundreds of emails from our community. There have been so many interesting and thought-provoking questions that we’ve decided to create a series dedicated to answering the most frequently asked each week.

This week’s question is about Vanguard and VTSAX and comes from David R., who writes:

Q. I have finally come around to opening a taxable account at Vanguard – it is not as straightforward and easy as it usually seems on discussions on the show. There are big questions to answer like individual vs joint account (when married), different types of joint accounts (tenants in common vs entirety), whether or not to set dividends to reinvest or not (and considering tax-loss harvesting), and then how the money first goes into a settlement fund before you can actually buy VTSAX. Anyway, just saying that you might want to add some discussion at some point so that people understand that it is not as simple as “open an account at Vanguard and put your money in VTSAX.”

A. We don’t want to dive too deep into any of your queries because there isn’t a “one size fits all” answer for joint accounts, reinvesting, and the like. We can, however, walk you through the nuts and bolts of putting your money into a settlement fund and buying VTSAX.

For those who are unaware, in order to buy from Vanguard, you must first open a settlement fund.

It’s similar to a savings account at a bank, but it’s only used to “settle” trades – like buying and selling – and stores those funds in one place.

Here is a brief overview from Vanguard:

- When you put money into your settlement fund, you’re actually buying shares of that money market fund.

- When you buy securities, you’re paying for them by selling shares of your settlement fund.

- When you sell securities, the proceeds from the sale go directly into your settlement fund on the settlement date.

How to Open a Vanguard Account

Step 1:

Go to the Vanguard website and select “Personal Investors.”

Step 2:

On the next page, select “Open an account”

The rest of the opening steps are contingent on how you want to fund your account, personal information, and legal requirements. Remember, as this can be tricky, once all paperwork is submitted and approved and you fund your account, you must select where you want your money to go. If you don’t, your money will simply sit in your settlement account.

How to Invest In VTSAX

First, a few tips:

- From the Vanguard homepage, click on the “Buy Funds” page and log-in

- VTSAX requires a $3,000 minimum balance; however, VTI is the easier version of VTSAX to use since it is an ETF w/ no minimum

- Has a .04% expense ratio

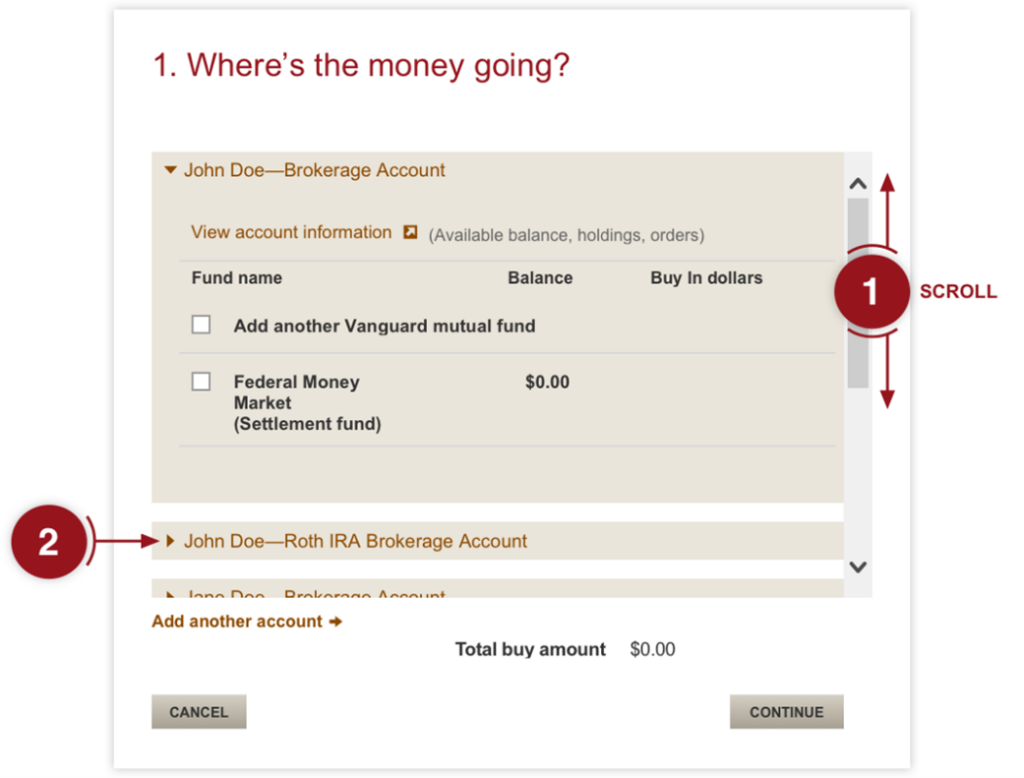

Step 1: Once you’ve logged in, you’ll see this page.

Scroll down to your account (if needed) and select the account and click “Continue.”

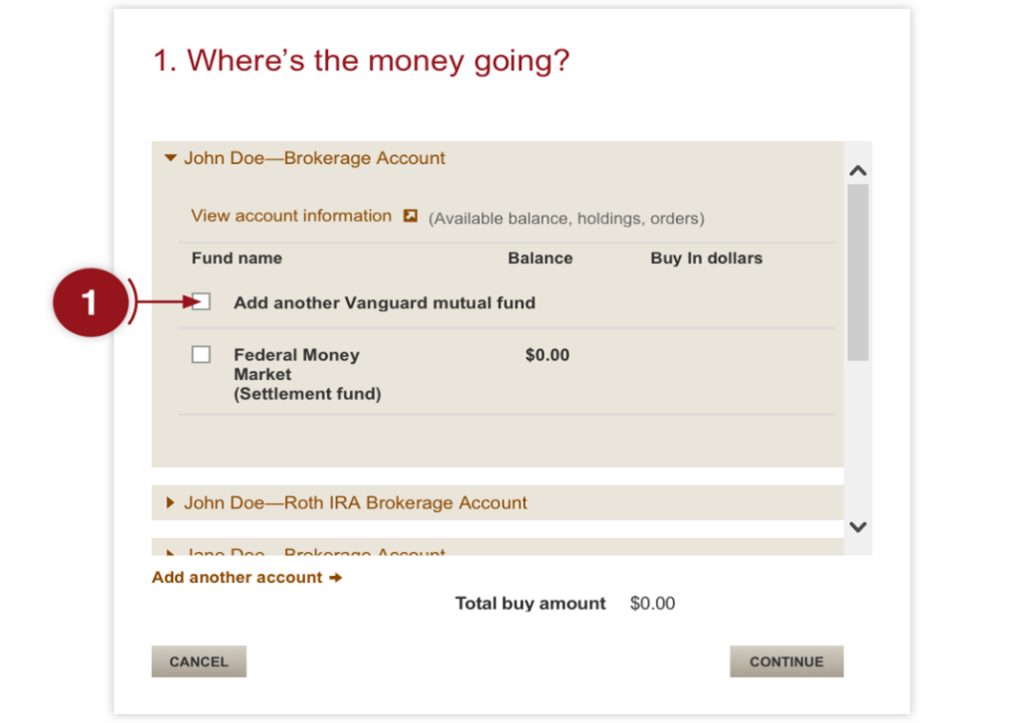

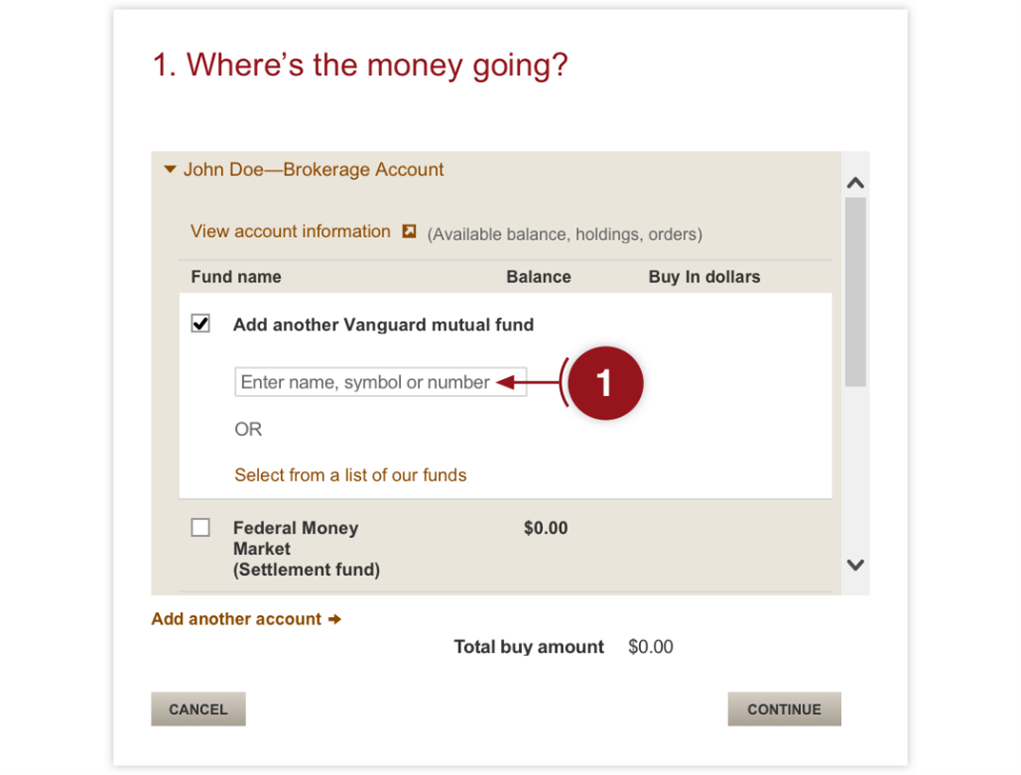

Step 2: Select the checkbox next to “Add another Vanguard mutual fund.”

Step 3: Enter “VTSAX” in the drop-down box.

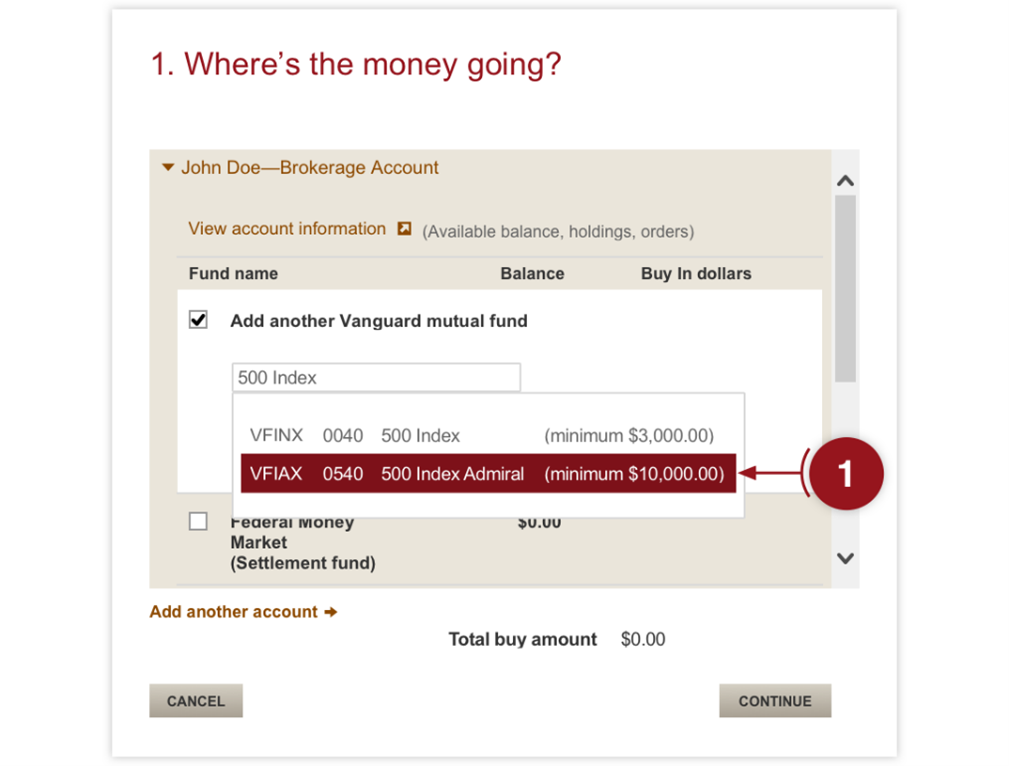

Step 4:

Select VTSAX from the auto populated information (you will not see “VFIAX” or another fund as seen in the example below).

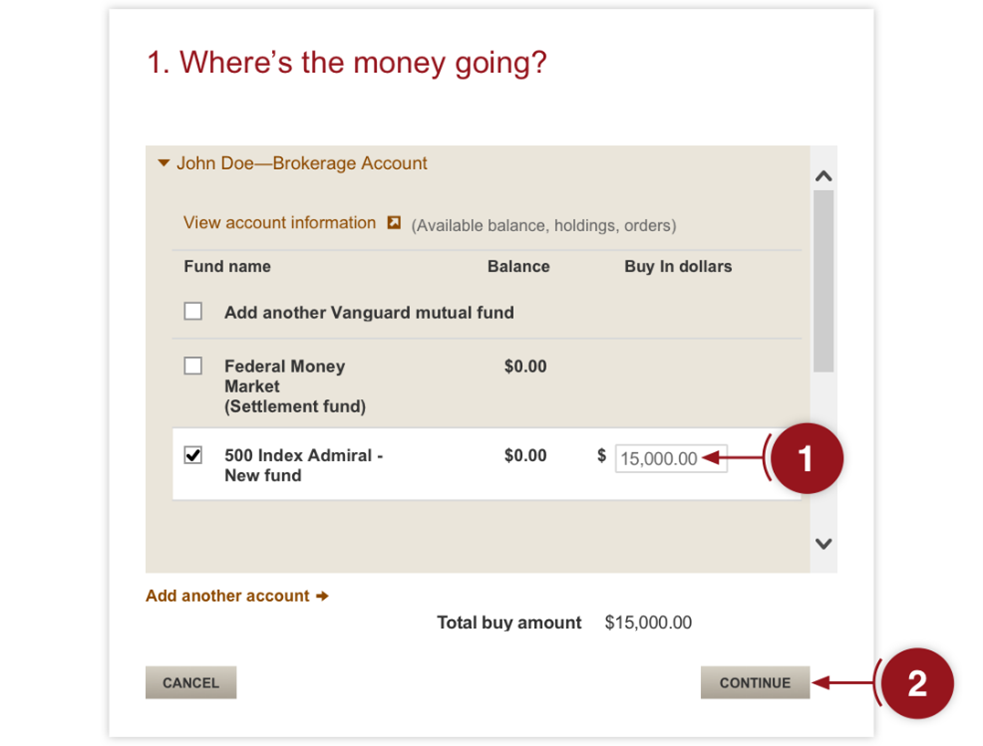

Step 5:

Enter the dollar amount you wish to purchase next to the VTSAX fund and click “Continue” (the example below shows a different fund).

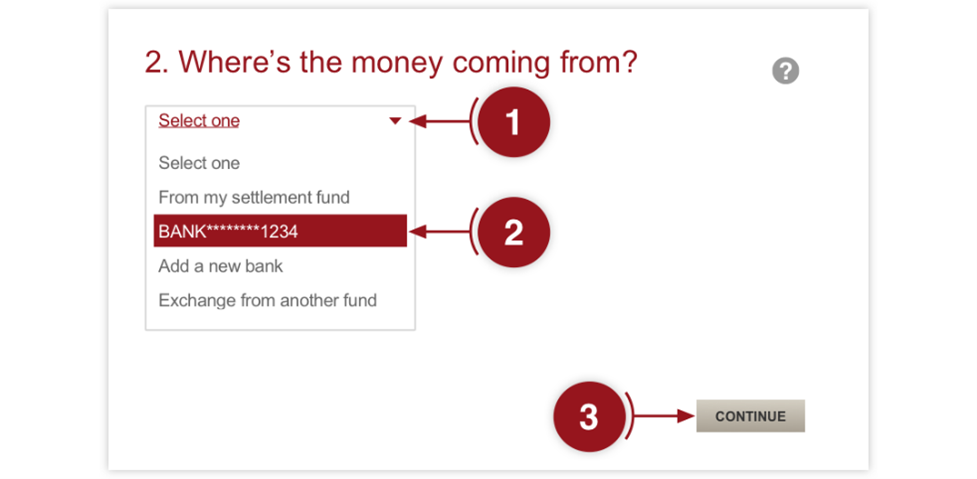

Step 6:

Expand the drop down menu from the top, right hand corner of the screen. Select the account you wish to fund your purchase.

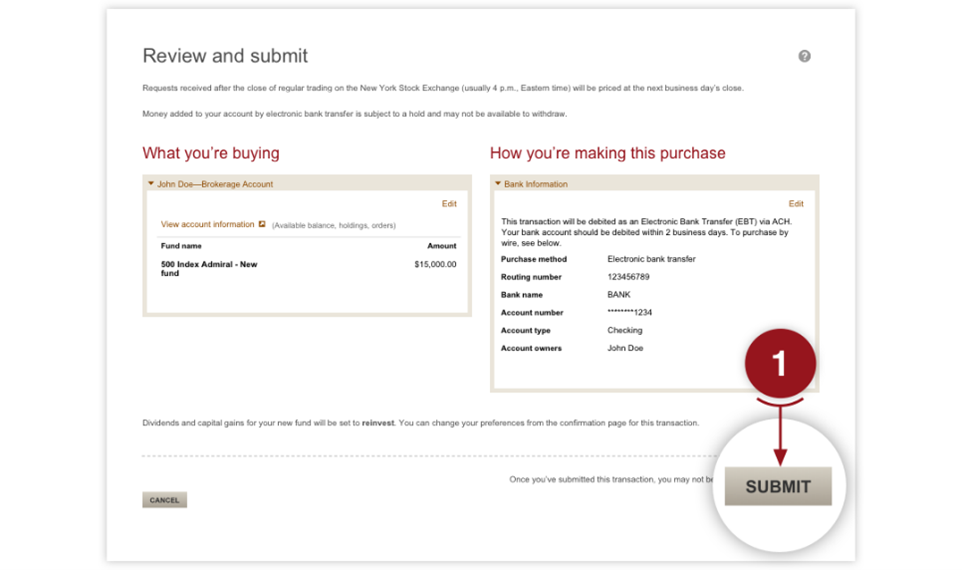

Step 7:

Please double-check all information on the submission screen. Once you are ready, hit “Submit.”

Step 8:

Finally, you’ll be taken to your confirmation page. Congratulations! You’re now invested in one of the highest performing mutual funds since, well, the invention of the mutual fund!

Hopefully that helps you out, David, and our other readers as well. Thanks for being the first of our weekly Community Q&A!

Dive Deeper: