Buying insurance reminds us of our mortality. We could get sick, hit by a car, or have our home destroyed. However, we still buy medical, auto, and home insurance to protect against those risks. But there’s one policy that most people don’t buy even though there’s a 1 in 4 chance that they’ll need it–disability insurance.

While life insurance provides an income to your family if you die, disability insurance provides an income if you become sick or injured and can’t work.Why Is Disability Insurance Needed?

Many people fear death, but disability should be a greater fear. For example, not only could you lose your job, but that could have a ripple effect on you and your loved ones. We’re talking about medical expenses, time away from work for your spouse, and numerous accommodations to daily life.

Yet, according to the Council for Disability Awareness, at least 51 working adults in the U.S. do not have a disability insurance policy. And research by the Federal Reserve shows that less than half of Americans have enough savings to cover three months of living expenses.

Many households are one accident or illness away from not being able to pay their normal monthly bills. Plain and simple, disability insurance provides income protection.

The FI community takes great strides to reduce that risk by paying down debts and building multiple streams of income. But how would you react if all of the FI strategies you’ve put in place were decimated by a major illness or injury?

Related: The ICE Binder: The Done For You Legacy Binder You’ve Been Looking For

What Does Disability Insurance Cover?

Disability insurance replaces a portion of your income if you are injured or become ill and are unable to work. There are generally two types of disability insurance–short-term and long-term. Each policy covers you based on the length of your disability.

You don’t have to choose one or the other. It is possible to buy both types of coverage if your budget allows.

Short-Term Disability Insurance

Short-term disability insurance covers injuries and illnesses that do not last a long time. These policies can offer up to two years in coverage, but the average policy offers protection for three to six months.

Examples of short-term disabilities that could benefit from this insurance protection are:

- Pregnancies

- Musculoskeletal disorders

- Digestive disorders

- Mental health issues

- Injuries

If you have a lot of PTO, vacation, or sick days, or have a healthy emergency fund, you may decide to skip short-term disability insurance. This is called self-insurance. In other words, you’re betting that you won’t become disabled. If you do, you can cover the lost income through paid days off or personal savings.

Long-Term Disability Insurance

Long-term disabilities are the ones that can devastate a family’s finances. The Council for Disability Awareness found that the average long-term disability lasts 34.6 months.

Examples of long-term disability claims:

- Musculoskeletal disorders

- Cancer

- Mental health issues

- Injuries

When shopping for long-term disability policies, the start date for benefits is a big factor in how much you’ll pay. The premiums go down the longer you wait for benefits to start.

Coverage will continue until you return to work or until you reach Social Security retirement age. Some policies even offer benefits that continue after you’ve returned to work.

Is This The Same As Worker’s Compensation Insurance?

They are similar but are not the same. Worker’s compensation insurance is paid by your employer in case you have a work-related injury or illness.

Disability insurance coverage protects you regardless of the cause of the disability.

What Should I Look For In A Disability Policy?

There are multiple types of disability insurance. And the nuances of the policies that you’ll evaluate will make a big difference in the monthly premiums and the benefits.

Own Job Vs. Any Job

When you purchase a policy that covers your own job, it will pay benefits if you are unable to perform your current job. However, if you are able to perform a different job, you will not receive payments.

Any job policies will not pay unless you are unable to work.

For example, let’s say a mechanic injures their back and can no longer work as a mechanic. If they have an “own job” policy then benefits would kick in. However, if they have an “any job” policy they may not because s/he can do other work, say a desk job.

Own job coverage is less expensive than an any job policy.

Total Vs. Partial Vs. Residual Disability

Some policies require you to be completely disabled before benefits will begin. Others will begin payments if you are partially disabled.

A disability policy with “residual” benefits will cover the gap between your old salary and new salary while you are disabled.

So, going back to our mechanic from above, let’s say the mechanic earned $60,000 while working as a mechanic. But after their injury, they take a job as the office manager of the auto shop and begin earning $45,000. Residual benefits would pay the $15,000 gap in earnings.

Elimination Period

The longer you wait for benefits to start, the lower your premium will be. Typically, you can choose from six-month, one-year, and two-year elimination periods.

The longer you wait for benefits the lower the cost of the policy.

Benefit Amount

The average policy will replace 50% to 60% of your lost income. However, most will not cover bonuses or commissions. Asking for a higher benefit will increase the premiums.

Cost Of Living Increases

Inflation is always working against us. Adding a cost-of-living-adjustment rider will ensure that the benefits you buy today will be good enough later on.

Where Can I Buy Disability Insurance?

If you’re interested in buying disability insurance, you have many options to choose from. You can get it from work, buy from an insurance agent, or tap into government benefits.

Disability Insurance From Work

Many companies offer short-term and long-term disability as part of their benefits packages. In fact, five states and Puerto Rico have state-mandated short-term disability insurance requirements.

When buying a disability policy through work, it can be paid for one of three ways:

- You can pay for all of it

- Your employer can pay the entire bill

- You can split the cost in any ratio

If you haven’t already, speak with your Human Resources department to discuss your company’s benefits package.

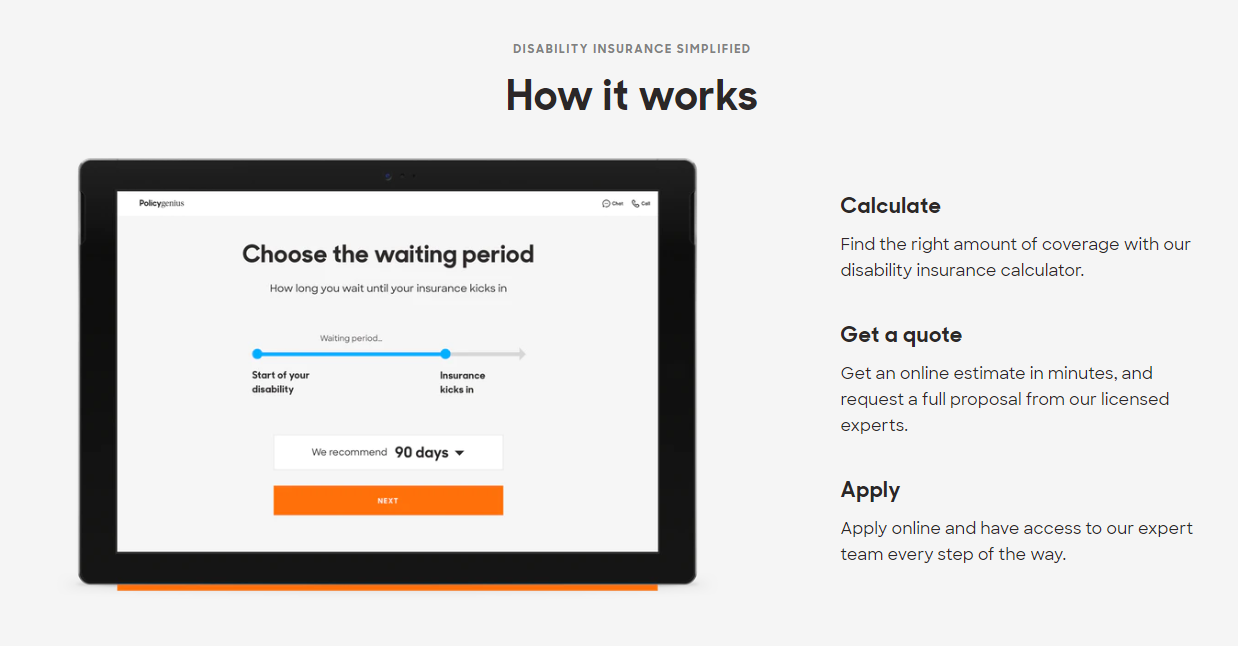

Getting Disability Insurance From Policygenius

One of the best places to start when shopping for disability insurance is Policygenius. Policygenius can help you find and compare the best rates for free.

My favorite thing about Policygenius is its commitment to helping its users through the entire process of enrolling in insurance. Before you even get a quote, they will help you calculate the right amount of insurance coverage for your particular situation, with their disability insurance calculator.

Afterward, Policygenius will walk you through a simple survey that will be used to generate quotes from a number of different insurers. If you have questions about the application process, they can even help you through it.

Policygenius is my first stop whenever I’m searching for a new insurance policy, no matter what kind. If you’re in search of a new policy, why not join the 30 million other people who have used their website to get over $35 million in coverage?

Get a quote from Policygenius today.

Buying A Disability Policy From An Agent

You are able to customize a disability policy when you buy coverage from an agent. With workplace policies, you generally have limited options to choose from.

Some life insurance policies have the option to add a disability “rider.” When I purchased an insurance policy several years ago, I added a disability rider rather than buying a separate policy. In theory, I saved money this way. But I am also at risk of losing both insurance coverages if I can’t pay the premium.

Related: Get The BEST Price On Life Insurance With Policygenius

Receive Government Benefits For Disability

Short-term disability benefits are not available from Social Security. When I lived in California, short-term disability coverage was offered by the state. I ran the numbers and declined the policy offered by my job. The state would have paid a similar amount as my workplace policy without the extra cost.

Social Security does offer long-term disability benefits through two programs–Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

SSDI is based on your income and requires you to work for at least 10 years. The maximum monthly benefit you can receive in 2019 is $2,861.

SSI is a needs-based program. It helps aged, blind, and disabled people that have little or no income. The benefits help meet basic needs for food, clothing, and shelter. The maximum payment is $771 for an eligible individual and $1,157 for an eligible individual with an eligible spouse.

Is Disability Insurance Right For You?

When you are pursuing FI, it is tempting to dismiss disability insurance. Your expenses are under control. You’re on a path to eliminate debt. And you could retire early if everything goes according to plan. But accidents and illnesses do happen.

With a high probability of disability at some point in your career, it makes sense to have coverage. As you can see above, you don’t want to have to depend upon government benefits to cover your disability expenses.

Personally, I self-fund the risk of short-term disability with emergency savings and focus on the biggest risk. With an average duration of almost three years, a long-term disability can be a killer to the best of FI plans.

Do you have disability insurance? What coverages and benefits were you most focused on? Share your strategy in the comments below so others can learn from you.

Related Articles