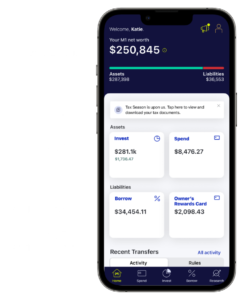

It’s no secret that investing can be complicated. So, when something comes along that demystifies and simplifies it, as well as makes it financially accessible to nearly everyone, people tend to get pretty excited. That’s why M1 Finance, a fee-free, robo-advisor, quickly became a FI community favorite. With its sleek, intuitive interface, M1 allows you to invest, borrow, and manage your cash all in one place.

M1 Finance

M1 Finance successfully reimagined what a brokerage can do for you. In addition to providing a means to easily focus on maintaining your asset allocation, M1 Finance can provide an alternative to holding a large cash position as an emergency fund using their M1 Borrow product and is accessible to investors who have $100 to invest or hundreds of thousands of dollars.

👍 Pros:

– Commission-free investing

– Fractional shares

– Easily define and maintain asset allocation plan using simple pie definitions

– Auto-invest feature

– Margin loan and margin borrow (but avoid unless necessary)

– Tax efficiency

– Supports Traditional IRA, Roth IRA, SEP IRA, and taxed brokerage account types

👎 Cons:

– Limited trading windows

– No automatic tax-loss harvesting

– Limited order options

– ChooseFI

Summary

Whether you are brand new to investing or are looking for a simple and intuitive way to open a low-cost index fund, M1 Finance is great for those on the path to Financial Independence. M1 makes investing in both taxable and tax-advantaged accounts like IRAs and Roth IRAs quick, simple, easy, and free. M1 was built with powerful automation capabilities so you can take a set-it-and-forget-it approach to investing, helping you to build your FI number.

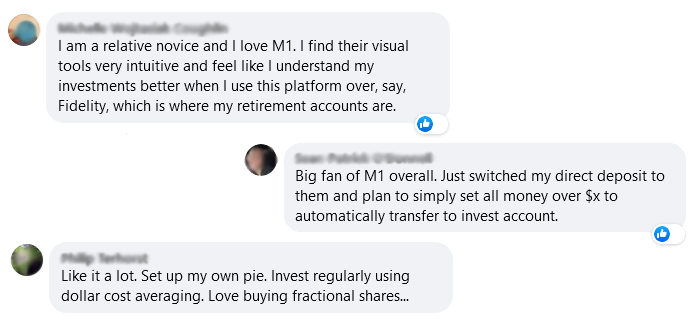

What the FI Community is saying:

What Is M1 Finance?

So, what is M1 Finance and what does it have to offer? Founded out of pure frustration by Brian Barnes, he (and many others) believe most financial services are not acting with the investor’s best interest at heart. Even worse, they are unnecessarily complicated and cumbersome.

Brian researched the investment platforms that were out there but couldn’t find what he was looking for. He wanted to be able to pick his investments and have recurring deposits automatically added to those allocations. Hating the idea of idle cash, Brian wanted a platform that puts all of his dollars to work.

Although all of this seemed relatively basic, what he thought would be a seemingly simple solution just didn’t exist at the time. So, Brian decided he would create it – a totally free (more on that later), robo-advisor brokerage that lets investors manage their money through smart, automated investing.

– Brian Barnes

Why is this so revolutionary? Well, let’s dive deeper into the details of M1 Finance to find out.

Who Should Use M1 Finance?

People on the path to financial independence are buy-and-hold investors, which is simply a long-term passive strategy to keep a stable portfolio over time, regardless of inevitable short-term fluctuations. They want a platform that was created with their investing mentality in mind. This is just that platform.

M1 Finance is great for beginners as well as much more seasoned, experienced investors. You can get started with any amount and can put that towards one of our favorite low-cost index funds.

M1 Finance is also perfect for people that want to be able to dollar-cost average fractional shares and put their wealth-building on autopilot. Dollar-cost averaging is the practice of putting a fixed sum of money into an investment on a regular basis. A 401(k) retirement account is a great example of this concept in action – you add to your investments with each paycheck.

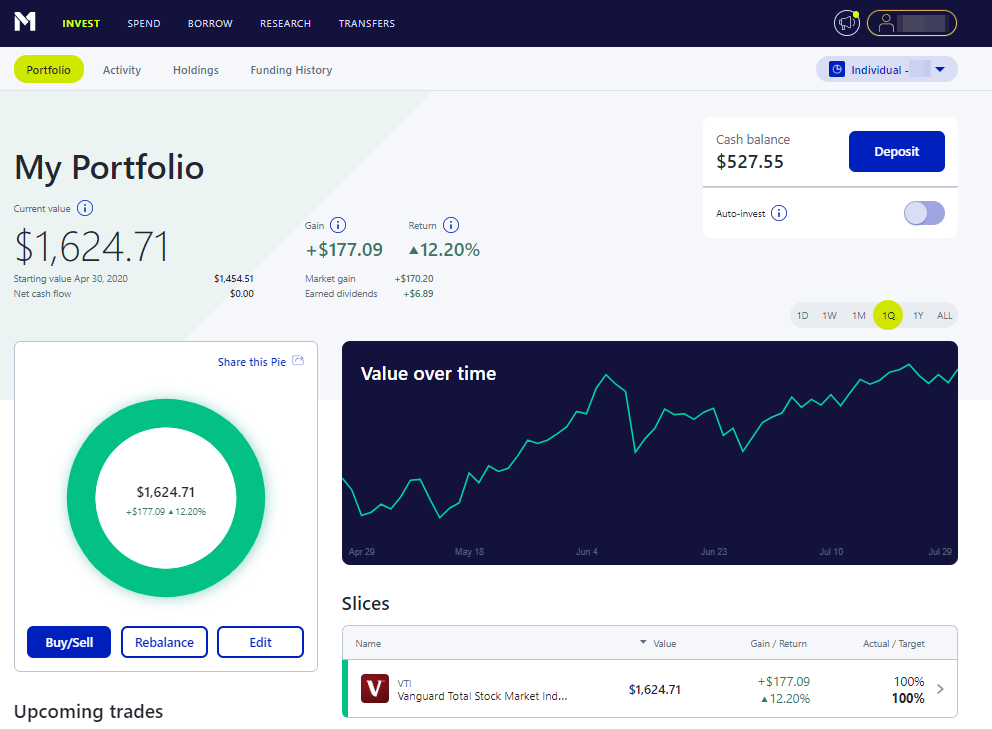

If you hate assets under management fees, and you want to access Vanguard Funds (without having to log on to the Vanguard platform or pay hefty commissions), M1 Finance is for you. M1 allows new investors to get started in Vanguard Total Stock Market Exchange Traded Fund (VTI) for as little as they want to test the waters. With just a $100 minimum, getting started is easy.

Once a new investor gets started, the chances of them continuing to invest across their life are very high. They begin building a habit that will help them save and invest even more when they make more money.

For more seasoned investors, M1 Finance gives the opportunity for a more sophisticated tilt to the Simple Path to Wealth by layering on more value and small-cap stocks.

They can follow the recommended investment portfolios of experts like Paul Merriman, or further customize them based on their own research. So, it’s still the Simple Path to Wealth, but with a smidge of complexity to increase the likelihood of maximizing returns.

Why Beginning Investors Should Use M1 Finance

- M1 requires no minimum balance to start investing with them.

- You can create your account in five minutes or less. (We have tested this to make sure!)

- You can purchase ETFs with no fees or commissions.

- You can buy fractional shares of VTI, something not allowed on other platforms.

- Everything is cap-weighted.

- M1 doesn’t charge management fees or commissions so you can take greater advantage of compounding returns over time.

Why Advanced Investors Should Use M1 Finance

- M1 has built rebalancing into the platform. You tell the system how much of each percentage of each asset class you want to hold, and it automatically maintains them throughout the year.

- It can act as a substitute for HELOC. As your money is saved, you don’t need as much cash. You can borrow up to 30% of your invested assets with them. You’re not leaving the market, selling any of your assets, or creating any kind of taxable event. You’re just taking advantage of your assets if you need them in an emergency.

- If you do want to take advantage of capital gains harvesting, you can optimize your investments with M1 to do that.

- The allocation strategy that they implement when securities are sold helps to reduce the amount of taxes that you owe. They do this by taking your portfolio targets into consideration to determine which securities to sell.

- M1 can help you dollar-cost average your investments. If you have a fixed amount that you’d like to invest in your M1Finance IRA, this investment strategy would allow you to split up those contributions. You would invest the amounts at different intervals, so you are always getting different prices. The prices of your orders will be averaged so you can hopefully lower your share cost.

Pros Of M1 Finance

First things first, when you open up the M1 Finance app or website, you’ll notice how nicely designed and intuitive the site is – it’s just beautiful to look at. The aesthetics, however, are just the beginning of the many notable pros on our list, including:

Commission Free Investing

M1 Finance is a free investing platform. There’s no cost for each transaction. And, unlike other robo-advisors, there is no minimum deposit. Plus, there isn’t a complicated questionnaire to determine your risk tolerance.

Fractional Shares

The ability to invest fractional shares means that you can get all your money working all the time. You don’t need to wait until you have enough to purchase a full share of stock to invest. You can buy right up the amount you have at any point.

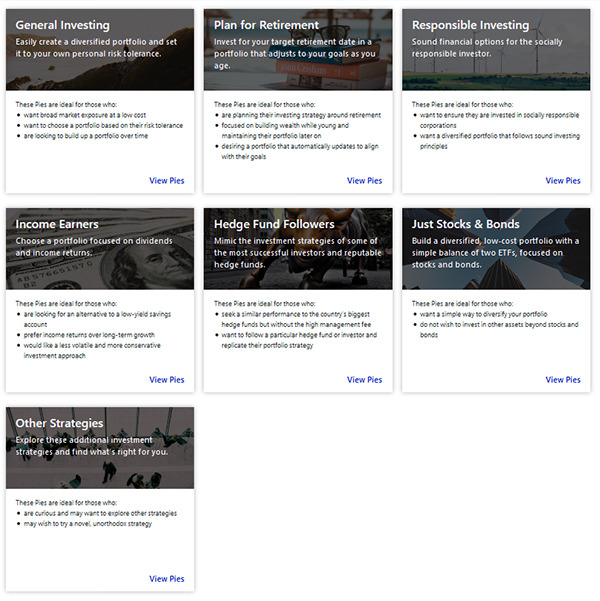

M1 Finance Pies

It’s hard to overstate how powerful the Pie feature is.

The deceptively simple pie structure had never been seen before in the brokerage world. I say deceptively simple because the ability to embed a pie within a pie allows you to layer complexity and maintain these incredibly complex portfolios entirely on autopilot. M1 Finance does this while preserving your ability to visualize your plan and map your progress to your goals.

M1 Finance gives you the freedom and ability to create your own customized pie, in which you choose your own favorite stocks and bond funds, or you can opt for one of the many Expert Pies created by M1 staff, which are categorized like this:

- General Investing: pies you can set to your own personal risk tolerance.

- Plan for Retirement: pies that are optimized for your target retirement date in a portfolio that adjusts to your goals as you age.

- Responsible Investing: pies for the socially responsible investor.

- Income Earners: pies focused on dividends and income returns for a more conservative investment approach.

- Hedge Fund Followers: pies for those who want to replicate the portfolio strategies of the biggest hedge funds, but without the high management fee (Berkshire Hathaway, Tiger Global Management, Green Light Capital, etc.).

- Just Stocks & Bonds: pies for those who want an easy way to diversify their portfolios without having to invest in other assets beyond stocks and bonds.

- Other Strategies: pies created with novel and unorthodox strategies, like their Cannabis Pie for example.

Looking to follow your investing heroes? With the M1 Pie feature, it’s also possible to track and replicate other people’s pies. So, if you want to replicate a Boglehead 3-fund strategy, the Paul Merriman Buy & Hold Strategy, or JL Collins Simple Path to Wealth – M1 Finance makes it possible. You can replicate that for part or all of your holdings in less than a minute. It’s that easy.

Read more about M1 Pies and learn how to get started here:

Dive Deeper: M1 Pies: Level Up Your Dividend Strategy and Optimize Your Portfolio Like a Pro

Auto-Invest Feature

What makes auto-invest so powerful is that it builds on the M1 Pie feature. Auto Invest is an optional feature you can turn on. If you choose to turn on the auto-invest functionality, you can be confident that your transfers are being invested in a way that maintains your desired asset allocation no matter how complex.

Automatic Investing Schedule

This feature allows you to set up an automatic schedule that invests deposits if your cash balance exceeds the total dollar amount that you have specified.

With the automatic investing schedule, you can start investing in your goals. You can still make extra, one-time investments, but at the very least you should intend on investing at least $500 dollars a month. M1 Finance lets you make one decision and be confident that the results will take care of themselves. While you can always make changes and increase or decrease the amount over time, it’s essential to set it up.

As with everything in life, it’s so easy to do nothing, but the truth is that inaction is just too expensive. Yes, it can be painful to have to decide to invest a portion of each paycheck. You might feel the money burning a hole in your pocket – thinking about how this is money that you could be spending, but these are the things you need to command control of to achieve true FI.

Margin Loan and Margin Borrow

A margin loan is a loan against your portfolio’s value and should be avoided if the intent is to borrow money to invest in the market. It may be something to consider if you use it judiciously, like paying down a loan with a much higher interest rate.

M1 Finance allows you to borrow up to 35% of your portfolio value at a low, low-interest rate – as low as 2%. You can access these funds in less than 10 seconds.

The M1 Borrow interest rate is variable and is tracked to the Federal Funds Rate. Currently, that rate ranges from 3.5% down to as low as 2%.

We love this feature, and we use it, but with some caveats. M1 borrow is an excellent alternative to paying for an expensive whole life insurance policy for years so that one day you will be able to borrow against it or even a HELOC. It is also a reasonable solution for consolidating or paying off high-interest debt like a car loan or credit card debt.

Again, we do not recommend that you invest on margin, which quickly turns ‘investing’ into gambling. It allows aggressive traders to buy more stock than they could otherwise afford. It’s possible to magnify your returns, but it’s also possible that you can amplify your losses and lose even more than you invest. (don’t do it)

We think of it as a much more optimized HELOC (Home Equity Line of Credit) and prefer it for several reasons. Since your borrowing capacity is capped at 35% of portfolio value, it incentivizes you to save or invest more. The interest rates are 2-3% more competitive than a HELOC, and it’s available to renters as well as homeowners.

Dynamic Rebalancing

M1 Finance maintains your Pie Allocation by adding new funds to underweighted assets. You can also rebalance on-demand with just one button click.

Tax Efficiency

Selling funds, at some point, is inevitable. It might be because you are cashing out some shares, rebalancing, or trading out one investment into another.

But how do you do that in the most tax-advantaged way?

M1 Finance has your back. The platform has a built-in tax minimization strategy that ensures you pay the smallest amount of tax when selling parts of your portfolio.

When you request a withdrawal from your portfolio, M1’s algorithm determines which stocks or parts of your investment pie to sell based on your portfolio targets. With those considerations in mind, M1 sells in this order.

- Losses that offset future gains

- Lots that result in long-term gains

- Lots that result in short-term gains

You will still owe taxes on interest and dividends, but you can be confident that your capital gains were ‘realized’ in the most tax-efficient manner possible. A feature like this is a huge deal and removes hours of decision-making, which saves you time and improves your outcome.

Dividend Dashboard

Watching your money make money for you is one of the most powerful and behavior-reinforcing steps you can make on the path to Financial Independence, but most brokerage dashboards do it poorly. M1 Finance immediately breaks out your total return and your dividend payments over a period that you can determine. (1 Day, 1 Month, All Time, Etc.) The data is also presented in a very compelling way.

What is Total Return?

The total return is both similar and different to compound interest. When you own shares of a company, you’re expecting your money to make money for you, but your total return is comprised of two factors: the growth of the company and dividend payments.

Is M1 Finance Good for Dividend Investors

Dividend investors put a higher emphasis on the dividends they can expect and much less emphasis on growth because they are focused primarily on cash flow. If this is your mentality, you will appreciate how easy M1 Finance makes it to see this information.

M1 Finance Signup Bonus

M1 Finance also offers a transfer bonus when you are rolling over a 401K. Rates and offerings vary, so be sure to check and see what the current offer is.

Cons Of M1 Finance

While M1 is truly an incredible service, it’s not without a few issues. There are a few M1 Finance cons of note that were experienced. Two of them are solvable and one of them is just unfortunate – but it’s not a deal-breaker.

Limited Trading Windows

M1 Users have their orders placed at 10 AM EST Monday to Friday. Since the Stock Market opens at 9:30 AM EST, as long as you have your Buy or Sell Order submitted before 10 AM, you will be in the queue. Depending on the Trade Volume that day, you might see your order executed anywhere from 10:15 out to 11:30 AM.

In our opinion, this is a reasonable tradeoff considering you are getting this transaction for FREE. But if you are a day trader trying to bob-and-weave in and out of the market, you will find it frustrating. If you are a long-term, buy-and-hold investor and are used to purchasing index mutual funds where you get the average price at the end of the day then this is a non-issue.

Pro Tip: You can get a second trade window if you upgrade to M1 Plus – click here to find out more.

No Automatic Tax Loss Harvesting

M1 Finance does not offer this as a stand-alone feature.

Check out the podcast episode where we sat down with Sean Mullaney and discussed how this tax strategy works: Tax Loss Harvesting and Other Money Moves to Make During a Financial Crisis | Ep 205

But to summarize, if you have a stock or ETF that has gone down in value, you can sell those shares at a loss. You ‘realize’ the loss. Depending on how much of a loss you’ve realized, you can claim up to a $3000 deduction in the current tax year, and you can roll over the remaining loss to future tax years.

The key when selling shares for tax-loss harvesting purposes is to avoid IRS wash sale rules. In short, you can’t sell the shares claim the loss then rebuy the shares the next day. You have to wait at least 30 days before purchasing a substantially similar stock.

Investing solely in tax loss harvesting is like letting the tax tail wag the dog. It would be nice if they carved out more space for tracking this, but it’s not a must-have feature. Tax loss harvesting works with M1 Finance the old-fashioned way. A common-sense approach would be to use tax loss harvesting to clean up your portfolio or get rid of companies that you don’t want to own anymore.

If automated tax loss harvesting is a critical feature for you to have, it’s worth noting that Betterment built it into its platform. But there are significant tradeoffs, including management fees.

No Limit Order

M1 does not offer a way to put in a rule-based sell. You can’t set up a condition where you buy or sell if a stock goes below a specific share price. But that shouldn’t come as a surprise; this is not for day traders. M1 Finance is a phenomenal platform for long-term buy-and-hold investors.

No Access to VTSAX

You can’t access mutual funds, so you can’t get VTSAX (Vanguard Total Stock Market Index Fund) on this platform. But don’t worry – you can buy into the ETF version of VTSAX, which has a ticker symbol of VTI. This beats investing directly with Vanguard for some people because Vanguard requires a $3,000 minimum to invest in VTSAX.

While this may not be a problem for seasoned investors, for anyone who can’t come up with the $3,000 minimum to invest, M1 Finance is a perfect fit.

Like with most investing platforms, you will need a “helper” app, like Empower, to see and track all your assets in one place.

How To Get Started With M1 Finance

Check out our video guide where we walk you through the basics of setting up an account with M1 Finance and show you exactly why we are such big fans here at ChooseFI:

Investing With M1 Finance

ETFs & Stocks

M1 offers ETFs and stocks through three major exchanges: NYSE, NASDAQ, and BATS. Sure, this sounds like every other trading site, but, thanks to the site’s innovative design, it’s not.

When you first invest, you start by making a “pie” where each investment you choose makes up a slice. You then set up the target weight of each slice. Or, you can choose from already made pies that professional investors have designed. Now all you have to do is add money to your account and M1 assigns the money to each investment based on your asset allocation. That’s it.

You can add, remove, or edit these “slices” whenever you’d like, and you can keep track of your investments on M1’s easy-to-use app. Check out our video below that shows exactly how to sign up and get started with Paul Merriman’s Ultimate Buy and Hold Strategy.

Commission Free Investing

Part of M1’s mission is to offer commission-free investing. There are also no maintenance fees on your account, so every penny you put in is fully invested.

You do have to have at least $100 in your account to invest, but that’s nothing compared to similar services that require thousands. M1 Finance does this by allowing you to buy fractional shares of ETFs, which is one of our favorite things about M1.

Other Investing Options

Along with ETF and stock options, you can open a retirement account. M1 Finance supports Traditional, Roth, and SEP IRAs.

You can also open a Trust, LLC, or Corporate investment account. You must have a minimum of $5,000 to open an LLC account.

Related: Beyond 4%: The Argument For Flexible Spending Rules In Retirement

Automatic Rebalancing

Asset allocation and rebalancing are important parts of your investment strategy. M1 Finance automatically uses new contributions to the pie to buy assets that are underweighted in your pie.

For example, let’s say you have a pie that is 50% stocks and 50% bonds. Your stocks have done well and the value of that section of your pie has gone up. Your allocation is now 60/40 because of this. When you contribute money, M1 Finance will automatically buy bonds with this new money to bring your pie back into a 50/50 balance.

It’s like an autopilot making small course adjustments so that the plane stays on course and gets you to your final destination.

You can also rebalance manually at the click of a button if you wish.

Tax Loss And Capital Gains Harvesting

As with other investment platforms, you can optimize for tax loss or capital gains harvesting, depending on your tax situation in any given year. In a year where your tax rate is low, you can harvest capital gains by selling the highest appreciated assets without a significant hit on capital gains tax.

But in a year where your taxes are going to be high, you can harvest a tax loss by selling assets with the biggest losses and using those to offset your taxes.

Customized “Pies”

One of the coolest parts of M1 Finance is their “pie” style of investing. A “pie” is M1 Finance’s term for a portfolio. You can create a custom pie or choose from pies that have already been set up. As you invest, the new money coming into the portfolio is used to keep your pie in balance.

We recently had Paul Merriman on the show and he discussed his “Ultimate Buy And Hold Strategy“. His strategy is wonderful but a little complicated for the average investor who wants a “set it and forget it” type of investment.

As we mentioned earlier, Paul has created customized pies on M1 Finance that you can use to easily take advantage of his customized investment strategy. M1 even automatically rebalances your pies for you so it really is a hands-off investment.

Paul’s recommended pies are:

- UB&H WW 100% Equity For Taxable (UB&H stands for Ultimate Buy And Hold)

- Merriman UB&H Bond Allocation (Taxable)

- UB&H WW 100% Eq. For Tax Deferred

- Merriman UB&H Bond Allocation (Tax Sheltered)

Listen: Paul Merriman Introduces The Ultimate Buy And Hold Portfolio

M1 Borrow

With M1 Borrow, customers have two options – they can borrow against their portfolio or apply for a personal loan. The good news is that instead of filling out a traditional loan application, you can apply for a loan directly from your M1 account.

M1 Margin Loans

An M1 Margin Loan is a type of secured loan that lets you borrow against the value of the securities you already own in your qualified brokerage accounts. These loans are interest-bearing loans that use your underlying assets as collateral to act as a flexible line of credit.

Borrowers who have at least $2,000 in an M1 Individual Brokerage Account, Joint Brokerage Account, or Trust Account can borrow up to 40% of their portfolio to use for debt consolidation, medical bills, wedding expenses, home down payments, and more.

As of January 2023, a markup of 3.50 percentage points is added to short-term interest rates for basic accounts, making it one of the lowest rates you’ll find. However, M1 cuts its markup to 2 percentage points if you have the upgraded M1 Plus account.

Remember to keep in mind that this rate is variable and depends on the current Federal Reserve interest rate. The interest rate will go down for M1 customers if the Fed cuts rates and vice versa.

M1 Personal Loans

An M1 Personal Loan is a fixed-rate loan that you can use for things like consolidating debt, making home improvements, paying for medical bills, etc. Unlike M1 Margin Loans, they are unsecured and approval is based on your credit score.

There are, however, some restrictions on what you can use your M1 Personal Loan for. These include:

- real estate

- post-secondary education

- investments & securities

- business

- bridge financing

As of January 2023, the APR is between 7.49% and 21.75% with M1 Plus members receiving an additional 1.5% additional rate discount.

*source: M1 Finance

M1 Save: The M1 High-Yield Savings Account

M1 Finance offers FDIC-insured savings accounts with two different tiers, and you do not need an M1 Invest account in order to open one. Both tiers have no minimum balance, and both integrate with M1 investment accounts – but M1 Save only really becomes attractive when you pair M1 Plus with it.

When you upgrade to an M1 Plus account, an M1 Save account with get you an impressive 5.0% APY, which is nearly 13x the national average as of July 2023.

M1 allows you to transfer funds to and from your M1 Save account easily using the fairly well-known third-party bank data service, Plaid. The daily transfer limits are $50,000 for M1 Plus members and $10,000 for non-members.

Learn more about M1 Save and sign up here.

How Does M1 Finance Make Money?

So, if M1 Finance is free for investors, how do they make money? That’s a good question. Brian Barnes, the founder, and CEO, shared with us that M1 Finance makes money through securities lending, payments for directed order flow, and cash management.

M1 Finance offers investors the option to get a variable rate loan at a low 3.5% rate for standard M1 users and 2% for M1+ users (as of September 2021) on up to 35% of assets in taxable accounts that are invested with them. This is a game-changer and is a huge improvement over a HELOC which typically offers a variable rate tied to the prime rate and isn’t an option for renters.

M1 Finance Alternatives

Although M1 Finance is quickly becoming the gold standard, check out these other services to see what works best for you:

Empower

This robo-advisor syncs with your bank, credit card, and investment accounts to track your net worth, spending, and investment goals.

Empower breaks down investments into sectors such as US stocks, international stocks, US bonds, international bonds, and alternatives. It can also analyze 401(k) fees to determine if you’re paying too much.

Like M1 Finance, Empower has an FDIC-insured cash account that offers .05% APY with no minimum balance.

They charge .89% a year for investment management accounts under $1 million, which is a higher rate than M1 Finance. Customers need to have at least $100,000 in their accounts to qualify for professional help.

Check out our full review of Empower here.

Betterment

Betterment is a popular robo-advisor for new investors. They offer Traditional, Roth, and SEP IRAs, charging .25% annually on their investment accounts.

One difference between M1 Finance and Betterment is that the latter offers one-on-one help to customers with balances of at least $100,000. They give unlimited access to CFP advisors for an annual fee of .4%.

Unlike M1 Finance, Betterment doesn’t let users borrow against their investment portfolio. Betterment automatically rebalances portfolios and provides tax-loss harvesting. People who have a large nest egg and want more guidance with their investments might be better off with a service like Betterment.

Wealthfront

Wealthfront is a leading robo-advisor offering retirement accounts such as Traditional, Roth, and SEP IRAs. They also allow investors to save for their children’s education with a 529 account, which M1 does not support.

They offer tax-loss harvesting for all accounts with no minimum requirement. M1 Finance does not offer any tax-loss harvesting.

Wealthfront has a cash account with .26% APY. This money is insured by the FDIC like a checking or savings account from a traditional bank. This is free to open, and there are no maintenance fees.

The account minimum for investing is $500 and the minimum for Wealthfront cash accounts is only $1. Wealthfront charges a .25% fee on all investment accounts.

Like M1, Wealthfront also lets eligible customers borrow money against their accounts, up to 30% of the total value. Interest rates on this line of credit range from 2.4% to 3.65%.

Robinhood

Robinhood is a commission-free trading platform for people who like to sell stocks regularly. Customers can buy stocks, ETFs, gold, options, or cryptocurrency. Robinhood only offers brokerage accounts, not retirement accounts like IRAs.

There’s no minimum required to open an account. Robinhood doesn’t let customers borrow from their margin accounts, which M1 does. Active investors who prefer trading stocks regularly will benefit from Robinhood’s mobile app.

Robinhood currently has a waiting list for its cash account, which will offer .3% APY when it launches. It’s not yet clear when this program will launch or what other features it may have.

Acorns

Acorns is a micro-investing robo-advisor. The service invests the money it rounds up from your purchases. If you spend $2.68 at a coffee shop, it will round the purchase up to $3 and invest that 32 cents in your portfolio.

The app creates an IRA and sets up a portfolio based on your age and retirement timeline. Customers who sign up for Acorns can also set up automatic contributions from their bank account to put more money in their retirement accounts.

Acorns has three different tiers of service and charges $1, $2, or $3 a month depending on the option you choose.

Blooom

Customers who have 401(k)s may benefit from Blooom, the only robo-advisor that focuses on employer-sponsored retirement accounts. It’s not a competitor to M1; customers should consider opening both a Blooom and M1 account because M1 doesn’t support 401(k)s.

Blooom analyzes 401(k) fees, makes investment recommendations, and rebalances portfolios. They sync to 401(k) accounts and determine what changes need to be made based on the consumer’s retirement timeline. It’s completely hands-off for customers who don’t have to make any changes themselves.

Blooom offers three tiers of pricing, $95, $120, or $250 annually depending on the level of service you desire.

Dive deeper: The Best Investing Apps For Each Level Of Investing

Is M1 Finance Safe?

It’s important to know that you’re with a reputable company. M1 Finance is covered by SIPC Insurance (Securities Investor Protection Corporation), which is a rock-solid insurance company that covers your investments in the event of misconduct or a firm’s insolvency. All M1 Save accounts are FDIC-insured (up to $5 million) as well.

The Bottom Line

M1 Finance has one of the best mobile brokerage apps we have ever seen – truly a world-class investing app. It offers a nearly full suite of features on a tight intuitive platform. They have done an unbelievably fantastic job all the way around. For buy-and-hold investors with a medium to long-term mindset, this is the greatest, most revolutionary software of our time. We are confident that M1 Finance can and will help you reach your FI and investing goals.

Related Articles: