If you are looking for personal finance software to help you take control of your money you’ve probably come across Mint. Mint is a free financial service that allows you to view your entire financial picture in one place, but its real power is in its budgeting tools.

Here’s our review of what you need to know about Intuit’s Mint personal finance software.

What Is Mint?

What makes Mint easier than a spreadsheet is that you can link your various financial accounts to essentially create a dashboard to monitor your finances. Once your accounts are linked, transactions are automatically imported which saves you time from consolidating all of the information yourself.

In addition to budgeting, Mint keeps track of your upcoming bills, savings goals, credit score, and investments.

Because it does all of this for free, Mint advertises heavily to its users. You will see all kinds of offers, from credit cards to mortgage refinancing. Some of these may be helpful to you but always do your research before signing up for something.

Where You Can Use Mint

Mint offers mobile apps in the Apple App Store and the Google Play store. Additionally, you can always log into your account on a computer using your web browser.

Mint Features

Mint offers many features including bill tracking, budgeting, a free credit score, alerts and advice, simple categorization, and investment tracking.

Bill Tracking

After you link all of your accounts, Mint allows you to see at a glance what bills are coming due in the near future, along with their due dates and amounts due. If you download the app on your phone, you can get notifications before bills are due to avoid late payments.

Learn more about bill tracking here.

Budgeting

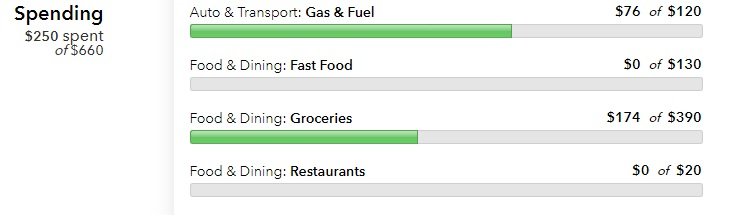

One of the most powerful features of Mint is budgeting. Within Mint, you can set up a budget, track savings goals, and keep an eye on your spending versus your budget in real-time as your linked accounts update.

You set your spending in each category and as transactions come in the amounts are deducted from the appropriate category. For this feature to work best, you’ll need to stay on top of the transactions and make sure they are being categorized properly.

Take the below example; let’s say you spent $55 at a gas station, Mint would automatically categorize that transaction as “gas.” Which may be fine. But let’s say while you were there you also grabbed a sandwich from the deli inside and the $55 includes both gas and your sandwich. To be totally accurate, you’d want to split that transaction into $50 for gas and $5 for food. Mint will not know to do that automatically.

So even though Mint will pull in the transactions and categorize them for you, you’ll still need to take a look at each one and make sure it’s going into the category you intend. You can also create your own categories, or rename Mint’s default ones. And, over time, Mint will learn your habits and begin to categorize transactions based on past events. For example, if you only fill prescriptions at Target, Mint will figure out that Target should be categorized as “medication” not “shopping.”

One last comment on budgeting before we move on. Do you know those confusing descriptions on your credit card statements? Mint changes those to real store names to make tracking your spending easier. Which is nice.

Learn more about budgeting with Mint here.

Free Credit Score

Mint can give you a free credit score as well as factors that impact your score, all for free. Technically, you’ll get a TransUnion VantageScore credit score, not a FICO credit score. While this information is good to know, it also gives Mint access to your credit information which helps them market credit products to you.

If keeping track of your credit score is important to you, consider signing up for Credit Karma or Credit Sesame. Both are totally free ways to stay on top of your credit.

Related: 15 Places You Can Get A Free Credit Score

Alerts and Advice

One of the handy benefits Mint offers is its alerts and reminders. In addition to notifications when bills are due, you’ll also get notifications for when funds in an account are running low, you have an unusual spending pattern, or when you exceed your budget. You can even get alerts when you’re charged ATM fees.

Investment Tracking

Keeping track of your investments can be complicated, especially when you have a 401(k) at work, multiple IRAs, a taxable investment account, and old retirement plans are previous employers.

Mint can combine the information from all of your accounts to get a big picture view of your investments including your overall asset allocation. Mint also analyzes your fees and can help you benchmark your investments against major indexes.

While Mint does investment tracking, here at ChooseFI we think Empower is the way to go if you are looking to track your investments.

Read our full review of Empower here.

Is Intuit’s Mint Really Free?

Is Mint by Intuit really free? The surprising answer is yes. You don’t have to pay a dime and don’t have to input credit card information to use their software.

There are additional services you can pay for, such as their three-bureau credit score and monitoring products, but you don’t have to sign up for them to access Mint.

How Does Mint Make Their Money?

Mint makes money in a few ways. First, you can upgrade from your free credit score to an Equifax three credit bureau credit report and credit score. Doing this will cost you $16.99 per month.

Unfortunately, the credit scores are based on the Equifax Credit Score model, not FICO Score. You can get your credit reports for free once per year from AnnualCreditReport.com. You can get credit reports and scores for free from many other places, too. I can’t recommend paying for this.

Next, Mint makes money when you sign up for products or services they recommend. Whenever you sign up for a new bank account or credit card, the company pays Mint a referral fee for sending them a new customer. Different offers may pay Mint different amounts, so make sure to check the offer they’re showing you is the best you can get before you sign up for it. They may be showing the same offer over and over because it’s the one that pays them the most.

Mint also earns money from ads that may be shown while you use its product. This is pretty common for free products, so it shouldn’t be shocking to anyone.

What may be more surprising is Mint sells your transaction data. It’s important to note, it isn’t selling your specific data. Instead, they combine your data with data from others and make it anonymous so it can’t be traced back to you. After data is anonymous and enough other data has been added, it’s sold as a group to interested parties.

Pros Of Using Mint

It’s Free

One of the biggest things Mint has going for it is the fact that it’s free. While you could end up paying for it in other ways, you could use it without technically paying a penny.

Automatic Importing Of Data

Another huge pro of using Mint is the automatic import of data. The fact that you can link your accounts for free is a powerful tool that helps cut down on input time letting you instead focus on categorizing transactions properly and figuring out how to cut unnecessary expenses.

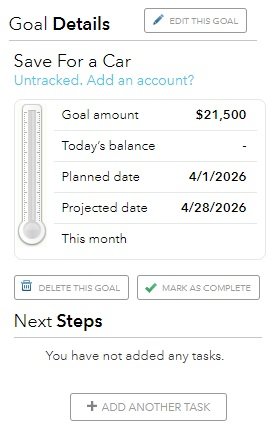

Visualize Goals

The ability to set up and track goals in Mint can help you visualize your progress toward your goals. While the goal-tracking piece of the software isn’t super complex or customizable, it can help keep you updated on your progress and motivated to reach your goals.

Helpful Reports

In addition to comparing your actual spending against your budget, there are other helpful reports and trends you can view within Mint. These reports help you look at your finances in different ways. Then, you can identify where you may have money leaks or other unnecessary spending.

Everything In One Place

Even though Mint may not have the best reporting solution for every area of your finances, they have all of the main financial bases covered. This allows you to have a one-stop shop to stay up to date on your finances, saving you time and frustration from having to learn multiple financial apps.

Cons Of Using Mint

Glitches

While Mint may make your financial life a bit easier to manage, it can be extremely frustrating to use. Glitches seem to be fairly common with the software after reading reviews from other customers.

When I was trying out the software, I ran into one, myself. After linking my investment accounts, Mint told me they couldn’t display my asset allocation at this time and to check back later.

Another common and frustrating error that seems to pop up often with Mint users is synching errors. One of the biggest benefits of Mint is the ability to link your financial accounts and automatically import transactions.

When an account becomes unlinked, you have to spend time relinking them if you can get it to work at all. I suffered through this problem with my old version of Quicken, so I understand how frustrating it can be to have accounts that quit syncing. Unfortunately, it’s just a fact of life with Mint.

Customer Support Is Only Available Via Chat

If you need help, you can access customer support, but that customer support is only available by chat during certain hours. For a free product, at least you can chat with someone to get problems fixed. However, it is often easier to explain problems over the phone than by typing.

It Isn’t All Hands Off

Mint tries to make tracking your finances as hands-off as possible. Even so, it still needs a manual touch to get things right. You’ll need to verify that your transactions are categorized correctly and make updates when you notice expenses didn’t get put in the right bucket.

Automatic Importing Of Transactions May Not Be Good For You

Automatic importing of transactions can save you a ton of time. That said, it might be too hands-off for people that need to tighten up their finances. Manually inputting each expense makes you realize exactly how much you spent on each purchase. Automatically importing transactions allows you to not view every single expense if you rather just look at the reports that are generated based on your transactions.

You “Pay” For Free Software

Finally, because Mint is free, you’re being advertised to and you’re giving data away for free. If you don’t have any issues with this, it isn’t a problem. On the other hand, many people would rather pay a small fee to keep their data private or to avoid seeing ads. In fact, ads tempt you to spend or get new products when you’re trying to buckle down and improve your finances.

Is Quicken Better Than Mint?

Quicken and Mint used to be owned by the same company, Intuit. Originally, Quicken was one of the major desktop-based personal finance tracking software programs available. A few years ago, Intuit sold Quicken and it is now run by a different company.

You used to buy Quicken once. Then, each year an update was released. You could upgrade if you wanted to purchase the new software, but you didn’t have to because Quicken came with three years of automatic updates from accounts you linked. Even after automatic updates no longer worked, you could still use the software by manually inputting your information.

Unfortunately, the new company changed Quicken to a software-as-a-service model. Now, you have to pay anywhere from $34.99 to $89.99 per year to have access to the software. If you don’t renew, you lose access.

Quicken offers many of the same features as Mint, you just pay for them. While I would have recommended the previous versions of Quicken where you could download and keep your software even after free updates expired, I don’t think paying for a yearly Quicken subscription is a great deal when you can get many of the same features for free through Mint.

Is Mint The Best Finance App?

While Mint may be the best finance app for one person, another app may work better for someone else. Ultimately, it comes down to your personal preferences and why you’re using Mint.

If your main goal is tracking your investments, a free app like Empower may better suit your needs. If your main goal is improving your finances with strict budgeting, Mint may be best for you if you like how their budgeting tools work. Others may prefer the budgeting tools offered by a paid app like You Need A Budget.

Giving Mint a try doesn’t cost you a thing. Sign up for a free account and see how you like their service. If you don’t like it, try another free service or consider paying for an app like You Need A Budget or even Quicken.

Make sure to take advantage of any free trial offers. Then, you can see if you like the app before you commit to the cost. This isn’t a problem with Mint since it’s free. If the app charges you upfront, don’t forget to request a refund if you end up not liking it within the risk-free trial period.

Related Articles