If you don’t drive very much you might be able to lower your car insurance bill with Metromile.

Maybe you bike to work, work from home, travel a lot, or you’ve retired and just don’t drive that much anymore. Metromile charges a low monthly base rate and then per mile. If you don’t drive your car very much this could save you a lot of money.

About Metromile

Metromile was founded in Redwood City, CA by David Friedberg and Steve Pretre in 2011. They were tired of watching low mileage drivers throw away money on costly insurance that favored those who drive more often.

Out of frustration, they became determined to disrupt the $250 billion dollar auto insurance industry. Thus, Metromile was born.

How Does Metromile Work?

Metromile takes a very different approach to auto insurance. Aiming to cover drivers who don’t drive frequently, but still want comprehensive coverage for when they do drive. Through their unique system, you might find yourself paying way less each month.

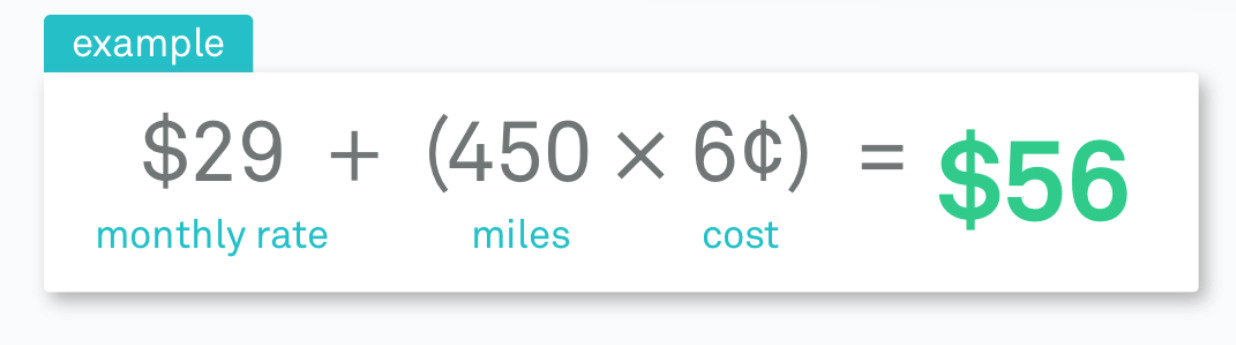

Metromile begins building your monthly bill with a flat fee starting at $29 per month. This is the base of your bill, which has a premium tacked on to it based on the miles you drive.

Your premium is made up of a per mile rate, calculated at the end of the month by a device that you install in your car yourself. While you might be panicking, calculating how much it would cost you to drive to work, remember that each mile will only cost you pennies.

When you sign up for Metromile, you will be given your own personal premium based on a variety of different factors, including the age of your vehicle, miles driven, and desired coverage level.

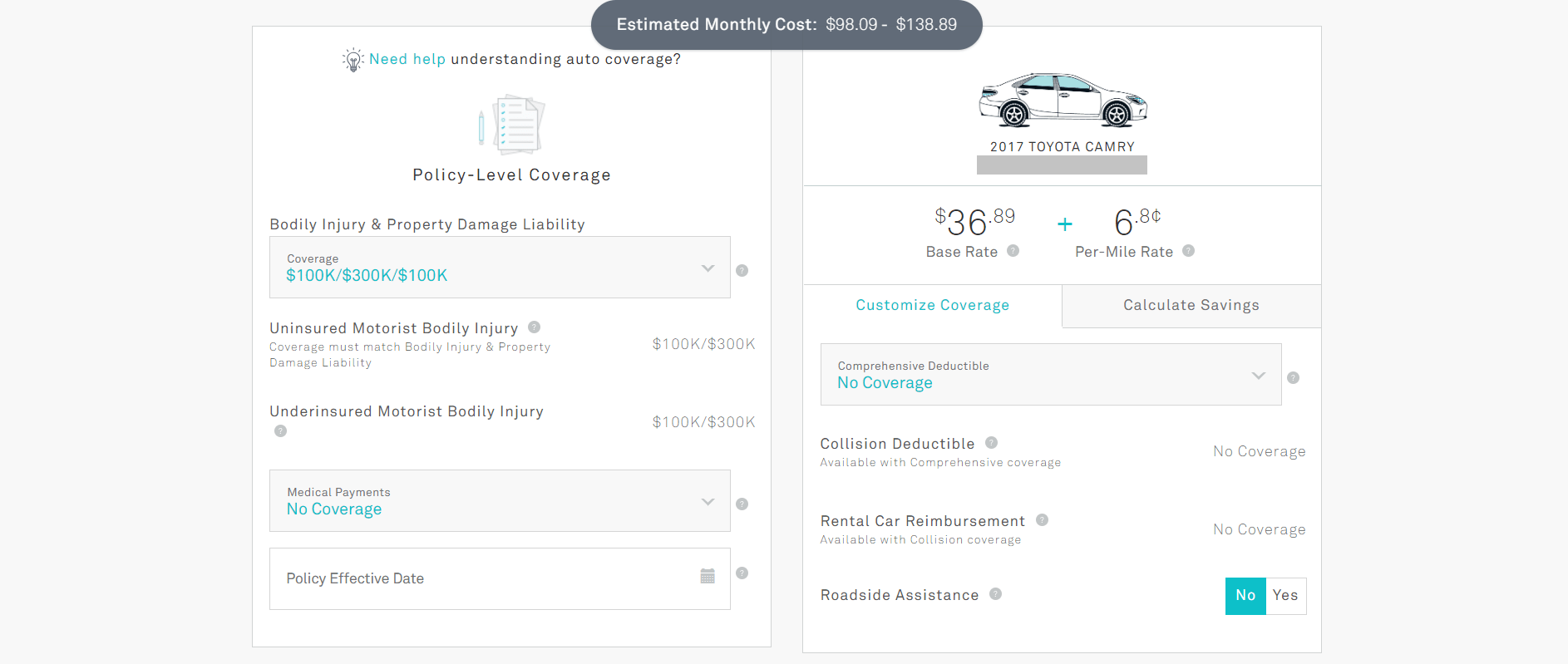

Here is an example of what your rate could look like:

You may be wondering what happens if you decide to finally take that road trip that you have always wanted to take. Will your car insurance suddenly go through the roof because you drive across the country?

Luckily, Metromile only charges you for the first 250 miles (150 in New Jersey) that you drive per day. With their fee structure, Metromile claims that the average driver, who only drives 5,000 miles a year, saves $611 on average!

Getting A Quote

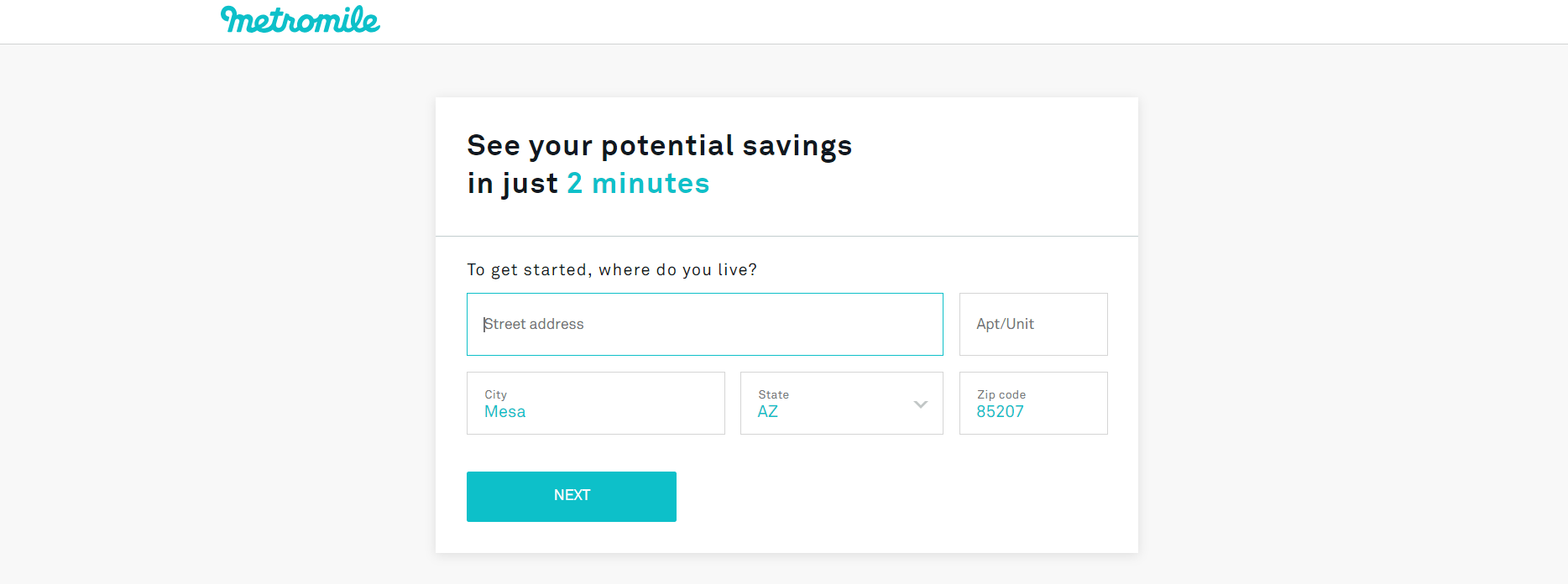

While Metromile isn’t in my state yet, I do have a friend in Arizona who was interested in getting a quote from Metromile and shared her experience with me. (There is a full list of states they operate in below.)

It was so easy! I didn’t even have to enter any vehicle information. I put in my name, address, and birthday and it pulled up all my vehicle information automatically. Since my husband has a long commute I knew Metromile wasn’t going to be a fit for his truck. I was able to easily remove his truck from the quote and only get a quote for my Camry.

After entering her zip code on the home page she was taken to a screen to enter her address:

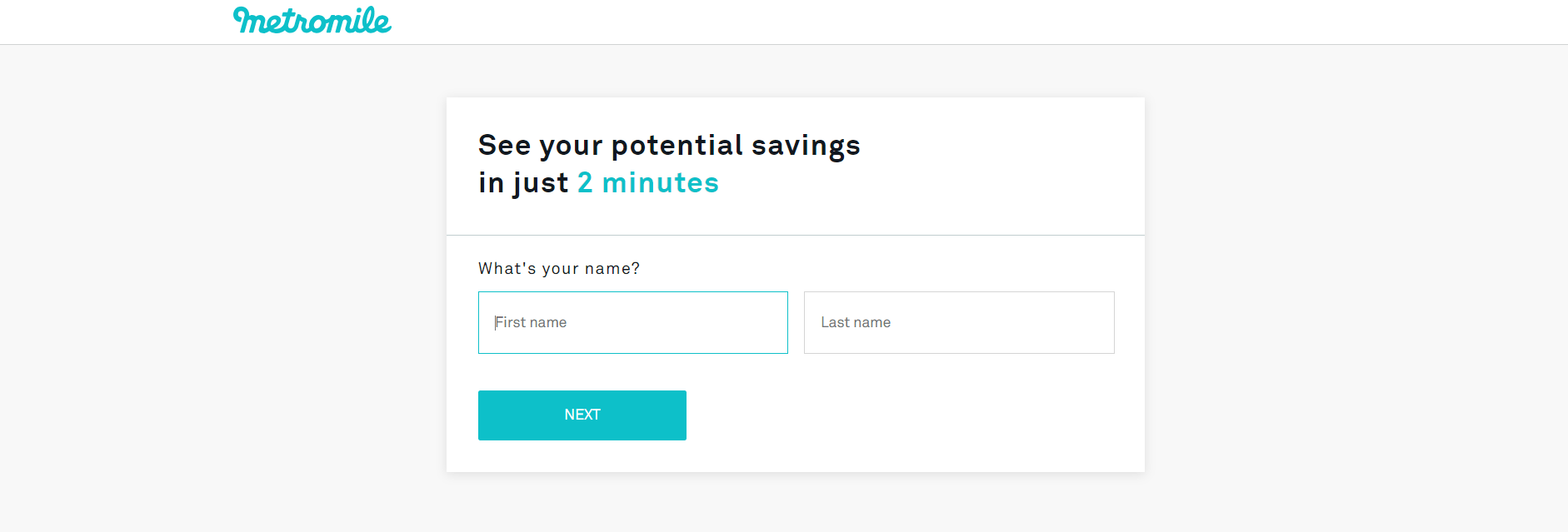

Then she was asked her name: (this is real tough stuff, guys!)

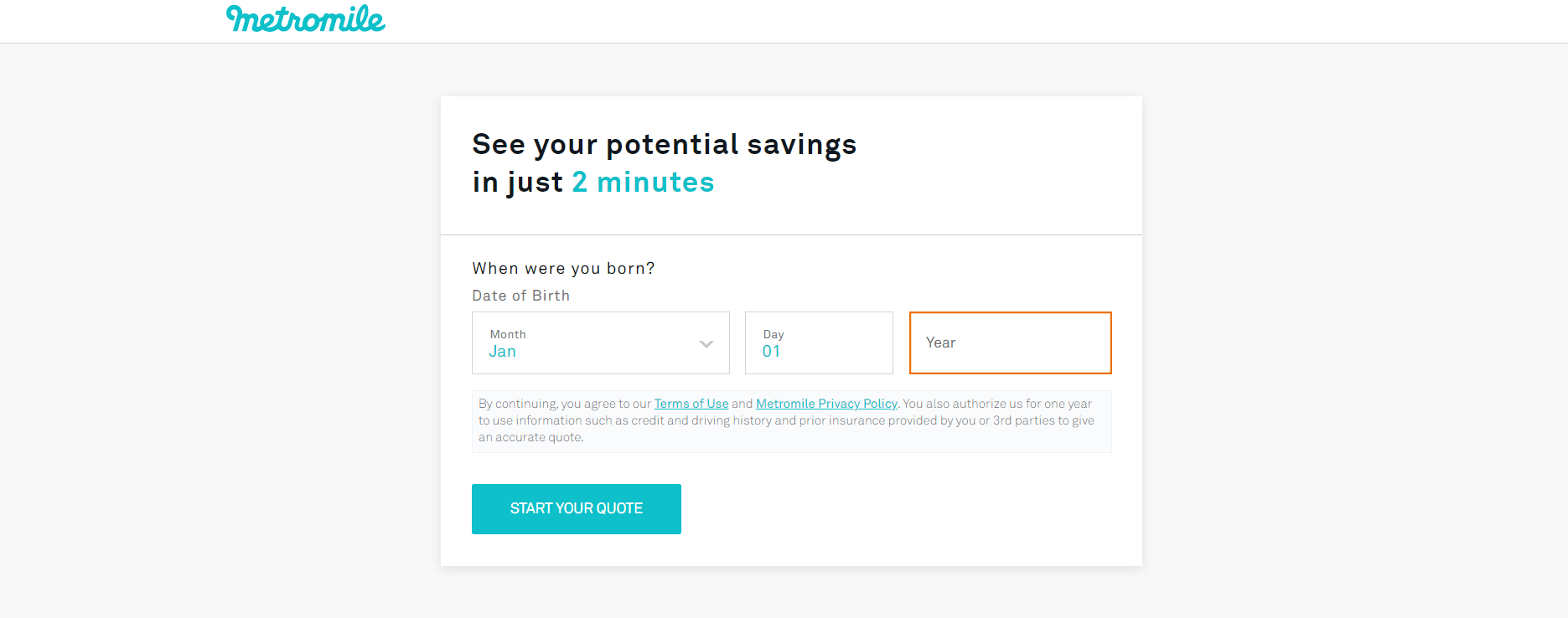

Next, she was asked her birthday:

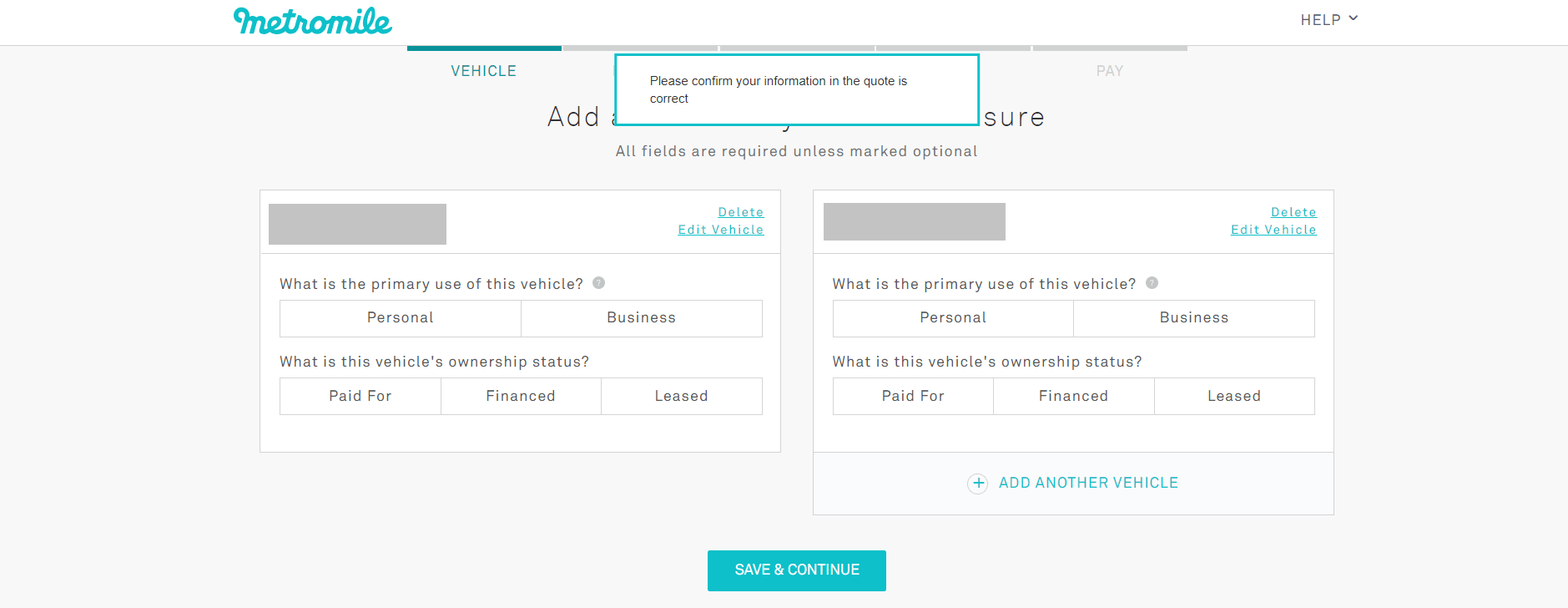

Once she had entered in her personal information the vehicle information automatically popped up. (Personal info has been obscured in the screenshot)

Since she didn’t want to include her husband’s truck in the quote she deleted it with the small “delete” link in the top right corner. This allowed her to proceed with just her 2017 Camry.

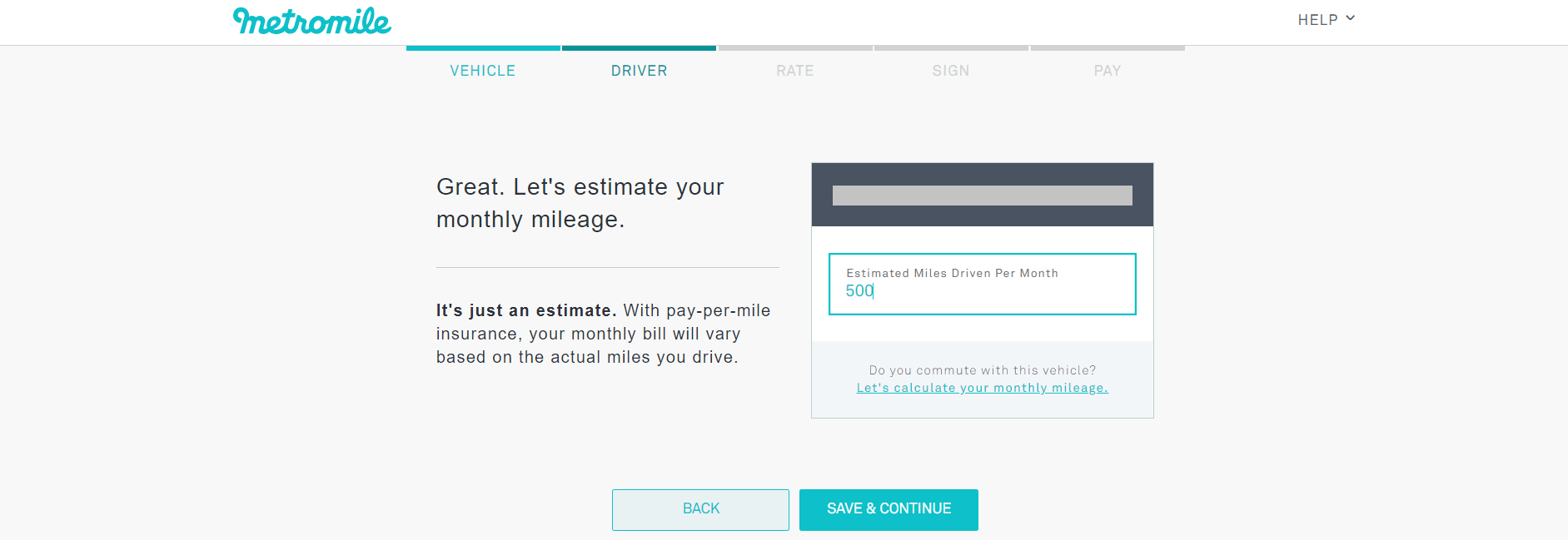

Next up, the all-important mileage estimate. This allows Metromile to estimate your monthly cost so you can compare it to what you are currently paying.

With driving her kids to school every day she figured she drives about 1,200 miles per month. She put in 1,500 miles per month just to cover any extras.

Finally, the quote!

As you can see, her base rate is $36.89 and then it’s 6.8 cents per mile. You can also make adjustments to your policy from here and see how it affects your rates.

She also got an email with a summary of her rates and examples of different monthly rates if she drove different amounts. For example, if she only drove 2,000 miles a year her monthly rate would be $48 per month.

Get your own Metromile quote here.

The email also explained some of their other features, which I’ll go over below:

Metromile Pulse

The Metromile Pulse is an amazing little device that’s used primarily to track your mileage and to wirelessly transmit that information back to Metromile. After you become a customer, Metromile will send you your Pulse device in the mail.

Once you receive it, all you have to do is plug Pulse into your car’s onboard diagnostics port located under your dashboard. This will allow it to record your mileage, giving Metromile the ability to truly personalize your monthly bill.

Smart Driving App

At this point you might be thinking that the Metromile Pulse is just a fancy odometer, but you’d be wrong. When you connect your Pulse device to Metromile’s Smart Driving App, you open up a whole new world of understanding about your car.

Let’s dive into all the features the Smart Driving App has to offer.

Track Your Vehicle’s Health

Through the smart driving app you can track your vehicle’s health, the trips you take, and even your car itself through GPS!

This means that you will know why your car’s check engine light has turned on and even what corner you parked your car on. If you don’t like the thought of GPS tracking, you can always turn it off by logging in to your Metromile account online.

Trip Data

Through the Pulse device, Metromile lets you look back at your recent trips, providing you with important data, including: how much you spent filling up your tank, your speed, and how far you traveled.

Low On Gas?

The Metromile Pulse can help you decide when, or if, you need to head to the gas station. When using the GPS tracking feature, the same pin that is dropped where your car is parked will tell you how much gas is in your tank.

Call For Assistance

The Metromile app can also help you when you get into a sticky situation. Metromile provides you with the ability to call 24/7 roadside assistance, file a claim, or access your proof of insurance.

Change Your Coverage Whenever You’d Like

If you find yourself lying awake at night, wishing you had more coverage, Metromile allows you to make changes from inside of the app. This means no more pesky phone calls and long hold times. Metromile’s app brings peace of mind to your pocket.

Get your customized quote here.

Discounts

Multi-Car

Metromile offers a multi-car discount, saving you money on both your flat monthly rate and your per mile premium. This makes choosing Metromile a no brainer, even for families.

Unfortunately, this is the only discount that Metromile currently offers. They do not offer discounts for students, veterans, or for bundling other insurance products.

Rental Reimbursement And Coverage

If you were in an accident and had to put your car in the shop, Metromile has your back! With rental reimbursement, you don’t need to worry about interrupting your busy schedule.

If your car is a total loss, Metromile will allow you to keep your existing policy. Even better, Metromile won’t charge you mileage while you are shopping for a new car.

Coverage

Metromile provides many different options for coverage. While most states do not require you to purchase more than just liability insurance, sometimes a little extra coverage can go a long way.

Liability

Required by almost every state, liability insurance will protect you, and other drivers on the road. This policy, by itself, covers the cost of damage to other driver’s vehicles and selves following an accident.

Liability insurance on its own is okay for some drivers, but those who want more peace of mind may consider some of Metromile’s other options.

Personal Injury Protection (PIP)

Personal Injury Insurance helps not only the driver, but their passengers, in the event of an accident. Whether an injury is minor or major, this policy option helps pay for medical expenses, funeral costs, and other essentials. Unfortunately, PIP coverage can vary by state.

If you happen to live somewhere where PIP is not offered, coverage for medical payments alone can often be added to your policy.

Comprehensive And Collision

When in an accident that damages your car, this is the coverage that you are going to be thanking yourself for having. While both help pay to fix damage on your car, only comprehensive insurance will help cover damage that is caused by incidents other than an accident.

When both are added to your policy, you are protecting yourself from costly repair bills.

Roadside Assistance

Maybe one of the most handy policy options, Metromile allows you to add roadside assistance to your policy. There for you when you need a jump, a tire repair, or even a tow, Roadside Assistance is well worth it.

Customer Service

If you have questions about how Metromile can work for you, you can contact them at 1-888-242-5204.

What I Like About Metromile

For some of us budget-conscious city dwellers or homebodies in the country, Metromile is the perfect option. Their dedication towards making the auto insurance market fair for those who do not rack up as many miles as typical Americans, coupled with the peace of mind provided by the Metromile Pulse, makes Metromile a true stand out.

Unfortunately, Metromile doesn’t yet provide coverage in my state, but I’ll be keeping an eye out for when they do.

What I Don’t Like About Metromile

Just like any other auto insurance company, Metromile is not without its downsides. Don’t break up with your current auto insurance just yet, Metromile only provides coverage in:

- New Jersey

- Oregon

- California

- Illinois

- Arizona

- Virginia

- Pennsylvania

- Washington

With plans to expand their market, Metromile hopes to be able to cover more drivers in the near future.

Unlike most auto insurance companies, Metromile does not offer many discounts. Although they offer a multi-car discount, Metromile does not offer student, veteran, or bundled discounts.

Should You Use Metromile?

While Metromile can provide steep discounts compared to the average auto insurance company, it just isn’t for everyone.

For people who commute long distances every day, or frequently take long trips in their car, Metromile can really add up. If you drive over 10,000 miles per year, Metromile really is not the insurance company for you.

Once you get your own quote, you can compare it to what you are currently paying.

Metromile vs. Esurance

I wanted to see how Metromile stacks up next to one of the only other pay-per-mile insurance companies, Esurance.

Esurance provides similar policies and follows the same structure as Metromile, just on a smaller scale. Unfortunately, the average rate of savings for Esurance’s pay-per-mile program is not easily found.

Maybe one of the biggest downsides to Esurance is its coverage area, covering only those in Oregon.

With a smaller coverage area and more fees, Esurance falls flat.

Final Thoughts

Metromile is on their way to reaching their goal of disrupting the auto insurance industry. Providing customers with comprehensive auto insurance, made especially for low mileage drivers.

Metromile makes it easy to keep track of not only your policy, but also your vehicle’s health, and all the trips you take. As long as you live in one of their coverage areas and drive less than the average driver, you’re sure to save on auto insurance.