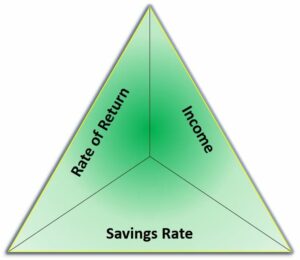

You’ve probably heard the saying, “Earn More, Spend Less, and Invest the Rest.” The Wealth Building Triangle is a way of visualizing each piece of that equation and how they combine to move you toward financial independence.

As the visual below shows, the three sides of the wealth building triangle are: Savings rate, Income, and Rate of return.

Each of the three sides is an integral component in creating wealth in your life and if you’re missing one, you’ll likely find yourself struggling to make progress.

So let’s take a deeper dive into the three components and the roles they play in helping you build wealth.

Savings Rate

We’re starting here because I truly believe that a person’s savings rate is the most important tool in building wealth and achieving financial independence. For the vast majority of readers, it’s also the area where you’ll have the most control out of these three.

How To Calculate Your Savings Rate

To find your savings rate, you first need to decide how you’re going to define it. Some people choose a dead simple approach by dividing the amount they save each month by their take-home pay.

With this approach, if you have a take-home pay of $4,000 and save $1,000, you’re savings rate is 25% ($1,000/$4,000 = .25).

Others, get more complex with calculating their savings rate by using their before-tax income, taking into account the tax money they’ll save by contributing to a 401k, or even counting the portion of their mortgage payment that goes towards the principal.

I personally prefer the simpler formula. But, if you’re a numbers person and doing complicated math makes you feel all warm and fuzzy, then, by all means, go for it!

And if you’d like a more in-depth discussion on how to determine how much you’re actually saving each month, check out our guide to calculating your savings rate.

What Savings Rate Do You Need?

Many people have read Mr. Money Mustache’s “The Shockingly Simple Math Behind Early Retirement.” He illustrates how increasing your savings rate has a double benefit. It means more money going into your accounts every month and it means you need less to live on in the future.

When you allow this concept to really sink in, you begin to realize how much of a game-changer increasing your savings rate can really be. Mr. Money Mustache explained it this way.

If your net worth was currently at zero, here’s how long it would take you to be able to retire at different savings rates:

| Savings Rate | Years Till Retirement |

|---|---|

| 5% | 66 |

| 25% | 32 |

| 50% | 17 |

| 75% | 7 |

Take a closer look at that math. Increasing your savings rate from 5% to 25% is only a 20% savings rate change. Yet, it results in an over 50% decrease in the number of years you’ll need to work before you can retire.

The same is true of increasing your savings rate from 25% to 50%. In this case, a 25% change in savings rate results in cutting your working years nearly in half yet again!

How To Increase Your Savings Rate

While we will discuss how to increase your income in our next section, there are lots of ways to increase your savings rate even when your income is at a standstill. With a little creativity and ingenuity, you can find ways to cut costs on nearly every line item in your budget.

Joel and Alexis are an amazing example of making changes to their savings rate! They went from a 7% savings rate to an 85% savings rate! By systematically reviewing all of their expenses and eliminating the waste. This cut decades off their working career and led to Joel leaving his job.

Liz from Frugalwoods is exceptionally eloquent at communicating the value of frugality. She illustrates that frugality not only increases your savings rate but also improves many aspects of your life.

We often default to thinking of “savings” as a form of deprivation. But Liz shows how aligning spending with our goals means eliminating wasteful expenses and living a more joyous life.

Related: Frugality Without Deprivation

Income

Your income level is undoubtedly a key component of wealth building. You need to have money coming in before you can save and invest it.

Most people have expenses they could reduce to increase their savings rate. But there’s no question that a higher income will make this process easier.

At the same time, we all know people that earn good or great incomes but are still living paycheck-to-paycheck. Joel and Alexis, before their “FI 180,” exemplified this lifestyle.

This is why I think income is second to the savings rate. If you spend like most “westerners” no amount of income will be enough. However, if you can combine a high income with a high savings rate, your journey to FI is officially on “easy mode.”

How To Increase Your Income

Income is sometimes an area of contention in the FI community. Some people tend to think of it as somewhat out of our control. They feel it’s determined by one’s industry and background or by government policies and other external forces.

While these all play a role, we in this community value questioning assumptions and taking action. For each of us, there are likely areas within our circle of influence where we can take steps to increase our income.

Adding A Side Hustle

One of our favorite ways to earn extra income is to add a side hustle. Whenever you hear “side hustle,” most people’s minds immediately jump to someone driving for Uber or Lyft.

And while there’s nothing wrong with choosing rideshare driving as your side hustle, we have lots of creative side hustle inspiration for you here at ChooseFI. Here are a few great side hustle ideas and case studies that you should check out:

How To Start An Etsy Shop Side Hustle

How M.K. Williams Self-Published Three Novels As A Side Hustle

Start Your Path to a New, High Paying Career With Salesforce

There’s no shortage of great ideas that you could apply to start your own side hustle. But what about making more money at your day job? Let’s talk about that next.

Increasing Your Day Job Income

One of the best ways to increase your income is to learn how to negotiate for a raise. If you’re adding great value to your company, you shouldn’t feel bad or embarrassed to ask for your compensation to be increased on at least an annual basis.

Another way you can increase your income is by spending your time more wisely while you’re on the clock. When we interviewed Bradley Rice, his story amazed and inspired us. In order to spend more time with his daughter, he decided to cut back to part-time with his Salesforce job.

But because he found ways to use his time more effectively (and add a side hustle), he made more money working 25 hours a week than he used to make working 60 hours!

Related: Podcast Episode: Career Hacking With ESI Money

Rate Of Return

The rate of return is the last of the three because it’s often a bit of a red herring.

When I’ve seen friends and family first starting to show an interest in their personal finances and wealth building, this is almost always the area that gets the most attention. And it’s easy to see why.

The media is full of discussions about what the stock market is doing each day or the latest craze. Everyone’s looking for the fastest way to turn one dollar into two and this leads to all sorts of mistakes.

Often, we end up chasing quick returns at the expense of long-term performance. Even while writing off our income levels and savings rates as fixed and out of our control.

In reality, it’s quite the opposite. We have the most control over our savings rate and income and the least control over how much our investments return.

It’s not all doom and gloom here though. Asset allocation and fee are the two major areas within “Rate of Return” that are absolutely within your control and are critical in helping you build wealth.

Related: Podcast Episode: JL Collins Stock Series Part 1

Asset Allocation

This simply means the types of investments your money is purchasing and the balance between them. Investors will use the term “Asset Classes” to describe these types of investments.

Common examples are cash, stocks (equities), bonds (debt), and real estate. Each class has pros and cons and it’s important to develop a balance that’s right for your goals.

One common mistake is keeping all of your money in cash (such as in a checking or savings account at your bank) because you’re afraid of a stock market crash. This means you end up with almost no return on investment and lose value to inflation.

Many people in the FI community keep the majority of their money invested in the stock market because it has shown strong returns on average over a long period of time.

Related: Asset Allocation When You Plan To Retire Early

Fees

Another common mistake, which I made starting out, is to ignore the impact of fees. While an investment may lose or gain money in any given time period, the investment’s fees are always going to cost you money.

As such, instead of chasing rates of return (out of your control) focus on minimizing fees (in your control).

The way I did this was by making the switch from an actively-managed mutual fund (~2% in fees) to a passive index fund (VTSAX with .04% fees).

- Two percent may sound tiny, but over the course of a 50-year career, these fees will compound.

- This could cost you 2/3 of your account value. So instead of an account that has grown to $1 Million, you may end up with less than $350k.

Remember, the point of this side of the triangle isn’t to define a single way of earning a return, just to emphasize the benefit in looking for ways to maximize the upside (return) and minimize the downside (risk and cost) in whichever type of asset you decide to use.

Related: Podcast Episode: FIRE State Of The Union With Todd Tresidder

Here are some investing articles you can check out:

- When 2% Costs Everything: How Investment Fees Cost You Your Freedom

- The Advantages Of The Individual Investor: Why You Can Beat Professional Money Managers

- Where Should You Invest? How To Determine Your Asset Allocation

- DRIP Investing: A Low-Cost Automatic Way To Save

- How To Open Accounts With Vanguard, Fidelity, And Schwab

Make The Triangle Work For You

In our financial lives, these three sides of the triangle interact with one another to ultimately determine your timeline to FI.

- For example, increasing your income can lead to an immediate improvement in your savings rate, as long as you don’t also increase your cost of living.

- And your rate of return is almost inconsequential if you’re saving 75%+ of your income.

The really fantastic truth for all of us in this community is that by doing just a little bit better than average in each of the three sides of the triangle, becoming financially independent is almost inevitable! It just becomes a matter of “when” instead of “if”.

- Maybe you can negotiate a raise at work (Income).

- Maybe you can cut out some unnecessary expenses like cable TV (Savings Rate).

- And maybe you can move your investments to a lower cost option (Rate Of Return).

This community and the various episodes of the podcast have great ideas for changes in all three areas. As you make small changes, you’ll find that they start to snowball and before you know it, you’ll be counting down the days until you hit your FI number!

Related Articles