Brad and Jonathan talk through the various methods of calculating a yearly savings rate and the numbers necessary to do so, and review Monday’s episode about setting up special needs accounts.

- Jonathan is back from 20 days with family in Zimbabwe, and Brad recaps his Christmas vacation.

- Brad and his family added 12 board games to their collection.

- William, from Monday’s episode, set out a road map for people who want or need to safe guard finances for special needs children or other dependents.

- Key: fund your trust as a part of executing your will to minimize tax liability.

- Start with a 529 Able, but as you reach $100k, begin to look at the next steps.

- Comment from Rebecca, that the 529 Able accounts in Nevada have higher fees than she preferred, so she’s funding a traditional 529 Plan and will eventually rotate it into a 529 Able.

- Every state currently has its own set of 529 Able options.

- Voicemail from Penny, who has a special needs trust and was on disability for 16 years, but has been back to work for the past 12 years and is now working to help her parents with their healthcare and financial needs.

- Financial independence is the ability to do the things that bring you joy, whether they bring in money or not.

- In 2019, ChooseFI is bringing in experts to answer specific, technical questions.

- William is helping to build the website and a more user-friendly local group site.

- Brad is going to Camp FI in Florida soon.

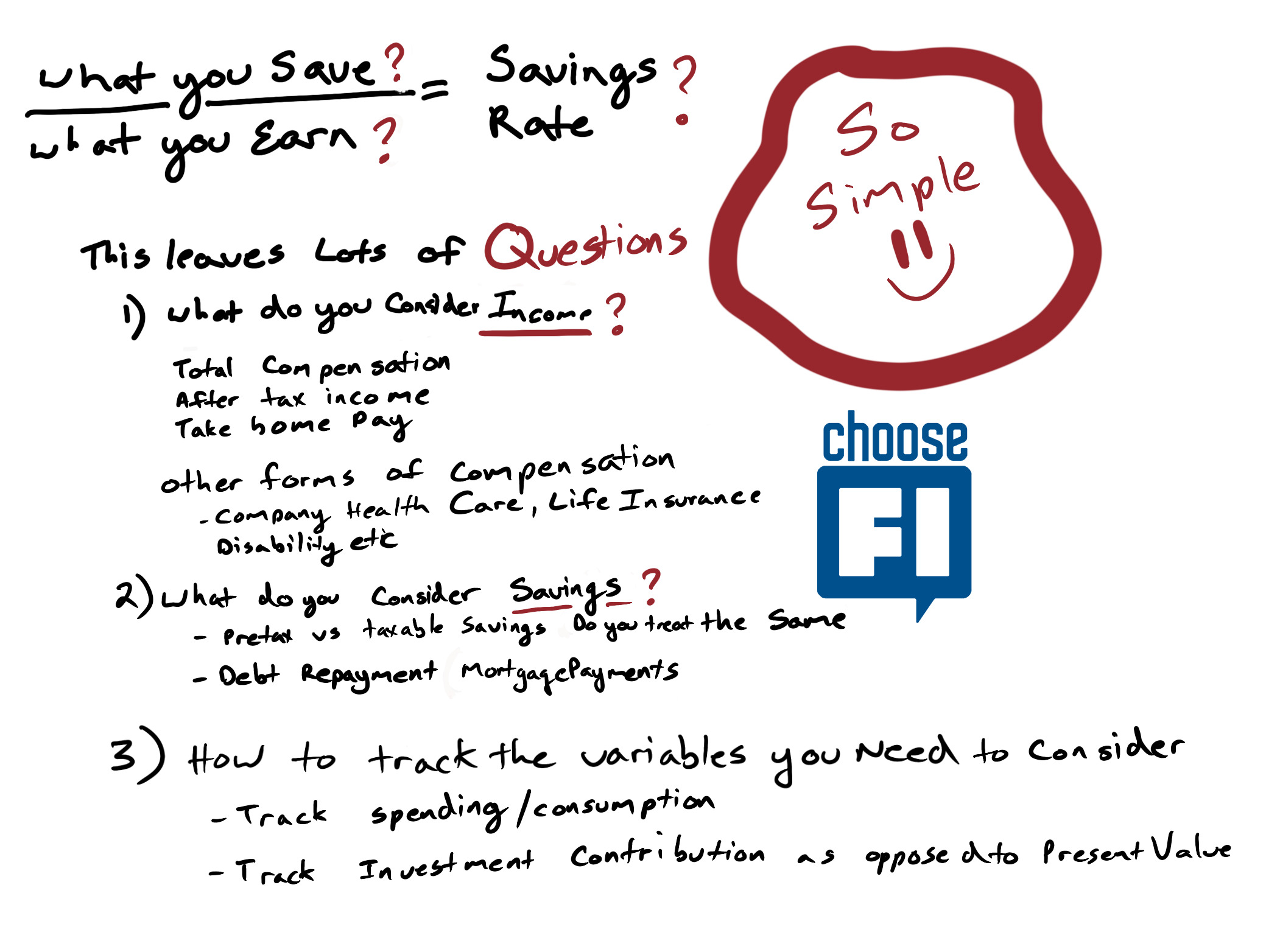

- How to calculate your savings rate:

- It sounds simple at first What You Save/ What You Earn. The Crux is what you consider Savings and What You Consider Income

- Four different ways to calculate:

- Gross total compensation

- Take your total savings/investments and divide by your total Gross compensation

- Take-home pay

- Take your total savings/investments and divide by your Take home pay

- After-tax compensation

- Take your total savings/investments and divide by your after-tax compensation

- After Tax Compensation with Adjustments for Pretax vs Taxable Savings

- This is similar to method 3 but it accounts for the fact that you haven’t paid taxes on your pretax accounts

- Gross total compensation

- Article: How To Calculate Your Savings Rate

- Jonathan Uses Mint to track consumption and Personal Capital to Track Net worth then uses W2, Tax Return or last paycheck of the year for reconciliation. There are several flaws in this approach. Mint does a poor job by default separating investments and savings from consumption (spending) without manual help. Personal Capital is excellent at displaying current net worth but if you have lots of contributions it can get be messy to extract contributions from the dividends gains and losses over an extended period of time

- Brad uses an excel sheet with three tabs: Profit & Loss (P&L), Net Worth, Accounts.

- In the Accounts tab, Brad records savings in each account at the beginning and end of the year, and totals up monthly expenses (cost of electric in Jan., Feb., Mar., etc.).

- Does Brad track every one of his credit card expenses?

- Net worth = add up all your assets and all your liabilities.