Important Note: The information for the Marriott Bonvoy Boundless® Credit Card has been collected independently by ChooseFI. The product details on this page have not been reviewed or provided by the bank advertiser.

Is the Marriott Bonvoy Boundless® Credit Card worth a spot in your wallet? When it comes to travel rewards, much of the focus is placed on high-value transferrable point or airline mileage programs. More recently, all the love has been going to cash back cards. With an unpredictable economy and current state of travel, it’s easy to understand why. The point values are stable, easy to redeem, and cash can be spent on anything.

Then there are those concerned about continuing to invest time and effort into any travel loyalty program. While there are likely to be some winners and, unfortunately, losers in the world of travel as a result of the pandemic, the cost of obtaining a co-branded credit card and devoting some everyday spending to it, risks very little in the grand scheme of things. But the upside is can be huge.

Given the high cost of lodging, accumulating hotel points is something almost everyone should have in their travel planning strategy. When looking for a hotel card, the Marriott Bonvoy Boundless® Credit Card is a solid contender. Not only apply for but to hang on to for the long-term.

Here’s why.

Table of Contents

- World’s Largest Hotel Chain

- Marriott Bonvoy Boundless® Credit Card‘s Best Ever Welcome Offer

- Are You Eligible For the Marriott Bonvoy Boundless® Credit Card?

- An Annual Free Night Award Worth The Annual Fee

- Enjoy Elite Status

- Turn Points Into Miles

- Redeem Points for Hotel and Air Packages

- Pool Your Points

World’s Largest Hotel Chain

Marriott International is the world’s largest hotel chain in the number of available rooms, consisting of 30 brands and 7,484 properties in 131 countries and territories worldwide. As much as we love to redeem Chase Ultimate Rewards for Hyatt stays, its footprint is small in comparison, with only 900 properties in just 60 countries.

So chances are, wherever you need a room, Marriott is bound to have a property nearby. Whether it’s for an economical night at a Fairfield by Marriott, or for a more aspirational experience at a Le Méridien overseas, the variety and distribution of Marriott hotel brands and properties is impressive.

Marriott Bonvoy Boundless® Credit Card‘s Welcome Offer

New Marriott Bonvoy Boundless® Credit Card cardmembers can earn, 5 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 in the first 5 months from account opening. $95 annual fee applies.

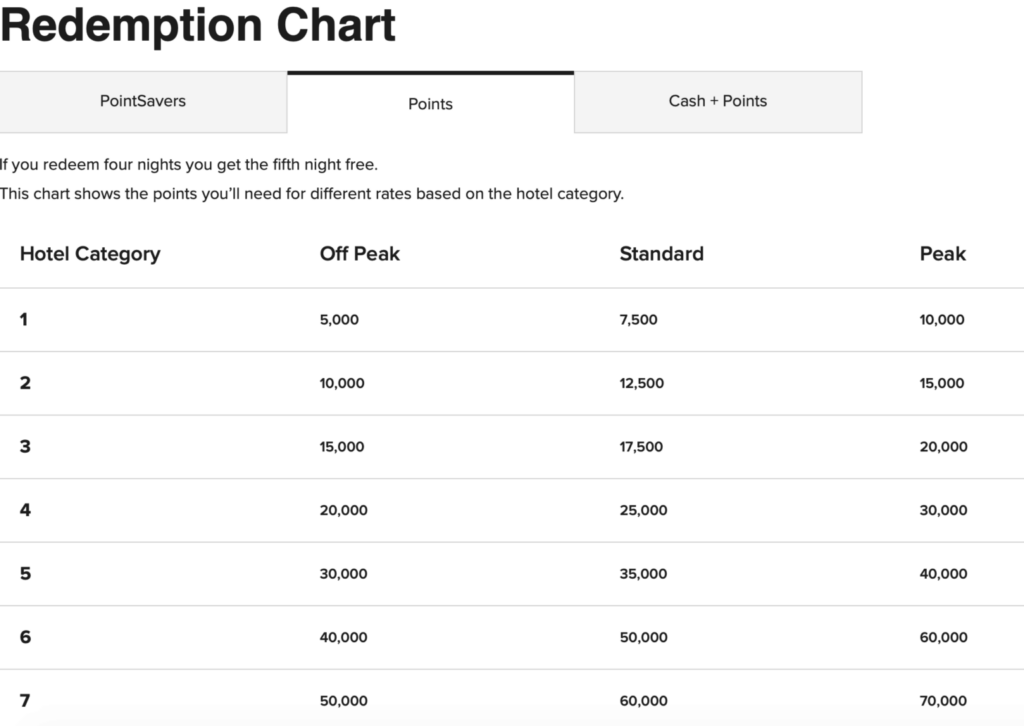

Marriott’s Redemption Chart helps you get a sense of how far these points can go:

Earnings Rate with Marriott Bonvoy Boundless® Credit Card

In addition to the very generous welcome bonus, cardmembers will continue earning points on every purchase with the Marriott Bonvoy Boundless® Credit Card. When used at one of Marriott’s more than 7,000 properties, cardmembers will earn an incredible 17 points per dollar spent. Even everyday spending earns a respectable 2 points per dollar on all other purchases.

An Annual Free Night Award Worth The Annual Fee

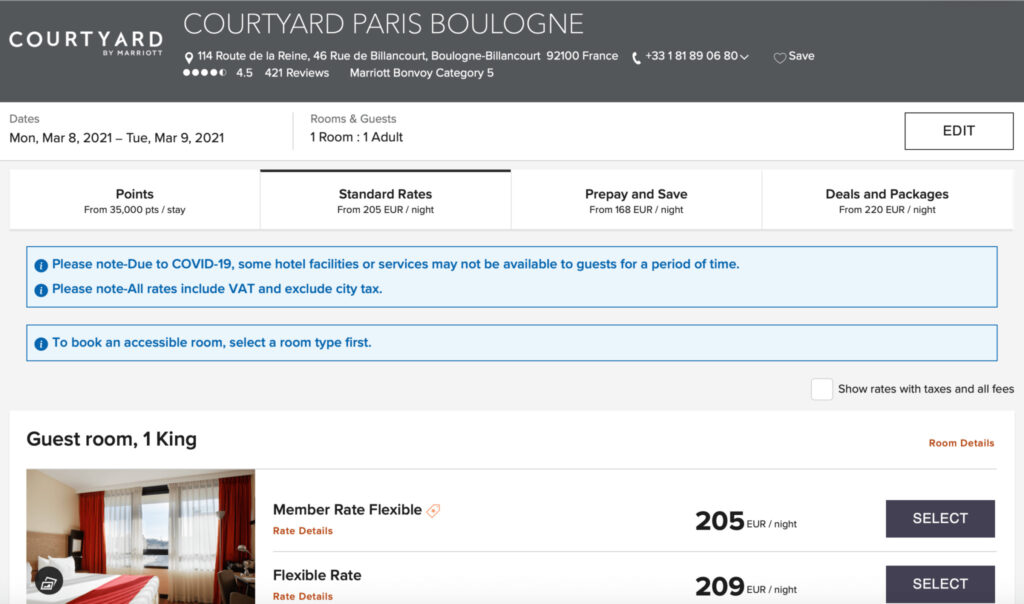

Annual fees can be a deterrent for some credit card users, but we think the benefits of this card make paying the fee worthwhile. The Marriott Bonvoy Boundless® Credit Card has a $95 annual fee. Each year, upon account anniversary, cardmembers will receive a free night award valid for a one-night stay with a redemption level up to 35,000 points.

Of course, this benefit only makes sense if you can use a 35,000 point free night certificate every year. And then if you’re also able to redeem it for a night that would normally cost you more than $95. Don’t forget that free hotel nights are usually tax-free as well. You would be hard-pressed to find a cash price at most properties for less than the $95 fee.

Remember the Category 5 Courtyard Paris Boulogne mentioned above? Would you rather use your 35,000 free night award, or pay €205, which is around $239? Paying the annual fee on the Marriott Bonvoy Boundless® Credit Card becomes a real bargain!

Enjoy Elite Status

The Marriott Bonvoy Boundless® Credit Card includes a few more perks. Cardmembers will enjoy automatic Silver Elite status each account anniversary year. It also includes a path to earn Gold Elite status with $35,000 in purchases each account year.

Admittedly, the elite status benefits are sort of ho-hum until you hit Platinum and Titanium, but even the lowest Silver tier has a few perks.

Elite Night Credits

Those who frequently stay at Marriott properties will elevate their status with 15 Elite Credit each calendar year. The 15 Elite Credits earned with the card each calendar year put you more than halfway on your way to the next level. Stay just 10 nights at Marriott properties and earn Gold Elite status. Stay 35 nights and you’ll hit Platinum, where you’ll receive lounge access and Suite Night Awards.

Points Bonus

Silver Elite status means you can earn points faster. Silver members will earn 10% more on every eligible Marriott purchase. This includes room rates and other charges made to the room, such as on-site dining and spa services. Hit Gold and begin earning 25% more.

Late Check-Out

Your travel plans and hotel check-out times don’t always line up. It can be a real pain to vacate your room and find a way to kill time before heading to the airport. As a Silver Elite member, you have priority late check-out. (Based on availability)

Exclusive Member Rates

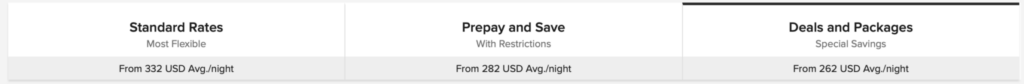

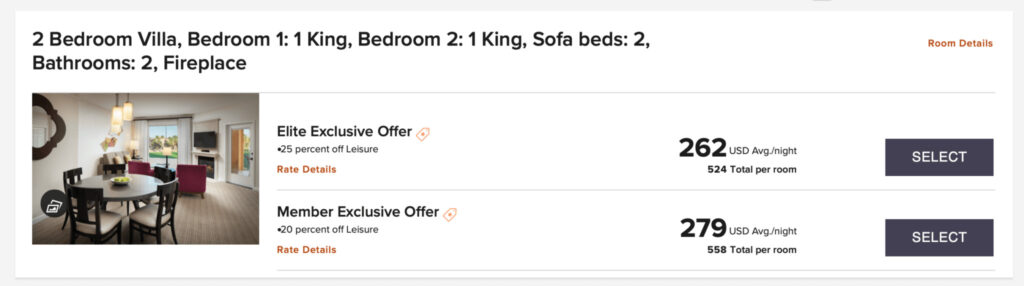

Elite status members can receive special room rates helping you to save even more. It’s great to save money on hotel rates, but not when there’s a chance your plans could change. Pre-paid or non-refundable rates lock you in.

One of the great things about Marriott’s elite member rates is that they can be a substantial discount off the standard rates and sometimes even better than pre-paid rates. Plus, they are usually cancelable up until 72 hours before check-in giving you savings and flexibility.

Get Your Fifth Night Free

Stretch your points and make them go further. When you redeem points, you get the fifth night free. This benefit is automatic when searching for five nights in the Marriott booking search engine and have the “Use Points” box checked.

Unfortunately, this benefit does not apply when using Free Night Awards, so given the option, it’s better to use Free Night Awards for stays 4 nights or less and points for 5 nights and more.

Turn Points Into Miles

Another reason to love points is that they are a transferrable hotel currency. points that may be transferred to one of more than 40 participating airlines.

Most points can be transferred to airlines at a ratio of three points to one airline mile. There are a few exceptions where the transfer ratio is worse, such as JetBlue where it takes six points to equal one TrueBlue point.

On the other hand, the ratio is slightly better for United. With the Rewards Plus program, you’ll get 10% more when transferring to points to United MileagePlus.

You may transfer between 3,000 and 240,000 points per day. The next time you need to top off your airline miles for an airfare redemption, points can be an excellent solution.

Redeem Points for Hotel and Air Packages

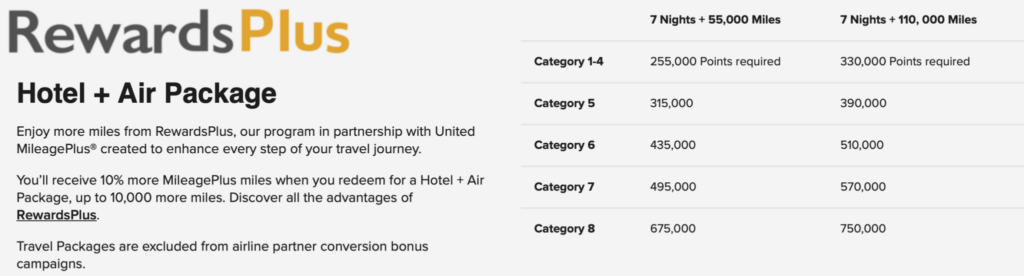

For as little as 255,000 points, loyalty members can receive an entire travel package. Points may be traded in for a 7-night stay in a Category 1-4 hotel and also receive 50,000 miles to help get them to that destination. When choosing United as their airline, the 10% more through the RewardsPlus program applies, resulting in 55,000 United Mileage Plus miles.

Pool Your Points

Have a small balance of points just sitting there? Or maybe you don’t have quite enough points needed to hit a redemption. In such situations, it’s good to know that you can transfer or receive points. Send or receive 1,000 points or more, and up to 100,000 per year to anyone with a account. Unlike many other rewards programs, transfers can take place between anyone, not just those within your own household.

Final Thoughts

The Marriott Bonvoy Boundless® Credit Card is a solid choice for a hotel rewards credit card. While point redemption rates may not be as high as other hotel loyalty programs, the wide availability of properties around the globe at all price points more than makes up for it. Add in the annual free night award upon account anniversary and it means this card is one to hang on to long-term.

Top Travel Rewards Offers

Top Travel Card

Details: $95 annual fee | Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

Most Flexible Travel Card

Details: $95 annual fee | Enjoy a one-time bonus of 75,000 Miles once you spend $4,000 on purchases within 3 months from account opening

Best Card for Side Hustlers and Business Owners

Details: $95 annual fee | Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.