Your W-4 lets your employer know how much of your paycheck to withhold for federal income taxes. If your state charges income tax as well then you will have a separate form for that. Everything we are talking about in this article relates to federal income taxes and the W-4 only.

You can use the W-4 to adjust how much will be withheld for taxes. If you know what your tax liability will be for the year, you can use the “allowances” section on the w-4 to make sure you aren’t having too much or too little withheld from your check each pay period.While simple, filling out the W-4 incorrectly impacts both your tax withholdings and your paycheck. Click here to download the 2019 W-4.

Understanding Personal Tax Liability

First things first, you’ll want to understand your personal tax liability. This is the amount you will owe in taxes in a given tax year. Understanding your personal liability helps you strike the balance between not owing any money at tax time and keeping the most amount of money in your paycheck.

Unfortunately, figuring out your liability relies on some guesswork. Your tax preparer can help you estimate your liability for the current year, or if you want a quick ballpark figure, you can also use an online calculator like this.

Your previous tax return can also help you figure out your personal liability, especially if your situation hasn’t changed much since last year. To do this, find your 1040 from last year and search for line 15. This shows you how much you owed in taxes for the previous year. It is important to remember that the tax law changes, and you should verify with your tax preparer before assuming this year’s tax liability remains the same.

Also, keep in mind, if you are married and filed jointly, this will be the total tax you paid as a couple.

How Does Understanding Personal Tax Liability Help?

You will use your personal tax liability to figure out how much should be being deducted from each paycheck and then adjust your withholdings accordingly. The goal is to have the proper amount taken each pay period so that you don’t get a big return, or owe any money at tax time.

Take your personal liability and divide it by the number of pay periods you have in a year. But don’t forget your spouse! If you file jointly their withholdings are also going towards your tax bill.

Simple Example:

If you are single this is fairly straightforward. Let’s say you determine your federal tax liability is $5,000 and you get paid every two weeks (or 26 times per year.) This means you will want to aim to have $192.31 be deducted from each paycheck. (5,000/26 = 192.31)

But let’s say it’s not the beginning of the year. Let’s say it’s September and you’ve already paid in $3,500. This means you will want to divide $1,500 (the amount you still need to have withheld this year) by the number of paychecks you will receive by the end of the year. Let’s say nine paychecks.

In this case, you would want to aim to have $166.67 taken out of each paycheck for the rest of the year. (1,500/9 = 166.67)

More Complicated Example:

If you are married filing jointly then things are slightly more complicated. Let’s say again that you’ve determined that your family’s tax liability is $5,000. We know from above that this means you will have to have $192.31 withheld per paycheck. (Assuming 26 paychecks per year.)

Before figuring out how much needs to come out of your paycheck, you’ll need to see what is coming out of your spouse’s paycheck. Let’s say your spouse is withholding $100 per check. That means you should aim to have $92.31 withheld from yours. This way, together, your family is withholding the needed $192.31 per check.

How do you control your withholdings? We get to that below.

How To Fill Out A W-4

Now we can dig into the nitty-gritty details of your W-4.

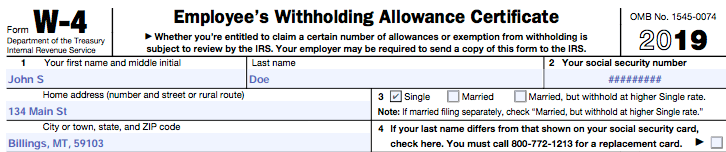

Lines 1 – 4: Personal Information

Lines one through three of your W-4 are the easiest. As long as you know your name, social security number, address, and marital status, you are good to go!

You only need to complete line four if your last name doesn’t match what is on your social security card. If that’s the case, you must call and have a new card made for you.

Line 5: Allowances

![]()

Line five is dedicated to one of the most important parts of your W-4–allowances. Allowances work like exemptions, telling your employer to put less of your paycheck towards income tax. This means that the more allowances you claim, the less money your employer will withhold from your paycheck.

While a bigger paycheck sounds like a great idea, you could end up with a huge tax bill at the end of the tax year if you get it wrong.

How Many Allowances Should I Claim?

The goal with allowances is to find a balance somewhere between having too little and too much withheld from your paycheck. If you can find that balance, you can keep more money in your pocket now! Sounds great, right?

This is going to go back to your personal liability and the math you did to figure out how much you want taken out of each paycheck. And honestly, this may take some fiddling over a few paychecks to dial it in.

There is a worksheet included with your W-4 to help you claim the right number of allowances. That’s a perfectly fine place to start, but take a look when you get your first paycheck. If you want more deducted, increase the number of allowances. If you are having too much deducted, decrease the number of allowances.If you feel like the worksheet isn’t helping you figure out how many allowances you should claim, the IRS created a calculator to help you. To use the calculator, you should first dig out your most recent pay stub and your last completed 1040.

Related: Challenge: Get Your Tax Return Down To Under $100

Line 6: Extra Withholdings

![]()

This line is for telling your employer to withhold an additional flat amount, above what they would normally withhold from your paycheck. You can use this if you really want to dial in on an exact amount you want to be withheld.

For example, let’s go back to our examples above and say you want $192.31 withheld. You are very confident in this number and you know it’s exactly the amount you want coming out of your paycheck. Let’s say you start with three allowances and when you get your paycheck you see that this caused $150.00 to be withheld.

Based on your calculations, you want more than that. So you increase your allowances to four. This causes $210.00 to be withheld from your check. Ah, that’s too much!

This is where the “extra withholdings” line comes in. You could drop your allowances back down to three and then ask for an additional $42.31 to be withheld. This would make your total withholdings exactly $192.31.

Typically, this line is not used, since these are all estimates anyway. We are hardly ever so certain of exactly what our taxes will be. Getting close is good enough.

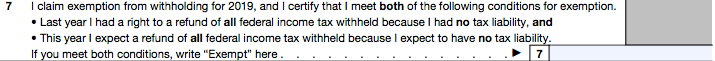

Line 7: Exempt

If you didn’t owe any federal income taxes last year and don’t expect to owe any this year then you can claim “exempt.” This means that no federal income taxes will be withheld from your paycheck.

Claiming exempt when you are not might make your paychecks bigger now, but you might be hit with a huge tax bill in April. Not only that, but the IRS may penalize you for not paying throughout the year.

Signing Your W-4

![]()

Now just sign and you are on your way!

When To Change Your W-4

Your W-4 is not a one-time deal. You can change your W-4 at any time, and it is usually as easy as contacting your employer’s HR department. You may want to consider looking at your withholdings whenever a major life event impacts your tax situation, including:

- Buying a home

- Having a child

- Change in marital status

- Change in income from obtaining a second job, starting a side hustle, or a raise

Final Thoughts

If you aren’t periodically reviewing your paystubs and tax liability you should change that practice. Paying attention to how much you are sending to the government each check is important. It just takes a few seconds when you get paid.

If you understand your personal tax liability and learn to balance your allowances, you are well on your way to keeping your money in your pocket. And more money in your pocket means more money for your retirement and investment accounts.

Related Articles