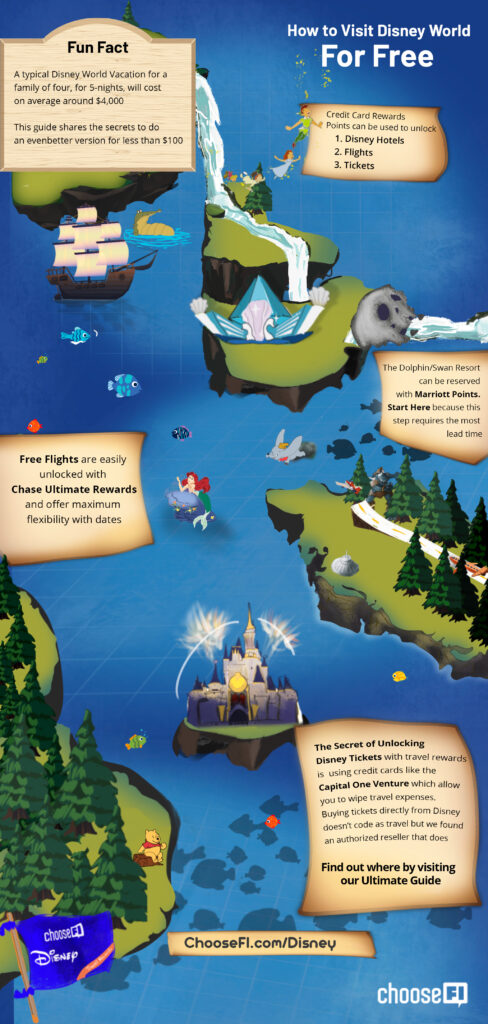

Walt Disney said, “It’s kind of fun to do the impossible.” And he’s right! It might seem difficult, but using credit card rewards points to earn Disney rewards for a free family vacation is absolutely possible!

A trip to Walt Disney World is the quintessential American family vacation. A typical family can expect to pay anywhere from $3,000-$5,000 combined for the ‘big three’ expenses of airfare, hotel, and park tickets to enjoy four days at the House of the Mouse.

You can turn your big Disney dreams into reality and book a trip to the Magic Kingdom for a fraction of the normal cost. All it takes is planning, and a little bit of pixie dust–all in the form of travel rewards!

(Nearly) Free Disney Vacation: Quick Steps

- Each parent opens a Chase Sapphire Preferred® Card and earns the sign-up bonus—this will cover airfare.

- Both parents open a Marriott Bonvoy Boundless® Credit Card and earn the sign-up bonus—this will cover hotels.

- Each parent opens a Capital One Venture Rewards Credit Card and earns the early spend bonus—the reward points can be used to cover park tickets.

Stick with us and keep reading for the full details of each step below!

Using Credit Card Rewards Points For a Disney Vacation

Let’s say you are shooting for a five-night Disney vacation. It will be four people (two adults and two children) on economy flights to Orlando with a five-night hotel stay and four, four-day passes to Disney World.

The 2 Basic Rules

- Earn the sign-up bonus by putting existing expenses on the new credit card. Avoid spending extra money to meet a minimum spend, just to earn the sign-up bonus.

- Pay off the balances on time and in full every month. Travel rewards only make sense if you avoid paying interest to the card issuer every month!

How To Get Free Airfare To Disney

The Chase Sapphire Preferred® Card is one of our favorite cards. It has a sign-up bonus that allows you to earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. The annual fee is $95.

Points are worth 1.25 cents through Chase Travel℠ (the easiest redemption method), so this bonus is worth $750 when redeemed this way.

Chase Ultimate Rewards® (UR) can be used just like cash to pay for travel. When using Chase Travel℠, there are no blackout dates, so rewards points can be used to book any available flight, making it ideal for family travel.

Flights from most major US cities to Orlando can be found for $400 or less. With this one credit card sign-up, two family members should be able to book flights to Orlando. However, both adults in a household are eligible to sign up for their own Chase Sapphire Preferred® Card and earn the corresponding sign-up bonus. So that should cover all four family members.

Helpful Tip: Don’t worry if there’s only one adult in the family earning a paycheck. Use household income when applying for credit cards even if you aren’t the one earning it.

How To Get a Free Hotel Stay At Disney

Important Note: The information for the Marriott Bonvoy Boundless® Credit Card has been collected independently by ChooseFI. The product details on this page have not been reviewed or provided by the bank advertiser.

Earn 5 Free Night Awards (each night valued up to 50,000 points) after spending $5,000 in the first 3 months from account opening with the Marriott Bonvoy Boundless® Credit Card. The annual fee is $95

Orlando has more than 450 hotels to choose from, but when using credit card points to visit Disney World, we recommend focusing on Marriott for a few reasons.

- Marriott gives the fifth night free when redeeming points

- Two on-site Disney Resorts to choose from

- Shuttles to the parks

Staying on-site provides guests with a few extra perks that can make paying the premium worthwhile, such as Extra Magic Hours, FastPass+, package delivery, and on-site character dining.

On-site options:

- Walt Disney World Dolphin: Standard rate is 50,000 points

- Walt Disney World Swan: Standard rate is 50,000 points

Or choose to stay off-site and spend even fewer points. Some of these nearby off-site options include free breakfast, free shuttles to the parks, or kitchens/kitchenettes.

- Sheraton Orlando Buena Vista Resort

- Fairfield Inn and Suites Orlando Lake Buena Vista

- Delta Hotels Lake Buena Vista

- TownePlace Suites Orlando at Flamingo Crossings

- SpringHill Suites Orlando at Flamingo Crossings

Helpful Tip: To book with points and receive the fifth-night free perk, all the points need to be in one Marriott account. Marriott allows the transfer of 100,000 points per year to another member by calling Guest Services at 1-801-468-4000.

How to Get Free Disney World Tickets

Yes, you can use credit card reward points for theme park tickets! Miles earned with the Capital One Venture Rewards Credit Card can be redeemed toward travel purchases made with the card. Simply make the purchase with the card, log in to the account, and redeem the points for a statement credit against travel purchases. The Capital One Venture Rewards Credit Card will earn . The annual fee is $95.

Most Flexible Travel Card

Details: $95 annual fee | Enjoy a one-time bonus of 75,000 Miles once you spend $4,000 on purchases within 3 months from account opening

The Secret To Making This Work:

Point redemptions can only be made against travel purchases. To qualify, the purchase must code as “travel.” Tickets purchased from the Disney website do NOT code as travel. Fortunately, theme park tickets purchased from the authorized seller, Undercovertourist.com, DO code as travel when you use your Capital One Venture Rewards Credit Card to pay for the tickets.

Bonus: Undercovertourist.com tickets are often cheaper than when buying through Disney!

The Step-By-Step Path To Disney on a Dime

The Chase Sapphire Preferred® Card

Step 1: Parent 1 opens a Chase Sapphire Preferred® Card and meets the minimum spending requirement for the sign-up bonus. Total earned: 60,000 sign-up bonus + 4,000 points from spending

Step 2: Parent 2 opens their own Chase Sapphire Preferred® Card and meets the minimum spending requirement for the sign-up bonus. Total earned: 60,000 sign-up bonus + 4,000 points from spending

Step 3: Log in to the Chase Travel℠ to book airfare to Orlando. Fares are listed in both dollars and points. When booking through Chase Travel℠, the ENTIRE fare may be paid with points making it 100% free. No separate taxes or TSA fees!

Helpful Tip: For easier booking within the Chase Travel℠, Chase Ultimate Rewards® points may be combined between members of the same household.

New To Travel Rewards? This Card Is For You!

Ready to unlock a world of free travel? Start with the Chase Sapphire Preferred® Card.

Details: $95 annual fee | Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

The Marriott Bonvoy Boundless® Credit Card

Important Note: The information for the Marriott Bonvoy Boundless® Credit Card has been collected independently by ChooseFI. The product details on this page have not been reviewed or provided by the bank advertiser.

Step 4: Parent 1 opens a Marriott Bonvoy Boundless® Credit Card and meets the minimum spending requirement for the sign-up bonus. Total earned: 5 Free Night Awards (each night valued up to 50,000 points).

Step 5: Parent 2 opens their own Marriott Bonvoy Boundless® Credit Card and meets the minimum spending requirement for the sign-up bonus. Total earned: 5 Free Night Awards (each night valued up to 50,000 points).

Helpful Tip: When additional points are required, Chase Ultimate Rewards® Points can be transferred to Marriott at a 1:1 ratio.

Step 6: Log in to Marriott and search for the Disney World area hotel you are interested in. Reserve with your award nights.

Helpful Tip: Marriott allows you to make points reservations before you’ve earned all the points. If you know your dates, you can make a reservation and lock it in while still working toward your Marriott Bonvoy Boundless® Credit Card sign-up bonus.

The Capital One Venture Rewards Credit Card

Most Flexible Travel Card

Details: $95 annual fee | Enjoy a one-time bonus of 75,000 Miles once you spend $4,000 on purchases within 3 months from account opening

Step 7: Parent 1 opens a Capital One Venture Rewards Credit Card and meets the minimum spending requirement for the early spend bonus. Total earned: Enjoy a one-time bonus of 75,000 Miles + 8,000 miles from spending

Step 8: Parent 2 opens their own Capital One Venture Rewards Credit Card and meets the minimum spending requirement for the early spend bonus. Total earned: Enjoy a one-time bonus of 75,000 Miles + 8,000 miles from spending

Learn how to apply for the Capital One Venture Rewards Credit Card here.

Undercover Tourist

Step 9: Purchase Disney World tickets at Undercovertourist.com with your Capital One Venture Rewards Credit Cards and then redeem your Venture Miles after the fact to erase part or all of the purchase.

The Bottom Line

With some planning, a free trip to Disney World is totally possible. It will take a little bit of effort and coordination to open and coordinate spending so that you can earn the sign-up bonuses but the memories you will make will be worth it.

If you want to learn more about travel rewards ChooseFI has a 6-part “ultimate guide” to getting started with travel rewards that will teach you everything you’ll want to know about travel rewards.

Top Travel Rewards Offers

Top Travel Card

Details: $95 annual fee | Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

Most Flexible Travel Card

Details: $95 annual fee | Enjoy a one-time bonus of 75,000 Miles once you spend $4,000 on purchases within 3 months from account opening

Best Card for Side Hustlers and Business Owners

Details: $95 annual fee | Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.