Empower, formerly known as Personal Capital, is our favorite free net worth tracker. We love it for its incredibly intuitive interface, the fact that it allows you to aggregate all your accounts, and because it’s absolutely free!

Empower is our favorite free net worth tracker because you can keep track of your entire portfolio in just one place. You don’t even have to move your accounts. Leave them exactly where they are, and Empower will allow you to view them in one place. It also has other important features like cash-flow tracking, a retirement fee analyzer, and an allocation checkup. The best part? It’s totally free!

Although it’s fundamentally a net worth tracker, Empower is so much more than that. Here are all of the different ways that Empower can serve you and help you keep track of every piece of your financial portfolio.

Empower Net Worth Dashboard

You’ll get a personalized net worth dashboard as soon as you set up Empower. It pops up when you log into your account and allows you to see all your accounts in one place. It combines all your accounts into a single clean chart that gives you a great visual representation of your current net worth and your progress over time.

Financial Tracking Made Simple

We love simplicity here at ChooseFI. We don’t want to log in to 30 different sites just to get an update on our financial situation. Not when we can use a site like Empower that takes care of everything for us.

Don’t get us wrong – we still love Excel sheets because we are nerds and love doing future value calculations and tweaking pivot tables. So don’t worry; we’re not saying you’ll never look at your Excel sheet again. But Empower does all the heavy lifting for us. Happy dance right here.

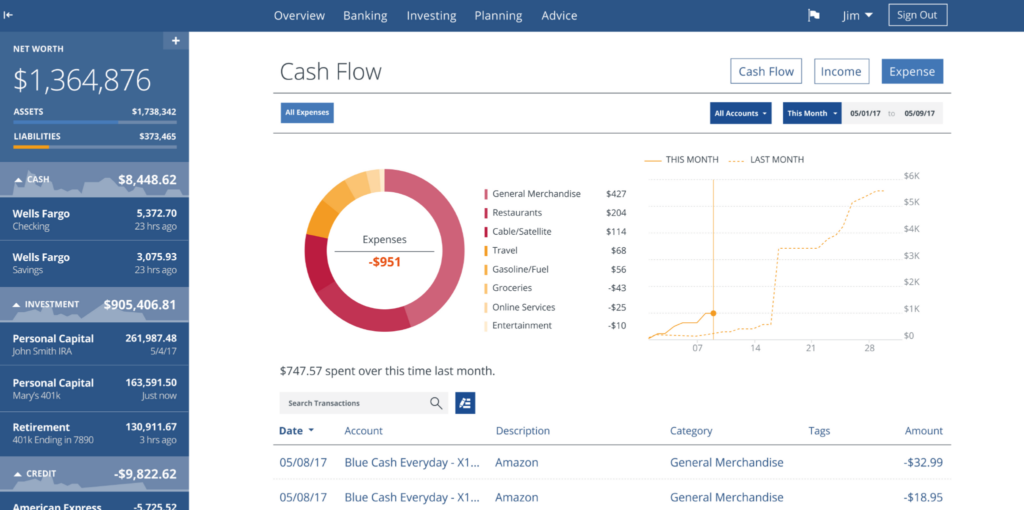

Better Tracking Of Cash Flow Month To Month

You can add your monthly expenses to your Empower dashboard to see how they affect your spending and net worth.

This is a great option for many people who want to have a truly holistic picture of where they stand financially. Some people choose not to use this feature. That’s not because it’s not a good feature but because they prefer to avoid adding the noise of monthly expenses to their overall net worth tracker.

Check your FI plan for free with Empower here.

Tracking Real Estate Investments With Empower

You also have the option to put it in your home, rental property value(s), and mortgage balance(s) as well.

Empower will pull estimated market values from Zillow and the mortgage balances from your lender. You can also manually add the market value of your properties if you don’t like Zillow’s estimates. That is just incredibly convenient!

You’ll link each individual account that you want to set up, and then from there, it kind of takes care of everything for you.

Start tracking your net worth today.

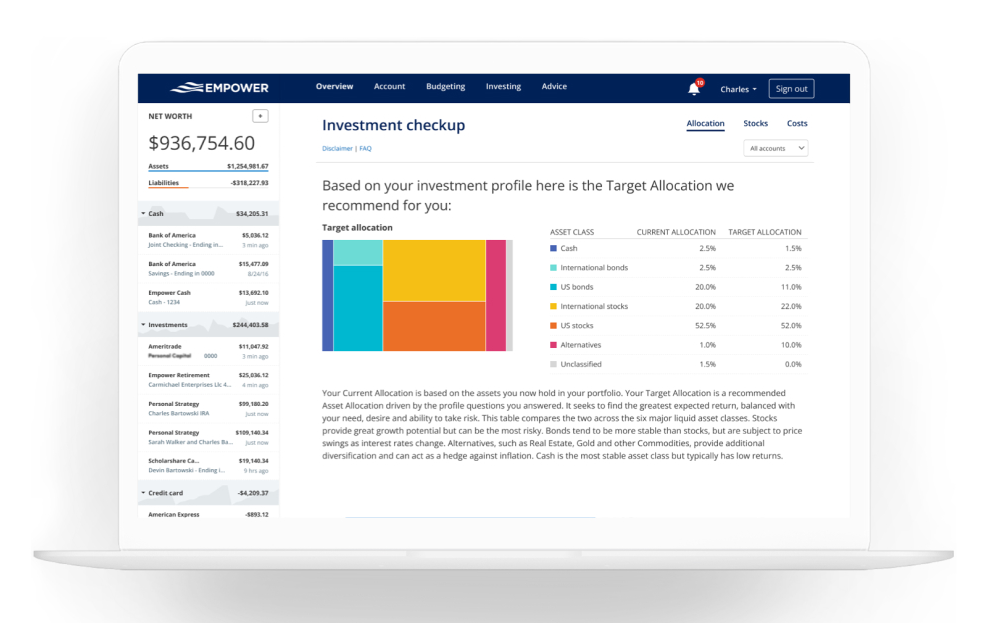

Investment Checkup

Having your accounts spread out all over the internet is a pain. What’s more, it could be dangerous to your bottom line if you can’t get a clear view of your allocation. Empower fixes this for you with its investment checkup tool.

This tool looks at all your investments and gives you a breakdown of exactly what you are holding. This breakdown allows you to look at your cap weight and allocation models. You know how much you are weighted in various sectors and U.S. stocks. This is a fantastic feature.

For example, let’s say you are aiming to have 80% stocks and 20% bonds. If you have mutual funds or EFTs in several different accounts, say your Roth and your 401(k), it’s very difficult to know precisely what you are holding in each fund and how that relates to your allocation goals.

But with the Investment Checkup, you can see exactly where you stand and can then decide if it’s time to take action.

Get started for free with Empower here.

Allocation Against The Efficient Frontier

Empower can show you where your allocation is on the efficient frontier curve. This is a type of risk modeling. Basically, it assesses where you are on this curve in terms of being able to expect a higher return without substantially increasing your risk. The implication is that there is a point of diminishing returns, where you take way more risk than you need for very little returns. It’s good to know where you stand so you can take action on your accounts if needed.

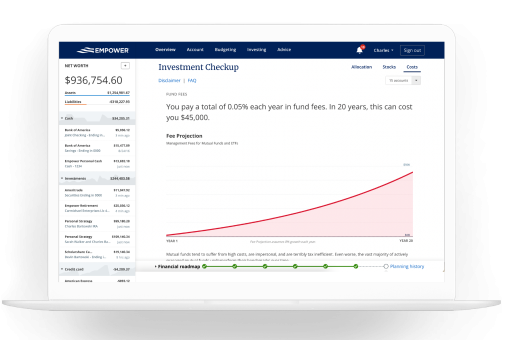

Retirement Fee Analyzer

If you are just starting to pay attention to your expense ratios, Empower has a feature that allows it to look at all the expenses you’re paying on your various accounts. It will highlight any of them that are exorbitant.

If you have accounts with past employers, you may find that they have some monstrously high fees. This is a quick way for you to assess that. After all, knowledge is power. Once you identify that you’re paying too much in fees, in many cases, you can choose to course correct and get into a fund that has much lower fees.

The difference in the fee percentages can be millions of dollars over your working career, so it’s well worth looking into.

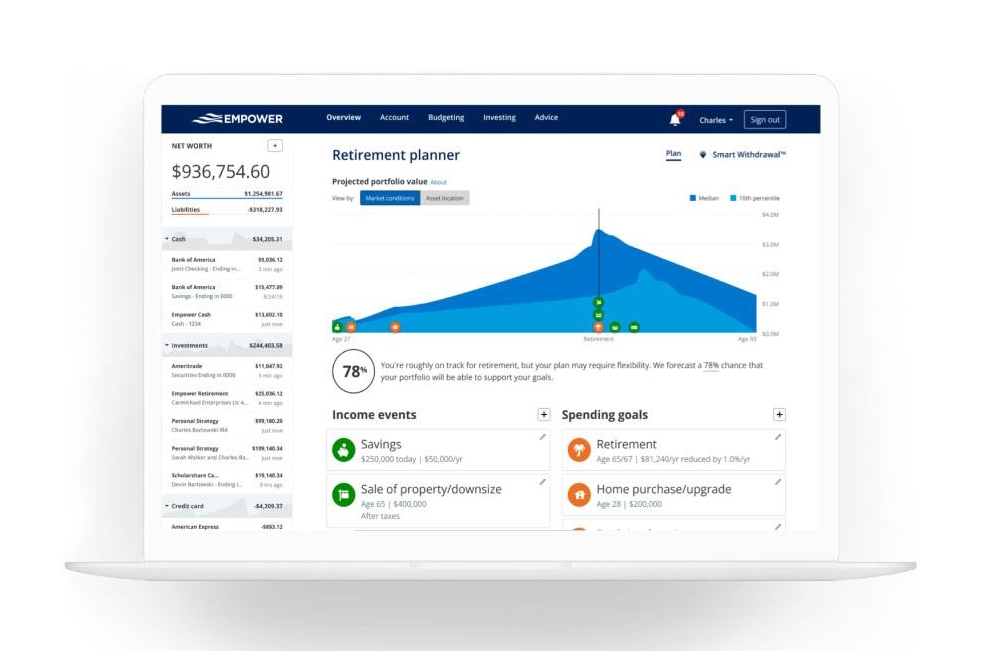

Retirement Planning Calculator

Empower has a wonderful retirement planning calculator. It allows you to input projected monthly spending and projected investments and then determine whether or not you’ll be able to afford this retirement.

You can actually input scenarios to see if they are viable or not. For example, if you say “I want to be able to spend $60,000 a year and I plan on living off of my portfolio at the age of 40…can I pull this off?” It runs 5,000 different calculations and then finds the likelihood that your plan will be successful.

This calculator is incredibly flexible and will allow you to play with all the variables.

It can tell you precisely whether or not you’re going to be able to accomplish your goal. Beyond that, you can add extra features like your Social Security estimate and your spouse’s Social Security estimate to make your retirement planning as accurate as possible.

They continue to improve this tool, so continue to watch for changes so you can keep going deeper into your retirement planning.

Check your FI plan for free with Empower

The Bottom Line

Ultimately, we love Empower so much because it is so simple to track net worth in one place. It’s a longtime favorite in the FI community, and we highly recommend it to the uninitiated.

You can get started for free right now!

Related Articles