I signed up for an account, here’s how it went.

How Acorns Works

We’ll cover the whole sign-up process below, but basically, after you sign-up for an account (which you can do online or through the app), you need to link a debit or credit card. Then, each time you make a purchase, Acorns rounds up your total to the nearest dollar, and the difference is invested for you.

Investing really doesn’t get any easier than that. But there’s a lot more that Acorns has to offer.

What Acorns Includes

Investment types

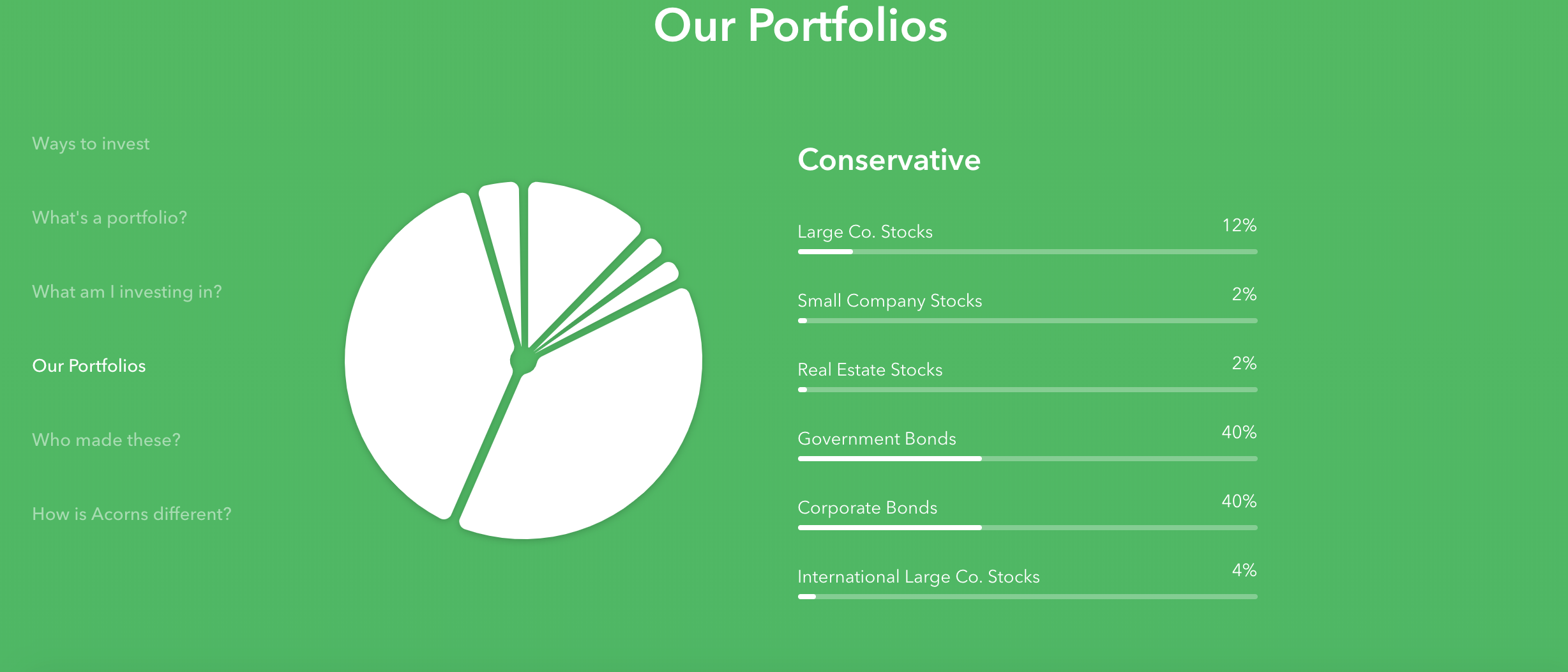

With Acorns Core (see below for plans), your spare change is invested in a diversified portfolio of stocks, bonds, and ETFs developed by Nobel Prize-winning economist, Dr. Harry Markowitz.

When you first sign up for an account, you tell Acorns all about your financial goals. From there, they figure out how much risk you can take on to meet those goals, and then they’ll assign you a portfolio.

If you have a low risk tolerance to loss or plan on needing your funds in the near to moderate future, for example as a house down payment, then a Conservative portfolio would be the safest option to invest through Acorns. It is 80% stocks and 20% bonds. >See how a Conservative portfolio is broken down below:

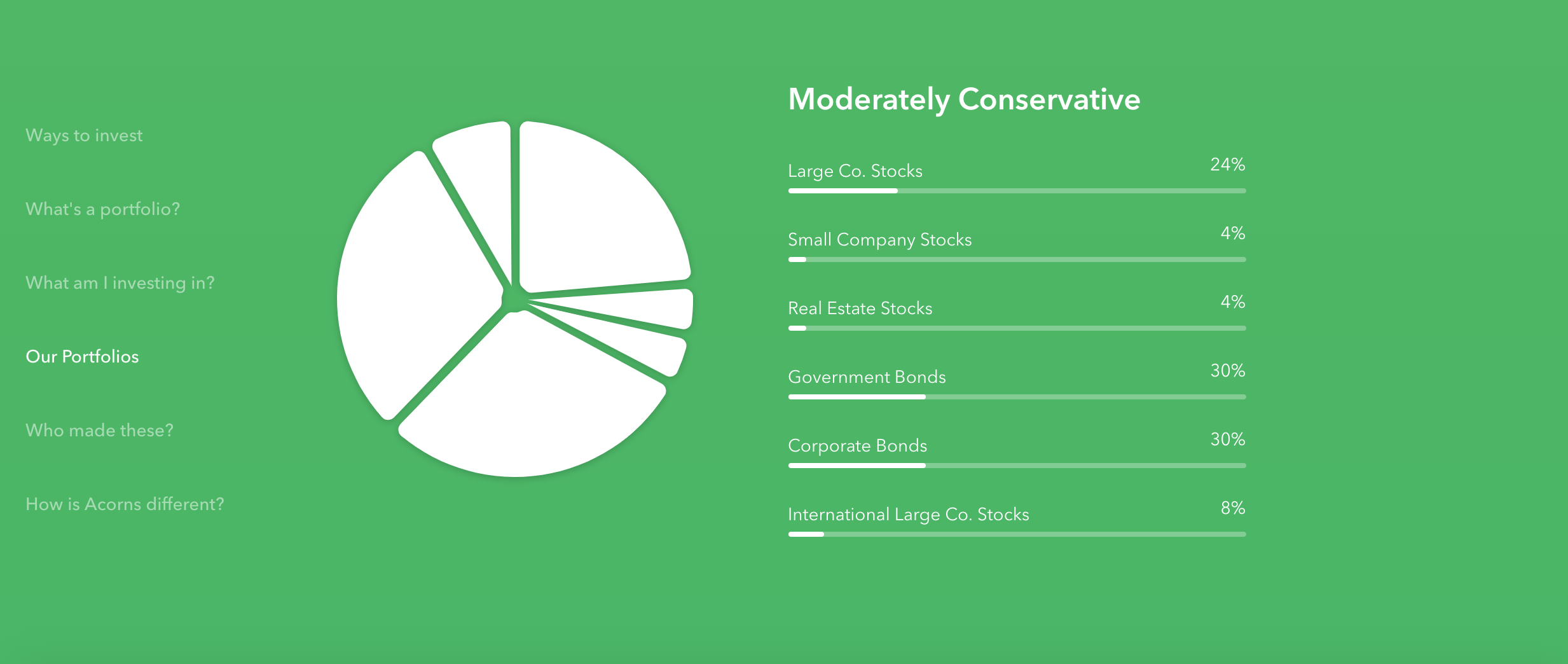

If you can tolerate more volatility or have a longer investment timeline, you can consider increasing your stock holdings with the Moderately Conservative portfolio with a 60% bond and 40% equity allocation. You can see the full breakdown below:

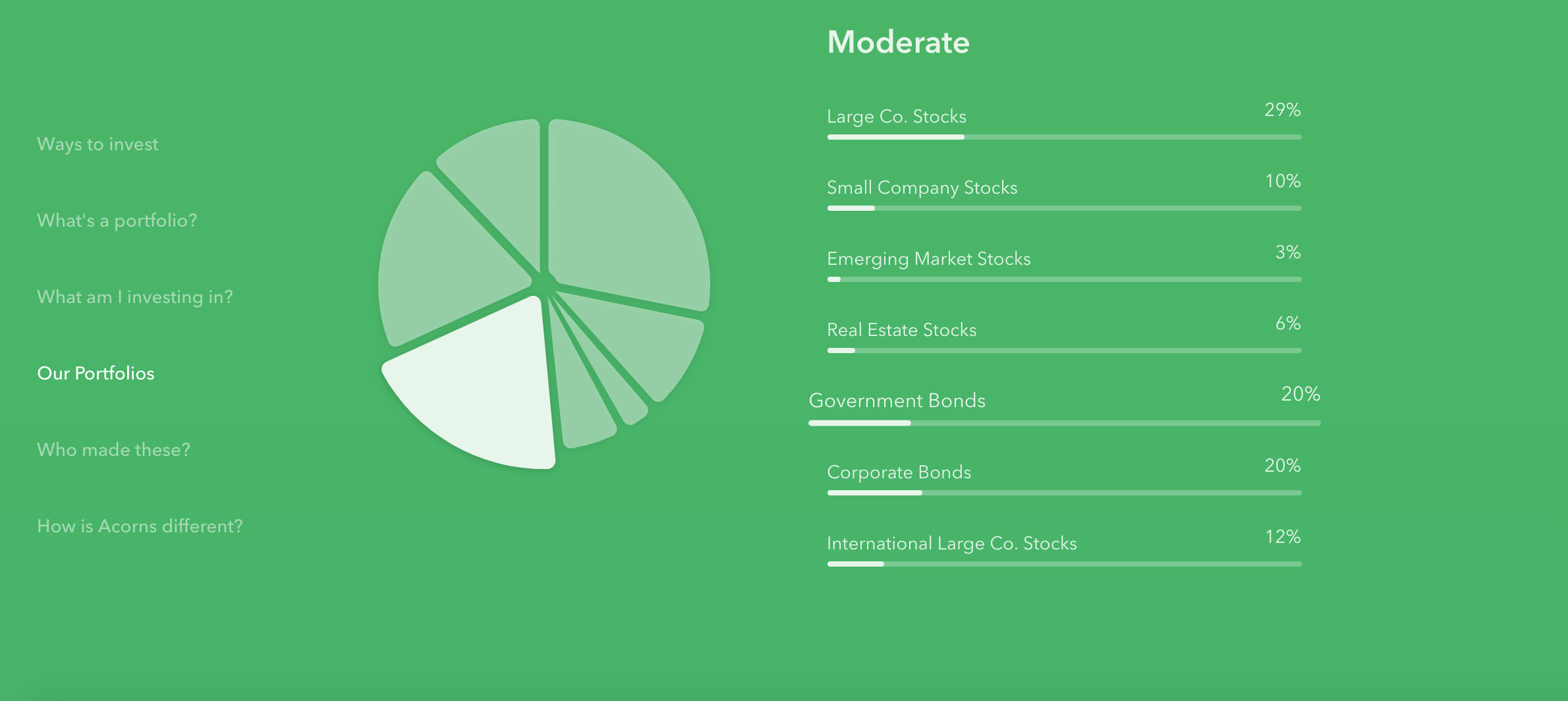

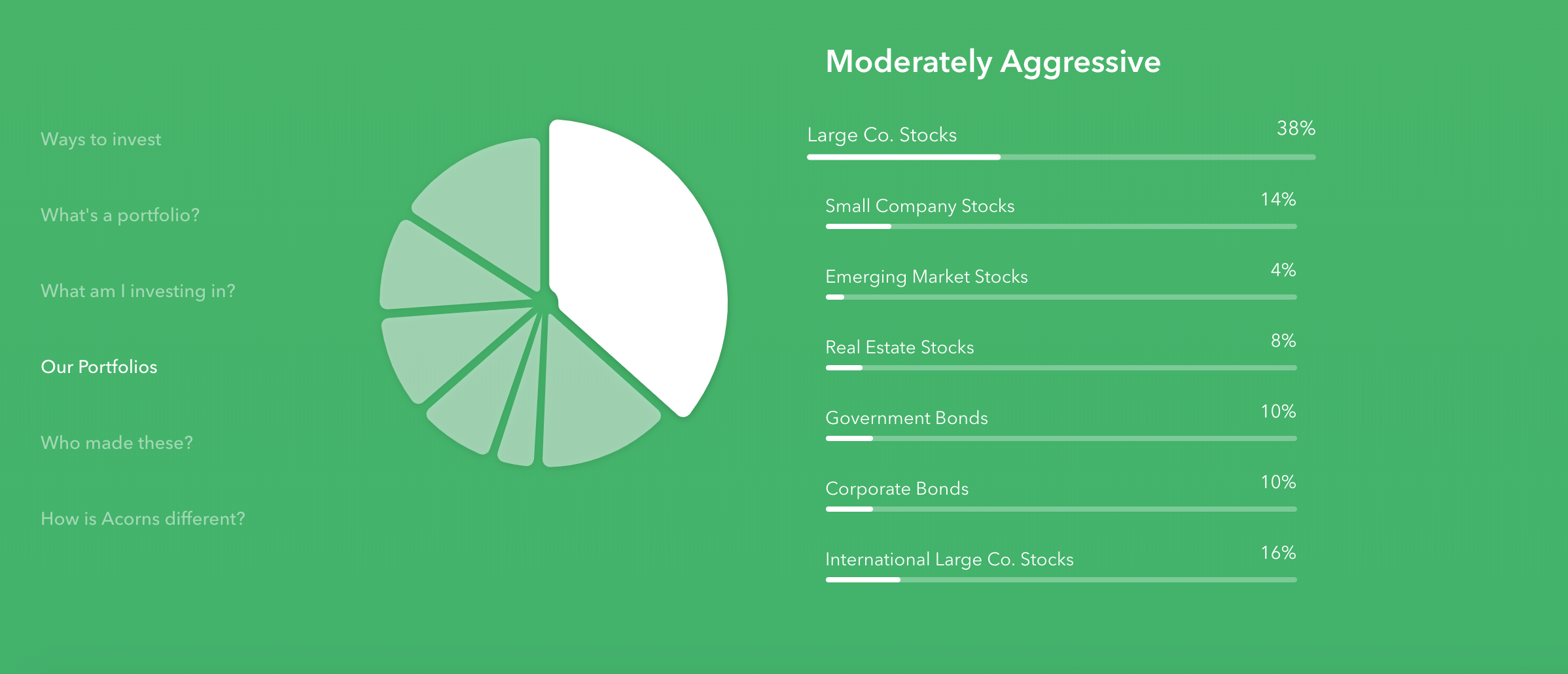

If you can handle higher risk, you can choose Moderate or Moderate Aggressive, with 40% bonds and 60% stocks for the Moderate allocation and 20% bonds with 80% stocks for the Moderate Aggressive portfolio. The more aggressive your portfolio choice is, the more stocks will be a component in your allocation and the smaller the allocation of bonds will be.

Finally, if you want to be a super-aggressive investor, Acorns has that option as well. Their most aggressive portfolio is 100% stocks. You can see the breakdown of that below.

Pricing

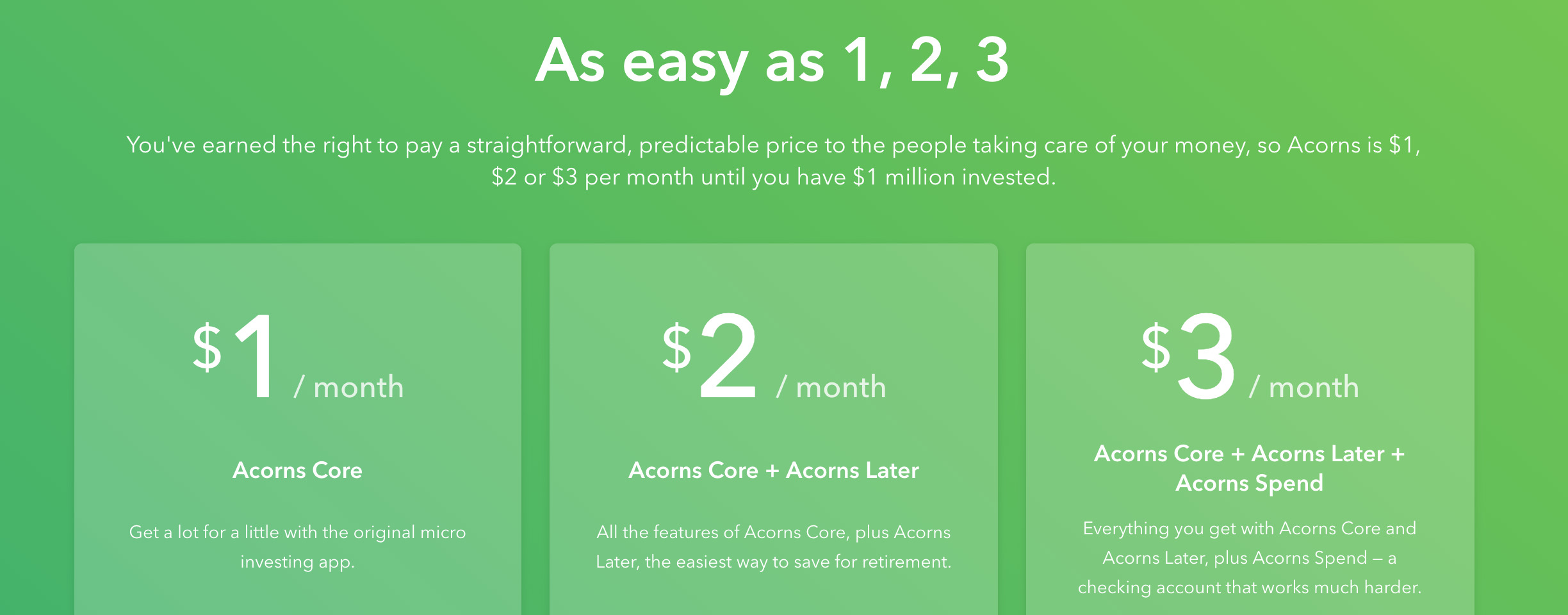

Acorns offers three different plans.

Acorns Core

The most basic version, called Acorns Core, is $1 a month, or $12 a year. This could actually be a very high fee, percentage-wise, considering that you are only investing spare change. If you invest $2 per day this works out to be a 1.6% fee. Which is higher than we recommend paying for an investment account. That said, if you want to start investing but can’t seem to get started Acorns may be just what you need to get going.

This is Acorns’s original model. With Acorns Core you’ll get:

- Automated investing

- Smart Portfolios (your portfolio is automatically rebalanced when the market shifts)

- Grow magazine

- Found Money (200+ top brands that invest in you when you shop)

- Great customer service

Acorns Later

The next plan–Acorns Later–is $2 a month, or $24 a year. Again, this is a very high fee considering you will likely have a low balance if you are only investing spare change.

This plan includes everything offered by the basic plan, plus:

- An IRA

- Automatic updates (as you approach retirement, your investments automatically shift to align with your goals)

- Recurring contributions

- Assisted rollovers

If you are attracted to the idea of automatically investing spare change, we recommend you stick with the less expensive Core account. If you want a retirement account we recommend opening an IRA with Vanguard or Fidelity.

Related: Vanguard Vs Fidelity–Which Company Is The Right Choice For You?

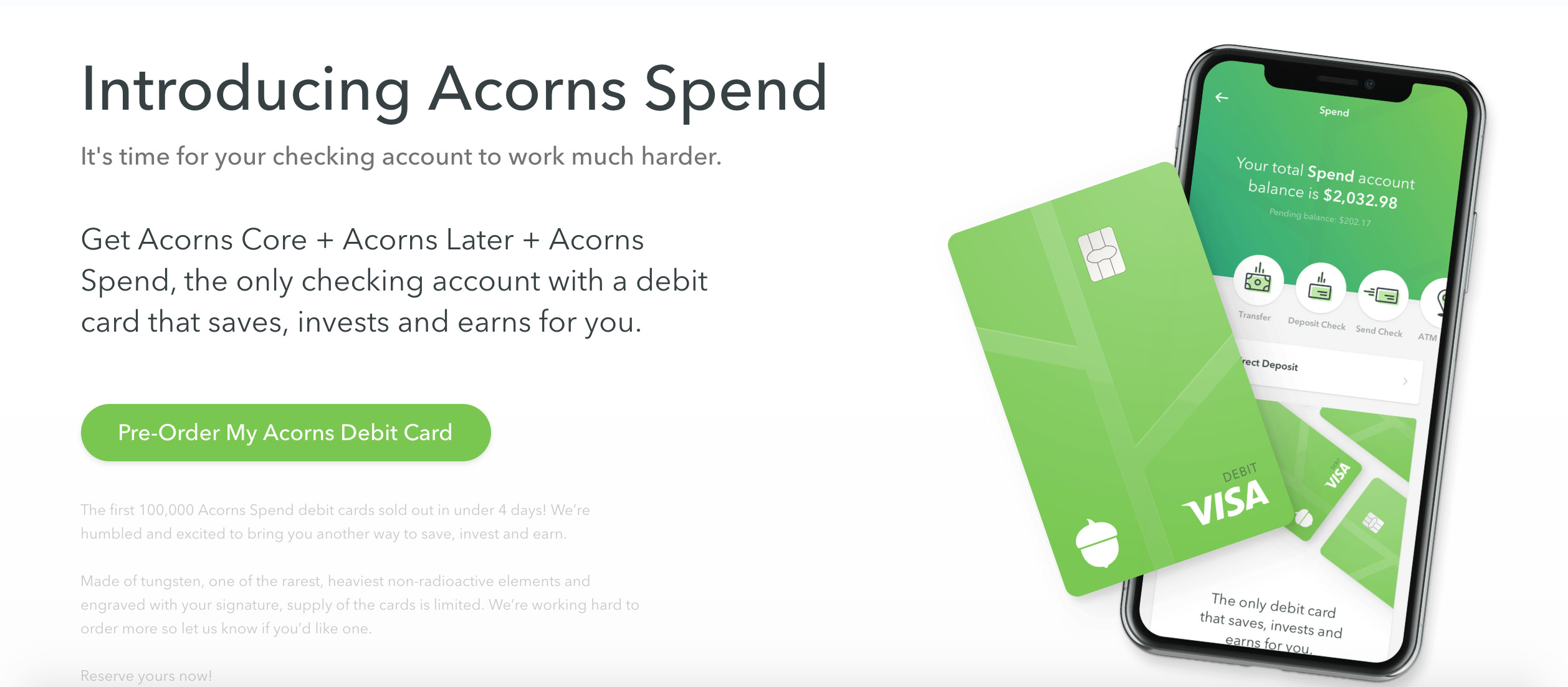

Acorns Spend

Finally, Acorns Spend is $3 a month and you’ll receive everything included in the last two plans, plus:

- A checking account with a debit card that automatically rounds up your purchases and invests them

- Instantly Save & Invest (automatic retirement savings, custom Spend Strategies, and more)

- No overdraft or minimum balance fees

- Unlimited free or fee-reimbursed ATMs

Right now, you’ll need to pre-order a card since the account isn’t active yet.

Again, we don’t see the benefit of the higher fee. There are tons of free checking accounts out there, so no need to pay for one and you get the automatic spare change investing in the Core account.

Found Money

I mentioned Found Money above, but let’s get into the nitty-gritty details of what it is. “Found Money” is money invested in your account by an Acorns partner company as a reward for shopping with them.

As an example, here’s an email I got after a few days of investing with Acorns:

Let’s say I was thinking about getting insurance through Liberty Mutual. If I get a free home or auto insurance quote from them, they automatically invest $5 towards my Acorns account.

You can shop with many different companies that will invest money towards your account simply for shopping with them. Some of these companies include:

- Airbnb

- Barnes & Noble

- Blue Apron

- Lyft

- Macy’s

- Walmart

- Nike

- Earnest

My Experience Using Acorns

For the purposes of this review, I signed up for Acorns Core, the basic Acorns account.

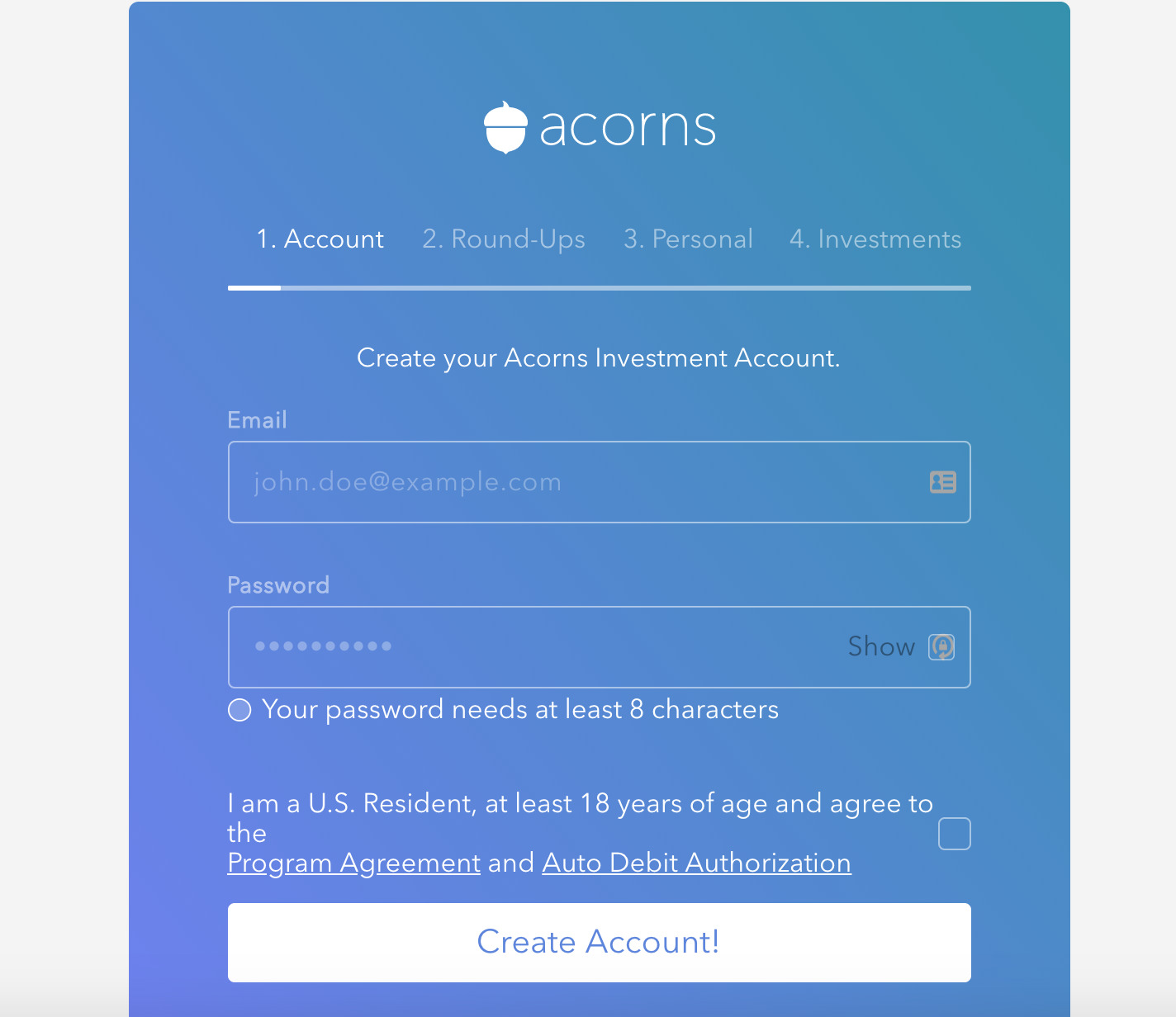

Setting up an Acorns accounts only takes a few minutes. You will need to provide quite a bit of personal information, though, so be prepared.

Here’s how it goes.

Step one is to create an account. You’ll need your email address and you’ll need to create a password.

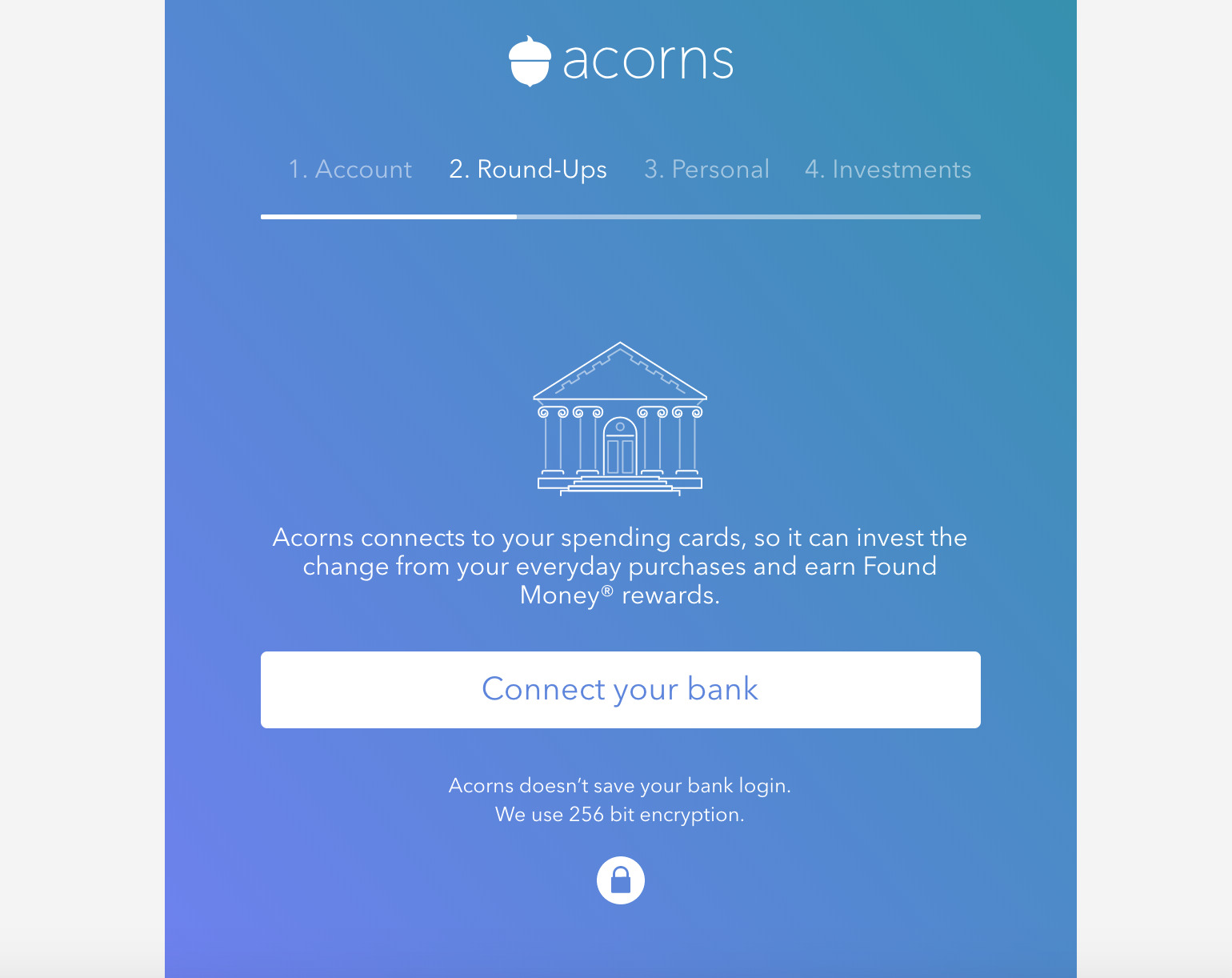

The next step is to connect your bank. By connecting a card to your account, Acorns has a funding source for your roundups. You can also set up one-time or recurring payments to your account.

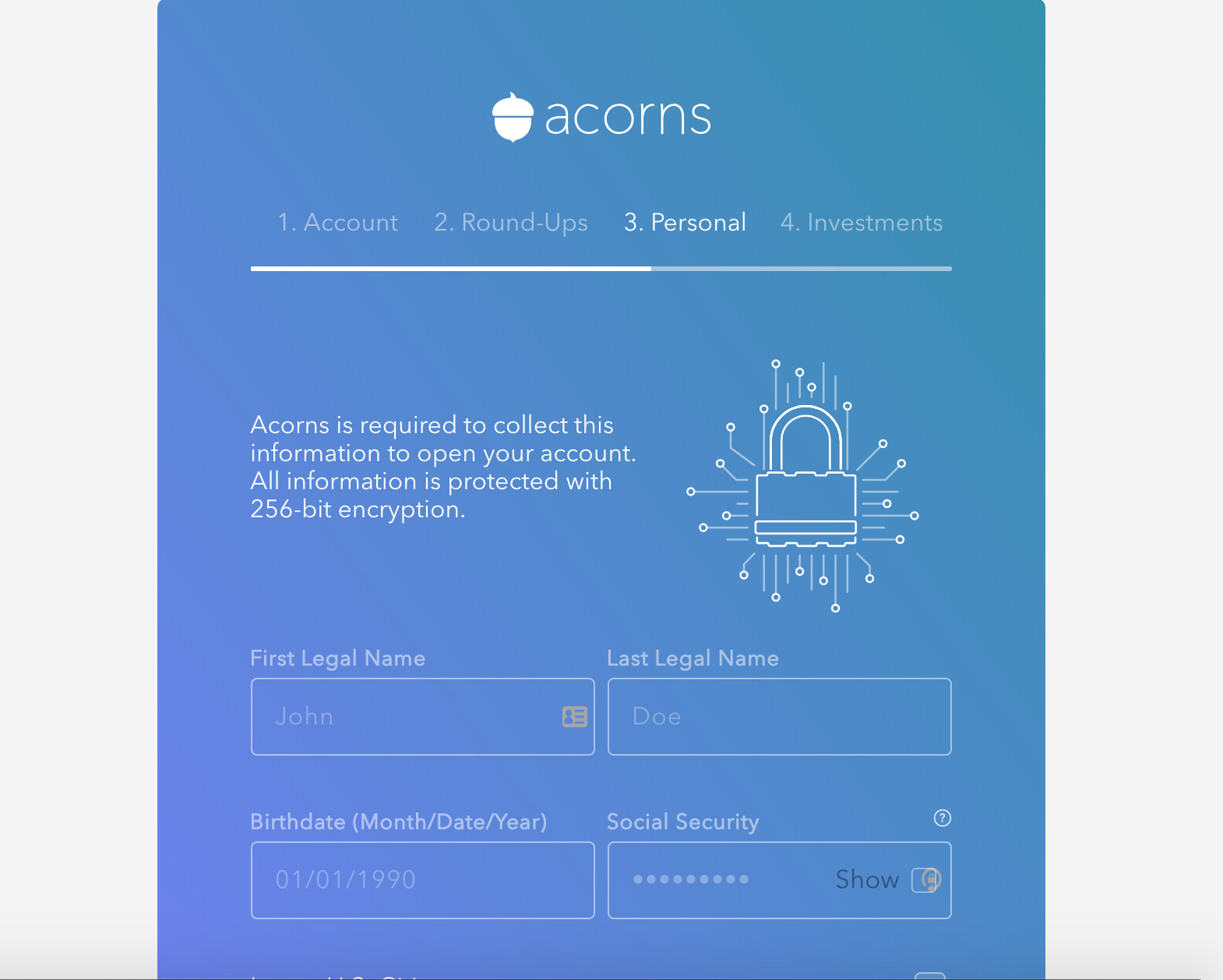

Here’s where the personal info comes in. To open any kind of investing account, you’ll need to provide a bunch of information, including your social security number.

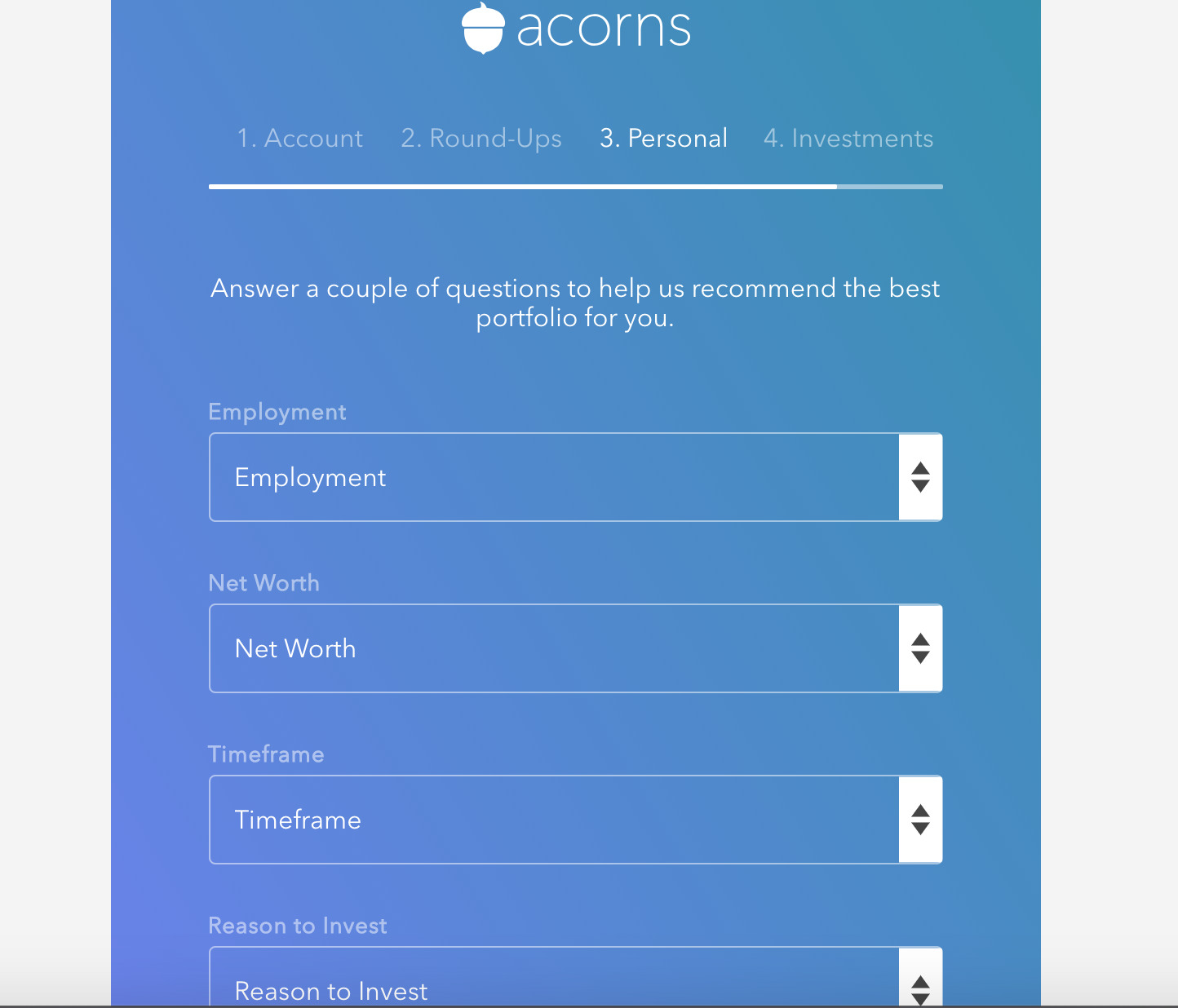

Next step comes even more personal information. You’ll need to verify your employment, your net worth, how long you want to invest for, plus why you want to invest.

All this information helps Acorns recommend the right portfolio for you.

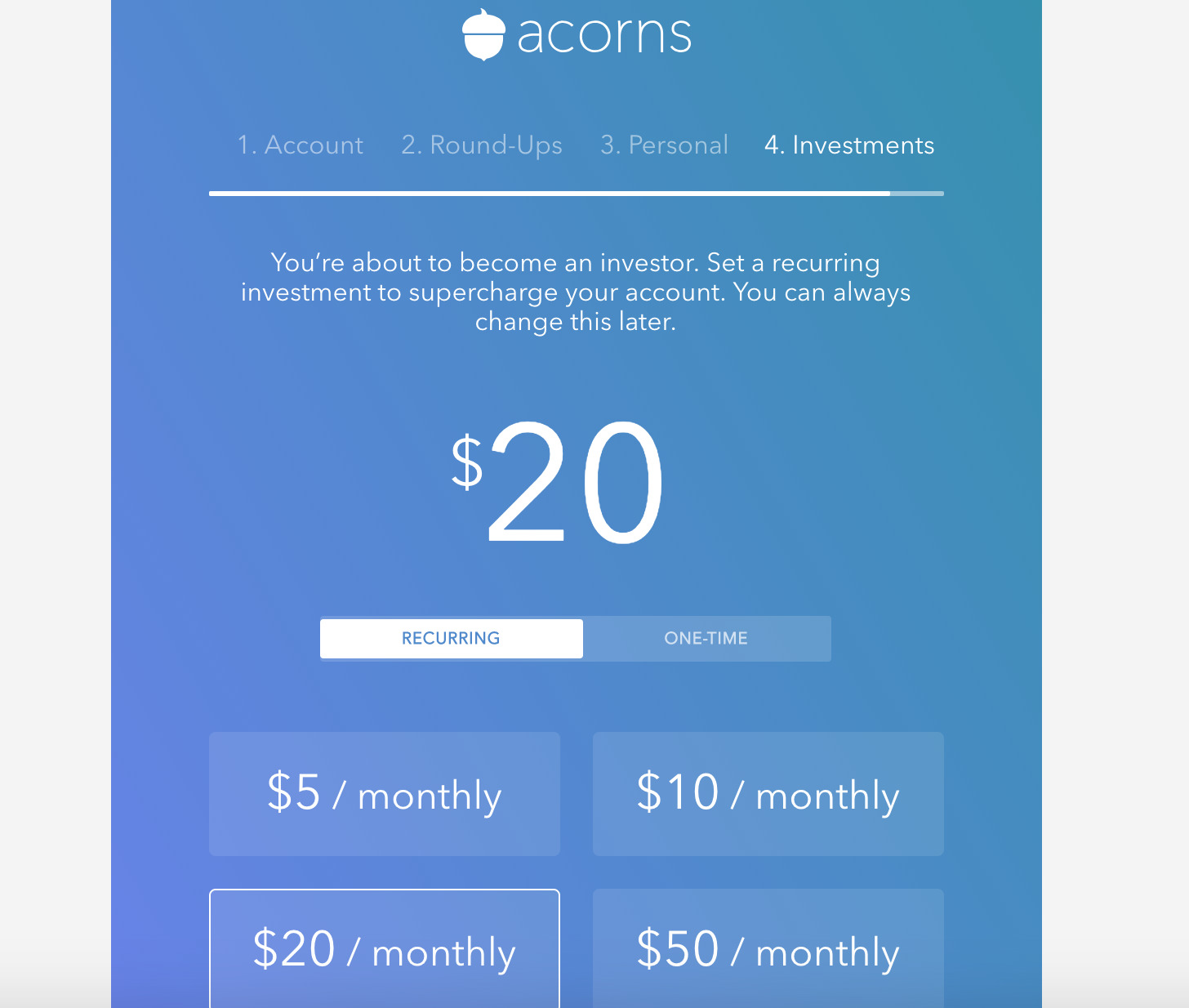

Finally, you can set up recurring payments to fund your investment account on top of the roundups from your spare change.

I opted not to do this for now. You can always go back and set up recurring investments later.

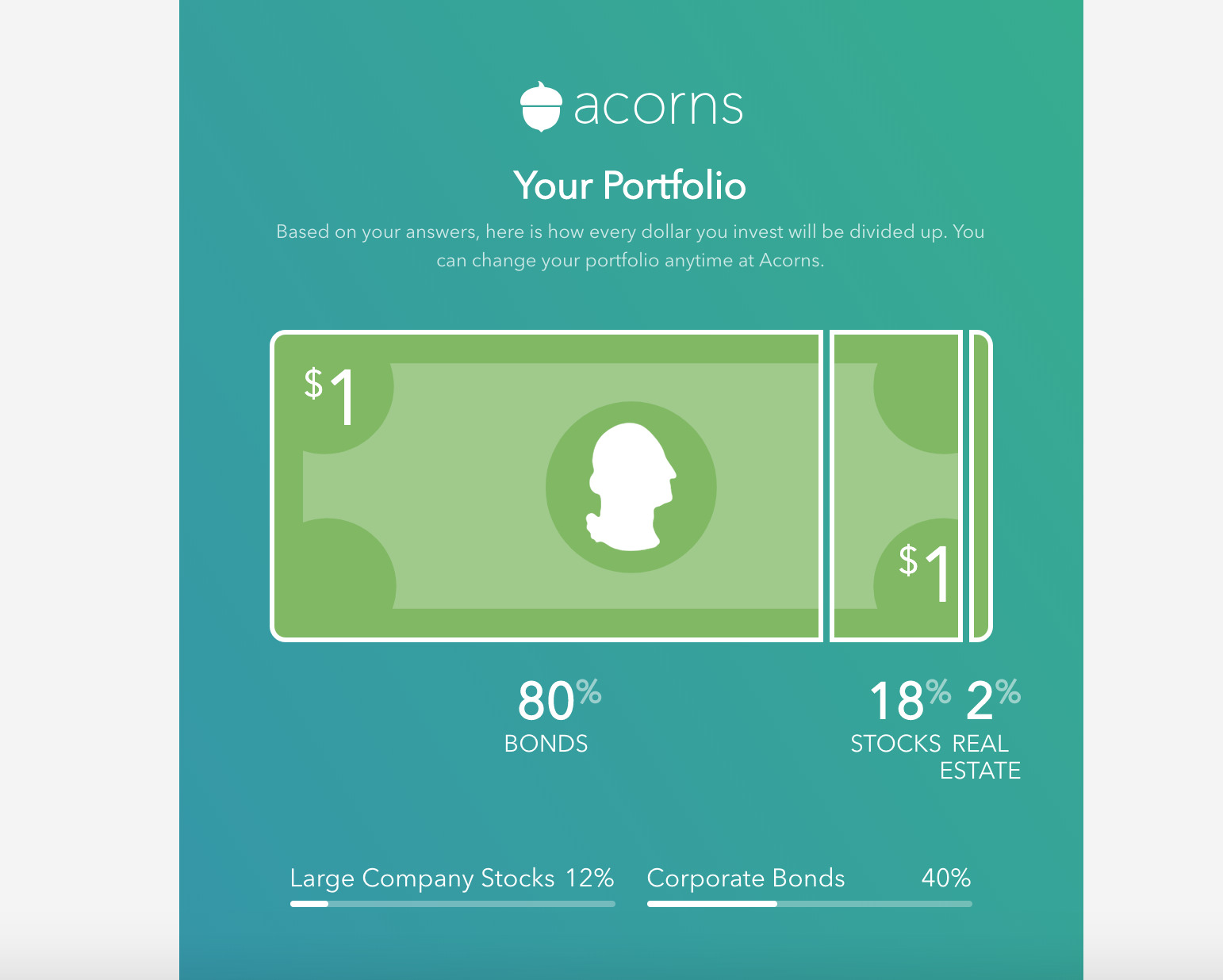

After you sign-up for an account, you’ll be shown your portfolio. I received a fairly conservative portfolio that focuses mostly on bonds, with a nod to stocks and real estate.

So far, I’ve enjoyed using Acorns. It requires almost no effort on my part, and with the Found Money offers, I get what is essentially free money for shopping at places I already shop at.

While investing in Acorns won’t be my long-term investing strategy (and it shouldn’t be yours), rounding up a few cents and investing them doesn’t hurt.

Use Acorns If…

- You want to start investing but don’t have thousands of dollars to invest right now

- You just want an easy way to get started investing

- You’re comfortable paying a fee

- You aren’t looking to get rich quick

- You want to invest over a longer period of time

Don’t Use Acorns If…

- You’re an experienced investor

- You have enough saved to get started with a low fee index fund

Final Thoughts

Acorns is a simple investing platform that lets beginner investors get their foot in the investing door. I invested just $1 and I already have over $10 invested due to roundups. This app is for people who want to get started investing but are having trouble getting started. But once your balance is high enough and you have built a habit of saving, you’ll want to move your money to a cheaper platform.

Related Articles

- How To Open Accounts With Vanguard, Fidelity, And Schwab

- When 2% Costs Everything: How Investment Fees Cost You Your Freedom