In today’s digital world, anything and everything is controlled by an app. That includes investing–and there are enough of them available that it can be hard to separate the best investing apps from all the rest.

To pick the one that’s best for you, you’ll want to consider how much control you want to have over your investments, how automated each app’s process is, and how much knowledge you yourself have of the investing world.

Luckily we’ve done the research and have narrowed the large list down to seven of the best investing apps for people on the go.

Choosing the best investing app will largely depend on whether you’re just starting to invest your money or you’re already a well-versed investor. The seven best investing apps that we recommend Acorn, Stash, Wealthfront, Betterment, E*TRADE, M1 Finance, and Robinhood.

Check out the summaries of each of these investing apps so you can get a feel of what makes each of them different and which one might be right for you.

New Investors

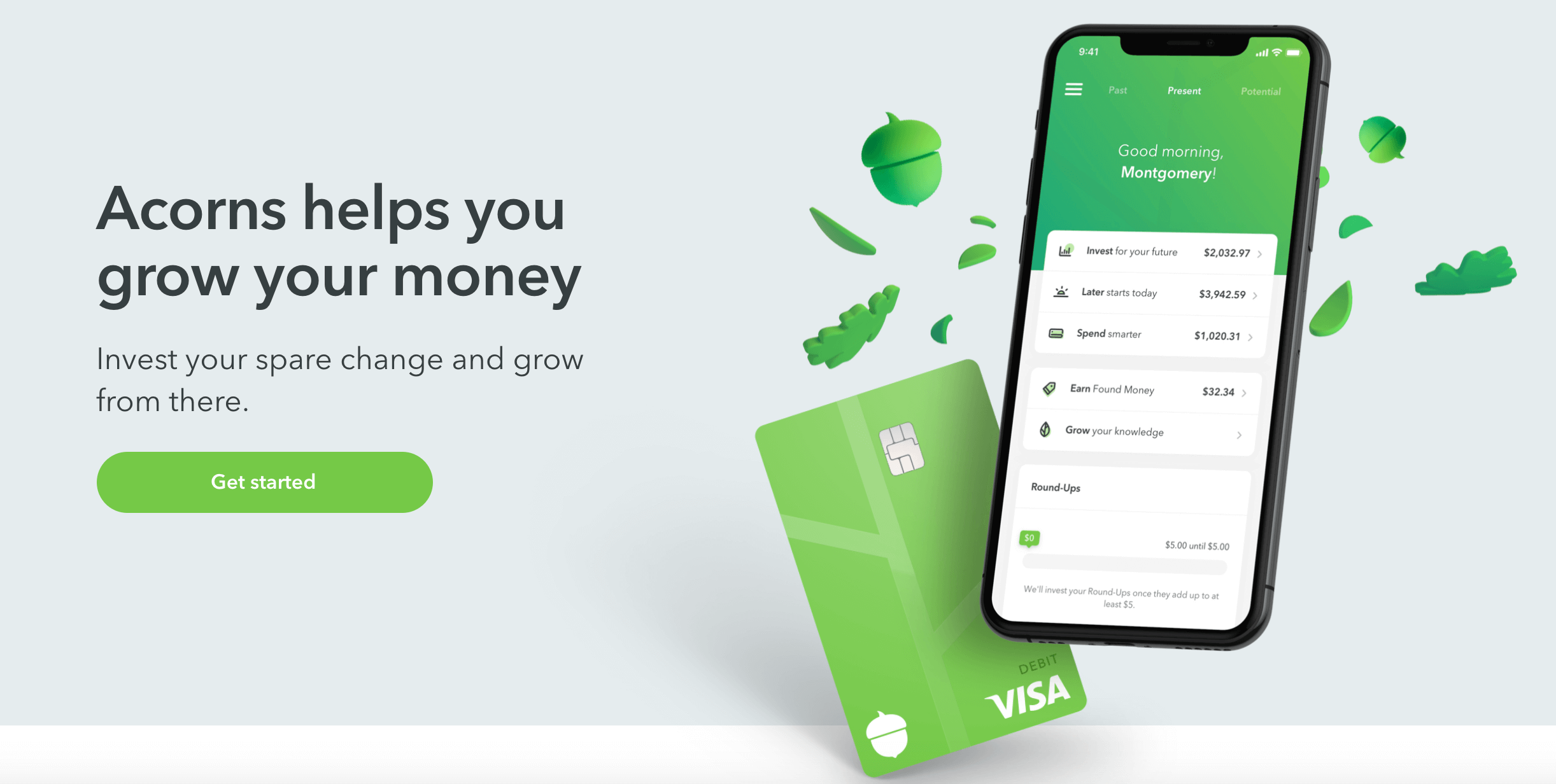

Acorns

Acorns is a micro-investing app that helps you put your spare change to good use by investing it for you. With a minimum investment amount of only $5, Acorns is a great jumping-off point for new investors who are looking to get their toes wet.

Features

Round-ups: After linking your card, Acorns will round your purchases to the nearest dollar, putting the difference in your Acorns Invest account. Once your spare change has added up to $5, the money will be transferred straight into your investment account.

One-time And Recurring Investments: In addition to contributing your spare change, you can make regular deposits to your investment accounts through Acorns. You can make one-time or recurring payments to give their account a boost. These payments can be as little as $5 at a time and can recur every day, week, or year.

Diversified Portfolios: Acorns offers five different and diverse portfolios, all tailored to give users the biggest return for their desired risk level. These are made up of six different ETFs (exchange trade funds), which include stocks and bonds.

Acorns Later: Acorns Later can help you save for your retirement and will even recommend an IRA and portfolio that matches your personal needs. Once set up, you can make recurring contributions that will come directly out of your specified accounts.

Cost

Acorns prides itself on being transparent and eliminating surprise fees. That is why they have developed a simple, low-cost, pricing structure that anyone can understand.

Invest: For only $1 per month, Acorns most affordable option has all you will need to get started. The app will round up your purchases and invest your spare change into taxable accounts.

Invest + Later: For $2 this plan offers everything that the previous plan offers plus gives you the option to open a retirement account. Acorn’s offers traditional IRAs, Roth IRAs, and SEPs.

Invest + Later + Spend: For dedicated Acorns fans, this $3-per-month plan includes all of the above, plus a checking account. The checking account offers reimbursement of ATM fees and will give you a 10% bonus on the change roundups that are invested through the app. Spare change is also invested right away rather than waiting for it to accumulate to $5 per transfer.

Related: Acorns Review: Automatically Invest Your Spare Change

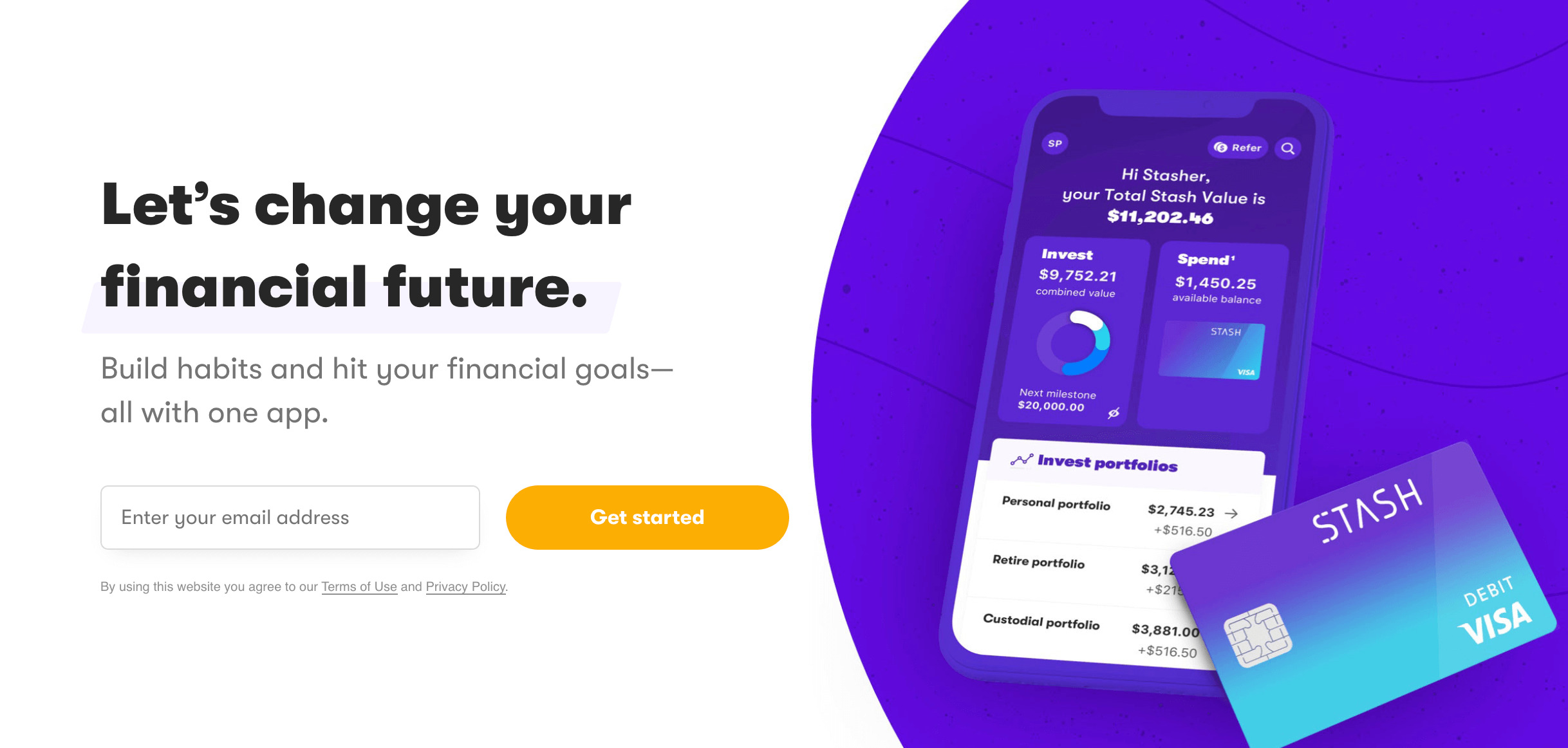

Stash

If you are new to investing and just can’t seem to wrap your head around the whole idea of it–let alone the idea of choosing the best investing app–Stash is a great app to start.

They offer fractional shares that cost pennies and no minimum balance, anyone can easily begin investing. But for new investors, the best part of Stash might just be the educational experience that can give them the confidence to become a more advanced investor.

Features

Round-Up Investments: Stash Round-Ups can get you investing without worrying about making deposits. Instead, Stash will round up your purchases to the nearest dollar and keep your change safe until you reach $5. Then Stash will invest the money for you.

Stash Bank Account: The Stash bank account comes with some great perks.

It has a $0 minimum balance and skips many of the fees you might expect. For example, it has no monthly fees, no overdraft fees, and access to thousands of fee-free ATMs.

If you decide to purchase the Stash+ plan, you will receive a metal debit card with 2x Stock-Back™. Stock-Back allows users to earn stock in a company when they use their Stash debit card to make a purchase in that company. For example, if you buy a new iPad you’ll get a small piece of Apple stock as a bonus.

Education: If you are a new investor, chances are that you have some questions. If that is you, Stash is worth using for its vast amount of educational information alone. With articles covering everything from how to build your portfolio to how to navigate volatility in the market, there is something to learn for everyone.

Cost

Stash offers three different plans to get you started on your investment journey:

Beginner: Stash’s beginner plan has all that you need to start investing for only $1 a month and includes the Stash checking account.

Growth: At Stash, $3 a month is enough to give you access to tools that are sure to help you get on your way to solid financial footing. Along with everything that the beginner plan gives you access to, you will also get access to traditional IRAs and Roth IRAs.

Stash+: Stash+ is the ultimate plan for those who want to get serious about investing. Bumping up to this level adds an impressive amount of extra features. For $9/month, you’ll have access to investment accounts for two children, monthly market insight reports, and even a metal debit card with 2x Stock-Back™.

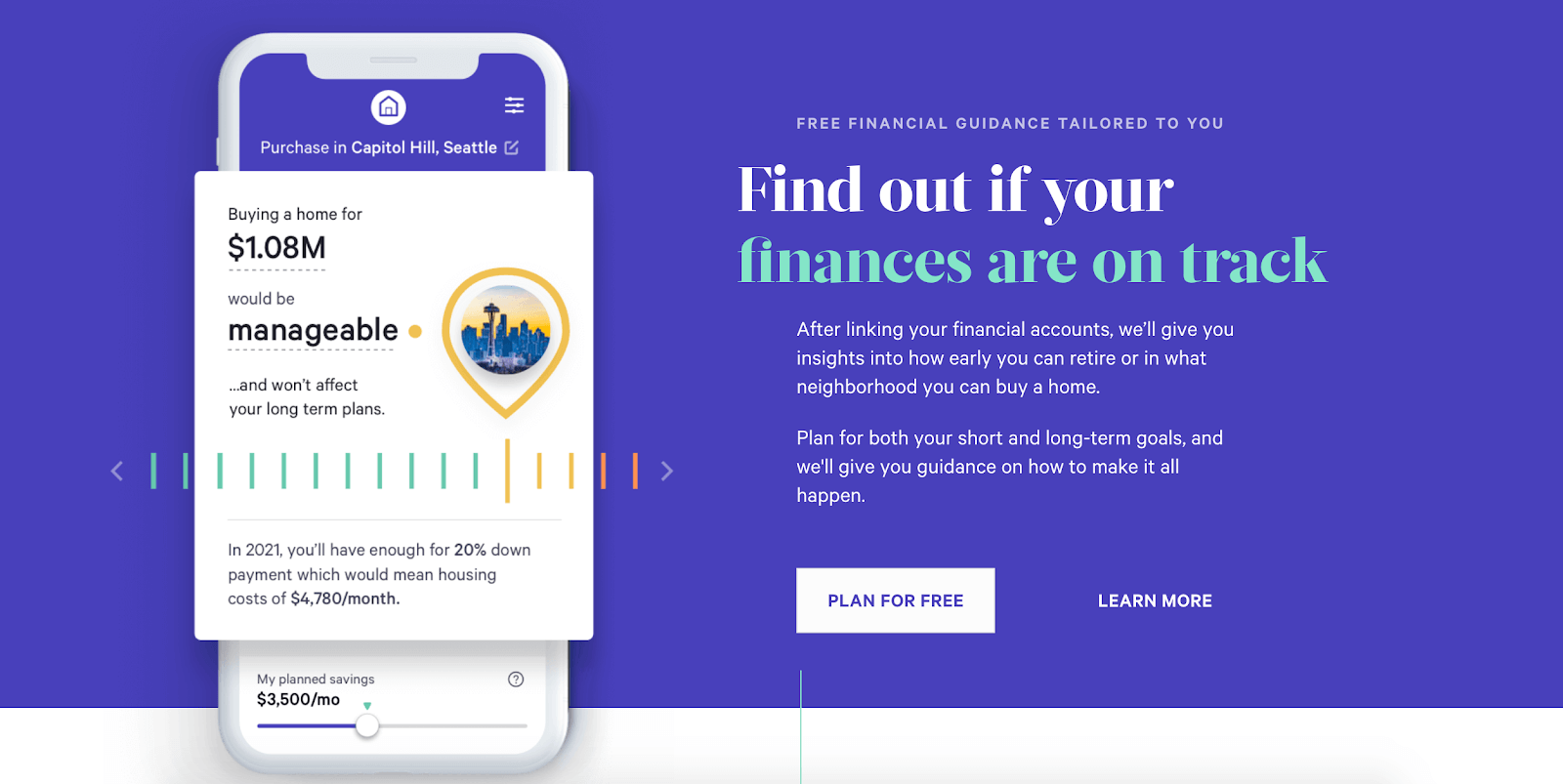

Wealthfront

If you’re not the do-it-yourself kind of investor, Wealthfront might be the perfect solution. For starters, they keep their fees low. But they also offer automated investing–all you have to do is tell Wealthfront your investing goals, and they’ll create and manage your portfolio for you.

Features

Automated Investing: Wealthfront is a robo-advisor. That means you won’t ever get in-person help, but Wealthfront’s team will build and manage your portfolio on your behalf. Wealthfront is a huge fan of passive investing. Their goal really is to make your life as easy as possible, at least when it comes to your money.

You can open an individual or joint account, and you can also open a retirement account with Wealthfront. In addition, they offer 529 accounts so you can start saving for your child’s education.

Free financial help: Wealthfront wants to make your whole financial life a little easier, not just your investments. That’s why they have a whole financial planning section. They can help you plan for a home down payment, retirement, or budget-friendly travel.

Wealthfront Cash Account: Wealthfront offers its own savings account that offers a high-interest rate. There are also no fees associated with the account and the minimum amount you’ll need to open a new account is just $1.

Cost

Since Wealthfront’s goal is to keep investing costs low, their annual advisory fee is just 0.25% of your account balance. Wealthfront has a handy fee calculator that can help you find out exactly what you’ll pay them in fees for their services.

All Levels of Investors

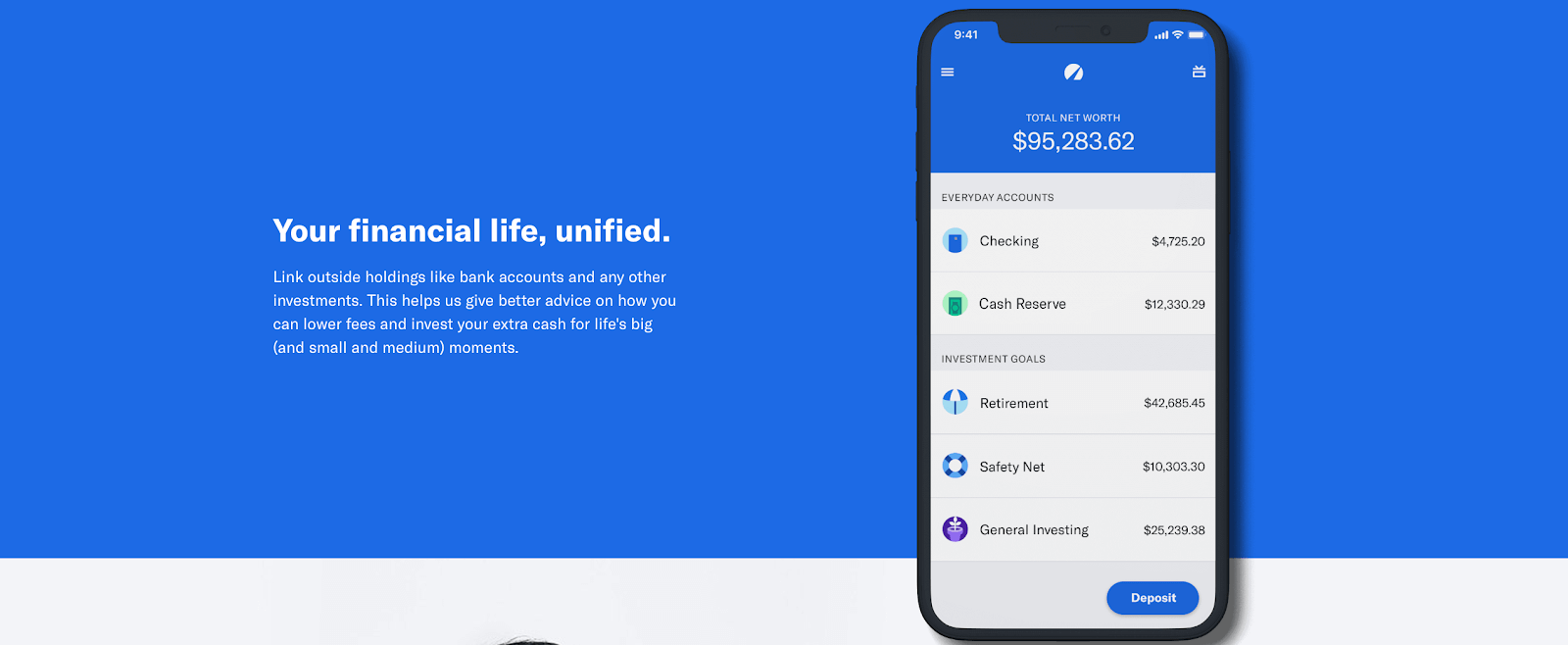

Betterment

Betterment is the perfect investing platform for beginners and seasoned investors alike. You can tell Betterment what your preferred risk level is and they’ll build a diversified portfolio for you.

Out of the many robo-advisors on the market, Betterment holds the title for most assets under management, coming in at $16.4 billion. This makes them one of the most trusted robo-advisors on the market.

Features

Diversified Portfolios: Betterment offers portfolios that have 14 different asset classes–six stock funds and eight bond funds. These asset classes are held in ETFs, which helps Betterment make sure your portfolio stays diversified. Betterment will also periodically rebalance your portfolio, so you always stay diversified.

Access To A Financial Advisor: For the more advanced investors, Betterment offers a financial advisor that you’ll have unlimited access to. You’ll need at least $100,000 in your account to earn this feature. Once you hit that point though, it’s worth taking advantage of communication with an advisor.

Retirement Planning: Betterment offers resources for anyone looking to up their retirement contributions. They’ll create a personalized plan based on you and your family’s needs. They’ll recommend the right accounts so you can start saving right away. Betterment also offers traditional, Roth, and SEP IRAs.

Cost

The Betterment app gives you a choice of two different plans: Digital and Premium. The Digital plan is the simpler of the two, requiring no minimum balance and charging a 0.25% annual fee. You’ll have full access to the robo-advisor, plus personalized advice.

The Premium plan requires a $100,000 account minimum. You’ll have all the same features as the Digital plan, but you’ll also get access to a licensed CFP that can provide you with a personalized investing plan. For the Premium plan, you’ll be charged an 0.40% annual fee.

Get started with Betterment here.

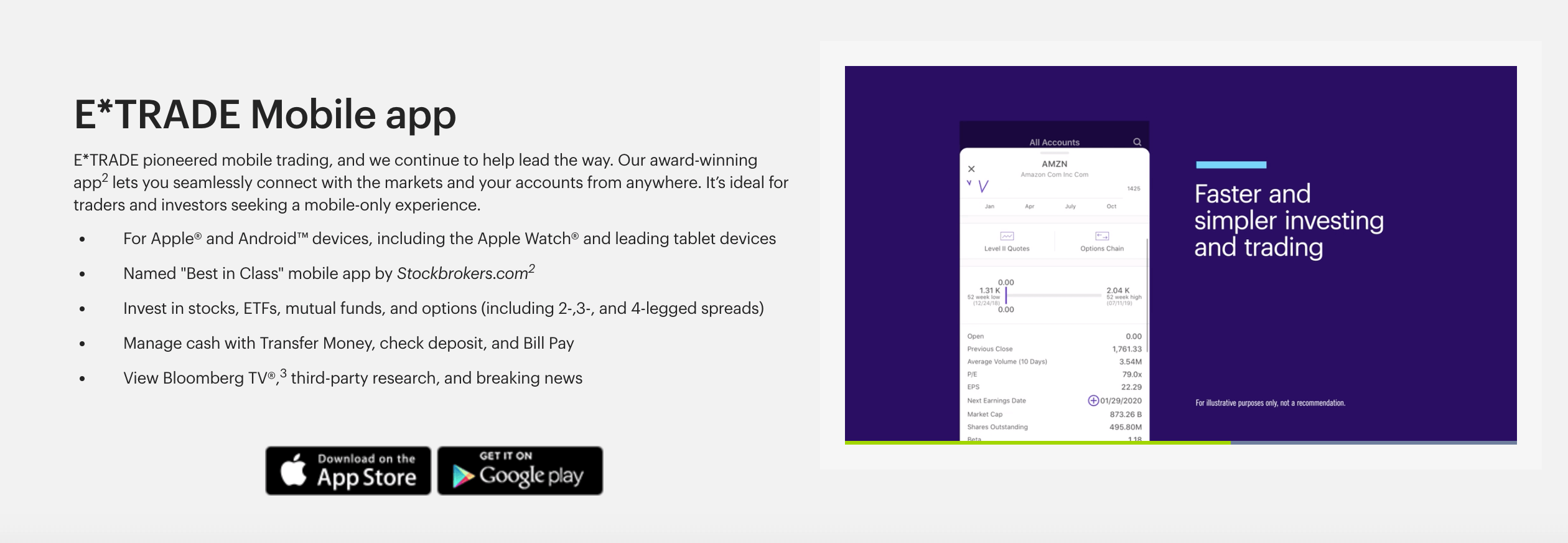

E*TRADE

E*TRADE is a great investing app for investors of all skill levels and can be used as independently as users feel comfortable. If investing isn’t your strong suit, E*TRADE will give you access to valuable educational resources that can help you learn your way around the market.

Features

Core Portfolios: If you’re just starting out with investments and aren’t sure how to navigate everything on your own, don’t worry. E*TRADE’s Core Portfolios are managed by their robo-advisor and offer three different options:

Core Portfolios: This portfolio will be recommended to you based on your answers to basic questions about your investment strategies.

Socially responsible ETFs: Investing with your conscience is a hot trend. You can personalize your portfolio with ETFs that represent your values.

Smart beta ETFs: These ETFs are chosen to help investors get ahead of the rest of the market. They can be added to your portfolio to help boost your overall returns.

Educational Resources: Both new and seasoned investors alike will appreciate the vast bank of educational resources that E*TRADE has to offer. Whether you are looking to learn how to invest for the first time or need help navigating more advanced trading practices, E*TRADE has your back.

Listen: What Is Socially Responsible Investing

Cost

E*TRADE offers plenty of free investment options. Their stocks, ETFs, and options all come with $0 commission fees. The few fees they do have for other investments aren’t bad. Options contracts come in at $0.65 per trade, Futures are $1.50 per contract, and Bonds are $1.00 per bond.

If you want a managed portfolio through E*TRADE, you’ll pay a 0.30% annual advisory fee.

Get started with E*Trade here.

More Experienced Investors

M1 Finance

If you are an investor who is looking for convenience and control of your portfolio, you will find it in M1 Finance. A cross between a robo-advisor and a traditional brokerage account, M1 Finance has become a favorite of many experienced investors.

Features

Customized Portfolios: M1 Finance has a pie-based interface. This allows you to control exactly how much of your portfolio is made up of specific investments. You can even automate the process of reaching your goals. If you are new to investing or don’t like the fuss of building your own portfolio, you can choose from over 80 expertly made portfolios.

Fractional shares: Fractional shares can help you get a piece of larger investments that may be outside of your price range. By investing in fractional shares, M1 Finance users can invest in some of their favorite stocks and ETFs regardless of the full share price point.

Recurring investments: M1 Finance gives users the option of automating their investment deposits on their own schedules. Because you set your own schedule, investors never have to worry about money being drawn from their accounts at undesirable times.

Cash Balance Control: Cash Balance Control is a system that M1 Finance has to help make sure that your money is growing, not just sitting around collecting cobwebs. By setting a maximum cash balance, users can ensure that any additional money in their account’s cash balance is automatically invested for them.

Cost

M1 Finance is generally free to use and won’t charge you commissions or usage fees. Coupled with its impressive features, this makes M1 Finance one of the most popular investing apps.

Get started with M1 Finance here.

Related: M1 Finance Review: Completely Free Investing

Robinhood

Editorial Update: In late 2020, serious security issues led to many Robinhood customers losing their funds. Even worse, Robinhood did not have the customer service resource needed to assist customers who were self-reporting the theft as they were occurring. We still think Robinhood is a neat app, but wanted to put this information before you for your consideration.

For investors who know their way around the stock market, Robinhood is a great choice for buying and selling on the go. While their platform may seem skeletal, it has all of the tools a seasoned investor needs to grow their portfolio. Even better, Robinhood is absolutely free.

Features

Fractional Shares: Robinhood offers fractional shares to its users. This feature also offered by some other investing apps on this list. By breaking more expensive shares up into smaller amounts starting at $1 per portion, investors of any budget can have access to the market.

Cryptocurrency: Cryptocurrency may be a controversial investment, but that doesn’t stop some investors from seeking out a way to buy and sell it. Luckily for them, Robinhood gives you the option of adding cryptocurrency to your portfolio.

Freedom To Choose Your Investments: The Robinhood app gives you the freedom to choose where and how you invest your money. In order to make sure you understand exactly what your choices are, the company offers a great informational section to educate you on all the financial jargon used in the world of investing. When you get down to it, you’re investing your money. You ought to be able to speak the language of investors and apps well enough to know what they’re doing with that money!

Cost

Robinhood is a powerful platform that many investors would happily pay for, but fortunately, Robinhood doesn’t carry any fees!

Get started with Robinhood here.

Which App Is Right For You?

Choosing which of the investing apps isn’t hard. It boils down to picking the one that gets you involved in the market, even when you’re on the go. Depending on your personal investing strategies and preferences, you may even be able to use several different apps to diversify your portfolio.

Here’s a table that breaks down each app to help you choose.

| App | Minimum investment required | Cost | Investment types |

|---|---|---|---|

| Acorns | None | $1-$3 per month, depending on the plan | ETFs |

| Stash | None | $1-$9 per month, depending on the plan | Stocks, ETFs |

| Wealthfront | $500 | 0.25% annual fee | ETFs |

| Betterment | None for the Digital plan, $100,000 for Premium plan | 0.25% annual fee for Digital plan, 0.40% for Premium plan | Stocks, bonds |

| E*TRADE | $500 for managed portfolios | $0 stocks, options, and ETFs, 0.30% annual fee on managed portfolios | Stocks, options, and ETFs, futures, bonds, mutual funds |

| M1 Finance | $100 | Free | Stocks, ETFs |

| Robinhood | None | Free | Sticks, funds, options, gold, cryptocurrency |

Final Thoughts

Investing apps are a tool that should be in everyone’s pocket. Not only can they help investors take care of their portfolio on the go, but some can also grow your portfolio with every purchase that you make. Whether you are a new investor or a well-seasoned pro, there is an investing app out there for everyone.

Related Articles

- Why Investing Conservatively Is Better

- Stocks Vs. Mutual Funds Vs. Index Funds Vs. ETFs: A Full Comparison