Each year, U.S. student loan debt continues to grow. Cumulatively, Americans now owe over $1.75 trillion in student loans. And according to Education Data Initiative, over two-thirds of bachelor’s degree grads from the Class 0f 2023 graduated with debt–with an average debt load of $37,338.

And the student debt situation is even more concerning for graduate students. The average student loan total at graduation for graduate students is now over $80,494, with the average law and medical student owing $118,100 and $250,990 respectively. With those totals in mind, there are key pros and cons you need to consider if you’re thinking about refinancing your student loans.

If you’re feeling burdened by your student loans, you may be wondering if refinancing your student loans would be a good choice. Before making a decision, consider the pros and cons of refinancing such as saving money in interest, having a single payment, and loss of eligibility for forgiveness programs.The Pros of Refinancing Student Loans

There are four main advantages that come with refinancing student loans.

1. You Could Save a Lot of Money in Interest

The biggest reason for refinancing student loans is the money it could save you in interest.

Let’s say you graduate with $50,000 in student loans at an average interest rate of 6.5%. Over ten years, you’d pay $68,129 in total for that $50,000 in debt. That means you’d pay over $18,000 in interest alone.

But if you were to refinance your student loans at 3.5%, you’d drop your overall to $59,332. That’s nearly $9,000 that would stay in your pocket simply by refinancing at a lower rate!

2. You Get a Single Payment With the Lender of Your Choice

Another nice thing about refinancing is that you could eliminate a lot of financial clutter in your life.

Depending on the number of years that you were in school, there’s a good chance that you took out multiple student loans during college. In fact, it’s not unusual for students to end up with 10+ student loans of various sizes.

It can be a major headache to keep track of that many different bills and due dates. By refinancing, you could shrink all of that craziness down to one bill per month. And, on top of that, you get to choose your lender.

Some private lenders are better than others (although virtually all of them will offer better customer service than a federal loan servicer.) Before you choose a lender, make sure to read online editorial reviews and check out their customer ratings on review sites like TrustPilot.

3. You Can Choose a Repayment Plan That Fits Your Budget

As we’ll discuss later, when you refinance federal loans, you’ll lose out on the ability to join an income-driven repayment plan. But that doesn’t mean that private loans don’t offer any payment flexibility whatsoever.

On the contrary, most private lenders offer a wide variety of repayment terms, such as 5, 7, 10, 15, and 20 years. If you want to maximize interest savings, you’ll want to choose a shorter term. But if cash flow is more important to you, then a longer-term may be a better fit.

And if you want ultimate payment flexibility, check out Earnest. They offer over 180 different repayment terms from 5 to 20 years, so can you truly pick the exact monthly payment that fits your budget.

4. You May Be Able to Remove a Cosigner

If you took out private student loans during college, then you’ll most likely have a cosigner on your student loans. And that can be a dangerous thing for the cosigner, as any late or missed payment will affect their credit in addition to yours.

The good thing is that your parents (or anyone who cosigned your student loan) may be able to get off the hook. During student loan refinancing, you may be able to remove your parents from your student loans.

Did your parents take out Parent Plus loans while you were in school? You may be able to have those loans transferred into your name as well by refinancing.

In order to do any of this, however, you’ll need to qualify for the new loans on your own which means you’ll need to have good credit and a strong income. But if you do, refinancing could be a great way to do your parents (or any other cosigner) a solid.

The Cons of Refinancing Student Loans

Ok, so we’ve looked at the benefits of refinancing student loans. But there are several drawbacks that you’ll want to be aware of.

1. You’ll Lose Eligibility for Income-Driven Repayment

Currently, there are four federal income-driven repayment plans:

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

With each of these plans, your payment will be set at 10% to 20% of your discretionary income. That means that your monthly payment will scale up or down with your annual salary.

That means if you’re making a lower income, income-driven repayment could make your payments much more manageable. Unfortunately, you’ll no longer be eligible for any of these plans after you refinance your student loans.

Losing eligibility for income-driven plans isn’t the end of the world. After all, you’ll nearly always end up paying more overall with an income-based plan. And there’s no guarantee that you’ll have a balance left over to be forgiven anyway.

However, if you currently have a very low salary or you have an unstable job situation, income-driven repayment may be a perk that’s worth holding on to.

Related: What are the Best Types of Student Loans?

2. You’ll No Longer Qualify for Federal Forgiveness Programs

Once you refinance your student loans, you’ll lose eligibility for all of the federal student loan forgiveness programs.

Most notably, that means you’ll no longer qualify for Public Service Loan Forgiveness (PSLF). Now if you don’t work in public service or for a non-profit, you won’t qualify for PSLF anyway. But if you do have a non-profit, federal, or state employer, PSLF is probably your best student loan repayment strategy.

With PSLF, you can receive full, tax-free forgiveness in as little as ten years. And, in the meantime, you’ll be in a better cash flow situation because you’ll be making payments on an income-driven plan.

If you think that you could qualify for PSLF, you should definitely not refinance your student loans.

3. You’ll Need a Good Credit Score and a Healthy Income

Deciding that refinancing your student loans is the right move for you is one thing. But actually being able to qualify for student loan refinancing is a whole different story.

At the very least, you’ll need to have a high credit score. Many lenders won’t even consider borrowers with scores that are lower than 660. But you’ll probably need a score in the 700s to qualify for the best rates.

You’ll also need to consider your debt-to-income ratio. Is your student debt total higher than one year’s worth of income? If so, you may struggle to find a lender that will approve your application.

However, some lenders have more lenient eligibility criteria than others. And with a comparison tool like Credible, you can shop multiple lenders at once to see if any are willing to make you an offer.

Related: Refinance Your Student Loans With Credible

4. You Can’t Revert Back to Federal Loans Down the Road

Ok, so let’s say you decide to refinance your student loans. You’re excited that you were able to land a better interest rate which will lower your monthly payments and save you a lot of interest overall.

But then a year after you refinance your student loans, you lose your job. You decide that you’ll just move your student loans back to the Department of Education so that you can qualify for income-driven repayment again.

Except you can’t do that.

Moving student loans from federal to private is a one-way street. You can’t go back to federal loans later. What that means is that you’ll lose out on a lot of payment flexibility once you complete the refinancing process.

Your new lender may have a forbearance program in place. But they definitely won’t have income-driven repayment. That monthly payment is simply going to stay the same until your loans are paid off (or until you refinance again.)

Who Should Consider Refinancing Student Loans?

Based on everything we’ve looked at above, these are the four criteria you’ll want to meet before you refinance student loans.

1. You Work in the Private Sector

As mentioned earlier, if you work in public service, you may qualify for Public Service Loan Forgiveness (PSLF). And that’s a huge opportunity that you need to be taking advantage of.

To emphasize how much money PSLF could save you, consider this case study. Imagine that you owe $35,000 at an average interest rate of 4%, you make $50,000 per year and you have two kids. Using the calculator from StudentLoans.gov we can see how much you’d pay under each type of repayment plan.

With the Standard 10-Year Repayment Plan, you’d pay $350 per month for a total cost of $42,000. With the cheapest income-driven repayment plan (REPAYE), you’d start out paying $150 per month and would pay a total of $47,897 over 174 months.

But with PSLF, you’d only pay $27,000 over a 120-month span. That’s a difference of $15,000 over the 10-Year Standard Plan and $20,000 over income-driven repayment! That’s more money than you’d ever be able to save through refinancing.

So if you qualify for PSLF, go for it! But for private-sector workers, refinancing may be your best way to save money on your student loans.

2. You Have a Good Credit Score and Debt-To-Income Ratio

According to MyFico, these are the three top credit score ranges:

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800+

If you have a credit score in any of these ranges, you may be able to qualify for a great student loan refinancing rate. But if your score falls below 670, you may want to focus on improving your credit first.

Not sure how to check your credit score?

The Federal Trade Commission (FTC) offers each US citizen a free credit report from each of the three credit reporting agencies (Equifax, Experian, and Transunion) within a 12-month period. You can pull all 3 at one time or you can stagger them across the year.

Equifax has also offered all U.S. residents 6 free credit reports per year through the year 2026. That is in addition to the free credit reports you can get via AnnualCreditReport.com. At the time of this Spring of 2023 update, Equifax, Experian, and TransUnion are continuing to offer free weekly online credit reports.

Related: Credit 101 The Ultimate Guide to Credit in 2023

Also, lenders will typically want to see that your combined monthly debt obligations are below 50%. If your debt-to-income ratio is too high, try paying down smaller debts (like credit cards) before applying for refinancing.

3. You Have a Stable Job

Do you have any concerns that you may lose your job or suffer a pay cut in the near future? If so, you may want to stay away from refinancing. With federal student loans, you can join an income-driven repayment plan which would make your student loan payments smaller while your income is down. But once you refinance, federal income-driven repayment will no longer be an option.

However, employees who are in stable employment will deal with the opposite problem. As your income goes up, so will your payments. So income-driven repayment becomes less and less helpful with each additional dollar that you earn. If you expect your income to remain stable or rise over the next few years, it may be a smart move to refinance your student loans earlier rather than later.

4. You’ve Built up an Emergency Fund

If you don’t have an emergency fund in place, you may struggle to make your student loan payments during a financial crisis. And, remember, with private student loans, you’ll have a lot less payment flexibility. To put it plainly, it’s really hard to make your private student loan payments go away (even if you choose a lender that offers hardship forbearance benefits).

For these reasons, make sure that you’ve built up your emergency fund before refinancing your federal student loans. People have different definitions of what a fully-funded emergency fund looks like, but having three to six months of expenses is a good start.

If you don’t meet any of the above criteria, refinancing might not be right for you. However, if you meet all the above criteria, refinancing could be a great move for you and could save you a ton of money over time.

Related: Student Loan Debt Repayment With Travis Hornsby

Credible Can Help You Find the Best Student Loan Refinancing Rates

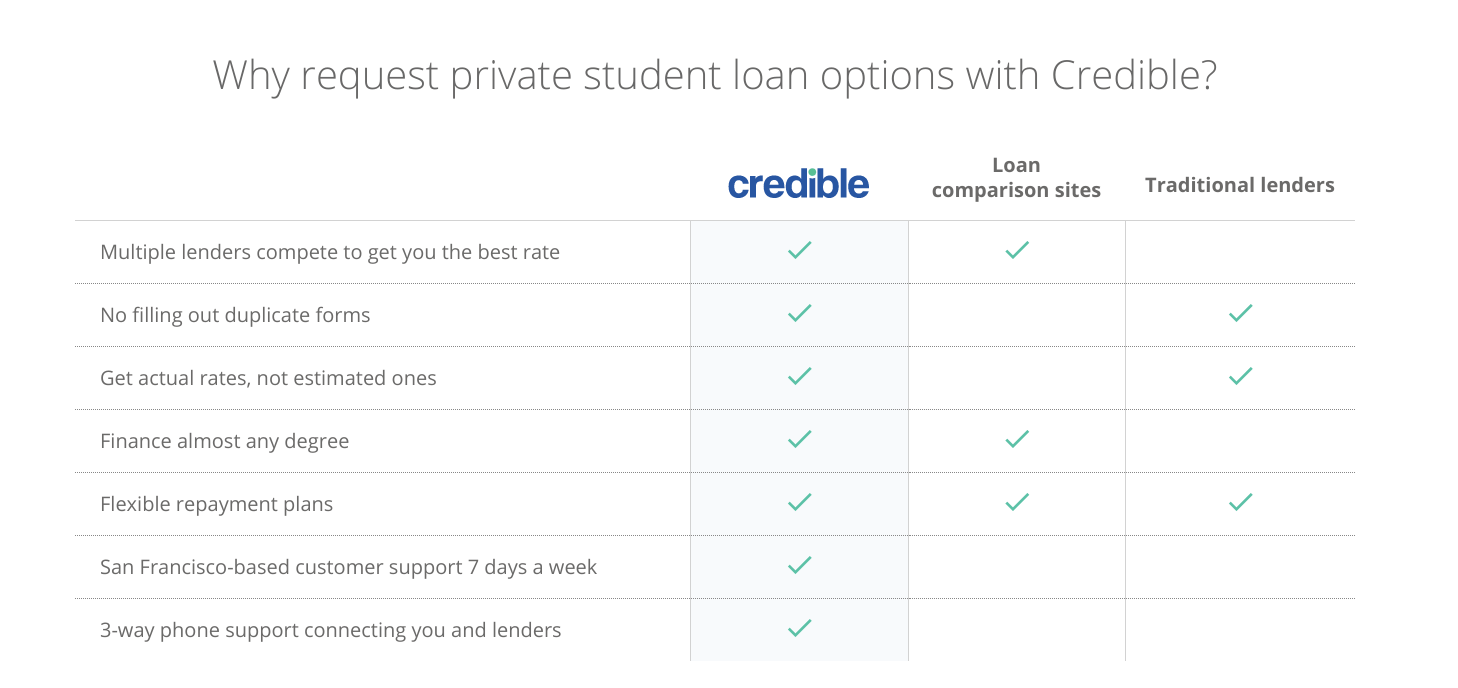

If you decide to refinance your student loans, you’ll want to make sure to shop around with multiple lenders. However, filling out separate applications with each lender can be time-consuming. Credible can simplify the process for you.

Credible is a comparison shopping site for student loans. They’re kind of like the Kayak of student loans. What’s so great about Credible is that you fill out one application and Credible sends it to all of their lending partners on your behalf. And there is no fee to use their comparison shopping tool.

*You can also use Credible to compare private student loan options, as well as mortgages, and personal loans. But here’s how the process works for student loan refinancing.

*Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

Check out Credible for yourself here.

Credible’s Simple Application Process

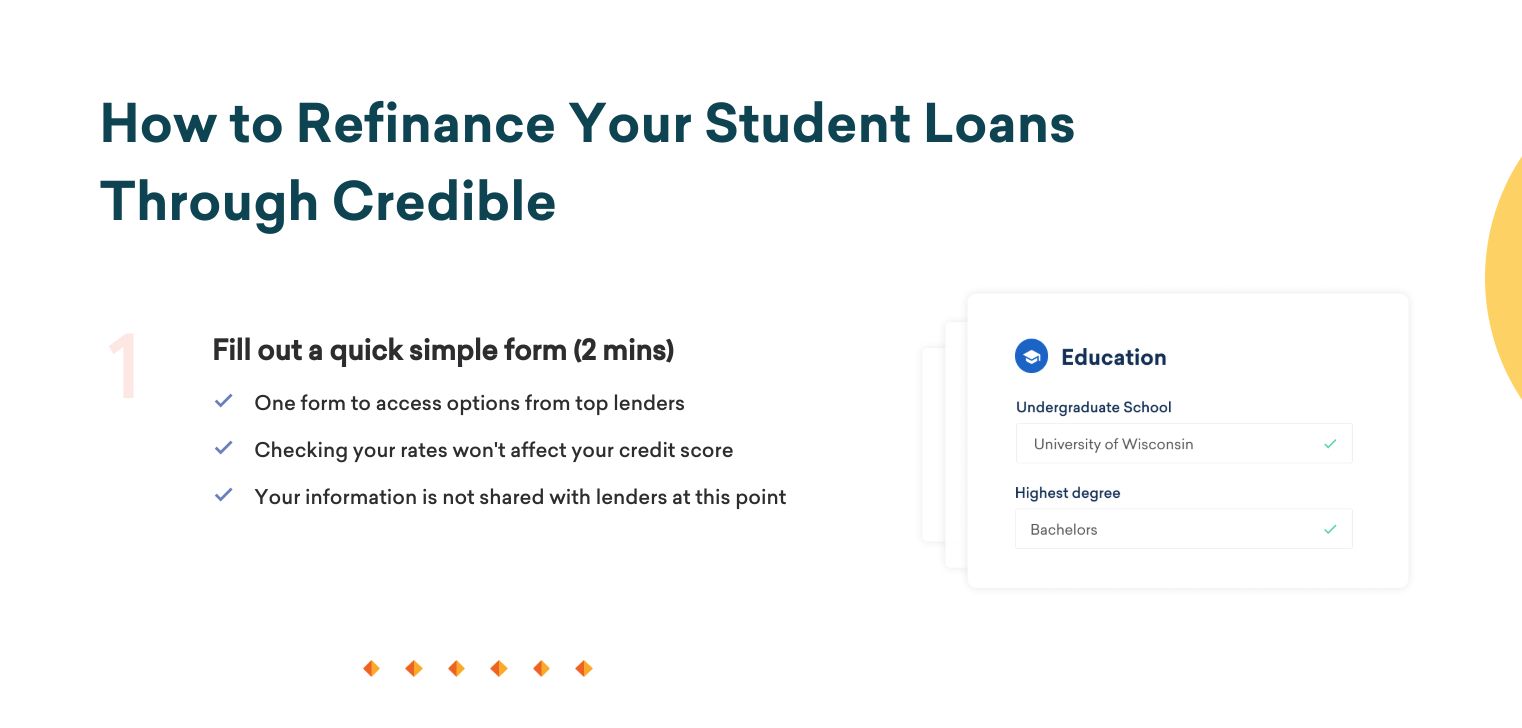

When you visit Credible.com, the first thing you’ll need to is fill out a simple form. Credible says this initial form takes less than two minutes to complete. After filling out the form, Credible will perform a soft credit check to show you your rates. But it should be noted that your information won’t be shared with lenders at this stage in the process.

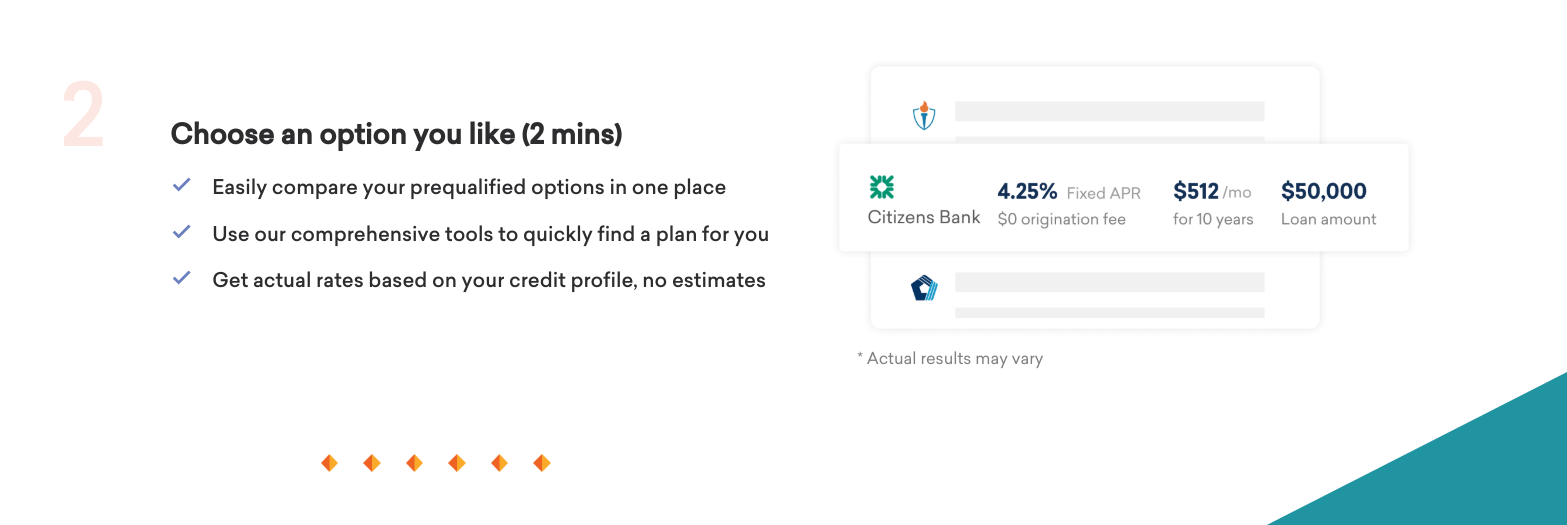

Depending on your credit score, Credible may immediately be able to show you pre-qualified offers from lenders. And they promise that these are real rates based on your credit rating, not unrealistic estimates.

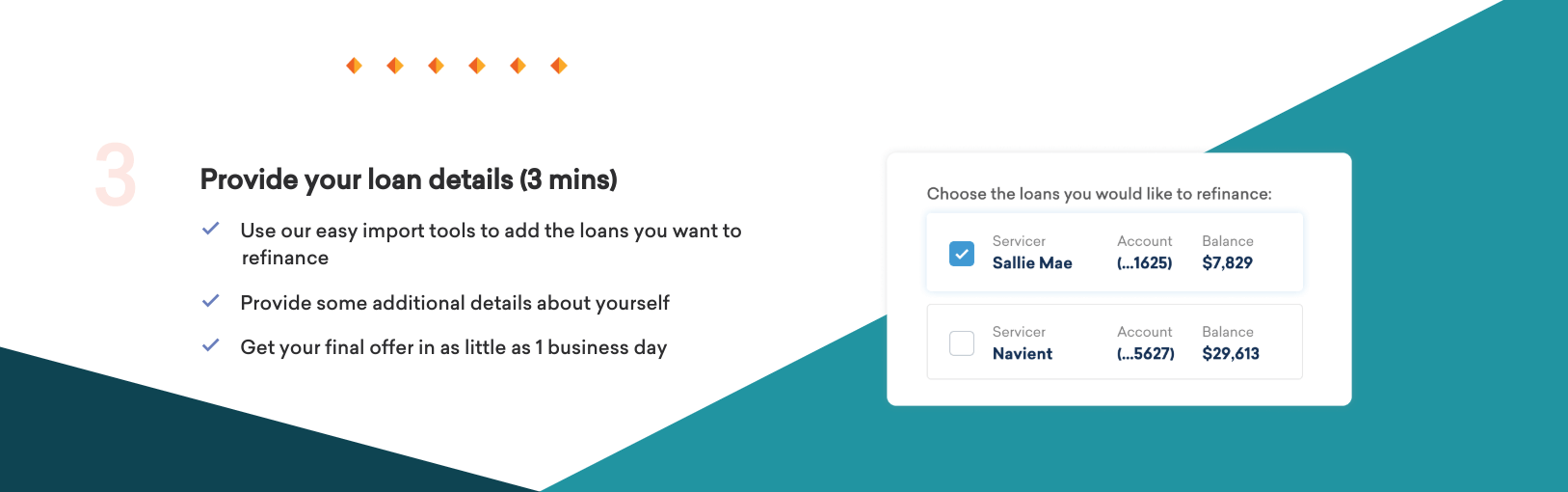

If any of the offers appeal to you, you can move forward with filling out a full loan application. Credible simplifies this step as well by importing your information directly into the lender application.

Once you submit your loan application, the lender must perform a hard credit pull. Credible says that you could receive your final offer in as little as one business day.

Get started with Credible here.

Related: Read our full review of Credible

Do Your Homework Before Choosing a Lender

When you’re comparing loan offers, there’s no doubt that interest rate will be a key factor. But the lender with the lowest interest may not always be the right choice.

For example, one lender may technically offer the lowest rate, but only for variable rate loans. At the same time, another lender may offer you a fixed-rate loan at a slightly higher APR. In that case, it may be worth it to choose the lender that is willing to give you a locked-in rate.

Also, you’ll want to consider payment terms. One lender may only offer five, ten, and 15-year loans, while another offers seven-year terms as well. Finally, you’ll want to consider things like forbearance and deferment options and death and disability discharge.

Consider reading a few editorial reviews from authoritative publications before making a final decision on any particular lender.

Should You Refinance Your Student Loans With Credible?

We always recommend that borrowers who are in the market for student loan refinancing begin their shopping process with Credible. But it’s important to point out that they don’t work with every lender. Here are their current partners as of mid 2023:

- Brazos

- Citizens Bank

- College Ave

- EDvestinU

- ELFI

- MEFA

- RISLA

That’s an impressive list, but it doesn’t include popular lenders like CommonBond, Earnest, or LendKey. We would recommend getting quotes from at least those three lenders as well before you make a final decision.

Related Articles