If you’re new to earning credit card rewards, you may not have a complete understanding of the ins and outs of rewards points. Today, we’re going to focus on one of the most valuable rewards programs—Chase Ultimate Rewards®.

While Chase may have the most valuable rewards currency, it’s gotten a lot harder to earn bonuses from Chase. This is in part due to some new rules, including:

- The Chase 5/24 rule. If you have more than five personal credit accounts opened over the past 24 months, it is highly unlikely that Chase will approve you for a new card.

- You can only earn a bonus from either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® and you can only earn a bonus from either card every 48 months.

With these rules, it is important to be intentional with your Chase Ultimate Rewards®. That way, you can get the most value out of them.

How To Earn Chase Ultimate Rewards® Points

Not all Chase credit cards earn Ultimate Reward points. If you want to earn Ultimate Rewards points, you’ll need to use one of the credit cards listed below.

Recommended For Everyone:

Recommended For Frequent Travelers:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Chase Sapphire (only available by downgrading)

Recommended For Business Owners:

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

- Ink Business Preferred® Credit Card

In addition to earning points on your everyday purchases, you can earn a sign-up bonus on most of these credit cards if you meet the requirements. You can also earn Ultimate Rewards points by shopping through the Chase online shopping portal.

How Chase Ultimate Rewards® Points Expire

Technically, Chase Ultimate Rewards® points don’t expire as long as you have a credit card open that earns Chase Ultimate Rewards® points. Chase also notes you’ll lose your points if your account is closed due to “program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement.”

The problem comes when you close your last card that earns Chase Ultimate Rewards® points. If you still have points remaining, you’ll lose the points if you don’t use them. Rather than give your points away, consider redeeming your points using the redemption options we’ll cover in just a little bit.

If you’re just closing a Chase card you no longer want but still have other Ultimate Rewards earning cards in your household or business, you can transfer your Ultimate Rewards points from one card to another. In order for the transfer to be legitimate, you need to transfer the points to yourself, a household member, or a business co-owner.

Otherwise, Chase may think you’re trying to sell your points, which is against the terms and conditions.

Ways To Maximize Redemptions

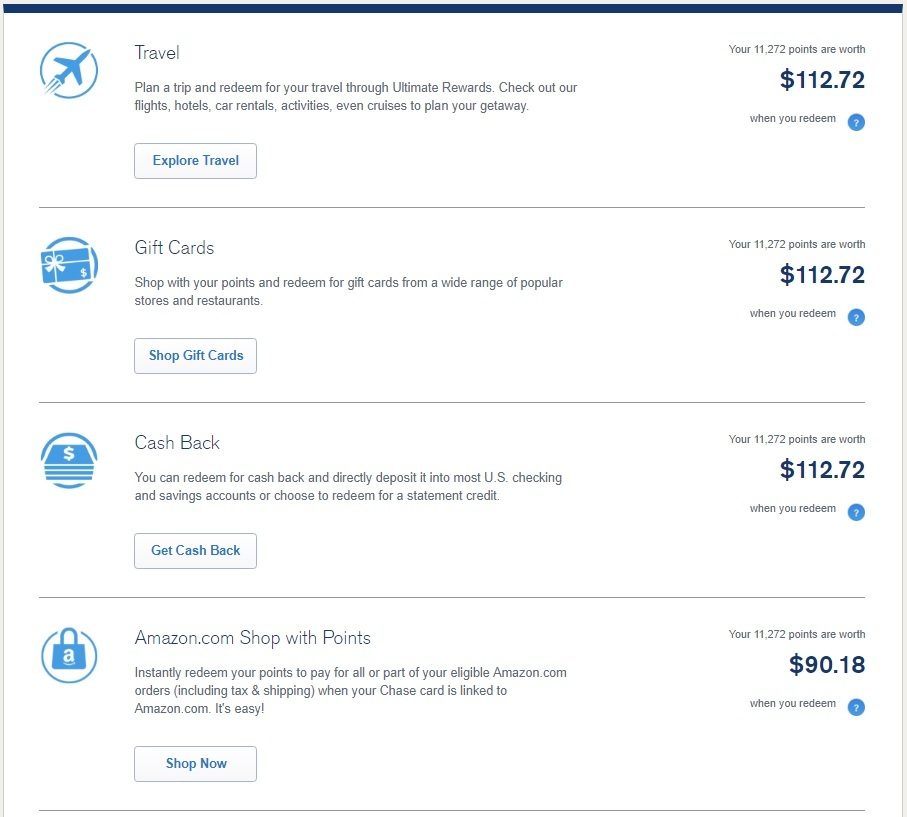

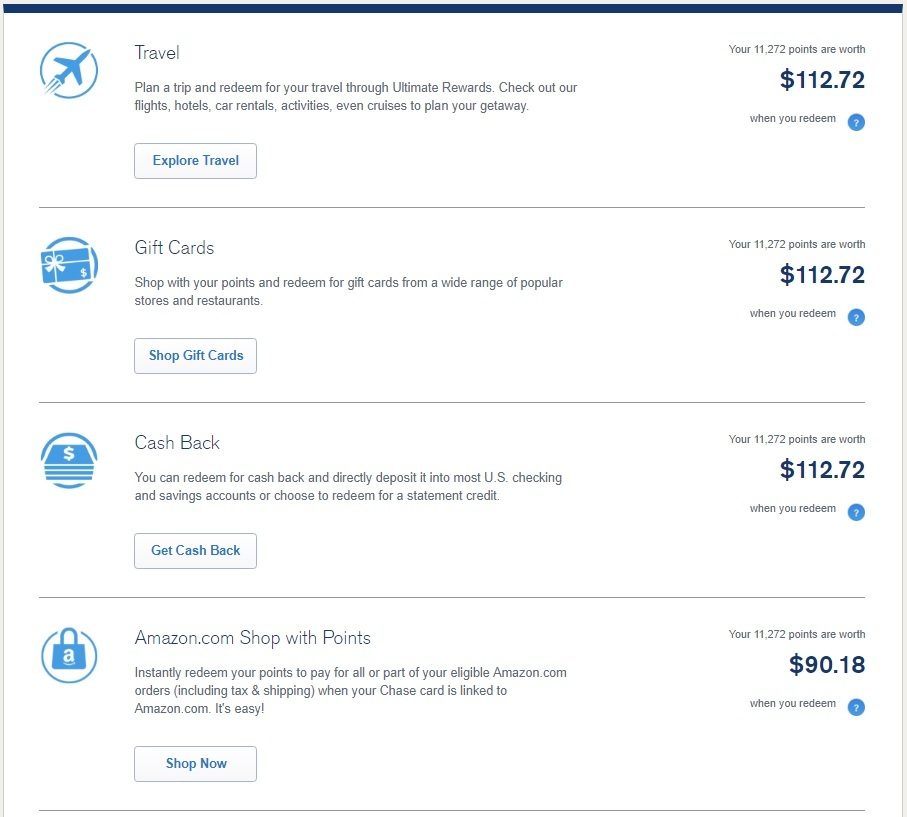

There are several ways to redeem your Chase Ultimate Reward®s points.

- Transfer your URs between your Chase personal and business credit card accounts as often as you’d like.

- Transfer your URs to another person who lives in the same household.

- Redeem your URs at Amazon.

- Transfer your URs to travel partners.

- Cash out your URs.

Let’s take a closer look at a few of these strategies

1. Transferring Chase Ultimate Rewards® Points Between Cards For Maximum Value

Don’t only consider transferring points because you’re closing a card and want to transfer points to avoid losing them. In fact, transferring points from some Ultimate Rewards earning credit cards to premium Ultimate Rewards earning credit cards can increase your redemption value.

For instance, points redeemed for travel through Chase Travel℠ are worth 1.5 cents each if you redeem them through a Chase Sapphire Reserve® or 1.25 cents each if you redeem them through a Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card.

If you’re going to book travel using Chase Travel℠, you should definitely transfer points from cards like the Chase Freedom Flex℠ to your premium account before booking travel to get maximum value.

2. Redeeming Chase Ultimate Rewards® Points at Amazon

Chase’s cards without an annual fee (Chase Freedom Flex℠, Chase Freedom Unlimited®, Ink Business Unlimited® Credit Card, and Ink Business Cash® Credit Card) allow you to redeem your points at a value of a penny per point for cash back, travel and gift cards. You can also redeem your points at Amazon for 0.80 cents per point.

However, if you or someone in your household holds a premium Chase Ultimate Rewards® earning credit card, you can transfer your points to that card to redeem your points using premium options.

3. Transfer Chase Ultimate Rewards® Points To Travel Partners

The same premium credit cards mentioned above offer yet another option to redeem Ultimate Rewards points. Rather than book travel through Chase Travel℠, you can transfer Ultimate Rewards points to certain travel partner rewards programs at a 1 point to 1 point ratio. Here are the current travel programs you can transfer points to:

- Aer Lingus AerClub

- British Airways Avios

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG Rewards Club

- Marriott Rewards

- Emirates

- World of Hyatt

Keep in mind, sometimes you’ll get a better value by booking through Chase Travel℠ and other times you can find better redemptions through the individual rewards program. Unfortunately, once you transfer points out of Ultimate Rewards, you can’t transfer them back. Make sure you want to transfer points before you pull the trigger.

4. Cash Out Chase Ultimate Rewards® Points If You Have No Other Use For Them

Finally, if you don’t have a premium Ultimate Rewards credit card, you can always redeem your points for cash at a value of a penny per point. If you’re going to close a card that still has a remaining points balance, make sure you cash out any points you have remaining so you don’t give them back to Chase.

Redemption Ideas For Great Values

Here are some great ways to use the points:

1. Transferring To Southwest

With the Companion Pass, every Chase UR is doubled in value. Together with the generous cancellation policies for redemptions (cancel up to 10 minutes of departure for full refund of points), plus two free check-in items, and this represents the best value for domestic and regional travel.

Related: Why You Definitely Want The Southwest Companion Pass

2. Transferring To United

One of the best uses of United Mileage Plus miles is by nesting multiple Excursionist Perks within each other. The basic idea is that you get a free regional flight when you redeem. With some planning, I was able to take my homeschooling family of four across Asia for almost five months by nesting three Excursionist Perks.

3. Transferring To The IAG Group Of Airlines

The IAG group of airlines includes British Airways, Iberia, and Aer Lingus. Even though all three have their own loyalty programs, they share the same currency–Avios. You can transfer these points between each other. We love Avios for their British Airways redemptions on American Airlines and Alaska Airlines, the solid redemptions on Iberia to Madrid and Aer Lingus to Dublin. Avoid actually flying on British Airways, though, as those come with expensive charges.

4. Transferring To Hyatt

Hyatt is our favorite hotel loyalty program because of its reasonable redemptions at attractive properties. It is also known for its generous program rules that reward members with bonus perks just for redeeming nights. Topping it all is the industry’s most customer-focused team.

5. Booking Travel At Chase Travel

With one of the premium cards mentioned above, you get a bonus on your Chase Ultimate Rewards® when you book travel through Chase Travel℠. If a flight cost $300, it would normally cost 30,000 Chase UR points. But with the Chase Sapphire Reserve®, you get 50% extra, so it would only cost 20,000 URs.

With the Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card, the bonus is 25%, so that same flight costs 24,000 URs.

Keeping Track Of Your Rewards

If you want to use category bonuses to maximize your points, you really need to get organized. Here is one simple way of doing it:

- Put tape on the card and write the category bonus on it. This is especially helpful if you have a reluctant partner who really doesn’t want to work on getting free travel.

- Set your phone, Internet, and cable accounts on autopay for a card the yields the highest category bonus.

- Check your account monthly to track how close to the bonus earning limit you have come. You want to stop spending on a card once you no longer qualify for a bonus category.

Some Recommended Tips To Stay Under 5/24:

If you are close to your 5/24 number and want to stay under it, here are some tips:

- The Ink Business Preferred® Credit Card, the Ink Business Cash® Credit Card, and the Ink Business Unlimited® Credit Card do not add to your 5/24 number. We recommend getting the Ink Business Preferred® Credit Card (among other things, it earns 3x for travel expenses), and the Ink Business Cash® Credit Card (to earn the 5%, put your phone, internet, and cable costs on autopay).

- Avoid applying for any new personal cards and instead, earn the maximum amount of points as you can by focusing on 5x and 3x.

Chase Ultimate Rewards® Points Are Amazing Once You Understand How To Use Them

Ultimate Rewards points are some of the most valuable credit card rewards points you can earn due to the great flexibility you have to redeem them. If you’re big into travel rewards, you can explore the various points transfer partners to find insane values on a value-per-point basis.

That said, you can still get great value for your points by using Chase Travel℠, too. Just make sure you use your points on the card that gives you the highest value per point for the cards you have. Finally, never let your points expire by closing a card with a points balance. Cash them out or transfer them to a transfer partner before you lose them.

If you really want to maximize your travel rewards check out Ultimate Guide to Credit Card Travel Rewards series.