London, UK is a hugely popular tourist destination. It is easy to get to London from many places in the US and it’s a relatively short flight across the Atlantic. There are quite a few direct flights from East and West Coast major airports and major airline hubs. With so many things to do for the whole family, no wonder millions of American tourists visit London every year.

However, it can also be a very expensive destination. You can often get great deals on airfare but accommodations are pricey, whether you are using cash or points.

Let’s look first at the sweet spots for booking award flights to London. There are more options than what I have listed here to find award flights to the UK, but these are the lowest redemptions I have found.

If you really want to maximize your travel rewards check out Ultimate Guide to Credit Card Travel Rewards series.

Air France/KLM Flying Blue

When searching for award flights, look for the flights that require redeeming the fewest points or miles.

Flying Blue points are easy to earn—the program is a transfer partner of all three transferable points programs (Chase Ultimate Rewards®, American Express Membership Rewards, and Citi ThankYou points).

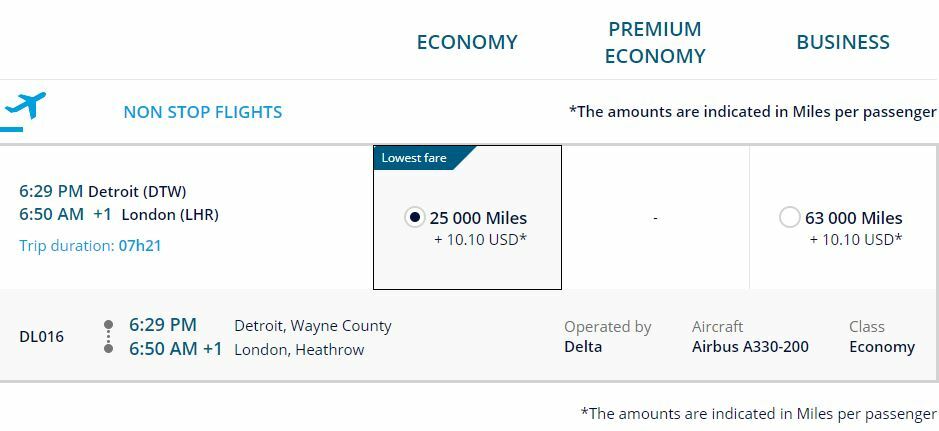

As you can see from the screenshot below, you can fly from Detroit to London on a Delta operated flight in economy for only 25,000 points and $10.

If you were to book the same flight on Delta.com, you would need 32,000 Delta SkyMiles, so this is definitely a great deal!

To book your award ticket with Air France/KLM Flying Blue program you need to create a Flying Blue account. After you have found award availability, transfer your Chase, Amex or CitiPoints to Flying Blue. The transfer is almost instantaneous. Once you see the points in your account, you can go ahead and book your flights.

Delta SkyMiles

The 32,000 SkyMiles needed to fly to London is not a bad deal either, certainly less expensive than other options. And Delta’s partner, Virgin Atlantic, even though not part of the SkyTeam alliance, will allow you to book tickets on Virgin Atlantic with Delta SkyMiles. This gives you more options for award flights to London using your Delta SkyMiles. When looking for award space, always look for the lowest award level, requiring the redemption of the least amount of your SkyMiles.

In the last few months Delta ran has run “award sales”, so definitely be on the lookout for these if you have Delta miles.

Delta miles can be earned by opening one or more American Express Delta cards, such as Gold Delta SkyMiles Credit Card from American Express. The sign up bonuses for Delta cards might seem huge, but I recommend that you have maxed out the opportunities with the Chase before you open Delta credit cards. Delta is also an American Express Membership Rewards transfer partner.

It is pretty easy to look for award availability on Delta.com with their monthly calendar view. Once you find availability online you can book it on the website or over the phone. Another great thing about Delta SkyMiles is that they never expire, so you don’t need to worry about losing them.

ANA Mileage Club

It might seem counter-intuitive to book a flight from the US to London with All Nippon Airways, a Japan based airline. But you can get some good deals to get you over the ocean; and this is where having a good stash of transferable reward points or miles is really important.

ANA is a member of the Star Alliance carriers, including United, Air Canada, and Lufthansa; which would allow you to transfer American Express Membership Rewards points to ANA at a 1:1 ratio. Then you could book your round trip ticket on United or other Star Alliance carriers.

You will need 55,000 ANA Mileage Club miles for economy round trip or 88,000 ANA Mileage Club miles for business round trip.

The real sweet spot here is the business class award. If you were to book a business class award directly with United MileagePlus program, you would need 60,000 United miles one way on a United operated flight or 70,000 one way on United partners. The surcharges will be higher booked with ANA (around $200) but you are saving a ton of miles!

Japan Airlines Mileage Bank

JAL is another Japan based airline that has great award redemption rates to London. Because JAL uses a distance-based award chart, the best redemption will be from the East Coast. You can use JAL miles to book flights on American Airlines or British Airways. However, AA operated flights have a lower cost compared to British Airways.

From the east coast you will need 39,000 Mileage Bank miles for economy round trip or 63,000 Mileage Bank miles for business round trip.

You can transfer Marriott Points to JAL at a 3:1 ratio. You will also get 5,000 airline miles bonus for each 60,000 points transferred, since JAL is a Marriott partner airline. So if you transfer 60,000 Marriott points, you will get 25,000 JAL Mileage Bank points.

You can earn Marriott points by opening Marriott Rewards Premier Plus card or Marriott Rewards Premier Business Card. Please note, Marriott personal card is subject to Chase’s 5/24 rule.

You can also transfer Starwood Preferred Guests points to JAL at the same 3:1 ratio. I wouldn’t recommend applying for these cards if you are under 5/24. Note that Starwood and Marriott have recently merged so the rules may change.

Because JAL, American Airlines, and British Airways are all apart of the OneWorld Alliance, it is best to book your award ticket with JAL by searching for AA operated flights on aa.com and then call JAL customer service to book your flight.

American Airlines

When looking for award space to London, American Airlines has some good deals. (British Airways will show up as well, but be sure to confirm fees and surcharges before booking, as they tend to be costly.)

You will need 45,000 American miles for economy round trip (off peak); 60,000 American miles for economy round trip; or 115,000 American miles for business round trip.

The economy off peak and business class trips are the sweet spot and worth checking out.

You can earn AAdvantage Miles by opening one or more personal or business Citi AAdvantage MasterCards or AAdvantage Aviator Red World Elite personal or business MasterCards. All of these cards have very generous sign-up bonuses and AAdvantage Aviator Red World Elite Mastercard does not have minimum spending requirements.

London Accommodations

Here are a few ways to save on your London accommodations. This list is by no means exhaustive, these are just a few techniques I use to find deals.

Cash Bookings with Hotels.com and other Online Travel Agencies

These general tips apply to any hotel booking; use them to save money on any hotel in the U.S. and abroad.

Hotels.com is well known and a common site used for hotel bookings. Hotels.com has it’s own reward program, can be used with certain discounts and coupons, and is generally easy to use.

Expedia.com also has its own rewards program.

If you are making a cash booking (vs. an award booking) to make hotel reservations, sticking with one OTA (online travel agency) is always a good idea and start benefiting from their reward programs.

Please note that if you are booking a chain hotel through a third party site like Hotels.com, you probably will not get your chain exclusive elite benefits or earn elite qualifying nights. Always compare prices and cancellation policies on hotels’ own websites and third party sites before you book. Weigh the savings, the offered rewards, the flexibility, and other such policies when determining what is your priority.

For me personally, flexibility and cash savings are more important than being loyal to one chain. There are many wonderful non-chain hotels in Europe that are cheaper or better than major international chains. Being flexible definitely pays off!

Because London is such an expensive city, I recommend staying just outside the city center. London has great public transportation, and the tube will take you anywhere you need to go. There are also, so many beautiful walkable neighborhoods. You will feel more like a local if you are slightly away from the more touristy parts.

Using Chase Travel℠ to Book Hotels

You can book hotels directly through Chase Travel℠. If you have Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card, your points are worth 1.25 cents each. If you have the Chase Sapphire Reserve®, you points are worth 1.5 cents each.

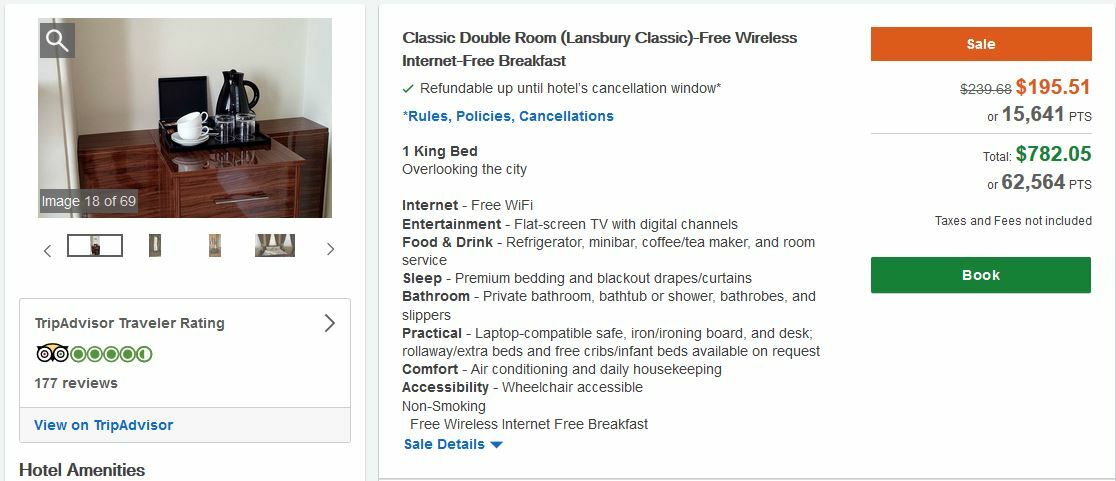

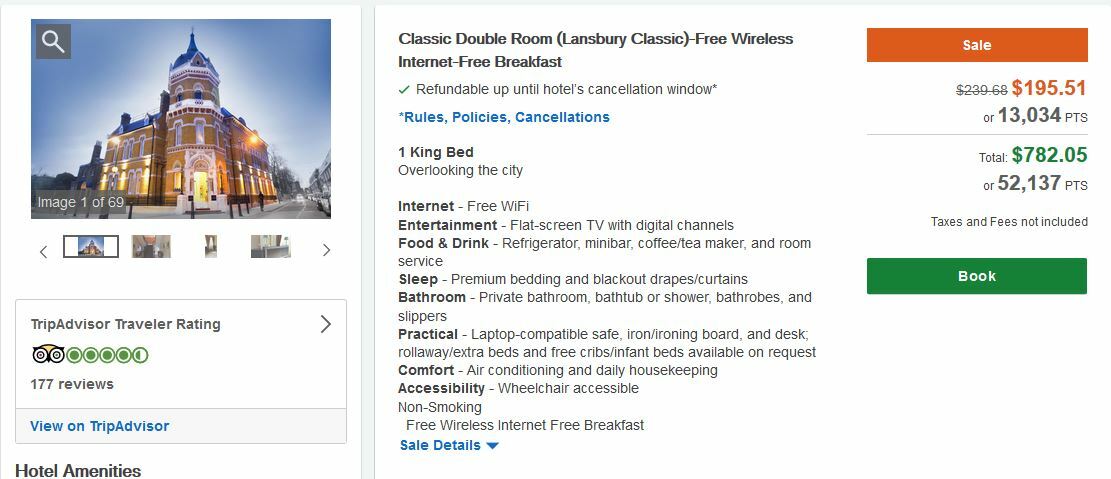

Here’s a charming hotel with great reviews in the Canary Warf area of London. At the time we created this article, you could have booked it through the portal for 15,641 points/night if you have the Chase Sapphire Preferred® Card or the Chase Sapphire Preferred® Card

If you have the Chase Sapphire Reserve®, the same hotel will cost you only 13,034 points/night.

As you can see, the difference in points is substantial. If you have the Chase Sapphire Reserve® and another Ultimate Rewards Earning card, consider transferring the points to the Chase Sapphire Reserve® before you book. It is very easy to combine points from multiple Ultimate Rewards accounts. You can also combine points within the same household.

Marriott

Marriott recently introduced standard, peak and off-peak rates. They also have “stay four nights, get fifth night free benefit” for award stays. This will help to make your stay a little longer and less expensive.

Here are a few Marriott hotels that give your points great value.

Aloft London Excel – category 4 hotel, 25,000 points/night until 2019. After 2019 the rate will change to 20,000-30,000 points. The hotel is located in the Docklands area,which is a bit of a hike to central London but at just 25,000/night, it’s a great value.

There’s a good number of category 5 hotels in London. You will need 35,000/night for a standard room until 2019. After 2019 the rates will be 30,000 to 40,000 points depending on the time of year:

- Town Hall Hotel & Apartments, London, a Member of Design Hotels

- Residence Inn London Bridge

- London Marriott Hotel Kensington

- Hotel Xenia, Autograph Collection

- London Marriott Hotel Regents Park

- London Marriott Hotel Maida Vale

- Residence Inn London Kensington

- London Marriott Hotel West India Quay

- Marriott Executive Apartments London, West India Quay

If you know you will be going to London in 2019 during what most likely be a peak season such as summer months, holidays, etc., you might want to book your Marriott award stay in 2018 and get the best use of your reward points.

You can earn Marriott rewards points by opening Marriot Rewards Premier Plus and Marriot Rewards Premier Business credit cards.

Hyatt

I am a big fan of Hyatt Hotels. Hyatt points are easy to earn by opening the Hyatt credit card or by transferring Chase Ultimate Rewards® points. Two Hyatt hotels in central London aren’t exactly cheap but both are a great value at 25,000 Hyatt points.

The cash prices for Andaz London Liverpool Street and Hyatt Regency London are well above $400 during summer months. So at 25,000 points/night, these two properties are a great deal.

Hilton

Hilton rewards depend upon the hotel category, time of year, and the demand for each property. The best deals for Hilton hotels in London can be found at category 6 and 7 hotels, and there’s a good number of these all around town. The price in points will fluctuate between 30,000 to 60,000 HHilton Honors points.

To see the exact amount of points you will need for a Hilton stay, go to Hilton.com; enter your dates and your destination and on the next screen, in the upper right corner you can toggle between the price in points and the price in local currency.

Final thoughts

You can find cheap fares to London or use miles to get there but your accommodations aren’t going to be cheap. But there are lots of options. Some of the best values would be to book a hotel through Chase Travel℠ using the points you might have with Hyatt, Hilton, or Marriott.

London does have tons of great restaurants including some inexpensive great eats and lots of free attractions so you can still have fun on a budget!

If you really want to maximize your travel rewards check out Ultimate Guide to Credit Card Travel Rewards series.

Top Travel Rewards Offers

Top Travel Card

Details: $95 annual fee | Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

Most Flexible Travel Card

Details: $95 annual fee | Enjoy a one-time bonus of 75,000 Miles once you spend $4,000 on purchases within 3 months from account opening

Best Card for Side Hustlers and Business Owners

Details: $95 annual fee | Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.