After meeting some people at CampFI and talking about what I do for a living, I was encouraged to write an article about ways to be a smart consumer of healthcare. I work for a broker/third-party administrator and we insure a lot of small businesses. I know a lot about health insurance, at least in Ohio.

Healthcare Cost

According to the National Conference of State Legislators (NCSL), the average annual premium for health insurance is $18,764 for 2017. That is a lot of money to spend on health insurance premiums! Hopefully, your employer is contributing or paying part of it.

So that is just premium and doesn’t include what you spend throughout the year on your actual episodes of care. These costs are contingent upon things that are specific to your plan:

- Deductible

- Coinsurance

- Maximum out of pocket

- Copays

I recommend getting to know the specifics of your health plan and tracking what you typically spend on healthcare in an average year.

More and more people are on high deductible health plans (HDHP) which are HSA compatible. That is what I’m on for multiple reasons. Anyways, if you are on an HDHP you pay a certain dollar amount for all episodes of care until you hit your deductible. You may or may not then have coinsurance which continues until you hit your annual maximum out-of-pocket. When you have money on the table, it should incentivize you to shop around for the lowest cost!

Regardless if it is your dollars or the insurance company’s dollars, it’s always a good idea to shop for the lowest cost episode of care. For the former, the benefit is obvious–keep more $ in your pocket. For the latter, it will benefit you down the road by keeping your premiums down. Insurance plans renew annually and they base increased premiums on things like:

- Loss ratio (premium received versus claims paid out)

- Trend

- Predictive risk modeling

Seeking low-cost options can be a way to hedge off increased premiums.

Related: I Lost 77 lbs, And How You Can Too

Shopping Around For Care

So how do you shop for low-cost healthcare consumption? You can certainly experiment with medical tourism but I want to focus on how to do it right where you live.

The first thing to consider is if you can compare costs with your insurance company portal. All carriers, when you are insured with them, allow you to create an online account which allows you to log in and see things like:

- Claims history

- Deductible tracking

- Explanation of Benefits (EOB)

- Finding an in-network provider

- And hopefully a cost comparison tool

Here are the carriers that I know for certain have a cost comparison tool that you can utilize:

- Anthem Blue Cross Blue Shield

- UnitedHealthcare

- Aetna

- Medical Mutual of Ohio (Ohio based company)

Most insurance companies have an app that you can download on your smartphone which allows you to log into your portal. I have a little story of how an app saved me hundreds of dollars that I’ll share in a bit.

How do you find out if your insurance company has a cost comparison tool? Either create your account and explore or call them (the number on the back of your insurance card). They’ll tell you.

Once you have established that your insurance company has a cost comparison tool, check it out! They are typically simple to use. You input the episode of care you will need (i.e. MRI, X-ray, specific surgery, etc.) your zip code and it will spit out a listing of facilities and/or providers and their average cost. Sometimes they even list patient satisfaction ratings for the providers.

Violating My Own HIPAA

I can violate my own HIPAA and tell you a personal story. I see a doctor every year or two for a condition I was diagnosed within my 20’s. Fortunately, I am basically healed of it but I do get checked out periodically. Anyways I saw my doc, who works for a big hospital system here in Cleveland, and he wanted me to get X-rays to see if there was any progression. He told me to go to the basement, get the X-rays and they’ll send him the report. I told him I was on an HDHP and was going to shop around for X-rays. He looked at me like I had four eyes. However, he accepted it and I told him I’d bring him my X-rays on a disc.

Before leaving the hospital, I searched on my carrier’s app via my phone and used the cost comparison tool. I found an imaging center down the road that was ⅛ the cost of having an X-ray at said hospital! Needless to say, I drove there, got my X-rays on a disc, and drove it back to my doc. I saved several hundred dollars. FYI, the imaging center also sent a report to my doc.

Stand Alone Imaging Centers & Labs

As a general rule of thumb, stand-alone imaging centers and labs charge a fraction of the cost of having major tests done at a hospital. Imagine if you need a big-ticket item like a CAT Scan or an MRI. You can save thousands of dollars by going to a stand-alone imaging center versus having it done at a hospital.

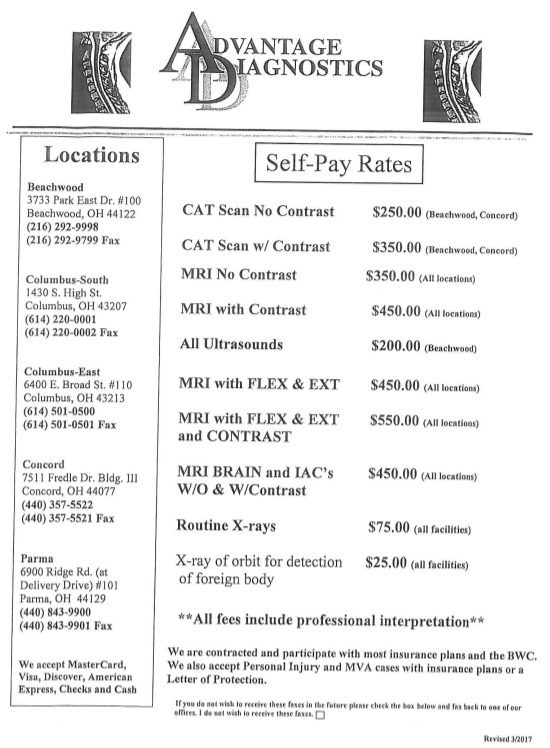

I don’t work for this particular imaging center, Advantage Diagnostics, but I want to post their self-pay rates so you can see how low their costs really are. They do take insurance and cannot publish those contracted rates since it is different for each carrier. However, sometimes their self-pay rates are cheaper than having it go through your insurance. Hmmm…

I recommend searching in your specific area for stand-alone imaging centers. If not, use travel rewards and come see me in Cleveland!

Other Ways to Save Money

Blood work is another way to save money. There are stand-alone labs which draw blood and, you guessed it, charge a fraction of the cost of having it drawn at the hospital. Here are a few I’m familiar with which have locations around the country:

Unless you are going the self-pay route, I recommend that once you find a stand-alone facility, make sure it is in your insurance carrier’s network.

Hospitals

Not all hospitals are equal. Here in Cleveland, we have some big-name hospital systems and they are great. People travel from all over the country for the phenomenal care available in Cleveland. However, we also have a nationally ranked, public healthcare system called MetroHealth. We have found that MetroHealth has some of the lowest costs. I personally have received outstanding care from Metro. My advice is to research the hospitals in your area.

Lastly, I want to review shopping for prescriptions. If you are on a health plan with prescription co-pays, this may not be as important to you. If you are on an HDHP plan, it will be crucial. The first tool, I’ve found is Good Rx. You can go to their site (or mobile app), create a login, and search for your specific prescription. You’ll input your prescription, dosage and zip code and voila! There will be a listing of pharmacies within a certain radius of you and their cost for your specific Rx. Please note that you’ll want to search every prescription as a particular pharmacy may be the lowest for one Rx, but another pharmacy may be lower for another Rx.

You can also print out coupons from Good Rx. Speaking of coupons, a lot of people don’t know that the drug manufacturers often issue coupons for high-cost prescriptions. The reason is that if they cover the cost of your Rx for the first month or two, you’ll meet your deductible and then the carrier will pick up the cost for the rest of the year. Their motive may not be great, but if it allows you to get your Rx for free or a very low cost, take advantage of it. There is another great site to apply for these manufacturer’s coupons and that site is called needymeds.org.

In my job, I’m always searching for lower cost, high-quality ways to seek care. If I find more healthcare hacks, I’ll definitely share.

Let me know what you are finding and/or if this was useful to you.

Related Articles

- Getting Health Insurance When You’re Self Employed Or Retired Early

- How An HSA Fits In With Your FIRE Plans