What if I told you there’s a tool available to you to help pay for your child’s education? What if I told you it’s something as simple as a Roth IRA?

You’d be pretty excited, right? I know I was when I learned that using a Roth IRA for college, and other expenses, was something I could do. And it’s been one of my favorite tools for setting my kids up for their long-term success.

Although this is a great tool, I want to take a second to say it may not be the best tool for everyone. For one, withdrawing from your Roth IRA can seriously affect the financial aid your child may receive. Two, taking money from an IRA will leave with less for your retirement, whether that is for you or your child. Here’s an article that explains the pros and cons more thoroughly.

There are many ways you can pay for college, but your IRA is one of the only ways you can fund your retirement. So make sure you know all your options before choosing to pay for your child’s college with your retirement savings.

So how can setting up a Roth IRA help your child with future expenses? We’ll discuss that and how you can establish an account, in this post.

Using A Roth IRA Without Penalty

As of 2019, you can contribute up to $6,000 annually (or $7,000 if 50+) to your Roth IRA. This number is the same for any minors with custodial Roth IRA accounts. Due to compounding returns, this can end up turning into a decent amount of money by the time they are adults.

Money contributed to a Roth IRA is from taxable income. Therefore, you have paid the taxes already on this money prior to investing it into the Roth account and the earnings accumulate on a tax-deferred basis. This means that your child won’t have to pay taxes on any of the initial contributions since taxes were already paid on that money.

However, any distributions they take from the earnings portion will be subject to regular income tax.

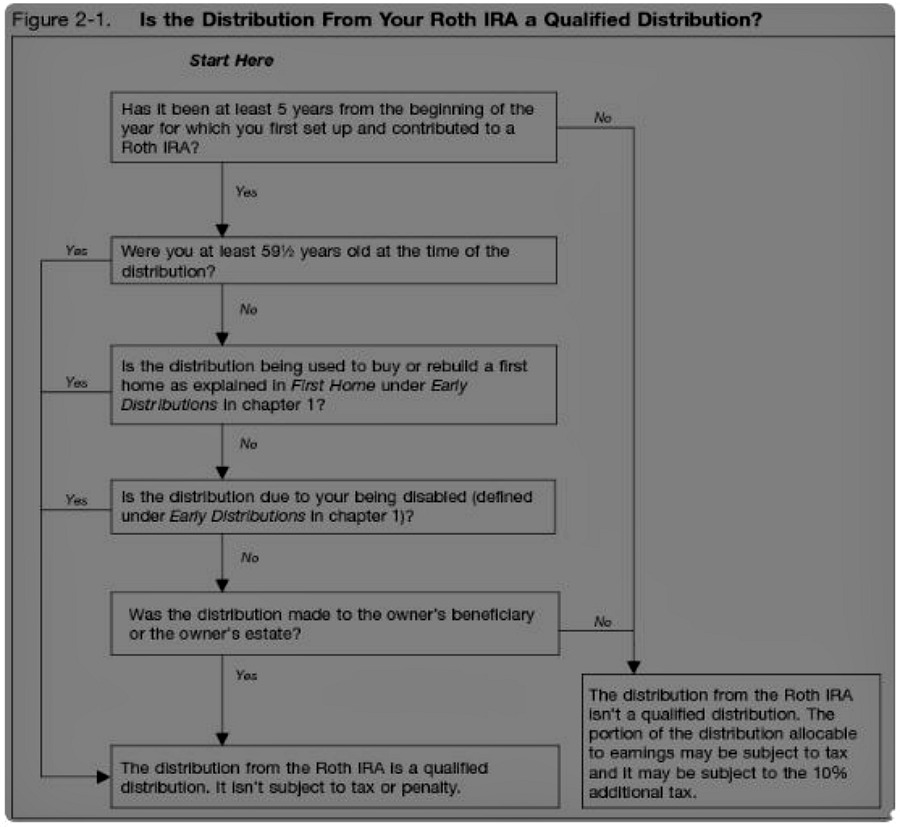

Most of the time, if a person withdraws money from their Roth IRA account, it is also subject to a 10% penalty for early withdrawal. There are a few exceptions that allow your children to take distributions from their Roth without generating a penalty. Here’s the IRS’ explanation of this.

Related: When And Why Your Child Should Open A Roth IRA

Educational Expenses

If you want to use your child’s Roth IRA for college, the first rule to be aware of is that the account has to have been in service for at least five years prior to any distribution of earnings. This rule includes ANY distributions your child might be planning to take, including for their education. However, this rule does not apply to contributions. Any money contributed to the Roth IRA can be withdrawn at any time.

So if you open a Roth IRA for your child when they are 15, they won’t be able to take any distributions for their education until they are 20 years old. If they do there are penalties attached. Therefore, if this is an option you are thinking about for your child’s higher education, make sure to set it up early enough for them to fully benefit from it.

Eligible Institutions

Once that decision is made, you and your child need to ensure that the educational institution they plan to attend is eligible. Eligible institutions include:

- Vocational schools

- Colleges

- Universities

- Post-secondary schools

No matter which category it falls in, though, it MUST be eligible to participate in the student aid programs administered by the U.S. Department of Education.

Eligible Expenses

Once your child knows that their institution is eligible, they will need to double-check that all of the educational expenses are also eligible.

Eligible educational expenses include:

-

- Books

- Equipment (calculators, laptops, lab equipment, etc.)

- Fees

- Room and board (must be enrolled at least half-time to qualify)

- Supplies

- Tuition

Distribution For Repayment

Your child’s distributions for educational expenses cannot be more than the amount accrued for their education. In other words, if the amount they use pull from their Roth IRA is greater than their actual college expenses, that portion is subject to the standard income tax rate and the 10% penalty.

For example, if Amy’s eligible college expenses are $10,000 and she pulls out $11,000 from her Roth IRA. She would owe a $100 penalty. She took $1,000 more than her actual expenses, so she would owe 10% of $1,000, or $100.

However, if they received any of the following, these CANNOT be reimbursed by taking Roth IRA distributions:

- Pell Grant

- Tax-free portions of scholarships or fellowships

- Tax-free distribution from a Coverdell savings

- Employer-provided educational assistance

- Veteran’s educational assistance

- Any other tax-free payment for educational expenses (excluding gifts or inheritance)

Let’s go back to Amy. Her eligible college expenses are $10,000 but she also received a Pell Grant of $3,000. This grant reduces her expenses to $7,000. She can take $7,000 from her Roth IRA for college without penalties.

Items that are CAN be reimbursed by taking Roth IRA distributions:

- Monetary gifts for educational expenses

- Loans for their education

- Funds pulled from their own savings accounts

- Wages earned and used towards educational expenses

- Inheritance used towards educational expenses

Back to Amy! Her eligible college expenses are $10,000 and she received a Pell Grant of $3,000 and a gift from Grandma for $5,000. How much can she take from her Roth IRA without penalty? Still the $7,000. Grandma’s gift does not reduce her expenses the way the Pell Grant did.

*Please also note a potential downfall to taking a distribution for college expenses is that it will affect your child’s FAFSA. By taking a distribution, you child is then creating income that they must report on the FAFSA. This can have the negative effect of reducing their financial aid eligibility. Therefore, it may actually NOT be in their best interest to take a distribution early in their college career, if at all, depending upon all other income factors.

Other Approved Expenses

Using a Roth IRA for college is just one of the ways this kind of account can benefit your child. There are other exceptions to the 10% early withdrawal penalty, including:

- Purchasing their first home, up to $10,000 lifetime distribution

- If they become disabled

- Unreimbursed medical expenses that equal more than 7.5% of their AGI (Adjusted Gross Income)

- Paying medical insurance premiums during a period of unemployment

- Reservist duty for 179 days or longer

- Some natural disaster relief (depending upon the year and situation). Examples currently listed include Hurricane Harvey, Hurricane Irma, Hurricane Maria, and the California wildfires

Here is a great chart from the IRS to help determine if the distribution is a qualified one or not.

Benefits Of A Roth

The benefits of a Roth IRA for college or other expenses provide a far-reaching impact. This is especially true if you open their Roth accounts while they are young, but old enough to have earned income.

The even bigger bonus is that you, or others, can gift them money into their Roth IRA accounts. The maximum a person can gift, in 2019, without being subject to the gift tax is $15,000. Since this is more than can be contributed to your child’s Roth per year, this is just another way to help them grow their future success.

Related: Gift Tax 101: The Tax Consequences Of Giving Large Sums Of Money

Tax Implications

The tax implications of a Roth IRA are pretty simple. Unfortunately, your child can’t use contributions as a tax write-off because all contributions were previously taxed. But, since all contributions were originally taxed, your child won’t have to pay taxes on that money when he or she takes a distribution later.

They will only have to pay standard income tax on the portion of a distribution which comes from the earnings portion.

Funding A Roth IRA

Funding a Roth IRA for your child can be the trickiest part of the whole scenario, at least when it comes to setting up the account.

Since your child has to have earned income, they will need a checking account to fund the Roth IRA. This account must have the EFT (electronic funds transfer) option available in order to properly fund their Roth IRA.

However, you, as the parent, can also put money into their Roth IRA as a gift. So don’t discount this as another option to fund their Roth IRA if your child isn’t making enough earned income to fully fund it.

Related: How To Open A Roth IRA For Kids And Teach Your Kids About FI

Who Can Open A Roth IRA

Anyone who has earned income can open a Roth IRA, including college students. If they are older than 18, they can open their own Roth account without needing a custodial account holder. But, if they are 17 or younger, the account needs to be opened by an adult. That adult will be considered the custodian of the account, but the account will be listed in the minor’s name.

However, once the minor turns 18, the account can be released to them as the main account holder.

I know quite a few parents who haven’t even told their children about their Roth IRA accounts. They haven’t mostly because they are afraid they will use the money on ineligible expenses. And I don’t blame them for thinking that. After all, we were all young once and knew way less than we thought. Especially as it pertained to money!

Roth IRA Wrap-Up

Overall, opening a Roth IRA for your child can only help them. They can use the magic of compounding interest to grow their account and can do so fairly quickly.

But the real benefits are using the Roth IRA for college or other expenses like purchasing a home. Since so many Americans are in debt just from these two things, it makes sense to use whatever tools we have to set our children up for a better, debt-free future.

If establishing a Roth IRA for college and helping my children understand the benefits of using it, then it’s a tool I’m happy to have available.

Have you opened a Roth IRA for your children? If so, what was your reason for choosing this type of account over another savings vehicle?

Related Articles