By now, you’ve all likely heard the Pillars of FI episode where Jonathan and Brad discuss the building blocks of financial independence. For those of you who haven’t–Jonathan sums up the idea of FI nicely:

The TLDR : FI isn’t about deprivation, FI is about cutting back on needless expenses that cost you too much and don’t add value to your life, it’s about trying to reclaim most valuable thing in your life which is your time.…instead of focusing on buying stuff to make up for my unhappiness, what if I just focused on happiness? What if I made a list of things that actually made me happy?…What we find out over and over again is that the list rarely includes stuff. Stuff is not a necessary prerequisite for happiness.

Here are the 10 pillars of FI that can help lead you to financial freedom:

1. Low-Cost Index Fund Investing

The first pillar is to invest in low-cost index funds. Jonathan points out that “the vast majority of professional investors do not keep up with the market over long periods of time.”

Since it’s impossible to determine the ups and downs of the market, you should go with the one thing you can control: fees.

Index funds have extraordinarily low fees compared to other investing platforms. Ten years ago, Omaha billionaire Warren Buffet agrees was so sure that the index would outperform the best of wall street, that he made a $1 million bet.

Warren Buffett was so sure that his chosen S&P 500 stock index fund would outperform a collection of hedge funds that he made a $1 million bet over it.

The Oracle of Omaha won. It wasn’t even close, he trounced them. In fact, the hedge funds admitted defeat years ago. The key to this bet was that the funds had to include their fees when reporting returns.

Market returns vary, fees are fixed. This headwind makes it nearly impossible for hedge funds to beat the index over long periods of time.

Related: FIRE Essentials: Low-Cost Index Fund Investing

2. Low Cost Housing

Unsurprisingly housing/shelter is the largest line item in peoples budget. Do you want to get the home of your dreams or do you want a good home that serves what you need it to do now and use the difference in savings to buy your freedom sooner?

If you really want to break the game consider House Hacking. This technique is so simple and powerful that if you implement it you can reach FI in 5-7 years.

Consider that 50% of your budget goes to housing and transportation. If you purchase a Duplex or Triplex and live in one side and rent out the other unit(s) you can find yourself in the the enviable position of living for extremely low cost or free. If you stack this superpower of House Hacking with living near your work, you can bike or walk to work cutting your transportation cost to virtually zero.

Related: House Hacking With Airbnb

3. Buy Used Cars

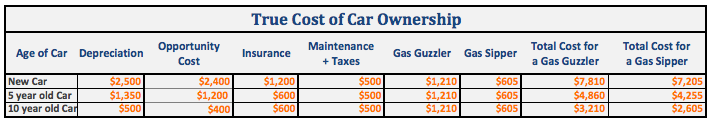

Why do we put so much emphasis and value on our brand new cars, with oversized car payments? A car is not an investment, it’s a rapidly depreciating expense. Listen to our podcast episode on the true cost of car ownership.

Cars will almost always be an expense, but let someone else take the depreciation hit. A new vehicle loses value as soon as you drive it off the lot. A gently used vehicle that gets great gas mileage is the optimal choice. The key though is to commit to driving the vehicle for as long as possible.

A car just a few years older will cost you half of what a new car will. Plus, if you buy a used car in good shape it’ll still be a while before you have to invest in major repairs, and it’ll still get decent gas mileage.

Below is a summary of the cost per year of car ownership:

Related: How To Buy A Used Car

4. Crush Your Grocery Bill

Most of us spend too much on food and end up wasting half of it anyway. Or, on the other end, those who go out for every meal are overpaying by a lot. Brad offers a specific savings example in the Pillars of FI episode:

“…instead of going out for an eight-dollar glass of wine or a six-dollar craft beer, bring the fun home, bring friends over and buy a six pack of craft beer. This is only going to be $9 total. That’s a small example that compounds and makes a big difference over time. So again it’s not about deprivation it’s just about being a little more intentional.”

Going out once in a while is fine–it’s good to get out of the house but, from a quality of food perspective, you can absolutely have the same quality or better experience at home. The bonus is that by adding creativity in, it allows you to spend quality time with your social circle and provides them the opportunity to get some frugal entertainment as well. Win/Win.

5. Tax Optimization

This is truly where the FI community shines. As a community, we have aggregated tax hacks that no one else is talking about. In the traditional personal finance community emphasis seems to be on the Roth and how you pay taxes up front, but it grows and can be withdrawn at retirement tax-free.

We challenge that and suggest that by utilizing the strategies that this community has put together there are multiple ways to put the money in pretax, let it grow tax-free, then pull it out tax free as well.

This is affectionately called #winning 🙂 This epiphany is why the FI community puts so much focus on maxing out maxing out tax-deferred accounts.

Here are the techniques and where you can find out more about them

- Article: The Roth Conversion Ladder

- Podcast Episode: Capital Gains Harvesting

- Podcast Episode: The 457

Related: The Triple Tax Benefits Of The HSA

6. College Hacking

Anyone who has been to college feels the pain of their now excessive student debt (if you don’t have debt, you’re one of the incredibly lucky ones).

College hacking is all about teaching your children how to go through the process of saving and preparing for the immense expense that is higher education.

While there is not a perfect answer for everyone, there are little hacks that can be put together as you come up with a game plan for yourself or your child

- Go to a community college for two years and then go to a four-year school and get that same four-year degree that everybody else is getting

- Take AP/Dual Enrollment Courses

- Test out by looking into CLEP tests

- Take advantage of the thousands of scholarships out there

- The Caddy Scholarship (Did you know there was a scholarship fund for Caddies?)

- In Roads Scholarship

- Fire Academy Scholarship

- Air National Guard

- Merit Scholarships

Podcast Episode: Demystify College Scholarships

Discover the framework for success from dozens of people who have found their own path to financial independence. Learn how to spend less, earn more, and live a fulfilling life of abundance. Download your free sample chapter today!

Choose FI: Your Blueprint to Financial Independence

7. Travel Rewards

There are some very prominent figures in the personal finance community that label credit cards as evil. We challenge that. Credit cards are a financial tool. When you are in the position of striving to save 30-50% of your income then you are positioned to really be able to take advantage of the incredible life-changing benefits of travel rewards. If this is a foreign concept definitely listen to our introduction to travel rewards episode.

Instead of travel being an expense that we pay for with our after-tax dollars, we are able to travel around the world for nearly free which allows us to do more for less. Again leveraging creativity to enjoy life on the path to FI.

Travel Rewards embodies the creative way that the FI community looks at problems–after all, one of the reasons we all want to reach FI is so we can take the time to really experience the world–what better way to do that than traveling?

Check out our Travel Rewards episode here.

- Note: If you’re someone who has issues with ongoing credit card debt, ignore this pillar. This is not for you. Focus on building your ground game first. Live below your means, never keep a balance, always pay your cards off early and in full.

Related: How To Save Money On Travel With The Right Credit Card

8. Cut the Cord

Between our Cell phone and Cable package, it is not uncommon to be paying $250 per month for these services. The cable is the most egregious in that you are paying so that the cable company can fill up 20 minutes of every hour with commercial breaks and the rest with the anger, fear, fog of war of the 24-hour news cycle.

It’s Time to Cut the Cord.

Instead of paying for everything consider downgrading to a Netflix or an Amazon prime package. When combined with a Roku or HD antenna, you will have more TV available than you know what to do with.

There are also smarter ways to cut your phone bill.

Brad suggests Republic Wireless. Jonathan Uses Project FI. These services piggyback off existing providers like Verizon, Sprint and T-Mobile and lean heavily on Wifi. The result is a comparable product that you can get for a fraction of the cost of the big players in the cell phone space.

Related: Cut Your Cell Phone Bill: Republic Wireless Review

9. Side Hustle

A major pillar of FI is starting a business or side hustle. When you reach financial independence in your 20’s, 30’s and 40’s you are unlikely to spend the next 40 years sitting on the couch. It’s not what can you do but what do you want to do. Being on the path to FI and no longer paycheck to paycheck affords you the freedom to fail–this freedom is the surest path to success.

Consider the side hustle as a form of “investing in yourself” The good news is, you can have a side hustle for pretty much any hobby or discipline. Also starting a business opens up the tax code for you and your family. The tax code is brutal for wage earners (W-2 employees). Starting a small business or becoming a freelancer gives you an incredible amount of flexibility.

The FI community has historically done a bad job at highlighting how powerful this lever is. We sought to remedy that by bringing Alan Donegan on the show to Unpack the Power of the Side Hustle.

Nick Loper came on the show to discuss how to find your side hustle idea.

Example Side Hustles

- Teach Online

- Create Blog/Podcast

- Buy an existing business

- AirBnb

- Virtual Assistant Services

- Join a Startup

- Start an Etsy Shop

- Rental Properties

Related: Why A Side Hustle Is FI’s Secret Weapon

10. Savings Rate & The 4% Rule

Forget a 40-year work career, if you can save 50% of your income your path to FI charts itself in 10 to 15 years. The Math is pretty simple. The 4% rule is a wonderful rule of thumb for figuring out how much you need to reach Financial Independence.

Joel from FI180 said it best in the Milestones of FI Episode ” I am saving for the ultimate luxury, a Perpetual Money Making Machine“

Once you have saved 25x your annual expenses in investments. Assuming average market returns over time that will easily be enough to cover your expenses for the rest of time in inflation adjusted dollars.

Note that it’s not based on income, it’s based on spending so for each $100 per month you can cut from your budget that is $30,ooo less you need to save!

If you can find what makes you happy and eliminate all the other waste in your life, your savings rate will increase over time.

These are the Pillars of FI

Related Articles