Well, maybe things aren’t so bad. As of July 4th, 2016 my retirement accounts matched the remaining balance on my student loans. Neither of those numbers is particularly impressive but it allows me to claim a net worth of $0. Net worth is a snapshot in time, it does not define you or even give you a good idea of where you are going. Instead, we need to look at savings rate and the trend over time

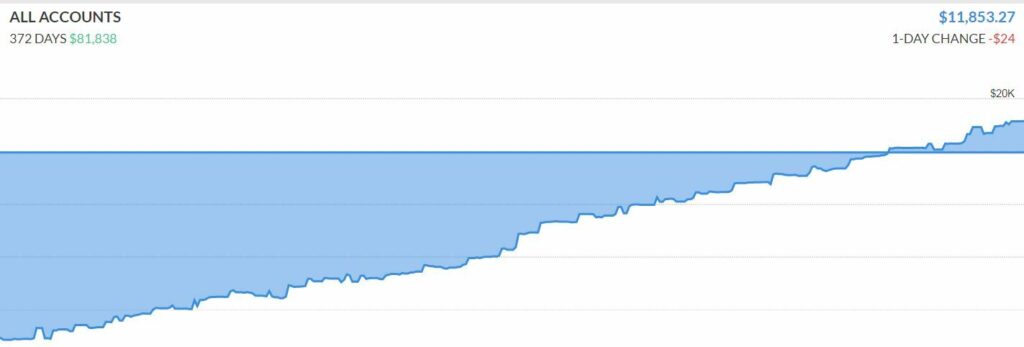

I use Personal Capital to track my net worth and have been doing so for the last 3 years. As of September, I have a net worth of $12,000, however, 3 years ago I had a net worth of -$168,000.

It’s great if you make $100K a year but if you spend $120K you are in worse shape than the teacher who makes $40K but lives within their means. That’s not to say that the higher salary doesn’t come with advantages but all too often those advantages are eroded away by lifestyle inflation.

My wife and I made the decision to live a comfortable but frugal lifestyle and we have thrown every other dollar at student loans for the last 3 years, We achieved a 50% savings rate by dialing in our expenses year by year. Each year we identified waste and by reducing our expenses a little at a time we were able to eliminate 6 figures of student loan debt without living on rice and beans.

The key to wealth is to spend less than you earn and invest the difference over time, however when you have debt it complicates things. Do I pay off debt or invest? The answer is…it depends. If you have credit card debt or payday loans, anything with an interest rate over 10% you are in a crisis and need to pay it off ASAP, but if your debt is student loans or even a car payment with a low-interest rate, you might be well served to do a little of both.

If you have access to a 401K or 403b that offers any sort of match you need to take advantage of it. In my case, my employer offers a $1 for $1 match on up to 4% of my salary. My wife’s employer offers a match on up to 7% of her salary. And while I make the case not to max out your 401K while you are paying off debt, you should never leave money on the table. By Participating in the match we effectively get our employers to put an extra $10K a year toward our retirement.

Now as my net worth continues to creep past $0, I am extremely grateful that I put that small amount of money aside. consistently over time.

The master plan is being initiated. For the next 6 months its simple, pay off the balance on the student loans. and learn this awesome technique called maximizing travel rewards points. Next year we will tiptoe into some real estate ventures and I will focus on developing 3-5 income streams.

This blog will provide an organized, curated, field guide for all the tools and skills I learn along the way.

Enjoy!

Jonathan