The Roth Conversion Ladder…let’s talk about what it looks like in a real world example.

The Roth IRA Conversion Ladder

- The Roth IRA conversion ladder is the key to early retirement and accessing your 401k/retirement funds and paying little to no taxes on the money

- It was amazing how open and honest Brandon was: depression, ‘quarter-life crisis’, deprivation period

- Brad went to a retreat over the past weekend for “designing the life you want to live into”

- Quote from Keith: “I never dreamed past here.” Dream bigger and find what brings you joy and happiness in life

- Money is not the end goal. It is a tool to let you live a better life

- How Brandon tested the upper limits on their spending and how it impacted their happiness (and only a couple of thousand dollars per year)

- Brad thinking differently: How could he spend a little more money to bring more joy to his life

Roth IRA conversion ladder step-by-step scenario:

- 20 year old guy earns $60,000 per year, has $30,000 of expenses per year, and is on a 20 year plan for FI. How does he take advantage of the Roth IRA conversion ladder to pay little to no tax and still fund his early retirement? The Key for the Roth IRA Conversion is to max out the 401K

- Itunes reviews – thanks to the audience!

- Question from the audience: Heather about what to do with her 401k after leaving her job. Should she leave it in her company’s 401k or roll it out to Vanguard and her own IRA?

- Question from Bryan: How the 4% rule works on pulling out money from Roth, 401k, IRA, etc. and how to manage your tax liability in early retirement

- When you reach FI, you aren’t going to sit back and do nothing when “retired”

- Where ChooseFI is going: college hacking from Edmund Tee and Seonwoo Lee

- Tax hack from an audience member: if you can’t itemize every year, consider putting all deductions (donations, state taxes, etc.) into every other tax year so you can itemize every other year and in the off year you get the standard deduction

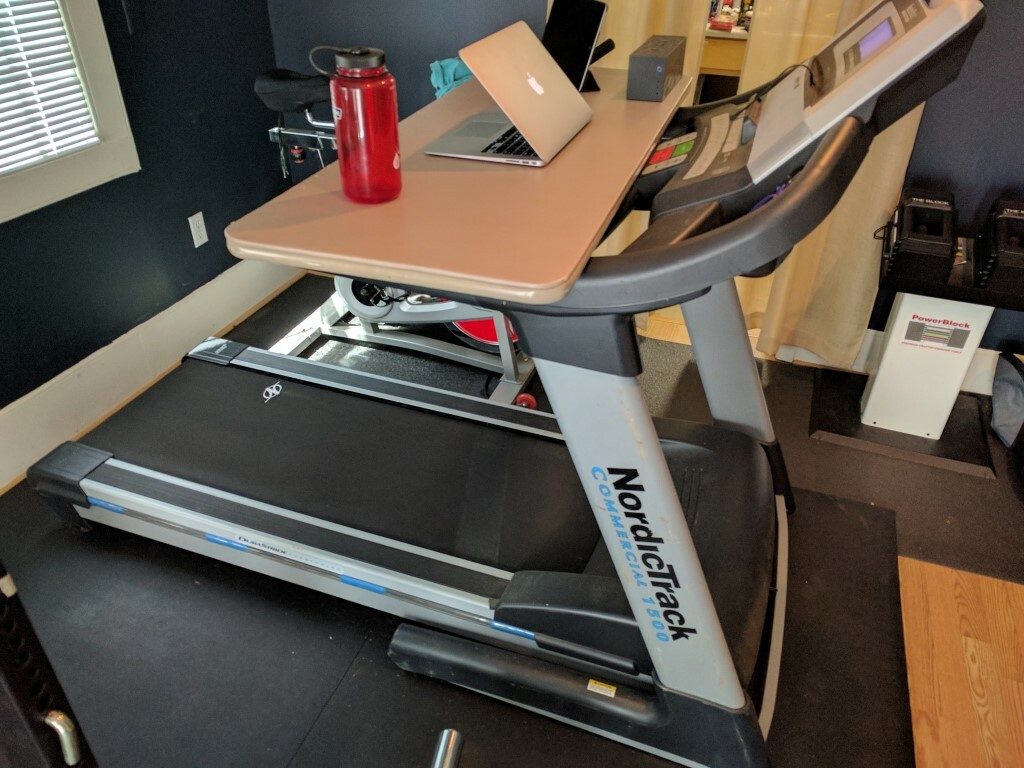

- Frugal hack of the week: Jonathan created a standing desk for his treadmill

For More Tax Related Content

Links from the show: