One central question remains in the FI community for those who seek to retire early: How will I pay for healthcare? The triple tax benefits of an HSA are your answer.

The fate of the US healthcare system is always up in the air. It’s not clear what the future holds for those who retire before they’re eligible for Medicare. Some FIRE devotees have decades to wait before they qualify, which means deciding how to fund their healthcare expenses without spending their entire nest egg.

Fortunately, there is a way to save for healthcare while getting significant tax benefits using an HSA (Health Savings Account). Read on to see why an HSA might be right for you.

What Is An HSA?

An HSA is a remarkable account solely designed for medical expenses. Stashing money away in an HSA lets you save for medical bills, so you’re ready in case of surgery, an expensive procedure, or an unforeseen injury.

HSAs can only be used for qualified medical expenses, which are wide-ranging and include prescriptions, dental and vision costs, chiropractors, and more. Non-qualified fees include insurance premiums, cosmetic procedures, and over-the-counter drugs.

Like IRAs or 401ks, there is an annual contribution limit for HSAs, currently at $3,650 for individuals and $7,300 for families. The limit increases every year with inflation. Like IRAs, savers 55 and older can put an extra $1,000 in their HSA every year to “catch up.”

You need to have a high-deductible insurance plan to qualify for an HSA. With a minimum deductible of $1,350 for individuals and $2,700 for families and an out-of-pocket max of $6,650 for individuals and $13,000 for families. These restrictions also change every year.

HSA vs. FSA

Unlike Flex Spending Accounts (FSA), funds in an HSA rollover from year to year. You can use HSA money tax-free even if you no longer have an HSA-eligible insurance plan. As long as you contributed the money while you were eligible, you can use an HSA at any point. There is no income restriction for HSA users like there is for Roth IRAs.

You can even leave behind an HSA for your loved ones when you die, though anyone besides a spouse will have to pay income tax.

Dive deeper: The Triple Tax Savings Of A Health Savings Account

What Are The Triple Tax Benefits Of An HSA?

In summary, the triple tax benefits of an HSA are:

- Contributions to an HSA are pre-tax.

- Any earnings you acquire through simple interest or investing are not subject to tax.

- If the proceeds are used towards qualified medical expenses, the fund is not taxed.

HSAs combine the benefits of both traditional and Roth IRAs. Contributions to an HSA are pre-tax and decrease your taxable income. When you put money in an HSA, you lower the amount of taxes you pay.

HSAs are also not taxed, and many HSA providers allow customers to invest the funds in their HSA once they have $2,000 in their account. If you have less than $2,000 in your HSA, you’ll earn interest at a similar rate to regular savings accounts.

Withdrawals from an HSA are also tax-free unless they’re used on non-medical expenses. If you use HSA money for a non-qualified fee, you’ll also be assessed a 20% penalty on top of income tax. If you’re 65 and older, you’ll only pay income tax on non-qualified medical expenses.

Dive deeper: Health Flexible Spending Account: When You Can Use Your FSA Money

How HSAs Get You To FIRE

After maxing out your IRA and 401k, the HSA is your best tax-free savings vehicle. It’s the only account that doesn’t tax contributions, earnings, or withdrawals. If you pick an HSA with the right company, you’ll have access to a vast selection of ETFs and other funds.

A common strategy for FIRE folks is to pay for medical expenses with a regular bank account, save the receipts, and then withdraw money from an HSA once they retire. As long as you have proof of qualified expenses, you can get reimbursed anytime, even years later.

Here’s a scenario: Phil and Joyce have a high-deductible insurance plan that’s HSA-eligible. They save the maximum amount every year and pay for medical bills out of pocket with their checking account.

Phil and Joyce retire at 45, but they’re not eligible for social security for at least 17 more years. They also have to wait 14 years to withdraw money from their IRA and 401k without paying a 10% penalty. This means they need a way to pay for expenses without incurring excessive fees.

Enter the HSA. Because Phil and Joyce always used their bank account for health expenses, their HSA has enough money to cover their cost of living. They can withdraw money from their HSA tax-free and penalty-free because they’ll use their medical receipts to reimburse themselves.

Dive deeper: How To Use Your HSA To Provide Income In Retirement

Tax Benefits Of The HSA And Rising Healthcare Costs

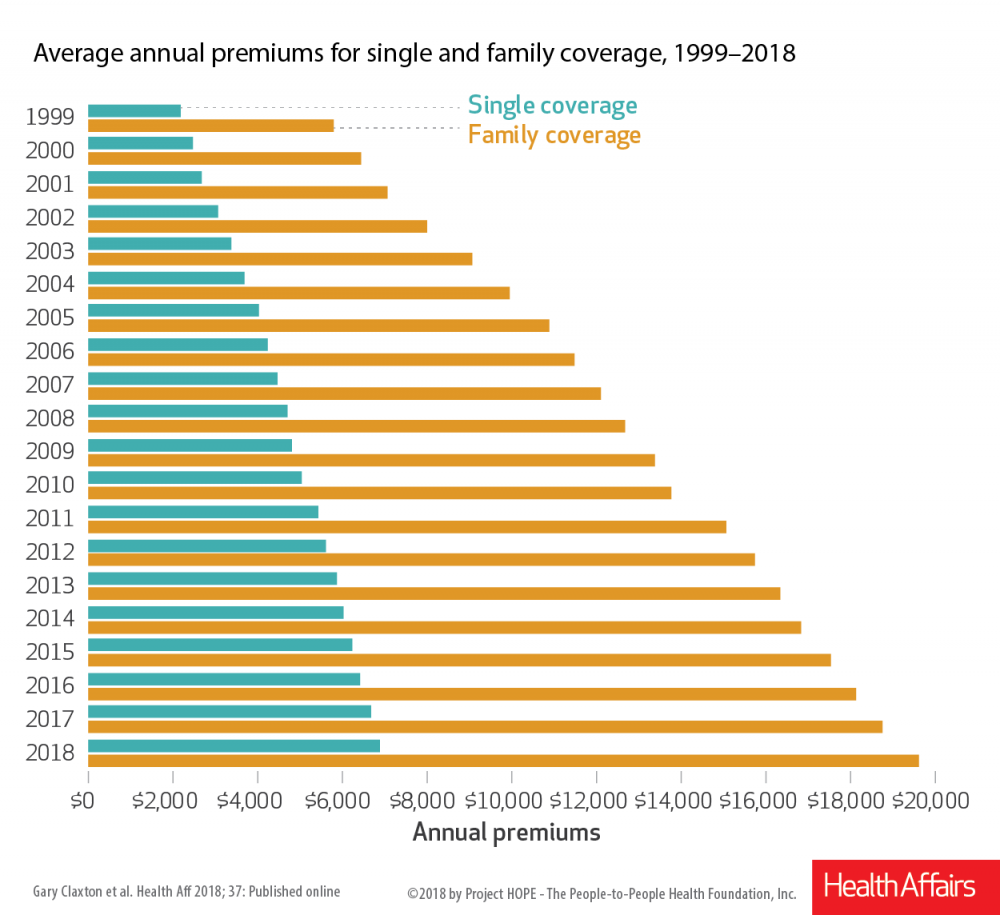

The rising cost of healthcare is another reason why early retirees love HSAs. Their only options for medical insurance are marketplace-sponsored plans or healthcare ministries. Exchange-based insurance and private premiums increased 28% from 2015 to 2018 and many insurers are dropping out of the marketplace. Until they become eligible for Medicare, paying for health insurance is a big question mark for the financially independent.

Enter HSAs. Having an HSA expressly set aside for medical bills is one more way to ease the burden of healthcare. Even though retirees can plan ahead for housing, transportation, and other major line items, they can’t decrease their healthcare costs without foregoing it or avoiding a doctor.

If you don’t have health insurance available through your workplace, you can open an HSA with any company you want. Like bank accounts, HSAs have their own fee structures and fund offerings. Compare HSA providers carefully before choosing one, so you’re not paying unnecessary fees.

Related Articles

- How An HSA Fits With Your FIRE Plans

- Planning For Healthcare In Early Retirement

- Get Free Health Insurance Quotes Through Policygenius