Roofstock’s mantra is that they offer “radically accessible real estate investing.” And after taking a deep look into what they have to offer for this Roofstock review, that seems to be completely true.

Investing in real estate isn’t as simple as other forms of investment. You need to find properties that can turn a profit, screen tenants, collect rent, deal with repairs, and the list goes on and on. But Roofstock takes 95% of the hassle of buying an investment property off of their customers’ shoulders.

With Roofstock, you can shop right from your computer for investment properties that already have paying tenants. Roofstock provides an impressive suite of tools to help you compare investment properties to find the right home.

Once you’ve picked a property, Roofstock will walk you through the closing process and will connect you with lenders, property managers, and insurance companies. You can start collecting rental income as soon as you close. Roofstock charges a 0.50% fee of the purchase price or $500, whichever is higher.

Roofstock: Radically accessible real estate investing

Turnkey Real Estate Investing

There are a lot of sites out there, like Zillow, that can help you find potential real estate investment properties. There are also a few companies, like Fundrise, that make it easy for you to invest in REITs.

But Roofstock is different in that they sell “turnkey” properties. In other words, the properties that are being sold on Roofstock already have paying tenants. That means you can start receiving rental income as soon as your property closes.

Dive Deeper: Discover Your Options For Investing In Real Estate

Listen: Turnkey Real Estate Investing And How To Build A Team With Paula Pant

Portfolio Investments

With Roofstock, you can also buy a portfolio of investment properties all at once. They say this increases your chances of getting the best deal. They also point out that this can provide immediate diversification in the real estate space and may help you find the best lender rates.

Roofstock: Radically accessible real estate investing

Fractional Shares

Finally, you can buy pieces of rental home investments for as low as $5,000 through their Roofstock One program.

Fractional shares with Roofstock allow you to own a whole or fractional interest in single-family properties. You receive potential passive income and tax benefits with no property management responsibilities.

With Roofstock One, you can buy shares of a property’s equity beginning at 1/10th. This could help you minimize risk by diversifying your money across multiple investment properties.

In the beginning, Roofstock keeps a 10% investment share in every Roofstock One property. They do this so that investors know that they are partnering in the investment and are fully invested in wanting to see it succeed. As far as liquidity goes, you’ll need to keep Roofstock One properties for at least six months. After that, Roofstock will give investors options such as converting to traditional ownership or, at times, the opportunity to redeem shares.

It’s important to point out that the 6-month ownership requirement only applies to fractional share ownership in Roofstock One properties. If you buy an entire investment property through Roofstock’s main service, you can sell your property at any time.

Roofstock: Radically accessible real estate investing

Accredited Investors Only

It should be noted that Roofstock One is only available to accredited investors.

An accredited investor is someone that has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year OR has a net worth over $1 million (excluding the value of his or her primary residence).

Check out Investopedia’s article for more information about accredited investors.

Shopping For The Right Property

Now that we’ve taken a bird’s eye look at what Roofstock has to offer, let’s look a little closer at how their service works. We’ll begin by looking at how you shop for investment properties on Roofstock.

Available Real Estate Investing Markets

Live in an area that’s not conducive to real estate investing? That’s ok. With Roofstock, you can, and in most cases will buy a property from an entirely different region. Roofstock has begun by identifying several markets that are ideal for real estate investing. Currently, Roofstock offers investment properties from the following states:

- Alabama

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nevada

- New York

- New Jersey

- North Carolina

- Ohio

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

- Wisconsin

Roofstock says that they’re always strategically considering new markets to expand into. But there are already plenty of homes on their site. You shouldn’t have a hard time finding a property that fits your budget and preferences.

Research Tools

Ok, so this is where Roofstock really stands out. Buying a property that you can’t actually see in person can be pretty scary. And Roofstock knows this. That’s why they’ve built in a ton of buyer tools to help you analyze properties.

Here are a few of the tools that you can use to compare Roofstock properties.

- Pictures, floor plans, 3-D tour, 3-D model, curb view

- Property inspection & valuation, title report & insurance quote

- Interactive tools for visualizing return and cost estimates

- Current lease, tenant details, and payment history

- Neighborhood Rating and local school scores

- Local property management options

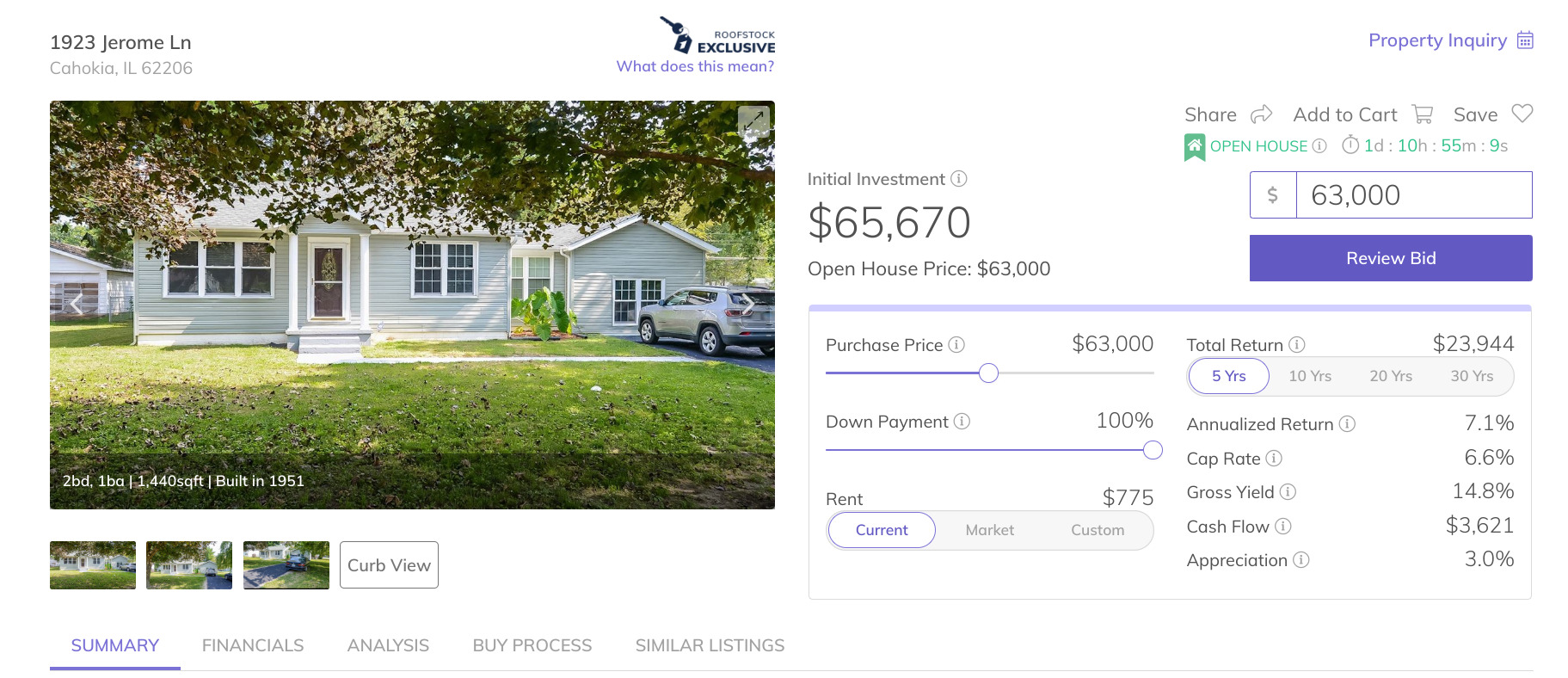

As you can see below, you’ll start your research on the property’s summary page.

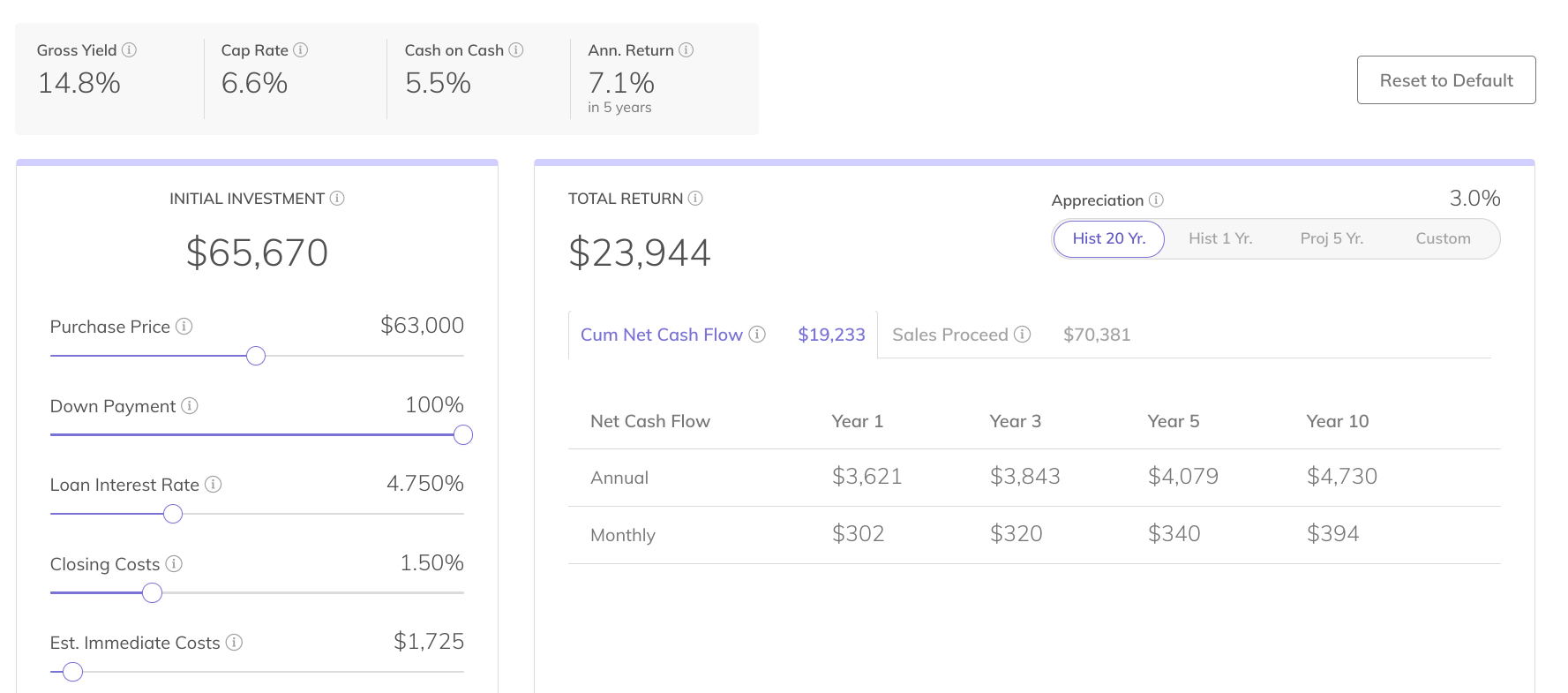

Then, you can check out the property’s “Financials,” including its gross yield, annual return, potential 20-year return, and more.

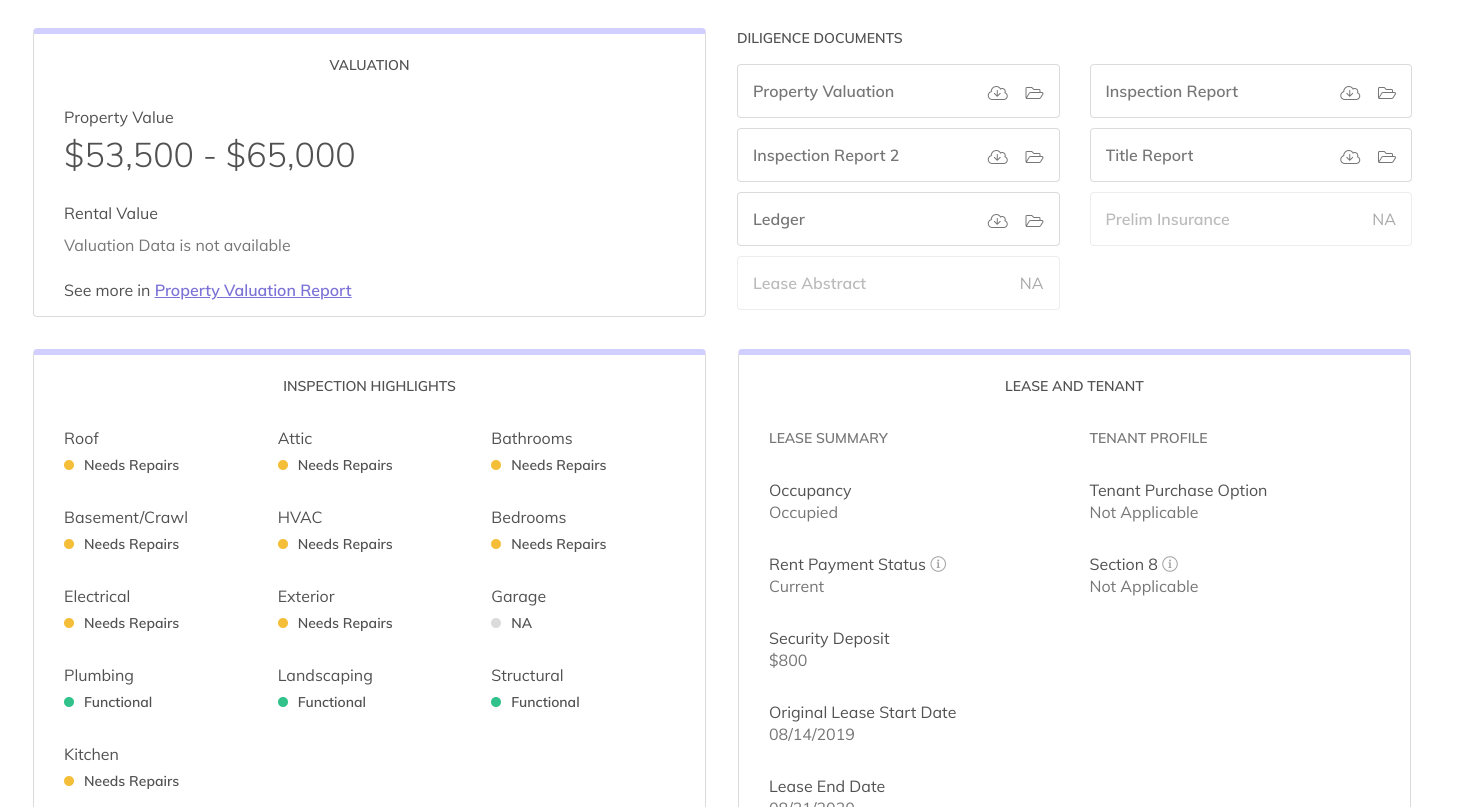

Finally, under the “Analysis” tab, you can see what Roofstock thinks the property is worth, what repairs you’re going to need to take care of, and more information about the tenant.

This really is one of the most important pieces of Roofstock’s service. Without this kind of detailed information, I don’t think very many investors would be willing to buy a property sight unseen. But Roofstock goes above and beyond to make sure that their buys feel at ease with their investment decision.

Take a look at what Roofstock has to offer here.

Pay Full Price Or Negotiate

Once you’ve decided on a property, Roofstock will give you two options.

- Buy Now: With this option, you’ll take a property off the market so no one else can buy it.

- Negotiate: You can make an offer to see if you can get a better price. Roofstock will notify you when the seller had made a decision.

It would have seemed crazy 10 years ago to think that it would be possible to click a “Buy Now” button for an investment property like you buy a pair of shoes on eBay. But Roofstock has made that totally possible.

The Closing Process

Once you’ve decided on a property, Roofstock will walk you through the closing process. You can pay cash or financing. If you need financing, Roofstock can help you find a lender.

The entire closing process is handled online and can be handled quickly within the 1031 Exchange timeframe. Roofstock says that sash sales typically close in about 15 days and financing deals within 30 days. It’s during the closing that Roofstock will collect their 0.50% fee or $500.

With their pricing structure, any contract price less than $100,000 will cost you $500. With a $150,000 home purchase, you’ll need to pay Roofstock $750 and you’d pay them $1,000 for a $200,000 home.

Its also during the closing process that Roofstock will help you secure homeowner’s insurance and, most importantly, help you find a property manager.

Finding The Right Property Manager

Finding a quality property manager is important for any real estate investor. But it’s even more vital when you’re living hundreds or thousands of miles away from your property.

Thankfully, Roofstock has built relationships with some of the best property managers in each of its markets. They’ll help you find the right person. And by taking advantage of their network, you may be able to save money as well.

Roofstock Property Manager Qualifications

Property managers that make it on to Roofstock’s network are heavily vetted and are expected to meet high-performance standards. Here are a few of the things that Roofstock says they look at when they’re considering a property manager.

- The necessary license in good standing

- Responsiveness & transparency

- Historical portfolio performance

- Reporting & data capabilities

- Length of time in business

- Preferred pricing for Roofstock customers

- Referrals from the real estate community

- Recognition from trade organizations

- Fee & pricing structure

- Market Coverage

It’s important to point out that you aren’t required to use one of Roofstock’s property managers. But if you do, Roofstock will introduce you to your property manager and help to get the relationship off on the right foot.

Get started with Roofstock here

What Your Roofstock Property Manager Will Do

Wondering what all your property manager can take off your plate. Here’s a quick list of the types of things that Roofstock says their property managers typically handle:

- Collect and disperse rent

- Address all tenant needs, concerns, and repairs

- Handle all tenant communication

- Evictions

- Preventative maintenance and seasonal care

- Scheduling and conducting routine inspections

- Hiring third-party contractors and providing quotes

- Lease and market your property if vacant

- Respond in a timely manner to any owner questions

- Provide regular updates or a monthly owner statement detailing property profit and loss

- Handle move-in/move-out inspections and security deposits

- Tenant screening and tenant applications

- Ensure requirements are met for section 8 tenants

If your lease expires, your property manager will take care of screening new tenants and getting your home occupied with a qualified tenant as soon as possible. And if your tenant breaks their lease early, your property manager will take care of collecting any additional fees.

What Your Roofstock Property Manager Won’t Do

Here are a few things that will typically be your responsibility to handle

- Paying the homeowner’s insurance premium

- Paying property and city taxes

- Funding the reserve fund

- Approving repairs and paying invoices

- Paying the utilities

- Paying HOA fees (if applicable)

These exceptions aren’t exclusive to Roofstock property managers. No matter who you hire as a property manager, it will usually still be your responsibility to handle these types of things.

How Much Do Roofstock Property Managers Cost?

Each property manager will choose their own pricing system. Most will charge a percentage of the monthly rental income. But some may offer a flat fee pricing structure.

Roofstock says that the average property manager charges 6-10% of the gross collected rent, but their managers will typically charge below 8%. They say that their size helps them negotiate favorable pricing from property managers.

Sell Your Property With Roofstock

It wouldn’t be possible to buy investment properties on Roofstock if people weren’t selling their properties on the site. So, yes, you can certainly sell your rental property on Roofstock.

The big upside to selling your property on Roofstock is that you get exposure to national (and even international) interested buyers. Roofstock says that homes listed on their site sell 77% faster on average than the typical listing. And because everything is handled online, it could help you cut costs. They say the average seller saves $11,500 in selling expenses.

Roofstock takes care of tracking down all of your property information and paperwork as well as creating your listing. They also oversee the closing process and you’ll continue to receive rental income until the deal is done. Your home will need to be in one of their available markets, however, in order to sell with them.

Finally, one of the biggest bonuses of selling on Roofstock is that your tenants will be able to stay in the home. If you have a rental property in one of their markets, selling on Roofstock could be a win for you and your tenants.

Learn more about Roofstock here

Roofstock: When Convenience Is Worth The Cost

In any area of life, you can usually save money if you’re willing to do more legwork on your own. But there are times in any industry where a company nails convenience so well that it completely disrupts the industry.

Amazon did this with shopping. They mastered the process and logistics of online shopping so well that most of us don’t even bat an eye when it’s time to pay our Amazon Prime annual membership fee. And here’s the thing. Shopping for clothes, electronics, and books isn’t really all that complicated. It’s something that we all know how to do.

But buying an investment property is something that many of us have never done. And if you make a mistake it could cost you tens of thousands of dollars. Roofstock knows what you need to be looking for and helps you make truly informed decisions.

For these reasons, I do think that Roofstock’s 0.50% fee is worth what you get in return.

If you’re a real estate investing veteran, you may not find as much value in what Roofstock offers. But if you’re a newbie, Roofstock could cut a lot of stress and worry out of the process of buying your first property and allow you to get started.

Related Articles

- How To Build A Real Estate Snowball Machine Without Debt With Rich Carey

- How To Buy Real Estate In A Roth IRA