Have you ever felt like you can’t relate to a lot of the prominent voices or people in the personal finance community? As a young church pastor, I have to admit that I often felt this way. When I heard people who were making six figures talk about all the money they were putting into …

Category Archives: Uncategorized

How To Calculate Your Savings Rate and Why It’s Important

Savings Rate is the most important factor to determine how long it’ll take you to reach financial independence. The higher your savings rate, the faster your path to Financial Independence. Find out everything you need to know about savings rates and how to calculate your personal savings rate.

7 Decluttering Tips to Organize Your Life in 2024

We all seem to have some clutter around the house, and some of us have a lot of it. This clutter that we have in our environments appears to be pretty innocuous on the surface. However, many of us feel overwhelmed and stressed out when we have far too much STUFF to keep track of. …

Continue reading “7 Decluttering Tips to Organize Your Life in 2024”

Stocks Vs. Mutual Funds Vs. Index Funds Vs. ETFs: A Full Comparison

In the early days of the stock market, it was just that…a market for stocks. And while you can still buy individual stocks today, there are many different investment products vying for your attention, including mutual funds, index funds, and exchange-traded funds (ETFs). With four different popular investing options, how can you know which is …

Continue reading “Stocks Vs. Mutual Funds Vs. Index Funds Vs. ETFs: A Full Comparison”

Starting Your FI Journey and Investing Later in Life | Community Q&A

Every week we here at ChooseFI get hundreds of emails from our community. There have been so many engaging and thought-provoking questions that we created a series dedicated to answering the most frequently asked each week. This week’s question comes from Evelina, who asks: Question: “I don’t have any debt and have six months saved …

Continue reading “Starting Your FI Journey and Investing Later in Life | Community Q&A”

Inflation and Withdrawal Rates | Community Q&A

Every week we here at ChooseFI get hundreds of emails from our community. There have been so many engaging and thought-provoking questions that we created a series dedicated to answering the most frequently asked each week. This week’s question is about inflation’s impact on the Safe Withdrawal Rate (SWR) or the 4% Rule and comes …

Continue reading “Inflation and Withdrawal Rates | Community Q&A”

FI Number and Withdrawal Rates | Community Q&A

Every week we here at ChooseFI get hundreds of emails from our community. There have been so many interesting and thought-provoking questions that we created a series dedicated to answering the most frequently asked each week. This week’s question is about calculating your FI number and withdrawal rates, and comes from YandaPanda, who writes: Question: …

Continue reading “FI Number and Withdrawal Rates | Community Q&A”

Live On Half Your Income And Change Your Finances Forever

If you would like to live on half your income, you will need to make some adjustments to how you live, work and stay entertained. I won’t sugarcoat it, living on half of your income will challenge everything about your life, but it will be so worth it. Because living on half your income means …

Continue reading “Live On Half Your Income And Change Your Finances Forever”

How Meditation Can Affect Your Finances

When my husband first suggested I start meditating, I was intrigued–and skeptical. I’d heard of the benefits and seen the effect it had on his anxiety and depression, but it seemed like such a chore. Sitting silently for an extended period of time sounded like my personal version of hell. How meditation can affect your …

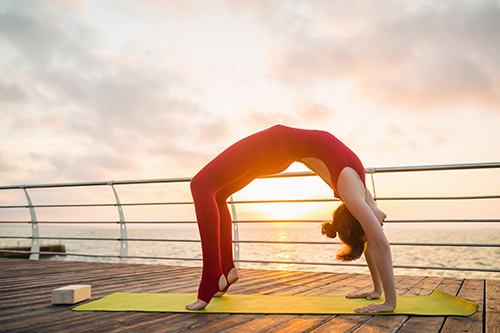

Frugal Fitness Hacks

It probably won’t come as a surprise to many people that the top two New Year’s resolutions are to save money and lose weight. Frugal fitness is at the top of most people’s lists. According to statista.com, a full 53% of respondents were looking to save money, and 45% were looking to lose weight. The …

How To Save Incredible Money By Learning One New Skill Every Month

I’m normally a do-it-yourself kind of guy. There’s a certain sense of pride knowing that I was able to fix this or built that. And it is totally frustrating to me when I have to pay someone for a simple task that I could have done myself. I bet you feel the same way! So, …

Continue reading “How To Save Incredible Money By Learning One New Skill Every Month”

Are You Maxing Out Your 401(k)? Don’t Miss Out On The Employer Match!

One very easy way to put an extra few percent toward your savings rate is earning a retirement savings match from your employer. Every additional percent of your income and your employer’s match that you put away puts you a few months–or maybe even years–closer to Financial Independence. So make sure you have an employer …

Continue reading “Are You Maxing Out Your 401(k)? Don’t Miss Out On The Employer Match!”