Everyone’s journey to FI is different. It’s important to know what YOUR journey looks like. You can’t know if you are on track unless you run your specific numbers. Comparing your journey to someone else’s won’t help you. Doing better or worse than someone else doesn’t mean anything to your own journey.

Enter OnTrajectory.

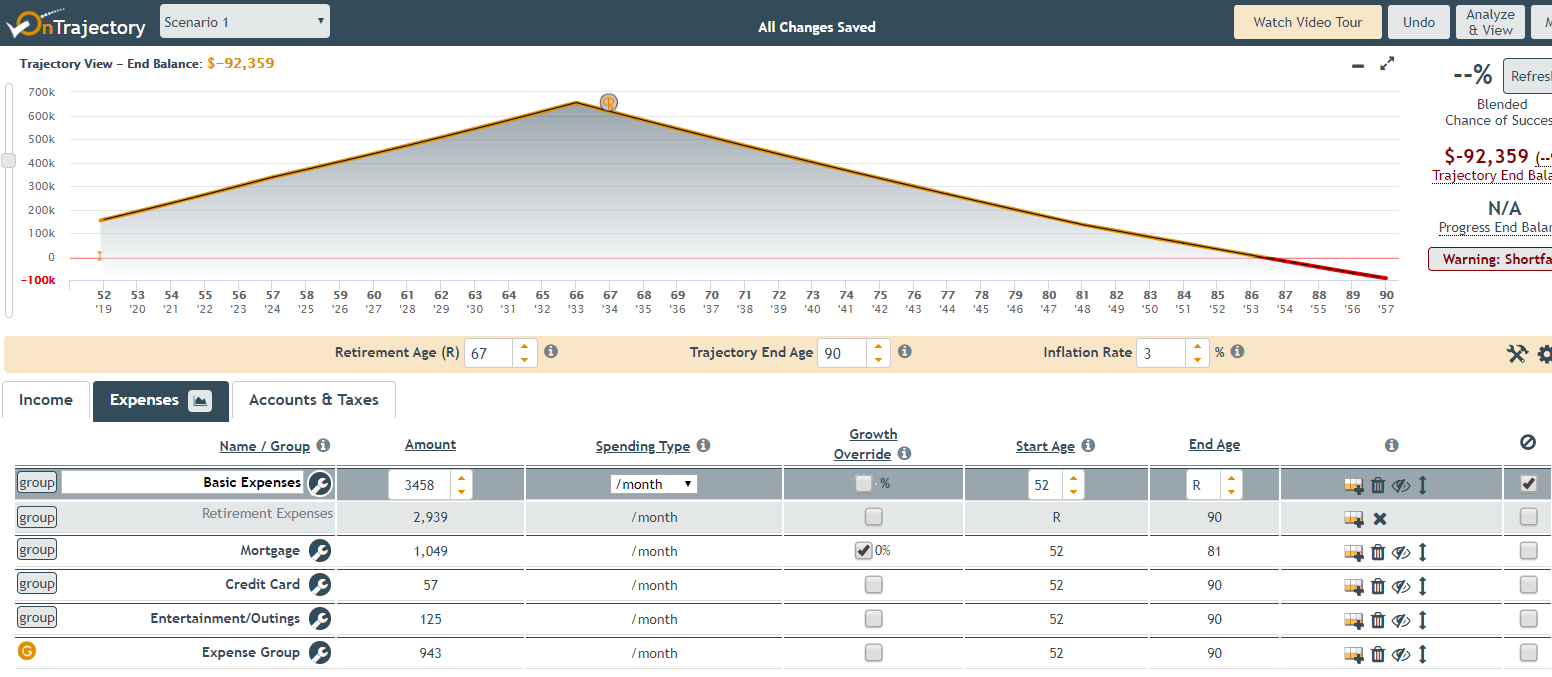

OnTrajectory is a cool site that will give you customized professional financial projections right at your fingertips. You can put in any combination of income, expenses, and savings rates to figure out exactly when you’ll hit your FI goal.The detail of the scenarios the app helps you create is astonishing. You really can personalize it to whatever your individual financial situation involves.

A Great Option For FI Calculations

OnTrajectory helps you figure out exactly where you are financially, and exactly what you need to do to get to FI: Your version of FI.

The interactive app helps you assess different spending, saving and investing scenarios so you can figure out when you can retire and even how long your money will last after retirement.

The OnTrajectory app is complimentary to Mint and YNAB, and a competitor to Empower. When I signed up to use the app, I found it quite easy to use–even for beginners. Here’s how it works. You start by answering four simple questions:

- The year you were born

- Your current savings, investment, and retirement savings amounts

- Your current gross annual income

- The dollar amount you save each month in regular savings and retirement

Then you enter other variables such as your monthly expenses. The system will estimate your monthly expenses, but you’ll want to enter your exact expenses for the best results.

You will also want to enter your estimated “after retirement” expenses. You’ll want to enter what age you want to retire as well. The app will estimate other numbers such as ROI and inflation rate, but you can adjust those numbers to your individual situation too.

After you’ve entered your numbers, you’ll press the “OnTrajectory” Button, and it will show you how much money you will have when you retire and how long that money will last you.

If the results aren’t to your liking, you can change your retirement age, your trajectory age (end of life age) and all other numbers to find the FI scenario that works for you.

OnTrajectory Accounts For All Scenarios

Every FI goal variable is taken into account with this app. You can change your income and add multiple income sources, stating how long each one will last. For example, if you pick up a second job or side hustle, you can enter that income amount and see how it will affect your target retirement date.

You can model the expense stream for various current and future expenses such as vacations, cars, and more. The app gives you multiple levels of control of current and future events to find out exactly how they’ll impact your FI journey.

This is a great way to determine how potential expenses might change your goals too. For instance, let’s say you have a chance to buy a vacation home. You can enter the cost of the monthly mortgage on the vacation home and see how that affects your plans.

The app will show you exactly how that new payment will affect your FI goals, such as how much further that expense will push FI out for you. Each change you make will give you a new graph showing how much money you’ll have when you choose to retire, and how long that money will last you.

The app even has a goals page that will allow you to set various goals and see how those goals affect your retirement date. There are endless ways you could play out various retirement scenarios to create exactly the plan you need to retire–whether early or not.

OnTrajectory Training

Another great feature of OnTrajectory is its free training program. Your live course in FI-Losophy will help you declutter, harmonize and thrive as you work to reach financial independence. This 1-hour-per-week, 7-week course will show you how to best use the Ontrajectory app. In addition, you’ll learn the hows and whys of FI and more.

Founder Tyson Koska teaches the class, which also helps you learn how mindfulness and healthy perspectives affect your financial bottom line. And the course is free with your paid subscription to the app.

How Much Does OnTrajectory Cost?

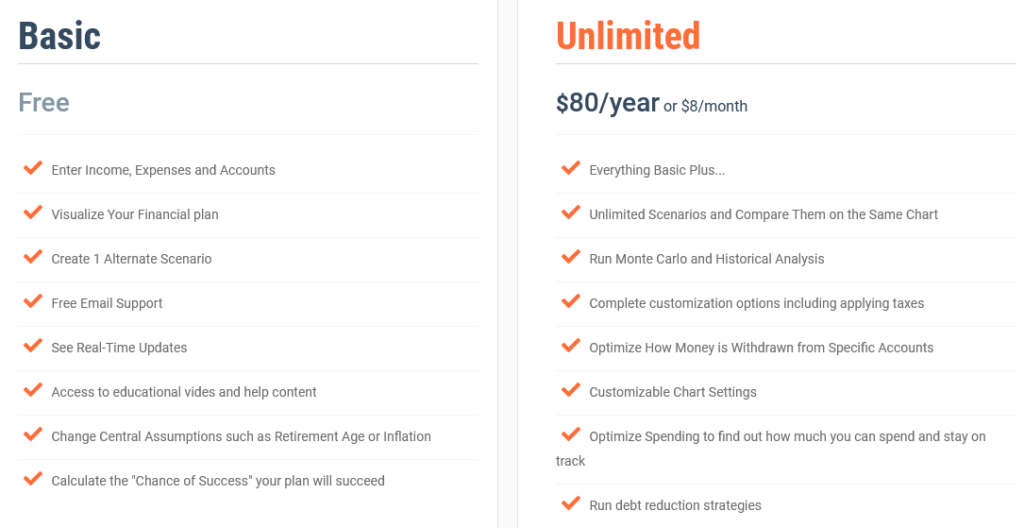

OnTrajectory offers two subscription choices: Basic and Unlimited

The Unlimited offers no limits on income and expense items, individuals, goals or scenarios.

Pros and Cons

Like any personal finance tool, OnTrajectory has its pros and cons. Here’s a quick summary of them.

Pros

- Easy to use

- Free FI-Losophy training

- 14-day free trial for using the app

- A comprehensive app for playing out all of your various potential FI scenarios

Cons

- The app doesn’t offer a free version–only the free 14-day trial

- There’s no advisor option to help you with investing, etc. like there is with Personal Capital

In my opinion, OnTrajectory is worth the cost if you really want to know the details on your FI journey. And if you’re a numbers nerd like I am, the app provides hours of entertainment.

OnTrajectory provides a great avenue for really nailing down how you can reach your retirement goals. And it’s a great tool for helping you stay motivated for the long term journey to Financial Independence.

OnTrajectory’s Founder

OnTrajectory founder Tyson Koska has a common personal finance history story. He grew up in an affluent area, but his family wasn’t particularly affluent. In other words, all the other kids had a lot more cool “stuff” than he did.

This truth impacted him, and when he got his first real job he started to buy all of the “stuff” he thought he deserved, needed and wanted. He entered the military and began working as a warrant officer, and he’d spend his weekends off spending money.

Tyson was spending more than he earned, and by 1988 he had accumulated thousands in credit card debt. He also bought himself a fancy new car–on credit. Subsequently, he got deployed to the Gulf War, and he was earning a lot of money he didn’t have any time to spend.

Tyson knew he wanted better, so he used the money he earned to pay off the debt. After that, Tyson developed a natural affinity for saving and investing. Eventually, he found the FI community and his passion for financial stability flourished. He got married and he and his wife had a baby. Life was flowing along nicely, as was the family’s journey to Financial Independence.

Soon Tyson and his wife were expecting a second child. He was thrilled about this new addition but panicked as he thought about the financial implications of adding a second child. He realized his FI date would definitely be impacted. What should he do?

Downsize the house? Squeeze his already-frugal budget tighter? Tyson wanted to have exact answers to these questions, and thus, the OnTrajectory app was born.

Listen to the OnTrajectory Tyson Koska podcast interview.

Summary

Every journey to FI is unique and knowing if your own numbers are meeting your goals is an important part of FI. OnTrajectory allows you to plug in your own numbers, no matter how complicated, and see if you are on track for FI.

Related Articles