Owning your own business comes with a lot of perks, but it also comes with tons of responsibility.

Using an accounting software is a must for many business owners. It can help you pay your employees, keep track of time clocks, send invoices, and much more. But many accounting software platforms are clunky and don’t really help make your life easier.

FreshBooks is a super simple, fun to use accounting software that truly makes your business life more organized.Today, I’ll go through the sign-up process and discuss in-depth all that FreshBooks has to offer.

How FreshBooks Works

FreshBooks describes themselves as an “all-in-one small business invoicing and accounting solution.” Which is quite a mouthful. But what does it mean?

Essentially, all that means is that FreshBooks offers accounting software to help you run your small business. But, unlike most complicated accounting software, FreshBooks promises that theirs is ridiculously easy to use.

You can automate tasks like invoicing and expense tracking, which saves you a ton of time. There are also lots of other features that make FreshBooks well worth having.

Let’s dive in.

FreshBooks Features

Invoicing

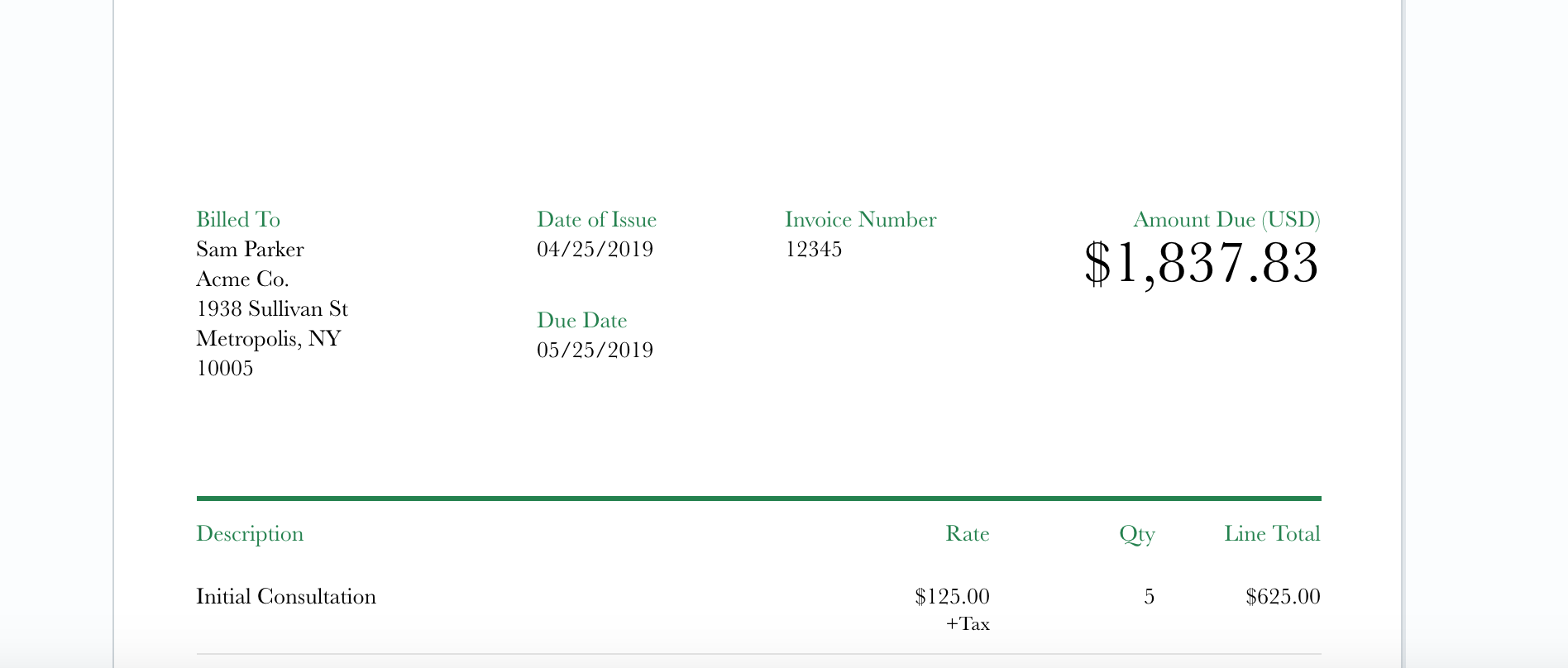

This is my favorite feature of FreshBooks. When I signed up for my account, they let me send a test invoice so I could see what it looks like.

All you have to do is input your basic information and FreshBooks gives you a professional, easy-to-understand invoice (see below).

How many invoices you can send will depend on the plan that you choose, but we’ll cover that in a bit.

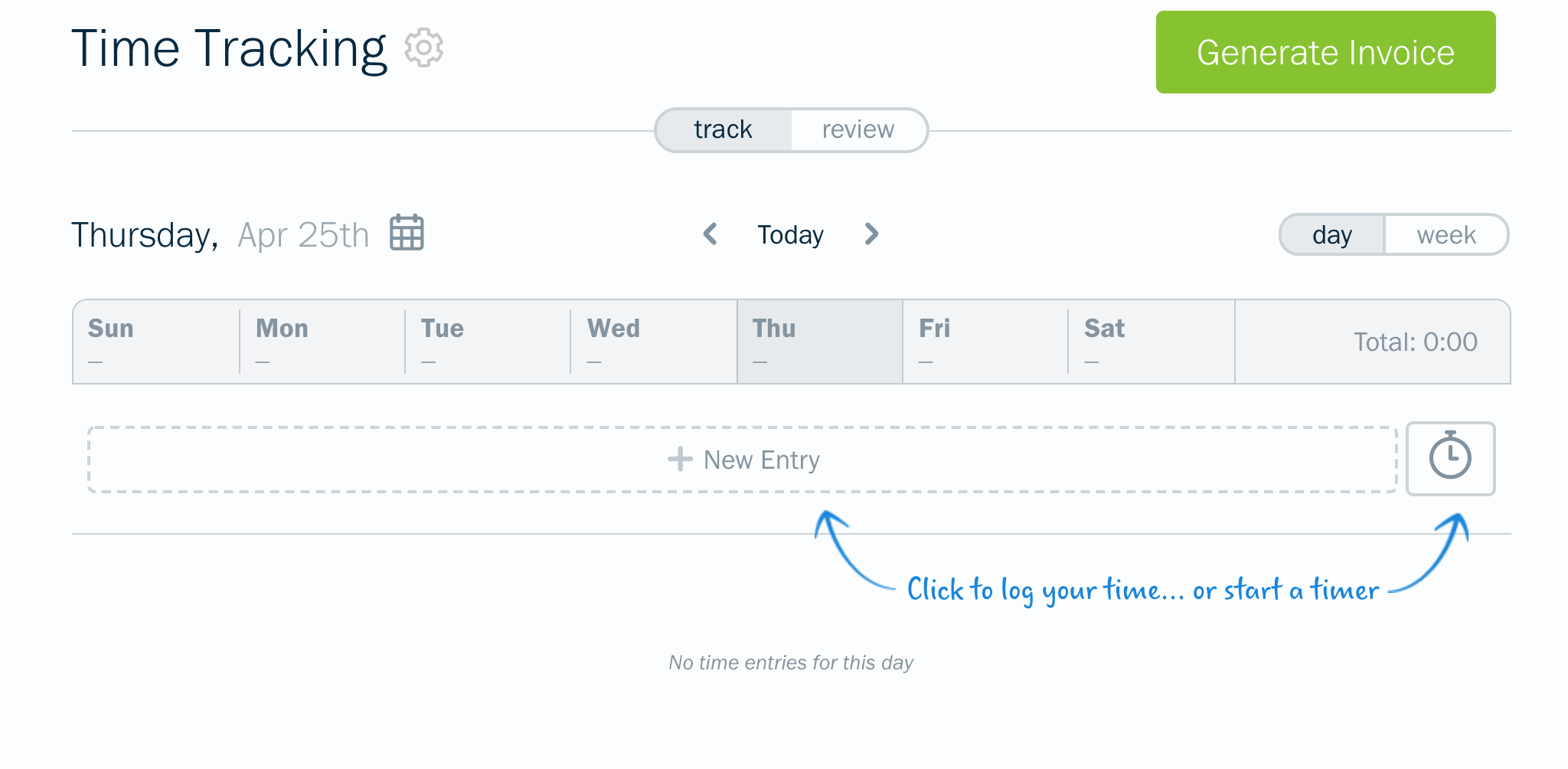

You can also generate an invoice from your Time Tracking section, making it even easier to bill people for your work.

Expenses

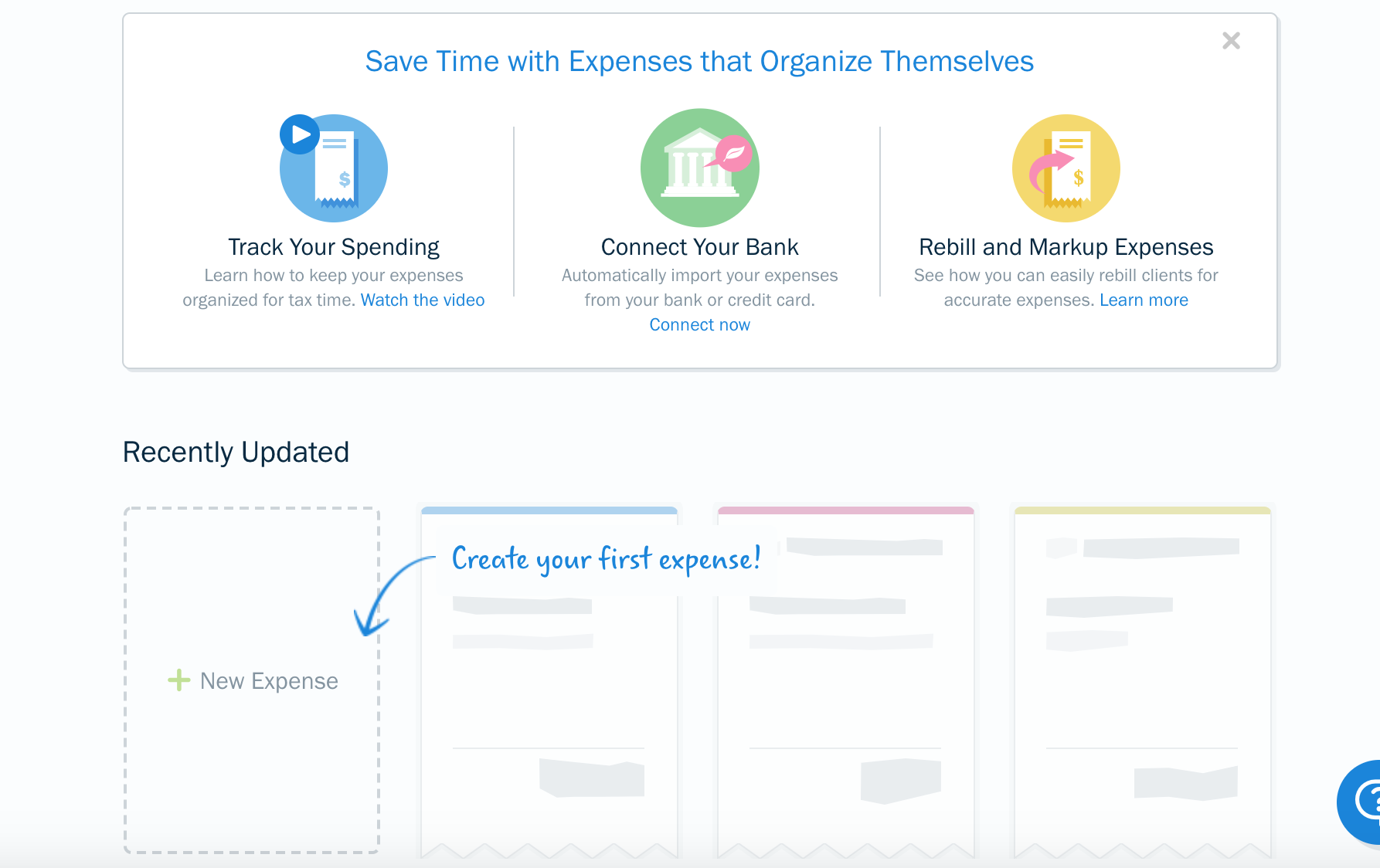

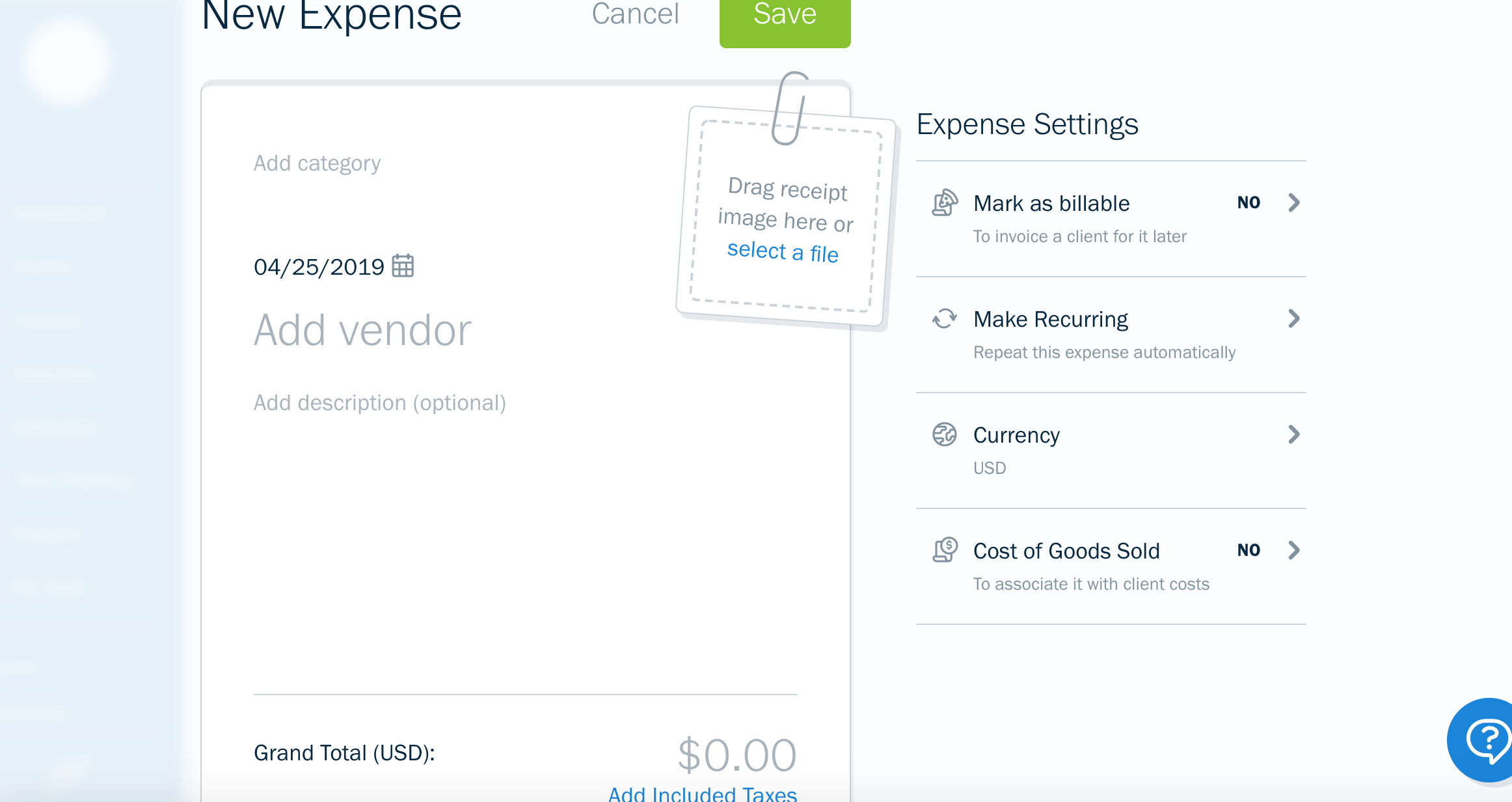

Rather than keeping piles and piles of receipts, FreshBooks allows you to track your expenses on their app or desktop version.

You can connect your bank or credit cards to FreshBooks so your purchases are automatically uploaded, or you can do things by hand (my preferred method).

If you decide to go the manual route, FreshBooks still makes it easy for you to upload your expenses, as you can see below. You can even attach images of your receipts; this helps a lot during tax season.

Time Tracking

While this is a simple feature, it’s important. With FreshBooks you can easily track the projects you do. Plus, as mentioned above, you can create an invoice from your time clock for easy billing.

Reporting

FreshBooks stores all your financial reports in one place. You’ll have access to the following:

- Invoice details

- Expense reports

- Item sale reports

- Payments collected

- Sales tax summary

- General ledger

- Profit and loss reports

- Time tracking reports

You can favorite any reports that you want by clicking on the star next to the report’s name. These favorited reports will be featured at the top of the reports section for easy access.

Learn more about FreshBooks here.

Adding Team Members

You can easily add your employees to your FreshBooks account. That makes keeping track of time clocks, projects, and expenses a whole lot easier.

Plus, you can limit access to your personal information so your employees or team members can only see what they need.

Mobile App

FreshBook’s mobile app is very easy to use and looks beautiful. When you open the app, you’re led to your dashboard where you can see how much you’re making, what you’re spending, and who owes you money.

Everything else you need (invoices, time tracking, etc.) is organized nicely in the bottom toolbar, making navigation easy on the app.

Customer Support

As I was navigating through FreshBooks, I noticed a question mark icon in the right hand of the page. This indicates FreshBook’s bot that can help answer any questions that you have.

You can also send them a message through their contact page, email them, or call one of the toll-free numbers. Here’s a summary of all of FreshBook’s contact info:

- North America: 1.866.303.6061

- Australia: 1.800.218.731

- UK: 0808.101.3408

- Ireland: 1.800.949.046

- Canada (this is where FreshBook’s is based): +1.416.481.6946

- Fax: 416.481.3800

- Email: [email protected]

FreshBook’s office hours are Monday–Friday: 8am–8pm EST (Eastern Standard Time)

How Much Does FreshBooks Cost?

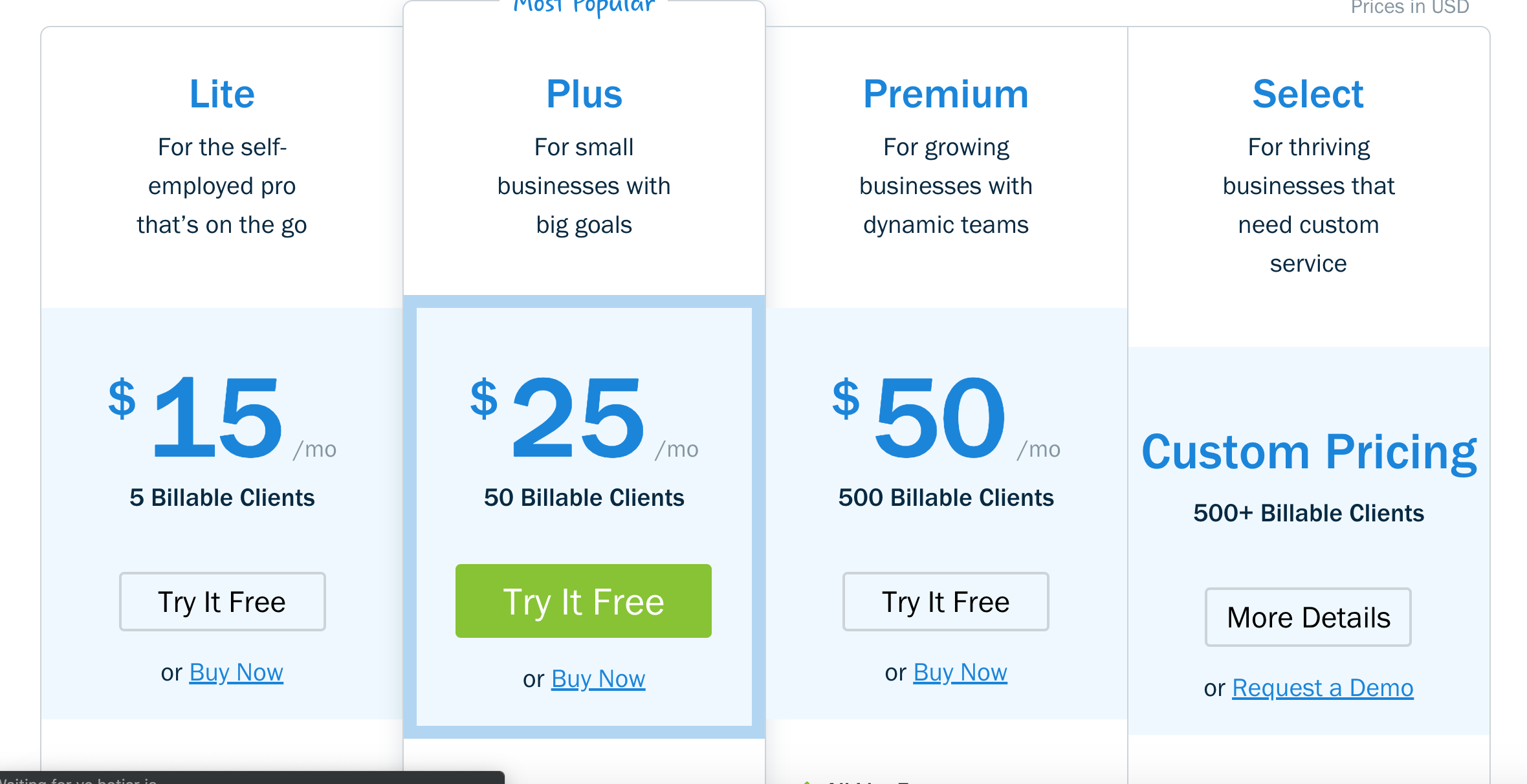

FreshBooks does come at a price, but compared to costly software like Quickbooks, the price isn’t that steep.

You’ll be able to do a free trial on any of the plans except the custom plan for 30 days.

The basic plan (which is the one I opted for) is $15 a month. As you can see, it’s best for self-employed folks that need to easily track their time, expenses, and invoices.

The more advanced plans are geared more towards small businesses, depending on how many clients you need to bill.

Finally, you can request a custom plan, but that’s best for larger businesses.

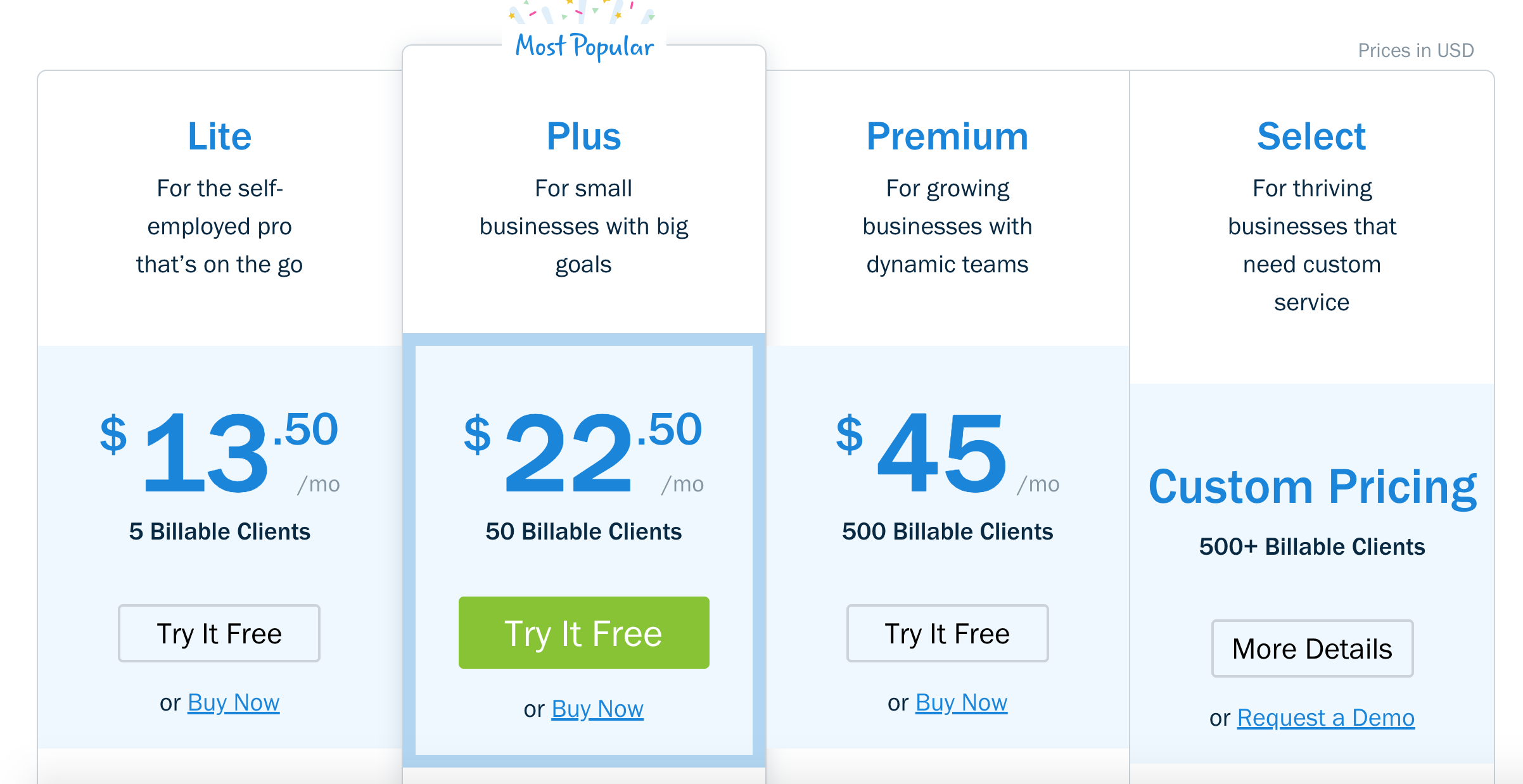

You can also pay yearly and get a discounted cost. Here’s what the yearly plans look like:

Who Is FreshBooks For?

FreshBooks is best for solo freelancers or those with a small team. I think once you outgrow the Plus plan you’d probably be better off with something a little more complex, such as Quickbooks. If you really have over 50 billable clients then you are working with a pretty big business.

I’m a self-employed freelance writer and editor, and keeping track of my projects, expenses, and invoices is something I’ve been doing by hand. It’s much simpler and efficient with FreshBooks.

FreshBooks also claims that larger corporations can benefit from them as well. Since you can create a custom plan, even larger companies can get everything they need from FreshBooks.

My Experience Using FreshBooks

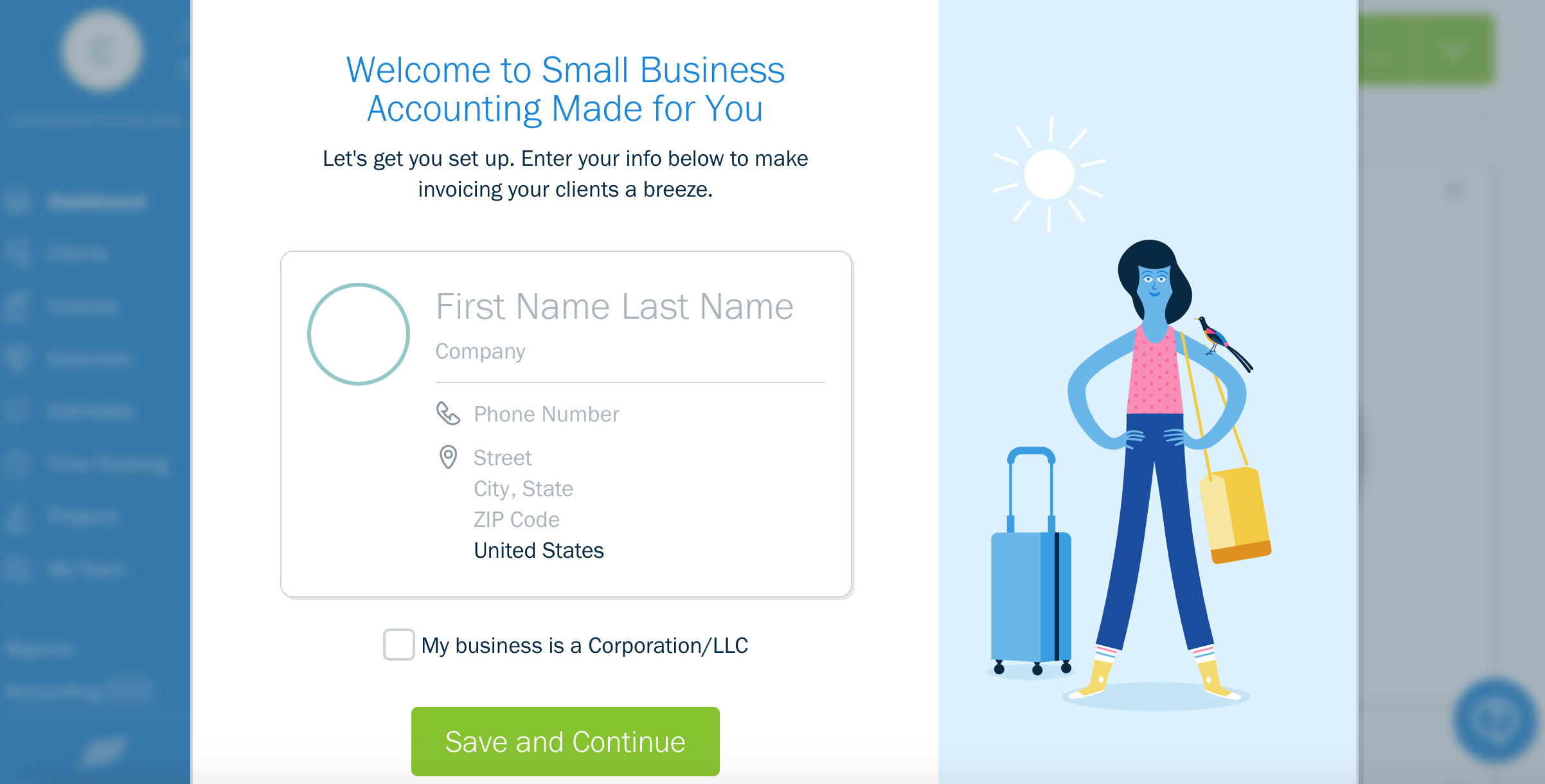

Signing up for FreshBooks was an incredibly easy experience. It took about a minute, and I didn’t have to enter any personal information other than my name and address, which is necessary for invoicing.

Let’s go step-by-step through the sign-up process so you can get an idea of just how easy it is.

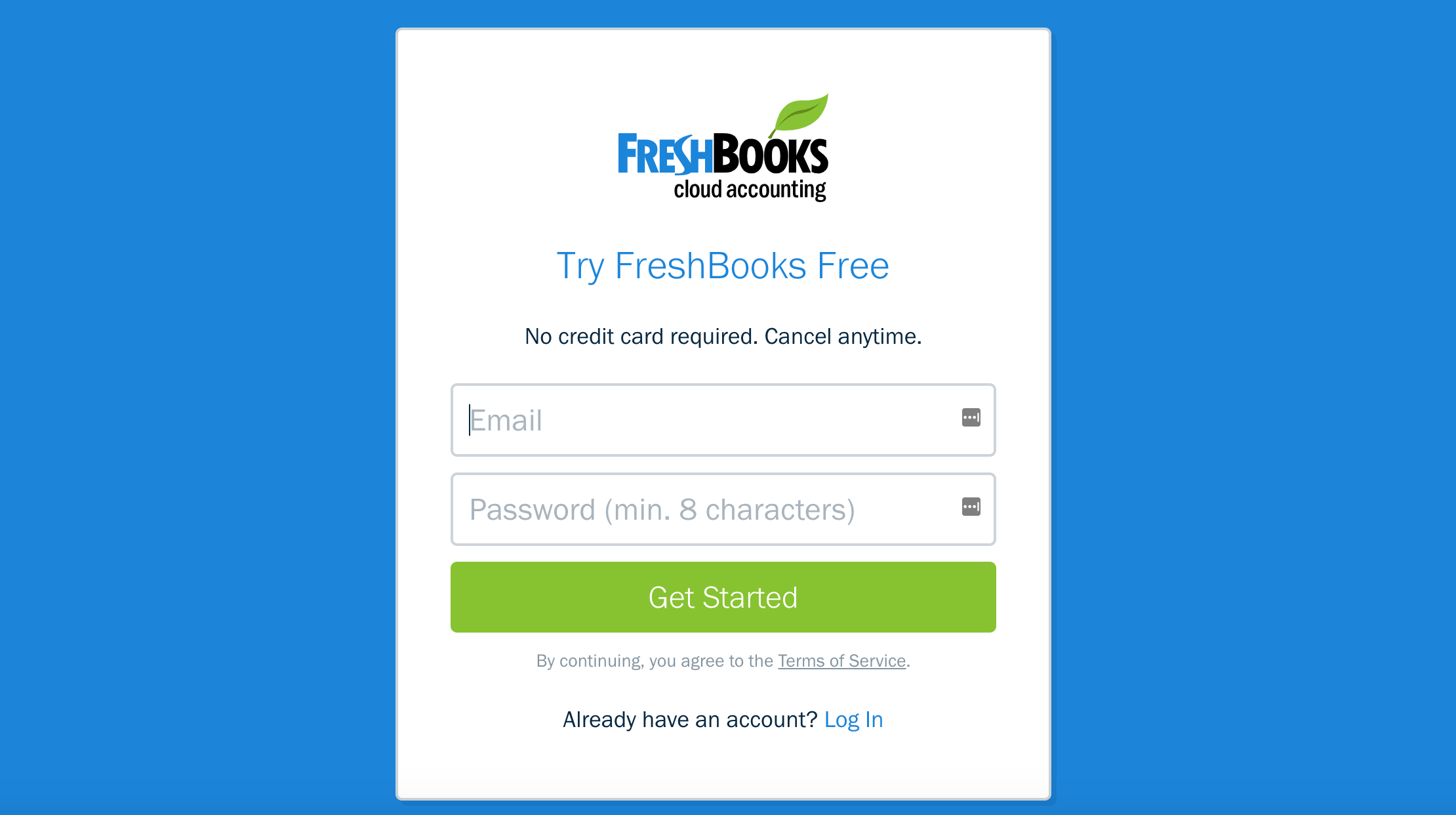

As always, you’ll need to enter your email address and create a password. You’ll also need to verify your email before you can take the next step.

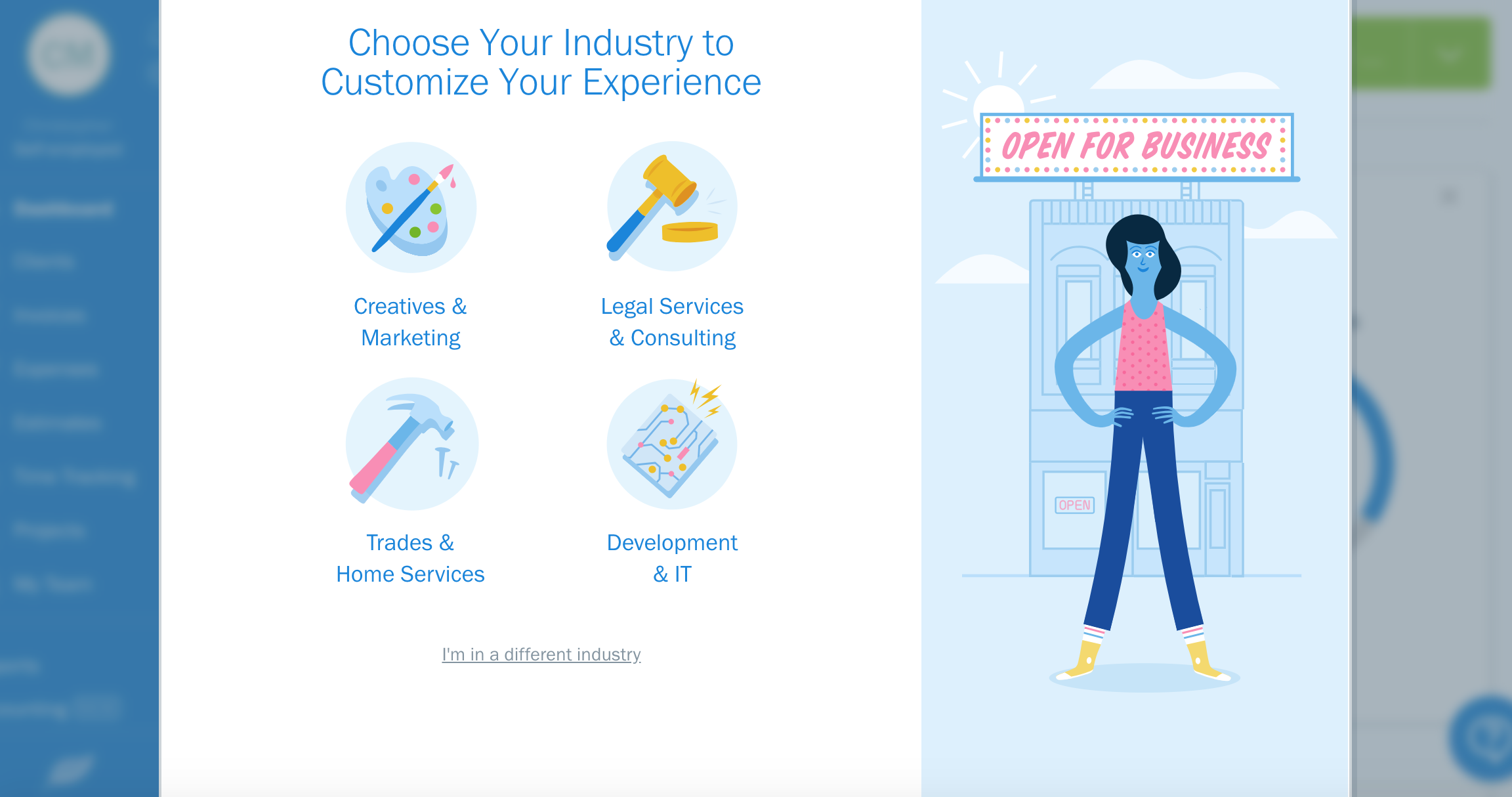

Next, FreshBooks asks you what industry you’re in so they can personalize your dashboard. I chose “I’m in a different industry” because none of the options applied to me.

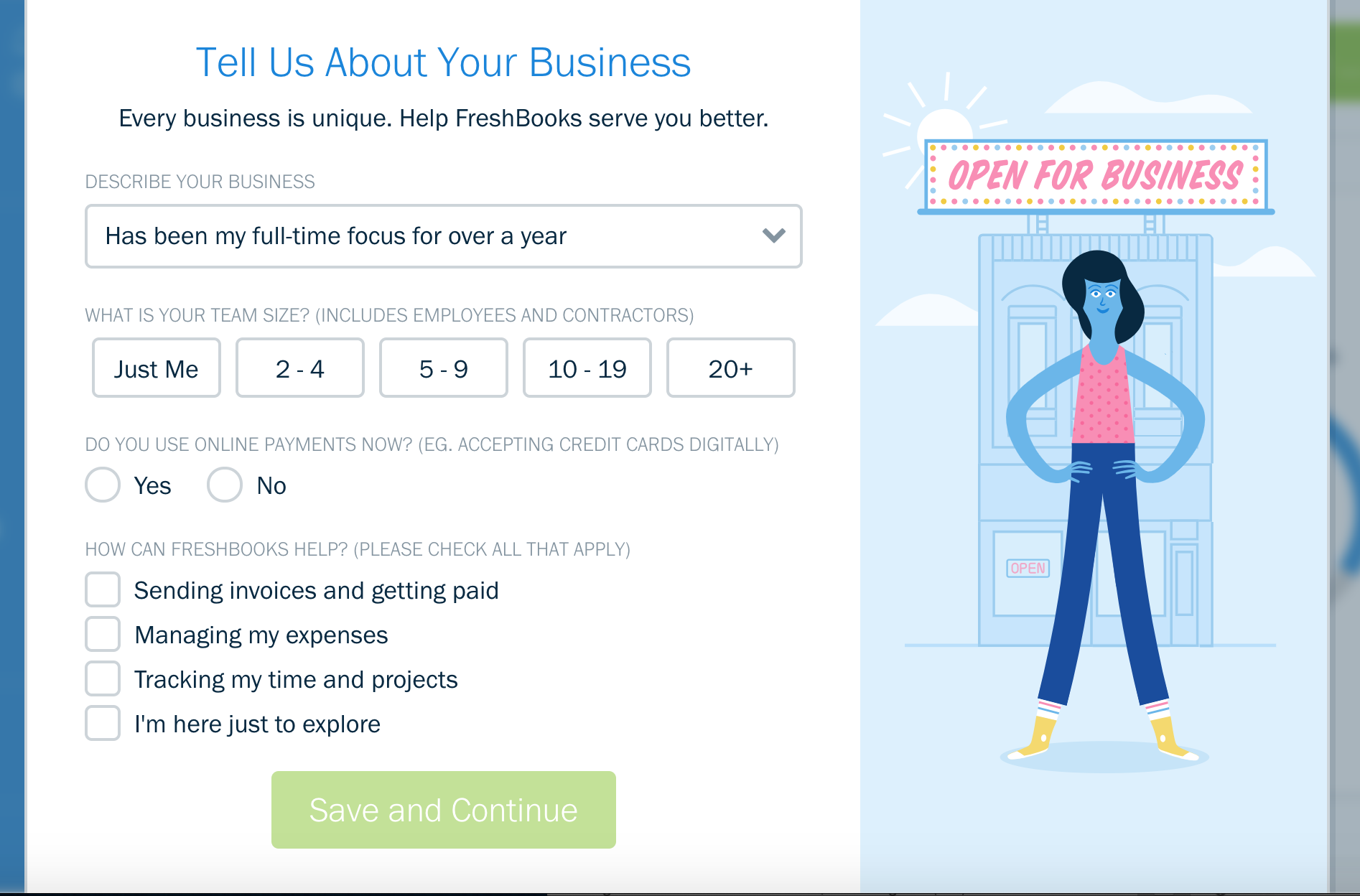

Since I chose the different industry option, FreshBooks asked me a few questions about my business.

The last step was simply naming my business. Again, this is for invoicing details.

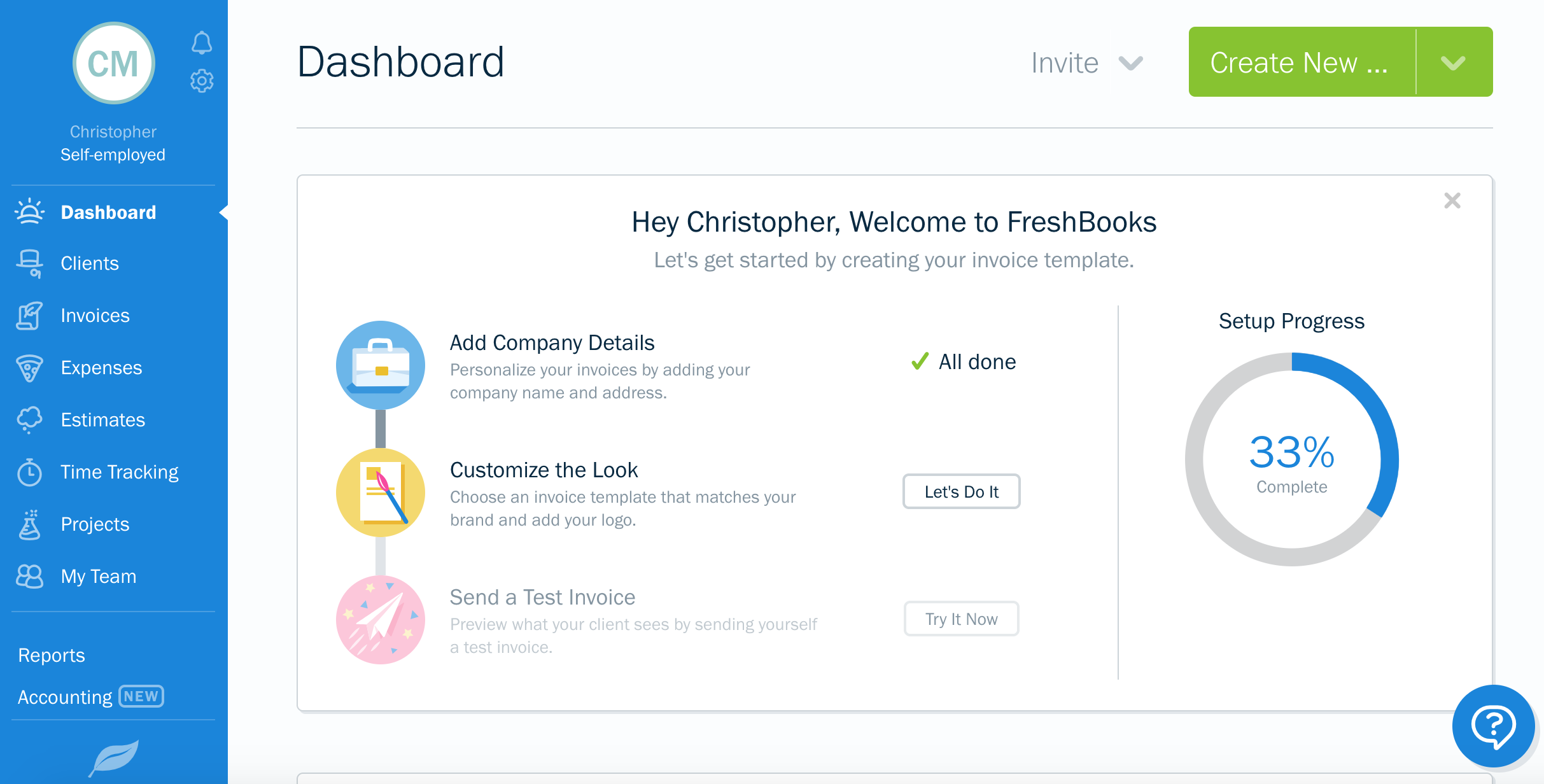

After the sign-up process, I was led to my dashboard. As you can see, everything is straightforward and all in one place.

As I clicked through the sidebar options, FreshBooks explained exactly how each page works, but honestly, it was all intuitive enough that I didn’t need any directions.

Start your free trial with FreshBooks here

FreshBooks Compared To Their Competitors

FreshBooks vs. Quickbooks

Quickbooks is the king of all accounting software. They have a sleek looking site that’s easy to maneuver.

The price point is slightly higher than FreshBooks, with plans starting at $20 (at the time of writing, you can get the basic version for just $10).

If you’re looking for more support, a few more features, and more advanced services, Quickbooks may be for you. But for those who don’t need all the glitz and glam of Quickbooks and want to pay less, FreshBooks has a ton to offer.

FreshBooks vs. Wave

Wave is a free accounting software for small businesses. That’s right, it’s totally free. That’s the biggest draw of Wave, but they also offer a host of nice features. Wave is a simple platform that offers account, invoice, payment, and payroll services.

If you need a completely free account, Wave is a great option. FreshBooks offers a much nicer design, and more features, however. So think about what you really need before going the free route.

FreshBooks vs. Xero

Xero is a beautifully designed accounting software that offers low prices (just $9 a month for their basic version), and by far the most features out of all the softwares I’ve mentioned.

To give you a sense of all that they offer, here’s a list:

- Accept payments

- Invoicing

- Asset management

- Contacts and smartlists

- The ability to transfer things over from Quickbooks

- Inventory

- Multi-currency accounts

- Pay bills

- Payroll

- Advisor tools

- And so much more

If you’re looking for a completely comprehensive, secure accounting software, check out Xero.

Final Thoughts

I loved FreshBooks! It was easy to use, aesthetically pleasing, and affordable.

If you’re looking for an accounting software that’s easy to use and can handle all your business needs, I would definitely give FreshBooks a try. I plan on using it from now on!

Related Articles