If you depend on the Health Insurance Marketplace for health coverage, open enrollment is an important time. First, it’s an opportunity for you to preview any planned changes to your coverage or premium. And if you’re unhappy with your current health insurance policy, open enrollment is your chance to shop around for a better deal.

Even if you currently have private health insurance, it’s a smart idea to check during open enrollment to see if a Marketplace policy could save you money.

For 2020 coverage, most states’ open enrollment begins on November 1st and ends December 15. You can sign up for health coverage at Healthcare.gov or your state’s own exchange. If you miss the open enrollment period, you won’t be able to enroll in Marketplace coverage unless you have an event that triggers a special enrollment period. However, you no longer have to pay a fine for not having health insurance.Continue reading our guide for open enrollment to make sure that you’re fully prepared.

When Open Enrollment Begins And Ends

As stated, most states begin open enrollment on November 1st and close their enrollment periods on December 15th.

The key things to point out here is that open enrollment will end before your coverage begins. This could cause some unpleasant surprises for those who procrastinate checking their coverage this year. If you don’t notice until January that your monthly premium has increased, it will be too late to make any changes.

It’s important to note that if you live in a state that has its own state-run exchange, you may have a longer enrollment period. And your state can always choose to extend their enrollment period. In 2019, all but two of the state-run exchanges chose to add additional time.

If your state has its own exchange, you’ll want to check to see if they’ve chosen a different enrollment period. Otherwise, December 15th is the date to mark on your calendar as the last day you can apply for Marketplace coverage.

Where To Sign Up For Health Coverage Once Open Enrollment Begins

For most states, you’ll sign up for Marketplace coverage at Healthcare.gov.

As mentioned earlier, there are a few states that have their own exchanges. In 2019, there were 12 state-run exchanges:

- California (visit California’s website)

- Colorado (visit Colorado’s website)

- Connecticut (visit Connecticut’s website)

- District of Columbia (visit the District of Columbia’s website)

- Idaho (visit Idaho’s website)

- Maryland (visit Maryland’s website)

- Massachusetts (visit Massachusetts website)

- Minnesota (visit Minnesota’s website)

- New York (visit New York’s website)

- Rhode Island (visit Rhode Island’s website)

- Vermont (visit Vermont’s website)

- Washington (visit Washington’s website)

Changes For Nevada Residents

Nevada has said that they plan to become the 13th state to use their own website, beginning with 2020 coverage. Nevada already has a state-run exchange, but they’ve been using Healthcare.gov for enrollment.

If Nevada does go through with moving away from the Healthcare.gov site, Nevadans will enroll at Nevada Health Link. This is also a good site to check for Nevada Marketplace updates as we near the open enrollment period.

All Other States Should Remain The Same

If you live in any other state, your enrollment platform for fall 2019 should be the same as in previous years. However, the states of Pennsylvania, New Jersey, New Mexico, and Oregon each have exchange platform changes planned for 2021.

For 2020, some states have expanded their Medicaid coverage. Use the Healthcare.gov Medicaid expansion tool to see if your state has expanded coverage.

How To Apply For Marketplace Coverage

If you are already using Marketplace insurance, you may wonder if you can just let your plan auto-renew. The answer is yes. But this probably isn’t in your best interest.

It’s always a good idea to shop around during open enrollment. You’ll also want to check to make sure your plan will still be available in 2020.

If this is your first time using the Marketplace for health insurance, you’ll need to fill out an application. Although arduous, the application is pretty straight forward and easy to understand. But if you need help, you can set up a phone call with a Healthcare.gov Navigator.

It’s important to point out though that the Navigator program budget has been slashed again for the fall 2019 enrollment period. So if you think you’re going to need help, you may want to set up an early appointment with a Navigator or a local broker.

How To Compare Plans

Here are a few things you’ll want to keep in mind when you’re comparing plans on the Marketplace.

Compare Medal Categories

There are four types of health care plans on the Health Insurance Marketplace:

- Bronze

- Silver

- Gold

- Platinum

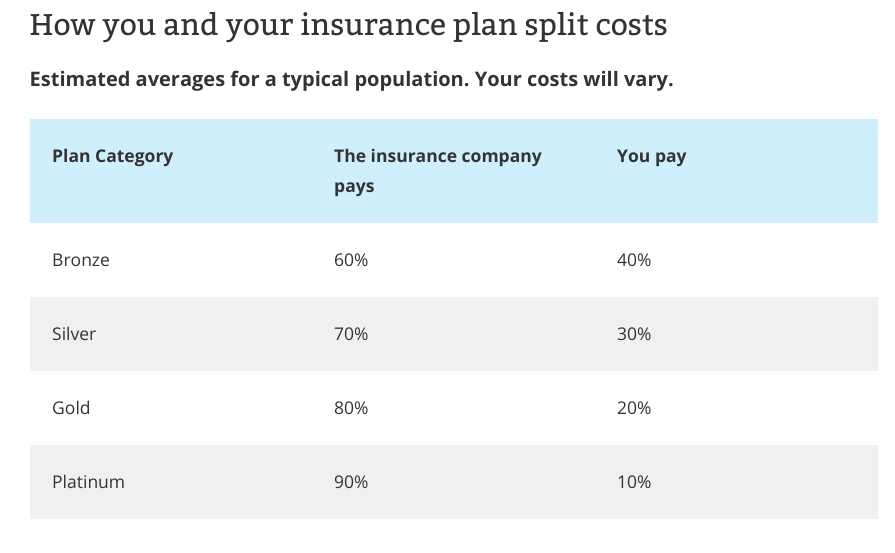

No matter which plan you choose, the quality of care will be the same. The difference between plans comes down to the percentage of your health care costs that you’re responsible for.

As you can see below, Healthcare.gov estimates that the average person will need to cover 40% of their healthcare costs on a Bronze plan, while they’ll only pay 10% on the typical Platinum plan.

The Bronze and Silver plans will have the cheapest monthly premiums, but will also cost you the most when you need care. If you have a chronic illness or you use an expensive medication, you may be better off choosing a Gold or Premium plan. You’ll need to consider your specific health situation in order to choose the most cost-effective plan.

Also, depending on your situation, you may qualify for extra Cost Sharing Reduction (CSR) savings. However, even if you qualify, you’ll only get those savings if you enroll in a Silver plan.

These “extra savings” are different than the premium tax credits which are available at any medal level. You’ll be notified if you qualify for these “extra savings” during enrollment. There is nothing extra for you to do.

Compare Total Costs

In addition to the monthly premium, you’ll want to consider other costs like the plan’s deductible, co-payments and co-insurance, and the out-of-pocket maximum.

It may seem tempting to pick a plan that costs $100 less a month. But if the deductible is $5,000 higher, you could end up paying a lot more overall if you suffer a significant medical event.

Compare Plan And Network Types

If you have a particular doctor or health care facility that you want to use, you’ll want to make sure that they are covered by the plan. There are four types of Marketplace plans–HMO, PPO, EPO, and POS.

Some plans allow you to choose almost any facility and doctor, while others are more restrictive. Learn more about the four types of Marketplace plans.

Related: Planning for Healthcare in Early Retirement

How To Determine If You’ll Receive Any Subsidies

Whether or not you’ll qualify for health insurance subsidies depends on your income level.

- In order to qualify for a premium tax credit, your income will need to be between 100% and 400% of the federal poverty level.

- In states that have expanded Medicaid and Children’s Health Insurance Program (CHIP) coverage, your income will need to be below 138% of the federal poverty level in order to qualify.

- If your income is below 250% of the federal poverty level, you could qualify for extra cost-sharing reductions that would reduce your out-of-pocket costs.

You can use the Healthcare.gov calculator to find out whether you’ll be eligible for any subsidy and how much it would be.

It’s important to note that the premium tax credit is given in advance based on your estimated annual income from your Marketplace application. You don’t have to wait to file your taxes for your tax credit to affect your monthly insurance premium.

Learn more about premium tax credits from Healthcare.gov.

However, if your actual annual income ends up being higher than what you estimated, you may have to pay back some of the credit. On the other hand, if you use less premium credit than you qualify for, you’ll get a refund when you file your taxes.

Finally, if you have an “affordable” minimum value plan available to you through your employer, you’ll be ineligible for a subsidy even if your income qualifies.

What Happens If You Miss Open Enrollment

You don’t want to miss your state’s open enrollment period. If you do, you won’t be able to enroll in Marketplace coverage unless you have an event that triggers a Special Enrollment Period (SEP).

Examples of qualifying SEP events include:

- Losing health coverage

- Moving

- Getting married

- Having a baby

- Adopting a child

Even if you have one of these events, you’ll only have 60 days to enroll in coverage. As someone who recently became self-employed, I can vouch for the fact that the Marketplace holds fast to their 60-day limit. If you try to apply even a few days past the 60-day limit, you’ll be denied coverage and will have to wait until the next open enrollment period.

If your application is denied, you can fill out a Marketplace Appeal Request Form, as long as you do so within 90 days of your denial.

What Happens If You Don’t Buy Health Insurance

Unlike previous years, you’ll no longer have to pay a fine for not having health insurance. But that doesn’t necessarily mean it would be a wise move to forgo insurance altogether.

If your income level is so high that you qualify for minimal premium subsidies (or none at all), you may want to consider shopping for private insurance and choosing a catastrophic plan. This could especially be a good choice if you’re young and don’t have any pre-existing conditions.

Plus, as a bonus, a high deductible health insurance plan will qualify you to open a Health Savings Account (HSA).

Related: The Triple Tax Benefits of the HSA

You may also want to consider alternatives to traditional health insurance, like healthcare sharing ministries or healthcare discount cards.

Final Thoughts

If you plan to use Marketplace health coverage this year, plan to begin your coverage shopping process as soon as possible after your open enrollment period begins.

The sooner you begin shopping around, the longer you’ll have to pick a health insurance plan that’s the right fit for your healthcare needs and budget.

Related Articles