From tying their shoelaces to opening those tricky milk cartons, there’s no doubt that kids have a lot to learn. And if you’re a parent, it can feel overwhelming. How can you find time to teach your kids about money management and financial responsibility when there are so many other things for them to learn?

Don’t get discouraged. Remember, think of this as an opportunity rather than a challenge! After all, financial literacy is one of the most empowering gifts you can give your child. Just the fact that it’s on your radar means you’re already way ahead of the game.

It’s a sad but true reality that most parents never talk to their kids about money. According to the Nation’s Report Card on Financial Literacy, four out of five adults say they never had a chance to learn about personal finance. Children who don’t understand the most basic financial concepts grow up to be adults who make costly money mistakes.

Here’s your chance to break that cycle! We’re pleased to share some of our favorite finance books for kids that will capture their attention with colorful artwork, fun characters, and engaging stories. Let’s take a look.

Best Books To Teach Young Kids About Money

M is for Money

Age Group: Written for children ages 3 to 8 years old

High school math and personal finance teacher Rob Phelan was already immersed in the world of financial independence when he was inspired to write a book on financial literacy for kids. The idea struck him as he searched for a money vocabulary book for his then-18-month-old son. When he couldn’t find anything, he decided to write one himself. As the co-lead Personal Finance Curriculum writer for the ChooseFI Foundation, he was uniquely qualified for the task.

M is for Money will teach your kids the basic terminology of money. Readers go through each letter of the alphabet, learning a new money term for every letter. Stash the Squirrel guides young readers through the story, encouraging them to ask questions of the adult reading with them. These questions create conversations about key money concepts. Phelan is donating at least 10 percent of the profits from his book sales to non-profit groups supporting youth financial literacy.

My Rows and Piles of Coins

Age Group: Written for children ages 4 to 7 years old

Tololwa Mollel is a children’s book author who has written 17 books that have been published all over the world. The award-winning author’s work has been translated into Korean, Spanish, Serbian, Norwegian, and more. He has beautifully woven the culture of his native Tanzania into a book about money for kids, My Rows and Piles of Coins.

The charming story tells the tale of Saruni, a little boy who is excited to empty his secret money box for a shopping trip. He hopes to buy a shiny new bicycle that he plans to use to help his mother bring goods to sell at the local market. He’s crushed to realize he hasn’t saved nearly enough to buy a bike, but Saruni won’t give up. This story features vibrant, realistic illustrations and lessons about saving to reach your financial goals.

A Chair for My Mother

Age Group: Written for children ages 4 to 8 years old

The award-winning classic A Chair for My Mother was first published in 1982 and was featured on the popular children’s show “Reading Rainbow.” It tells a moving story while teaching young readers the value of setting a goal, making a financial plan, and saving their money.

After a fire destroys little Rosa’s home and belongings, she teams up with her mother and grandmother to buy a comfortable new chair they can all enjoy. Rosa helps out at the diner where her mom works, and her grandmother chips in with the money she saves when she finds good bargains. Soon, the family saves enough to buy their new chair. It’s a great lesson for kids about how rewarding it can be to work hard for a goal.

Late author Vera Williams was a renowned children’s book writer and illustrator. In 2004, she was the United States nominee for the Hans Christian Andersen Award, the highest honor for the creators of children’s books.

The Four Money Bears

Age Group: Written for children ages 5 to 10 years old

Children’s money habits are shaped at a young age. It’s important for them to understand the basic uses of money early on. The Four Money Bears teaches kids the uses of money through fun and relatable characters: Spender Bear, Saver Bear, Investor Bear, and Giver Bear. Each bear teaches a key money lesson. They teach your children the value of spending cautiously, saving diligently, investing wisely, and giving generously. The bears work together to learn about financial responsibility. Readers will learn how to create a healthy relationship with money.

“The Four Money Bears” was written by financial services professional Mac Gardner, CFP®. He believes in the power of teaching through storytelling, which led him to publish this book to teach kids about money.

Best Books To Teach Older Kids About Money

Danny Dollar Millionaire Extraordinaire: The Lemonade Escapade

Age Group: Written for children ages 8 to 10 years old

Ty Allan Jackson is an award-winning children’s book author and literacy advocate. His books have been featured on CNN, “N.B.C. Nightly News,” “The Steve Harvey Show” and many other media outlets. Jackson wanted to find him a book about entrepreneurship and financial literacy for kids. When he couldn’t find one, he decided to write one instead – bringing the character of Danny Dollar to life. Danny Dollar Millionaire Extraordinaire: The Lemonade Escapade is based on Jackson’s 7-year-old son’s real-life experience selling lemonade.

Danny is a charming, determined kid with a plan to become a millionaire. As young readers follow Danny’s adventures, they learn vital financial lessons about earning money, banking, investing, and entrepreneurship in a fun, relatable way.

Milton the Money Savvy Pup Brings Home the Bacon

Age Group: Written for children ages 11 years old and under

Kids love dogs! Who doesn’t? That’s why Milton the corgi is the perfect lead character for financial planner Jamie Bosse, CFP®, R.F.C.’s children’s book. Bosse based Milton on her own real-life corgi. Her goal in writing Milton the Money Savvy Pup Brings Home the Bacon was to teach kids important, basic financial concepts.

In the story, Milton learns about the value of different coins. He also discovers that you can buy things you want by working hard to earn money and saving up your cash. This book teaches the concept of delayed gratification in a relatable way as Milton has to choose between buying a simple dog bone right away or saving up to buy some delicious bacon later.

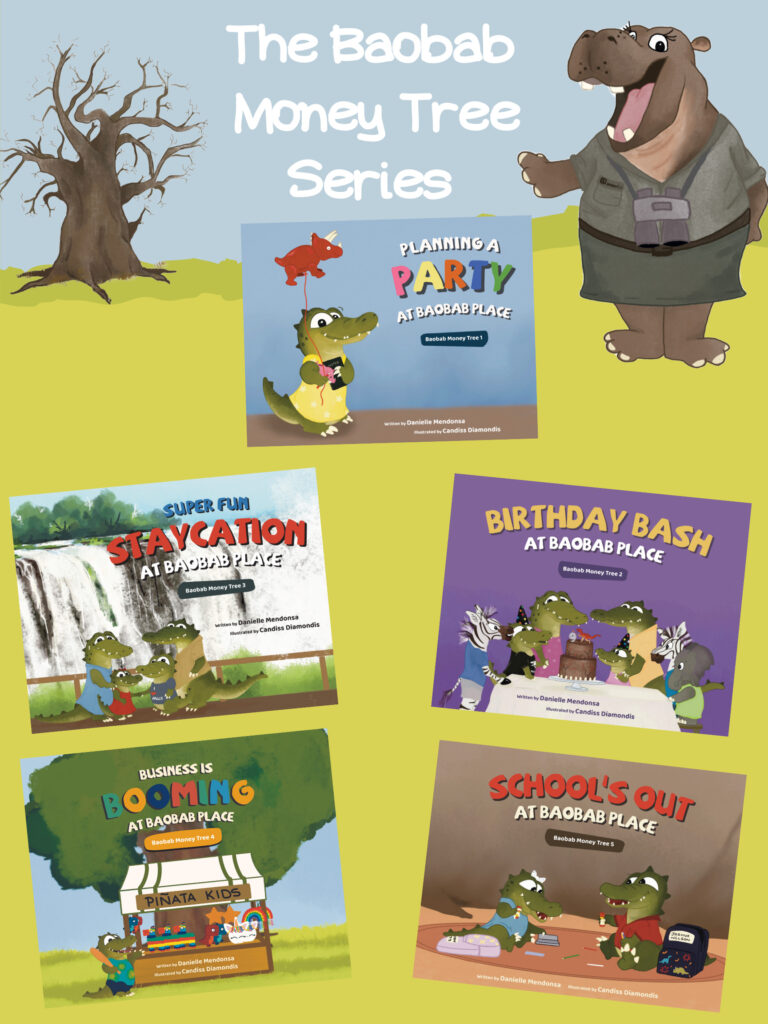

The Baobab Money Tree Series

Age Group: Written for children ages 7 to 10 years old

The Baobab Money Tree book series takes young readers on an exciting, colorful safari of money lessons throughout this 5 books series. Author Dani Mendonsa brings her expertise as an elementary school teacher, mom of two, and a ChooseFI Curriculum Development team member.

The series is set in Mendonsa’s native home in the southern African country of Zimbabwe. It teaches vital personal finance concepts through a vibrantly illustrated cast of charming African animals, including a family of crocodiles, a cheetah family, a giraffe, elephants, and more. Sassy, the fun-loving hippo, serves as the book’s adorable tour guide. She highlights key financial literacy points and gently encourages readers to take action in their own lives based on what they’ve learned.

Best Books to Teach Middle School Kids About Money

Investing for Kids: How to Save, Invest and Grow Money

Age Group: Written for children ages 8 to 12 years old

Investing for Kids: How to Save, Invest and Grow Money, a book on money management for kids, was written by Dylin Redling and Allison Tom of the popular blog Retire by 45. This fun little book takes kids through investment basics with help from the Dollar Duo, Mr. Finance, and Investing Woman. The book helps readers understand how stocks and bonds can help you build wealth. It’s written based on the idea that the sooner we understand money, the sooner we can make it work for us to build a better future.

Redling and Tom retired early at ages 43 and 44. They also wrote the personal finance book “Start Your F.I.R.E. Financial Independence Retire Early: A Modern Guide to Early Retirement.”

How to Turn $100 into $1,000,000: Earn! Save! Invest!

Age Group: Written for children ages 10 to 14 years old

Billed as “The ultimate kids’ guide to money: earning it, saving it, and investing it”, this book was brought to you by James McKenna and Jeannine Glista, the folks behind the Emmy-award winning Biz Kid$ financial literacy program. They have a passion for teaching kids about money and were passionate about making their book unique and entertaining to middle-school tweens.

This book builds on concepts from the show with a clear structure that shows kids the steps to reaching financial independence. It breaks wealth building into three basic ideas: how to make money, save money and grow money. It also includes a business plan template and a personal budget tracker.

Finance 101 For Kids: Money Lessons Children Cannot Afford To Miss

Age Group: Written for children ages 8 to 12 years old

Walter Andal wrote Finance 101 For Kids because he was disappointed at the lack of personal finance books available that he could use to help teach money lessons to his four kids. His book covers everything from the history of money to lessons on how to earn money and the definition of credit. Written in clear and straightforward language with funny illustrations, Andal introduces kids to saving and investing, the stock market, and the importance of giving back.

Andal has worked in insurance, banking, real estate, and health care. He’s also the author of the money book Finance 102 for Kids which applies the lessons from the first book to real-life situations.

Best Money Books For High School Students

Peeps, Let’s Talk About Money: A Fundamental Personal Finance and Money Management Guide for Teens and Young Adults

Age Group: Written for children ages 14 to 19 years old

A.B. Stanley’s Peeps, Let’s Talk About Money sets out to do precisely that. It introduces teens and young adults to personal finance in an engaging, relatable way. “Peeps” teaches that it’s not how much you make but how well you manage your money that counts the most. The book discusses essential money management lessons, teaching readers how to make a budget and build a credit history without going into too much debt. It introduces concepts like tax deductions, tax credits, investing in the stock market, and even prenuptial agreements.

Stanley is a part-time coach and lifelong investor with a passion for teaching young people about personal finance. He’s also the author of How to Get Rich Before 30: Investing Guide for Teens and Young Adults to Achieve Financial Freedom As Early as Possible.

Why Didn’t They Teach Me This in School? 99 Personal Money Management Principles to Live By

Age Group: Written for children ages 14 to 19 years old

Many of us asked this question long after graduation when we first learned about compound interest. Luckily, like this book, there are plenty of books about money to help teenagers gain a financial education outside the classroom. This book teaches eight key lessons focusing on 99 principles that can boost any reader’s money management skills. It’s a quick, accessible read, and it’s designed to inspire deeper thought about the reader’s relationship with money and the role of work in our lives.

Author Cary Siegel is a retired business executive who earned an M.B.A. from the University of Chicago and launched his career at Kraft. He led several companies in marketing and sales, and retired from the 9-to-5 at age 45, thanks to his money management principles. He wrote “Why Didn’t They Teach Me This in School” for his five teenagers.

I Want More Pizza: Real World Money Skills For High School, College, and Beyond

Age Group: Written for children ages 14 to 19 years old

I Want More Pizza teaches financial literacy by applying it to something everyone can relate to: PIZZA! The book covers the concepts of saving, spending, goal setting, compound interest, and much more. It uses a unique “pizza model” to make learning about personal finance fun and straightforward. Each “pizza slice” offers an important money lesson that forms a well-rounded financial education when combined with all the other slices.

Author Steve Burkholder worked as a C.P.A. for one of the world’s largest accounting firms and now works in corporate finance at a college.

The Early Investor: How Teens & Young Adults Can Become Wealthy (Investing Fundamentals For Wealth Creation)

Investopedia’s 2021 Best Investing Book for Teens, The Early Investor starts readers off with the basics of financial literacy and budgeting. It launches into advanced concepts like the power of compound interest, stock dividends, mutual funds and ETFs, and much more. It includes easy-to-read charts, graphs, and real-life examples that illustrate concepts of investing.

Author Michael Zisa has written financial literacy articles for various publications, and he’s been interviewed by “Forbes” and “U.S. News & World Report.” His work as a teacher, financial analyst, and financial advisor gave him the perfect background to write a book about personal finance for teens.

Money for Teens: A Guide For Life

Author Tim Wuebker wrote “Money for Teens” through what he learned while teaching a personal finance class to teenagers. Each week, he would ask the students what they wanted to learn about, and he responded by scheduling more than 60 guest speakers on various financial topics. This book offers more than 100 bite-sized chapters and exercises covering everything from budgeting to index fund investing to the F.I. and FIRE movements and building a personal mission and career.

Wuebker teaches personal finance to high school students and is also the author of several works of fiction, including “Tom Buchanan, Misunderstood,” an homage to “The Great Gatsby” told from another character’s point of view.